Feb 26

/

Alef Dias

Macroeconomics Weekly Report - 2024 02 27

Back to main blog page

Labor market will guide ECB's next steps

- The European Central Bank has linked the timing of its first interest rate cut to wage data. The discussion of wages in the minutes of the last Governing Council meeting suggests that these figures are unlikely to prevent a cut in June.

- Unemployment is the lowest it has been in 40 years and the slack created by those on the margins of the labor market is modest. Looking ahead, this growth is expected to slow down as workers soften their demands for higher wages in the face of lower inflation.

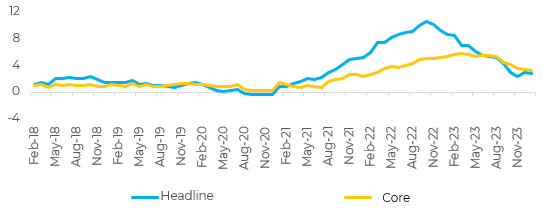

- Eurozone core inflation is likely to have fallen again in February, despite some upward pressure from energy prices. The core reading, in particular, is likely to have fallen quite a bit, as services inflation starts to fall again after three months of stagnation.

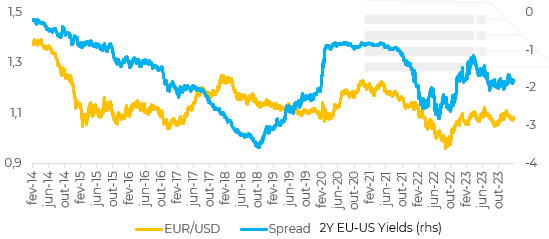

- As a result, the ECB is likely to cut rates at the same time as the Fed. Consequently, there isn't much upside for the euro from the point of view of the yield differential.

Introduction

The last few weeks have brought important data for the Eurozone economy and for the next steps in the ECB's (European Central Bank) monetary policy, and next Friday the February inflation data will be released. Given these new fundamentals, we will update our outlook for the European economy and the Euro.

Minutes suggest cut is near, despite high wage growth

The European Central Bank has linked the timing of its first interest rate cut to wage data. The discussion of wages in the minutes of the Governing Council meeting on January 24 and 25 suggests that these figures are unlikely to prevent a cut in June. We believe that the various measures of wage growth will have slowed sufficiently by then to allow the ECB to make the move.

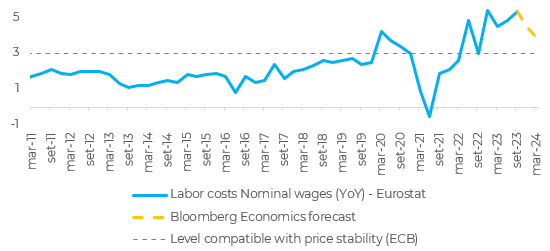

The ECB's chief economist - Philip Lane - was encouraged by the latest data. "The pace of wage growth remained high, but there were some early signs of a slowdown," said the economist. The dovish contingent tried to downplay the importance of high wage growth. "It was pointed out that nominal wage growth of around 5%... was not necessarily an excessive figure during a 'recovery' phase, bearing in mind that real wages had fallen by around 7% since the start of the bout of inflation.”

However, caution is still needed. "The gap between current wage growth of around 5% and a trend increase of 3% or 2.5% consistent with the 2% inflation target... was considered to be quite significant and likely to narrow only gradually over time," the minutes added.

The minutes also indicated optimism about the pace of inflation deceleration. "Inflation was moving towards the 2% target, possibly at a faster pace than previously expected," said Lane.

Image 1: EU - Basic and core inflation (%)

Source: Refinitiv

Tight labor market keeps ECB's focus on wage growth

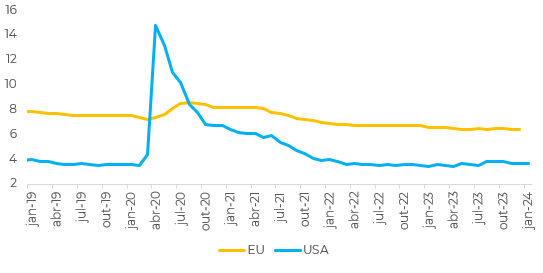

Given the ECB's signal that wage dynamics are an important driver of monetary policy, it's important to understand the outlook for the European labor market.

Although the increase in the participation rate has reduced inflationary pressures, the tight labor market is still translating into high wage growth. Looking ahead, this growth is expected to slow as workers soften their demands for higher wages in the face of lower inflation. This should allow the Governing Council to cut interest rates in June.

The rigidity of the eurozone's labor market worries the European Central Bank and has been one of its main justifications for raising interest rates. Unemployment is the lowest it has been in 40 years and the slack created by those on the margins of the labor market is modest. Furthermore, job vacancies, as well as survey data, indicate that it is difficult to find new hires, although there have been some signs that a turning point has been reached.

Although the increase in the participation rate has reduced inflationary pressures, the tight labor market is still translating into high wage growth. Looking ahead, this growth is expected to slow as workers soften their demands for higher wages in the face of lower inflation. This should allow the Governing Council to cut interest rates in June.

Image 2: EU - Nominal wages (YoY)

Source: Bloomberg

Image 3: Unemployment Rate (%)

Source: Refinitiv

Inflation probably continued to slow down in February

Eurozone core inflation is likely to have fallen again in February, despite some upward pressure from energy prices. The core reading, in particular, is likely to have fallen quite a bit, as services inflation begins to fall again after three months of stagnation. Market estimates point to core inflation falling to 2.6% in February, from 2.8% in January. The core reading should have fallen a little more, from 3.3% to 2.9%.

Weekly figures published by the European Commission suggest that road fuel costs may have risen by around 2.5% in the month on average in the euro zone, in the wake of higher global oil prices.

These upward pressures from energy should be more than offset by a decline in contributions from other categories. Food and non-energy industrial product inflation is likely to decline further, as the exceptional price gains seen in late 2022 and early 2023 continue to fall year-on-year.

In Summary

Despite the slowdown in European inflation, which should continue with the data to be released this week, the still tight labor market should prevent an interest rate cut at the next meetings. However, estimates point to a slowdown in wage gains, which is supported by an increase in the participation rate - which should allow for a cut from June onwards.

As a result, the ECB is likely to cut rates at the same time as the Fed. Consequently, there isn't much upside for the euro from the point of view of the yield differential. The resilience of American economic activity also favors the dollar.

Image 4: 2-year yield spread (EU vs. US)

Source: Refinitiv

Weekly Report — Macro

Written by Alef Dias

alef.dias@hedgepointglobal.com

alef.dias@hedgepointglobal.com

Reviewed by Pedro Schicchi

pedro.schicchi@hedgepointglobal.com

pedro.schicchi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.