Mar 19

/

Victor Arduin

Macroeconomics Weekly Report - 2024 03 19

Back to main blog page

What to expect from the Fed this week?

- In the upcoming Fed meeting (March 19–20), more information will be provided regarding the board's view on inflation in the country. The American central bank finds itself at a crucial moment, with improvement in some indicators and worsening in others.

- While the labor market has shown a cooling trend, with rising unemployment, shelter costs remain resilient and energy prices are once again exerting pressure on inflation.

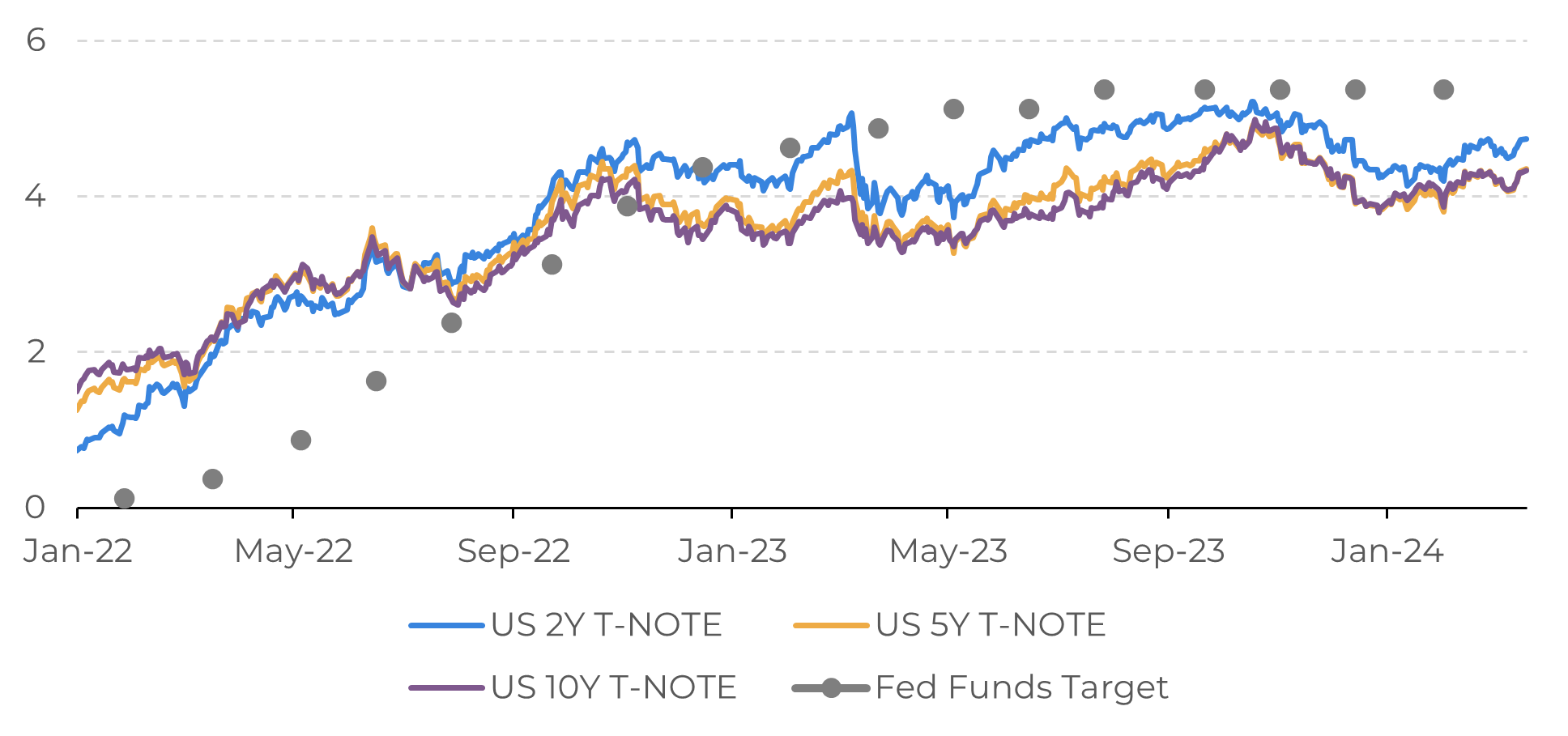

- Market bets are for an interest rate cut in June this year, but there is growing sentiment of uncertainty and risk aversion, with Treasury yields rising sharply in recent weeks.

Introduction

Once again, this week, the Federal Open Market Committee (FOMC) will convene to determine the course of monetary policy in the United States. While the market isn't expecting any rate cuts during this meeting, nor explicit guidance, the next upcoming meeting scheduled between April 30th and May 1st may introduce an official communication about the easing of monetary policy in the US.

If by the end of 2023 a more dovish view grew in the market regarding interest rates in the world's largest economy, the first months of 2024 show increasing uncertainty regarding inflation. Nevertheless, recent data supports the idea of a "soft landing" in the American economy, where bringing prices to the 2% target will be achieved without leading the economy into a recession. In this regard, let's discuss the possible outcomes of the Fed meeting that will conclude this Wednesday, March 20th.

Image 1: US – Treasury Yields and Fed Funds Target (%)

Source: U.S. Census Bureau

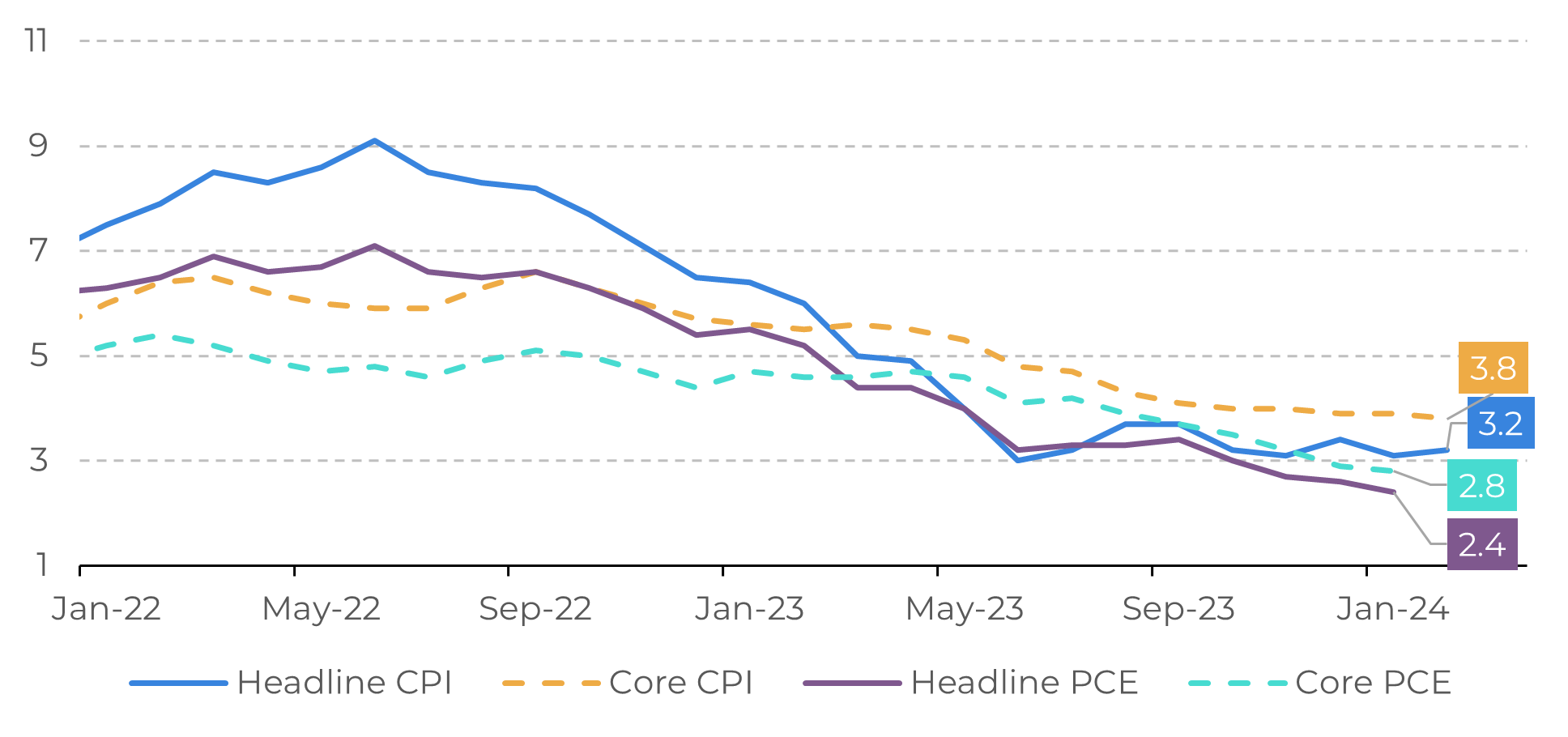

Image 2: US – Inflation (%)

Source: Bureau of Labor Statistics

Seasonal components are putting pressure on inflation in the US

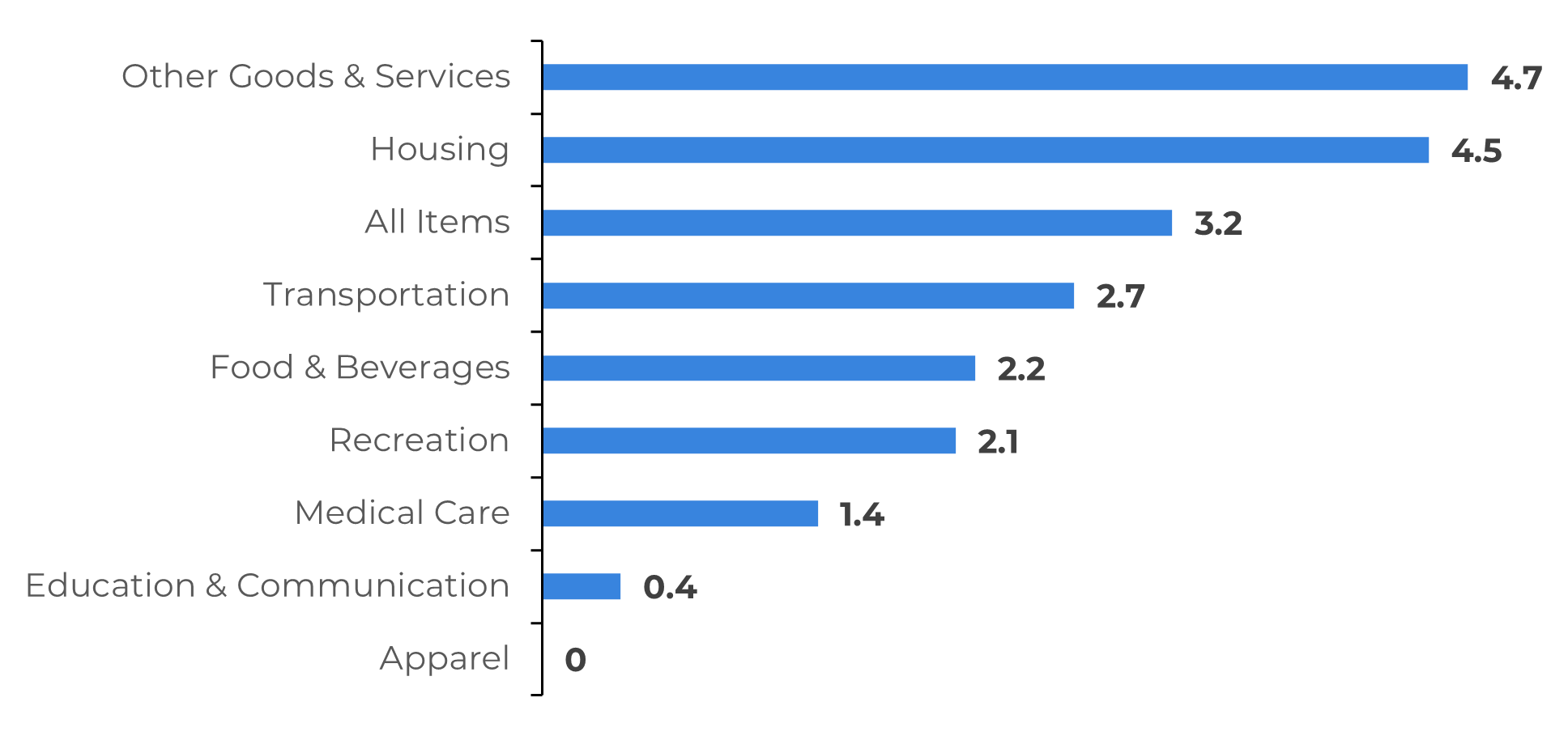

In general, the market still waiting for an interest cuts in June of 2024, but some considerations need to be pointed out. The CPI, which advanced by 0.4% in February, with 60% of the increase related to housing and gasoline costs. While shelter has been one of the most resilient components of American inflation, up by 5.7% over the last 12 months, energy, a more volatile component, is expected to exert pressure on the indices again in the coming months.

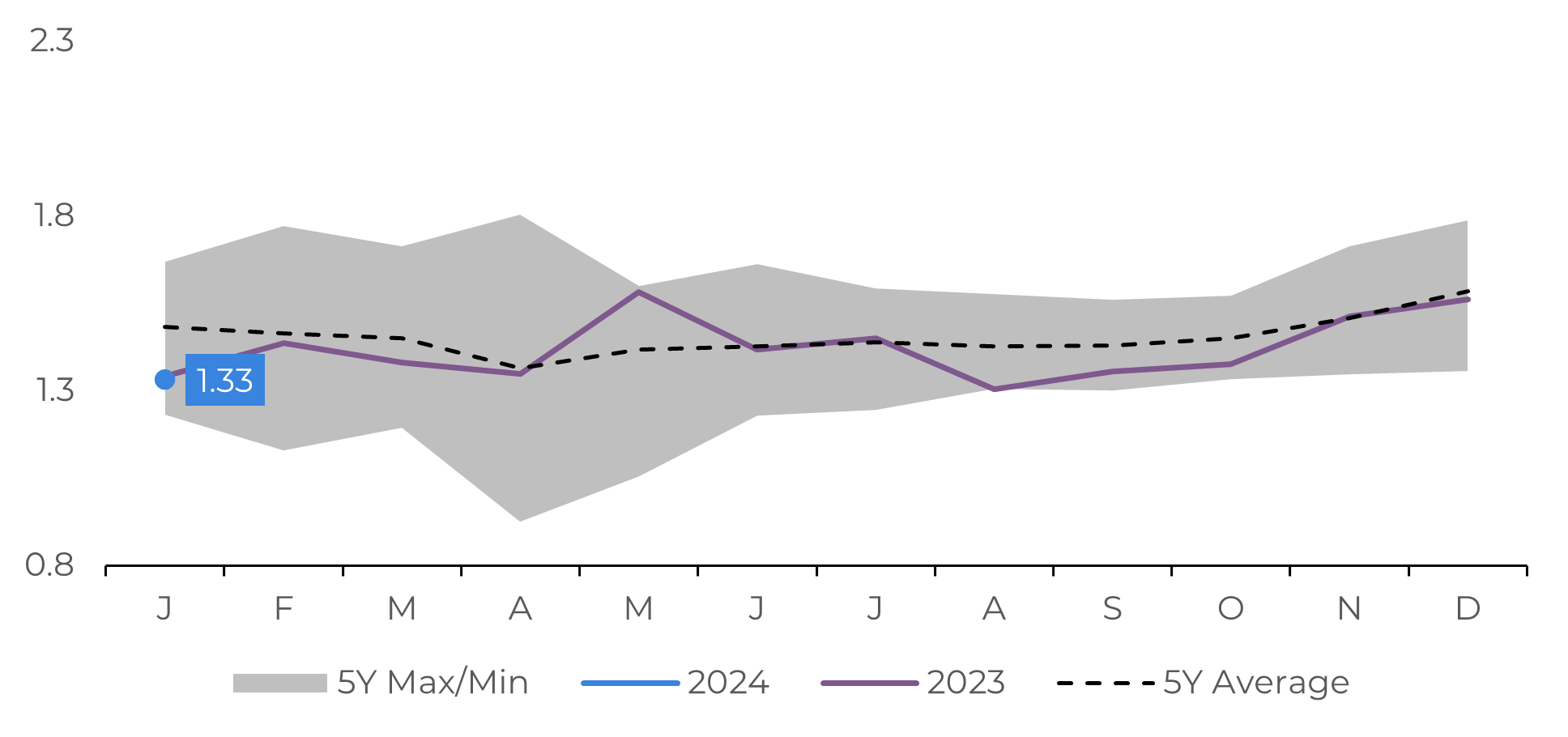

Analyzing data regarding the housing market in the USA, the property availability rate, a measure indicating the total stock of units for lease, was 6.6% in the fourth quarter of 2023, indicating a very tight market. The low supply of properties is exerting upward pressure on the rental market. Additionally, energy costs are reflecting the increase in oil prices and unscheduled shutdowns of the country's refineries, which have quickly removed more than 14 million barrels of gasoline from the country's stocks since February of this year.

Image 3: US - Housing Starts Seasonally Adjusted (Million Units)

Source: Refinitiv

At this moment, the Fed finds itself at a crucial point in its journey to bring prices to the 2% target. The combination of a strong economy, employment data showing moderation, and volatile components once again exerting pressure on inflation doesn't make it easy to predict the tone the Fed's communication will adopt this Wednesday. If current data still doesn't provide enough certainty for an interest rate cut, risks are growing around the economy with the current restrictive level, especially in the country's banking and real estate sectors, which is a concern for authorities in the country.

The PCE, the inflation index most closely watched by the American central bank, stands at 2.4% and is expected to continue improving in the coming months as it reflects fewer components exerting greater pressure on the CPI. That being said, we should expect a cautious Fed this week, with concerns about the trajectory of inflation, especially in the services and rental sectors, highlighting a cooling in the labor market. An increase in risk aversion is likely this month, with short-term treasury bonds appreciating. However, as more inflation data emerges in the coming weeks, we may witness a reversal of this scenario.

Image 4: US – Inflation YoY (%) in February

Source: Refinitiv

In Summary

There is room for a more conservative stance this week without announcing forward guidance towards easing monetary policy, as hawkish statements are part of the American central bank's efforts to anchor expectations. Therefore, there may be downward volatility for the rest of the month.

However, it is expected that this trend will reverse with the improvement of inflation data in the coming weeks. Despite some components causing concern, such as energy and housing, the overall balance reveals an improvement. Furthermore, the current restrictive level of monetary policy continues to contribute to the convergence of prices towards the 2% target. So, let’s wait for June!

Weekly Report — Macro

Written by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Reviewed by Thais Italiani

thais.italiani@hedgepointglobal.com

thais.italiani@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.