Jan 22

/

Victor Arduin

Macroeconomics Weekly Report - 2024 01 22

Back to main blog page

A cycle of interest rate cuts in the US is coming, but it depends on forward guidance

- Faster-than-expected declines in inflation have been one of the positive variables watched by Fed members in the past 12 months, increasing the likelihood of rate cuts in March 2024.

- However, it is important to observe that positive economic data and the resilient labor market in the United States provide incentives for a more conservative start to interest rate cuts, most likely in May of this year.

- Furthermore, conflicts in the Red Sea are pressuring maritime costs, potentially exerting pressure on global inflation as more ships are changing their routes.

Introduction

Despite a costly disinflationary process, which resulted the interest rates to the range of 5.25%-5.50%, the monetary tightening are bringing prices down to the 2% level without causing a recession or significant harm to the labor market.

Soon the much-awaited easing of monetary policy by the market will, once it starts, help weaken the dollar, make commodities cheaper for holders of other currencies, and bolster global demand.

Therefore, it's crucial to pay close attention to the hints that will be given by the Fed board members at the upcoming meeting on January 30-31.

Soon the much-awaited easing of monetary policy by the market will, once it starts, help weaken the dollar, make commodities cheaper for holders of other currencies, and bolster global demand.

Therefore, it's crucial to pay close attention to the hints that will be given by the Fed board members at the upcoming meeting on January 30-31.

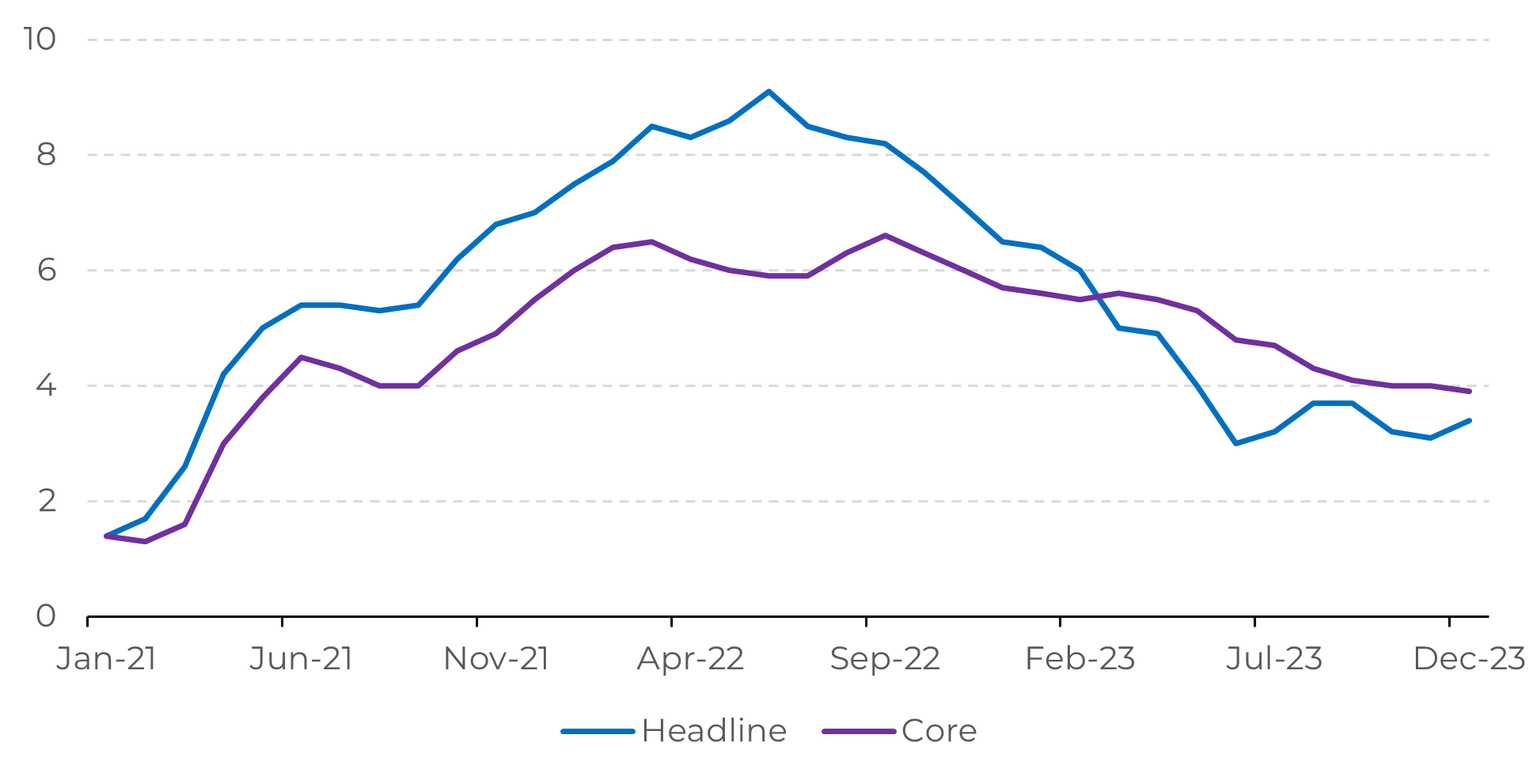

Image 1: US – Inflation (%)

Source: U.S. Bureau of Labor Statistics

Image 2:

US – GDP Growth YoY (%)

Source:Bloomberg

Labor market gains have moderated, but continue resilient

The market anticipates monetary easing this year, although it may not occur at the pace anticipated, in the major economies worldwide. In the United States, for example, the Fed, in its latest meeting, projected cuts on the order of -75 basis points in 2024, as indicated by its dot plots chart. Several analysis firms suggest that the first interest rate cut may occur in March, but we believe it will take longer, happening at the meeting on April 30 and May 1.

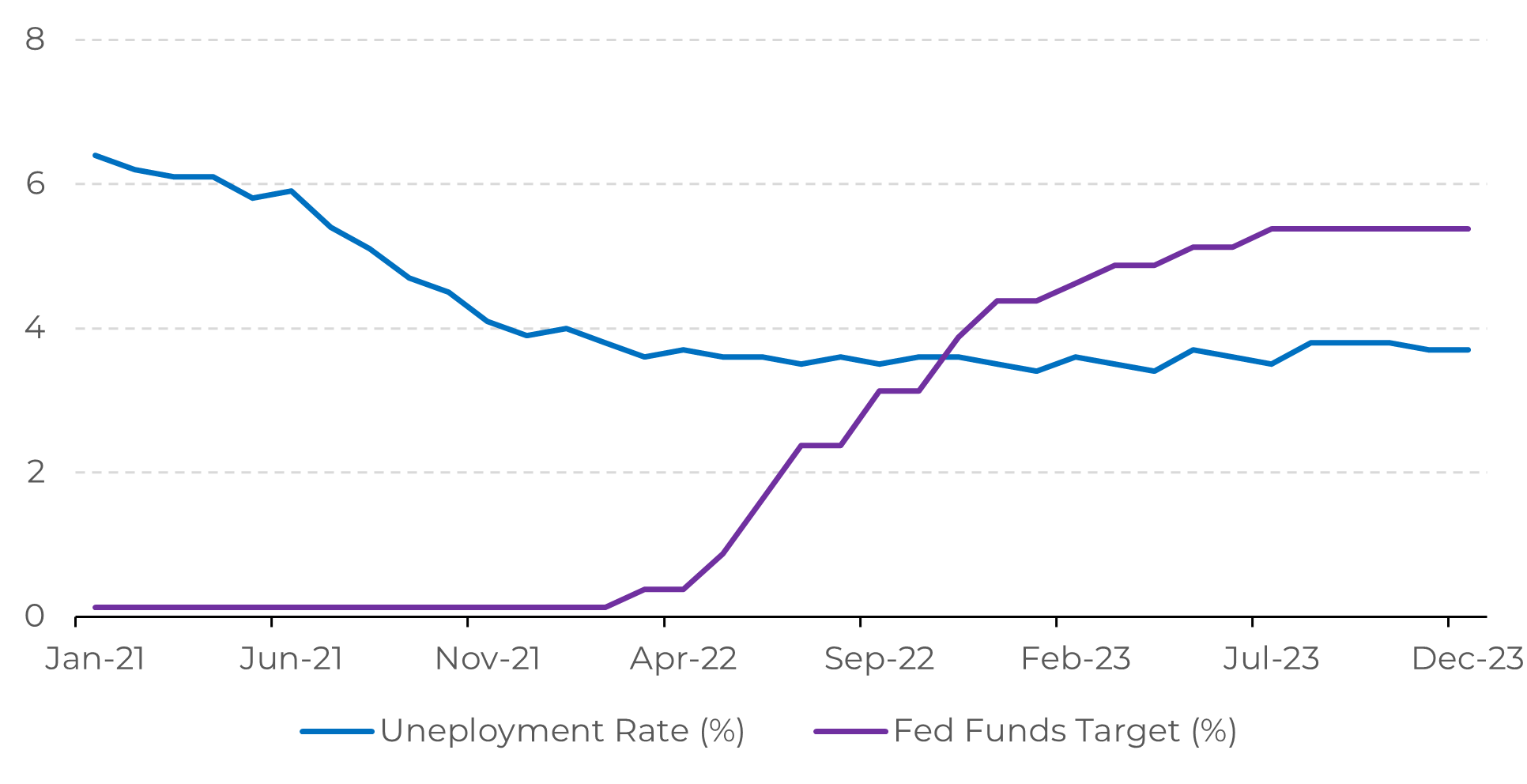

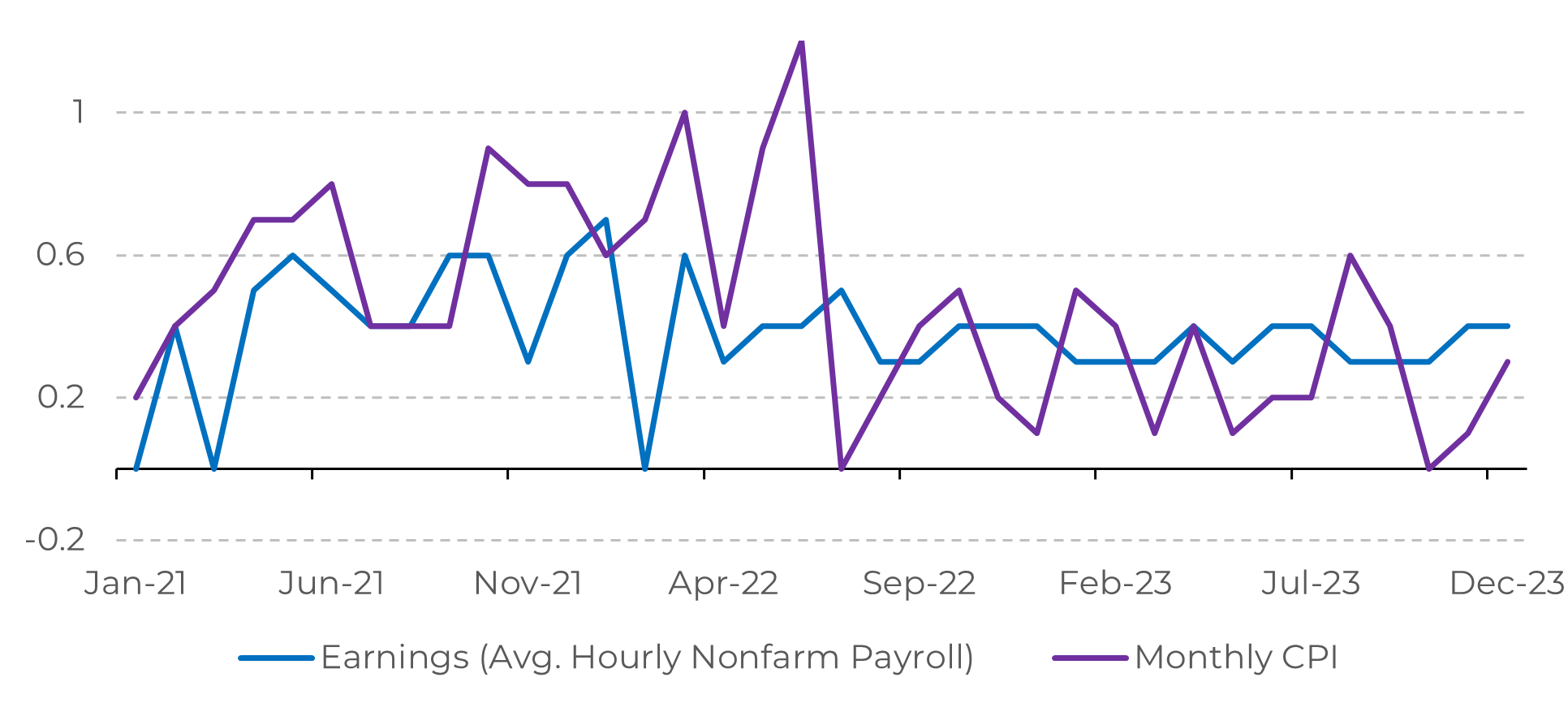

Let's observe some important data that influences the decision-making of members of the American central bank. Despite inflation continuing to converge towards the 2% target, which is very positive, the labor market remains highly resilient, with real gains of 0.8% between December 2022 and December 2023. Also, the strong restrictive monetary policy has not pressured unemployment, which has stayed stable below 4%.

Image 3: US – Unemployement and Fed Funds Target

Source: Refinitiv

The American central bank may assume a risk by implementing an interest rate cut too early, potentially unanchoring market expectations. Also, the positive economic results and the resilient labor market also do not provide incentives for an interest rate cut in March.

Another relevant factor causing concerns for American monetary authorities is the escalation in the Red Sea, where new developments arise every week and are already impacting maritime transportation costs. Despite being volatile and beyond the control of monetary policy, they pose an additional challenge in price control.

Therefore, it is important to observe the language that will be adopted in the next communication from the Fed, which may provide clear guidance on when the interest rate cut will occur. If it indeed takes place in March, this signaling is likely to happen in the meeting on January 30-31.

Image 4: US – Earning and Monthly Inflation (%)

Source: Refinitiv

In Summary

The disinflationary process in the United States has increasingly shown signs that it will be successful, meaning bringing prices to the 2% target without leading the economy into a recession, the so-called 'soft landing' often mentioned by the Fed.

However, despite igniting hope in the market, it is not anticipated to occur in March. The robust economic data does not justify an overly premature interest rate cut, as evidenced by the positive GDP growth and the resilient labor market.

If it does occur, a clearer communication in its forward guidance is likely to happen at the end of this month when monetary authorities convene for the first time this year.

Weekly Report — Macro

Written by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Reviewed by Alef Dias

alef.dias@hedgepointglobal.com

alef.dias@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.