Jan 29

/

Alef Dias

Macroeconomics Weekly Report - 2024 01 29

Back to main blog page

War and GDP - more risks for FOMC's week

- In view of last week's events and the imminence of another FOMC (Federal Open Market Committee) meeting, we need to turn our attention to the Fed once again.

- Last Sunday, a drone strike killed three American soldiers. These were the first American deaths since Israel and Hamas went to war and could have a significant impact on the macroeconomic scenario.

- US real GDP growth was 3.3% in Q4, above consensus estimates of 2.0%. This stronger economic growth could delay the convergence of inflation towards the Fed's 2% target.

- However, the latest PCE data showed a more benign scenario for one of the main price indexes monitored by the Fed, which favors an early interest rate cut.

Introduction

Given the events of the last week, and the imminence of yet another FOMC meeting, we have to return to the main macro theme of the first half of 2024: the start of monetary easing in the US.

Escalation of the war raises the risk of an inflationary rebound

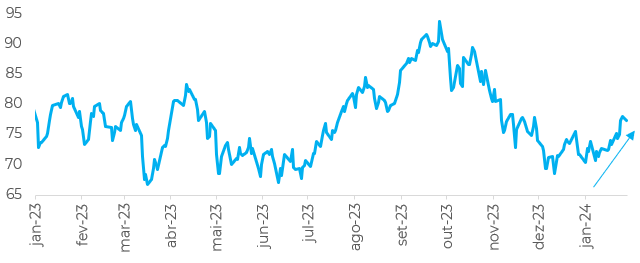

Last Sunday, a drone strike killed three American soldiers and wounded 34 others. The attack took place at a base near the border between Jordan and Syria. The US blamed Iranian-backed militants for the attack, while Tehran denied any connection to the strike.

The event is important. It resulted in the first American deaths since Israel and Hamas went to war on October 7. President Joe Biden has promised retaliation. The event could lead the US and Iran to war, despite their mutual aversion to direct confrontation. Oil prices rose to $84 a barrel after the attack.

There are two scenarios for how things will unfold next:

- The first, and most likely, would be a "one-off" counter-attack. The US hits Iranian targets or officials, and Iran doesn't escalate. The scenario is similar to what happened in 2020, when the US assassinated Iranian general Qassem Soleimani, and Iran did not respond in the same way. The assassination took place after the invasion of the US embassy in Baghdad.

- Secondly, an escalation of "an eye for an eye". The US hits Iranian targets or individuals, and Iran responds by hitting US interests, either directly or through its network of proxies and allies in the region.

The second scenario would potentially escalate the conflict to a wider level, adding a significant risk to global inflation, since much of the world's maritime trade passes through the Strait of Hormuz. A fifth of the global supply of crude oil would be at risk. Oil prices could rise to triple digits and a global recession could occur.

However, neither the US nor Iran want an escalation, which makes the first scenario more likely. Before the latest attack, Washington was considering reducing arms sales to Israel to prush for a reduction in operations in Gaza. The country is also involved in negotiations over a possible ceasefire in exchange for the release of hostages.

However, neither the US nor Iran want an escalation, which makes the first scenario more likely. Before the latest attack, Washington was considering reducing arms sales to Israel to prush for a reduction in operations in Gaza. The country is also involved in negotiations over a possible ceasefire in exchange for the release of hostages.

Image 1: Crude Oil WTI (USD/Bbl)

Source: Refinitiv

Strong GDP increases risks

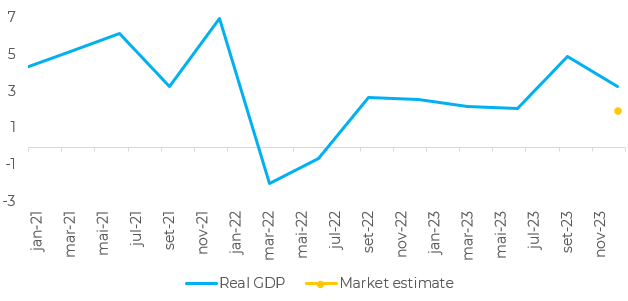

US real GDP growth cooled to a strong 3.3% in Q4 (vs. 4.9% previously). This was above consensus estimates of 2.0%. Consumer spending accounted for most of the growth, expanding at a pace of 2.8% (vs. 3.1% previously).

The trade balance also contributed to the "surprising" GDP. Exports expanded at an accelerated pace of 6.3% (compared to 5.4% previously), mainly in services. Imports grew by just 1.9% (compared to 4.2% previously), also driven mainly by services.

The trade balance also contributed to the "surprising" GDP. Exports expanded at an accelerated pace of 6.3% (compared to 5.4% previously), mainly in services. Imports grew by just 1.9% (compared to 4.2% previously), also driven mainly by services.

Overall, the economy recorded rapid growth of 3.1% for the whole of 2023, up from 0.7% the previous year. This result brings more confidence regarding the resilience of American economic activity, but there are still risks that must be monitored.

Growth in Q4 was largely driven by volatile categories and government spending. Business investment in equipment remained mostly sluggish, and inventories are likely to hamper future growth

Image 2: Real GDP (YoY) - US

Source: Bloomberg

Despite risks, new inflation data favors interest rate cut in March

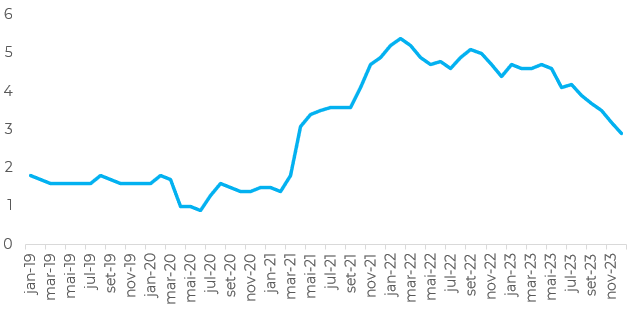

PCE inflation (Personal Consumption Expenditure price index), one of the main indices monitored by the Fed, rose by 0.2% month-on-month (vs. -0.1% previously) - in line with expectations, and keeping annual PCE inflation at 2.6%. The pace of core PCE increased to 0.2% month-on-month in December, up from 0.1% previously, but base effects allowed core annual inflation to fall to 2.9%, down from 3.2% previously.

Even as personal income and spending posted robust gains in December, inflation's momentum is slowing. The three-month annualized pace of core PCE inflation fell to 1.5%, and the six-month pace remained at 1.9% - both below the Fed's 2% average inflation target.

Image 3: Core PCE (YoY) - US

Source: Refinitiv

In Summary

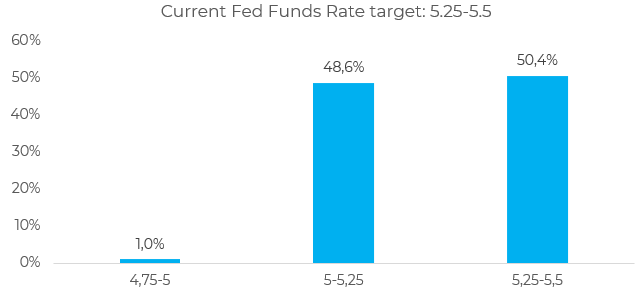

It could be said that the events of the last week have increased uncertainty as to when the Fed will begin its monetary easing cycle. The escalation of tensions between the US and Iran could have major impacts on energy and freight prices, while the resilient economic growth seen in the latest US GDP data could delay the convergence of inflation towards the Fed's 2% target.

However, the latest PCE data showed a more benign scenario for one of the main price indices monitored by the Fed, which favors an early interest rate cut. At the time of writing, the market was pricing in a 49.6% chance of an interest rate cut at the March meeting. As a result, this week's meeting is extremely important to understand what the FOMC's vision is for the next few meetings and what "conditions" are necessary for the interest rate cut cycle to begin.

We continue to believe that inflationary risks and the resilience of American economic activity and the labor market could "prevent" a rate cut in March, which could put downward pressure on commodities in the short term. However, the chances of the Fed cutting interest rates by May are 90.5%, so if there is no major escalation of tensions in the Middle East, we should see a reversal of this downward trend in the second quarter.

Image 4: Fed Funds Rate probabilities - meeting 20/03/24

Source: CME

Weekly Report — Macro

Written by Alef Dias

alef.dias@hedgepointglobal.com

alef.dias@hedgepointglobal.com

Reviewed by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.