Jan 3

/

Alef Dias

Macroeconomics Weekly Report - 2024 01 03

Back to main blog page

Credit stabilization should strengthen the Euro

- Monthly credit data published by the European Central Bank shows that the impact of credit supply on spending is stabilizing, which could marginally ease the pressure on the Governing Council to cut interest rates before the middle of the year.

- The baseline scenario seems to be that the eurozone will avoid a deep slowdown, because in addition to the stabilization of credit, the labor market has remained exceptionally resilient so far.

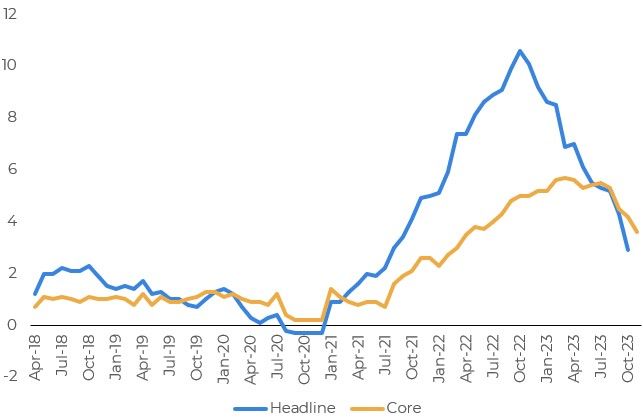

- Inflation, although still above the ECB's target, continues to decelerate. However, core inflation remains more resilient than headline inflation.

- With economic activity more resilient than expected, and a scenario of the ECB starting later the easing cycle compared to the Fed, the first half of 2024 seems to hold the prospect of the euro continuing to strengthen.

Introduction

Monthly credit data published by the European Central Bank shows that the impact of credit supply on spending is stabilizing, although it still exceeds the levels observed at the peak of the euro crisis. The stabilization may marginally ease the pressure on the Governing Council to cut interest rates before the middle of the year.

But what would be the consequences for the European economy and the Euro?

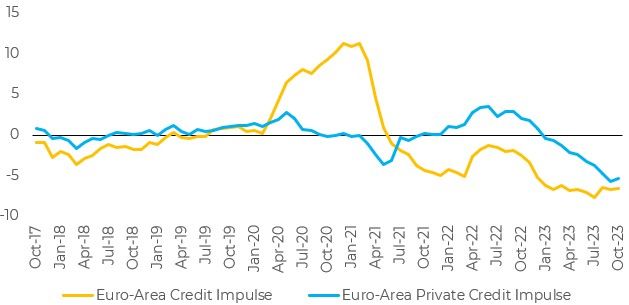

Credit impulse is stabilizing

The credit impulse for households and non-financial companies in the euro area increased to -4.5% of GDP in November, from -5.2% in October, bringing the three-month average from -5.0% to -4.9%. The latest three-month average compares with a low of -3.1% during the euro crisis and a low of -8.3% during the global financial crisis.

The credit impulse, which measures the change in credit growth rather than the real rate of expansion, is the best indicator of the stimulus to the economy from lending activities. More specifically, loans to households and non-financial corporations are more highly correlated with the growth of private demand (household consumption plus gross fixed capital formation).

Despite the stabilization, the three-month average of credit to households and non-financial companies fell by 8.0 percentage points from its recent peak of 3.1% in October 2022. This is consistent with an impact of around 7.1 percentage points on private sector demand due to the decrease in credit supply.

Image 1: EU credit impulse (YoY %)

As a result, the activity is less of a concern

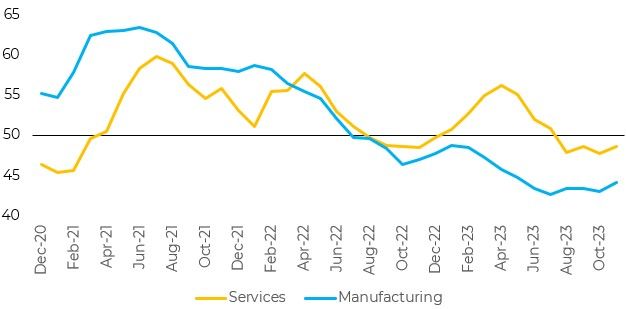

Standard economic models, such as those used by the ECB, estimated - at the start of the interest rate hike cycle - that the impact of higher rates should have already exceeded 2% of gross domestic product by the end of 2023 and could reach 4% by the end of 2024. Nevertheless, the impact seems to have been substantially smaller thus far.

Why the surprise and what does it mean for 2024? It could be that the economy has been pushed further into the upward cycle than expected, that monetary policy has lost its efficiency or that it is less restrictive than thought. There is still the danger that the models are right about the magnitude of the impact, but wrong about the timing. Perhaps the European economy will suffer the impact of 4% on GDP, but later and with a faster deceleration than expected.

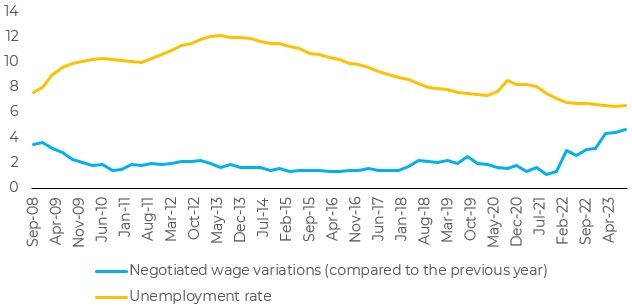

To assess this risk, labor market stress (fear of unemployment) can be analyzed using a temporal measure, similar to the Sahm rule, which is used as an indicator of recession in the US. This shows that labor market conditions in the eurozone are a long way from those that have historically been consistent with the start of the recession. This could change, and the situation needs to be monitored, but there are few signs that the edge of the cliff is near.

Why the surprise and what does it mean for 2024? It could be that the economy has been pushed further into the upward cycle than expected, that monetary policy has lost its efficiency or that it is less restrictive than thought. There is still the danger that the models are right about the magnitude of the impact, but wrong about the timing. Perhaps the European economy will suffer the impact of 4% on GDP, but later and with a faster deceleration than expected.

The baseline scenario seems to be that the eurozone will avoid a deep slowdown because the labor market has remained exceptionally resilient so far. A deterioration in employment prospects could be a catalyst for pushing a weak economy into recession. As workers lose their jobs or fear losing them, they reduce their spending, further depressing economic activity and labor demand.

To assess this risk, labor market stress (fear of unemployment) can be analyzed using a temporal measure, similar to the Sahm rule, which is used as an indicator of recession in the US. This shows that labor market conditions in the eurozone are a long way from those that have historically been consistent with the start of the recession. This could change, and the situation needs to be monitored, but there are few signs that the edge of the cliff is near.

Image 2: EU PMIs

Source: Refinitiv

Image 3: EU Unemployment and Wages

Source: Bloomberg

Inflation continues to slow

The Governing Council has focused directly on underlying inflation measures to assess the effectiveness of its monetary policy. The indicators that provide the clearest reading remain high, but have been on a downward trend for most of 2023. With product price inflation, in particular, declining, the big question is what will happen to services (of which wages make up a large part of the costs).

Normally, past inflation is one of the main drivers of wage increases, as workers try to regain purchasing power. This suggests that as high global inflation falls, wage growth will slow. This judgment supports our forecast, which shows services inflation falling to 3% by the end of 2024, from around 4.5% at the end of 2023.

Normally, past inflation is one of the main drivers of wage increases, as workers try to regain purchasing power. This suggests that as high global inflation falls, wage growth will slow. This judgment supports our forecast, which shows services inflation falling to 3% by the end of 2024, from around 4.5% at the end of 2023.

Image 4: EU Core and Headline Inflation

Source: Refinitiv

In Summary

If the inflation outlook evolves as expected, this will probably allow the ECB to make a cut in June and deliver 75 basis points of easing by the end of the year. Until then, policymakers will talk a lot about monitoring inflation, as they don't want expectations of rate cuts to take hold too soon. If inflation falls faster than expected, this could open the door to an early cut.

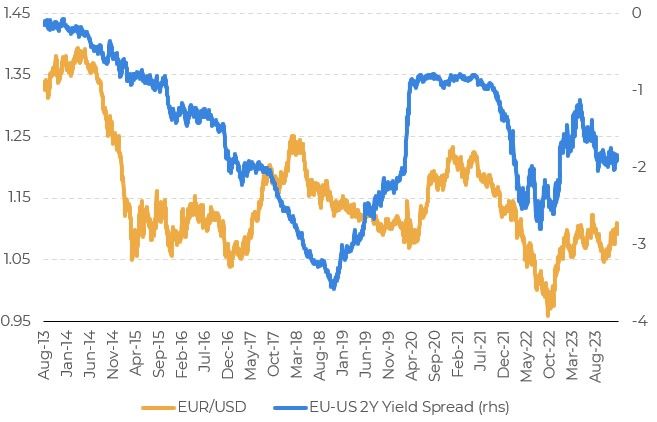

With economic activity more resilient than expected, and a scenario of the ECB starting later the easing cycle compared to the Fed, the first half of 2024 seems to hold the prospect of the euro continuing to strengthen.

Image 5: 2-year yield spread (EU vs. US)

Source: Refinitiv

Source: Bloomberg

Weekly Report — Macro

Written by Alef Dias

alef.dias@hedgepointglobal.com

alef.dias@hedgepointglobal.com

Reviewed by Pedro Schicchi

alef.diaspedro.schicchi@hedgepointglobal.com

alef.diaspedro.schicchi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.