Mar 26

/

Alef Dias

Macroeconomics Weekly Report - 2024 03 26

Back to main blog page

An initial analysis of the US elections

- President Joe Biden and former President Donald Trump secured their parties' nominations, setting the stage for the first rerun of the US presidential election in almost 70 years.

- Although it is still too early to predict the eventual winner, a rematch between Trump and Biden is likely to increase geopolitical and market uncertainties. Polls indicate widespread unpopularity for both, but Trump is ahead in the probability of victory according to polls and betting markets.

- However, American markets tend to be resistant to political volatility. Looking at the performance of the S&P 500 from 1937 to 2022, for example, it can be seen that the average annual return is 9.9% in presidential election years and 12.5% in non-election years. The S&P 500 has not fallen during a presidential re-election year since 1952.

- A favorable scenario for risk assets tends to be positive for commodities in general. The biggest impact should be on the energy complex: Trump's policies seem to be more favorable to fossil fuels, while renewables could benefit relatively in a Biden victory scenario.

Introduction

President Joe Biden and former President Donald Trump have secured their parties' nominations, setting the stage for the first rerun of the US presidential election in almost 70 years. With this in mind, we will analyze the likely main policies of each of the candidates and their impact on commodities and other assets.

How is the presidential race going?

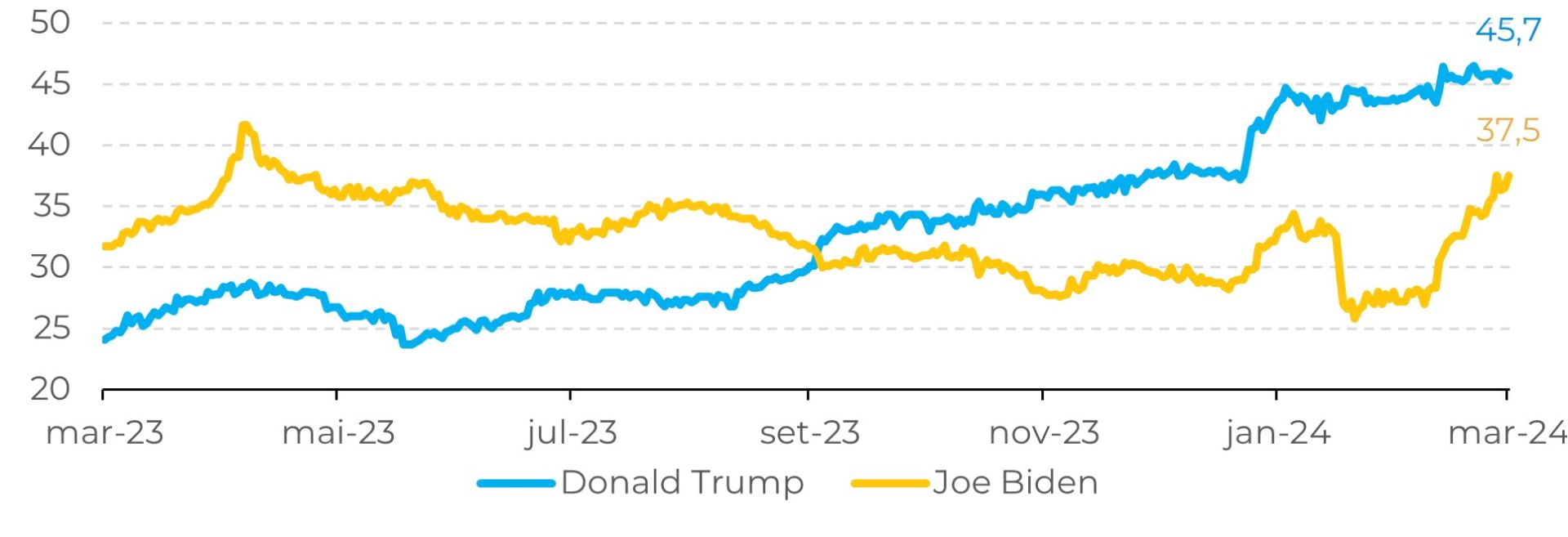

Although it is still too early to predict the eventual winner, a rematch between Trump and Biden is likely to increase geopolitical and market uncertainties, as public sentiment towards both candidates remains tepid, with little enthusiasm for a rematch. Polls indicate widespread unpopularity for both, but Trump is ahead in the probability of victory according to polls and betting markets.

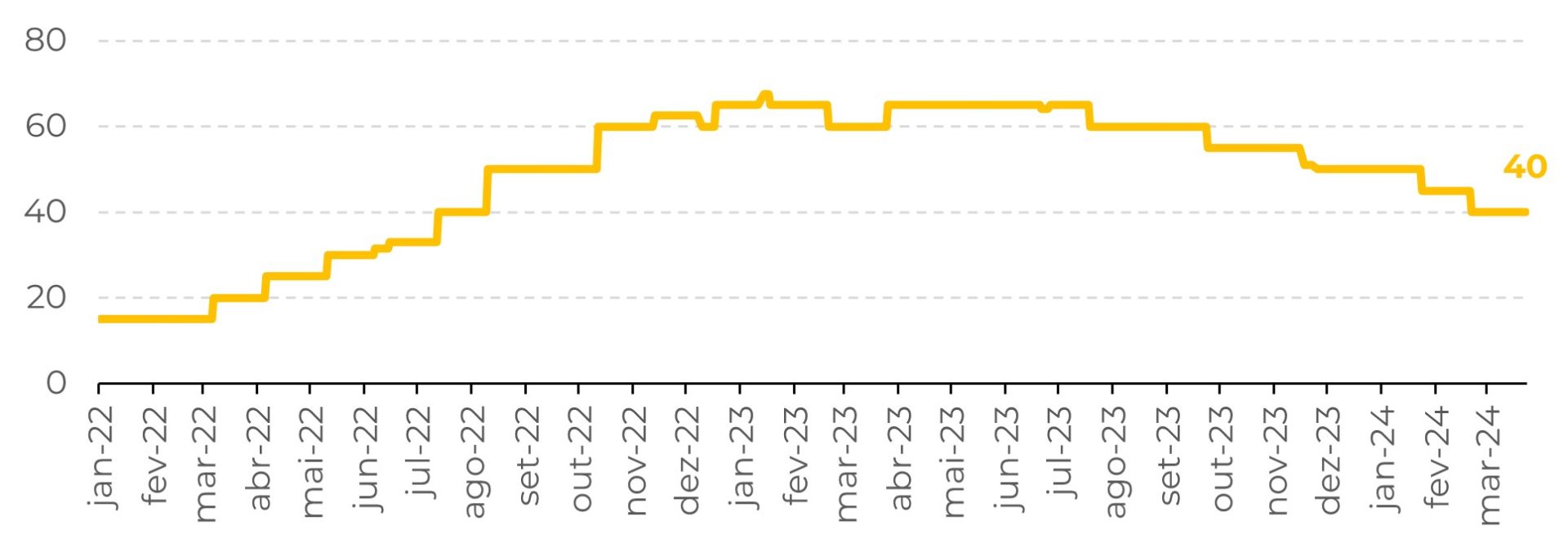

Ultimately, the candidates' chances and the impact on the markets will probably be guided by whether the US economy manages a soft landing, with volatility swings driven by politics. The historical record suggests that President Biden has a better chance of winning if the US avoids a recession.

Presidential victory odds (average bets, %)

Source: Real Clear Politcs

US recession probabilities (%)

Source: Bloomberg

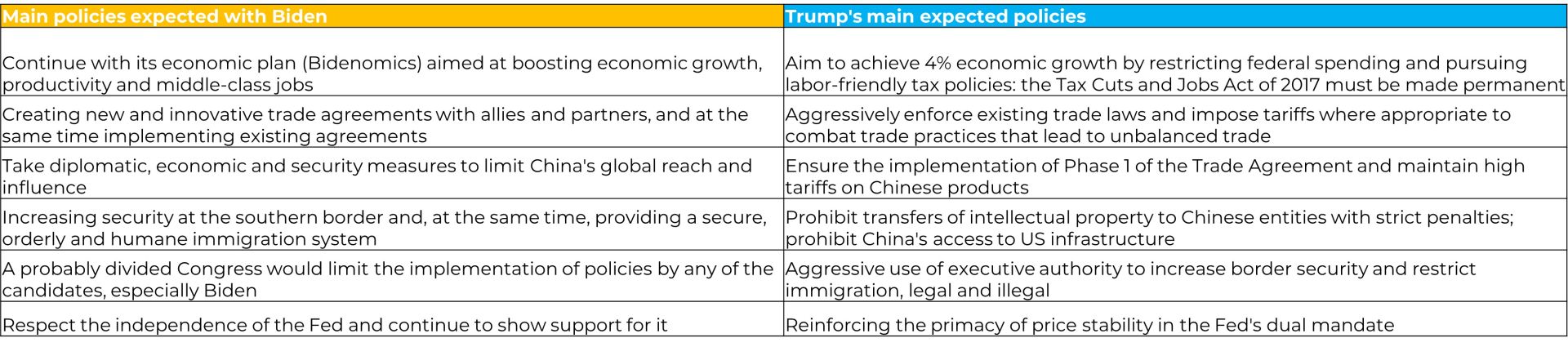

What are the main policies of each candidate?

Table 1 shows how the political priorities of the two candidates differ. Basically, Biden signals continuity of policy and a more subtle stance on foreign and trade policy.

In contrast, a Trump presidency could bring more friction, both domestically (through immigration restrictions at a time when the labor market is tight) and to the rest of the world. One of his political priorities is to impose a 60% tariff on imports from China and a 10% tariff on other trading partners, including the European Union.

On the other hand, Trump plans to reduce US corporate taxes, which could be positive for risk assets in general - but especially for US stocks. The impact on financial markets will probably be determined by the sequence of implementation of his policy: will the proposed corporate tax cuts come before legislation on immigration and/or import tariffs?

Table #1: Main policies of each candidate

Source: Standard Chartered

Impacts on the energy complex

The US election could have major impacts on the energy sector. Trump would seek to undo much of the Biden administration's work on combating climate change if returned to office after the November election, and would launch new efforts to expand fossil fuel production.

While some biofuel tax credit programs are traditionally bipartisan, Biden's SAF grand challenge and other biofuel policies could be at risk in a Trump victory scenario. During Trump's first term, this was illustrated by a series of exemptions granted to refiners, exempting them from complying with the Renewable Fuel Standard (RFS).

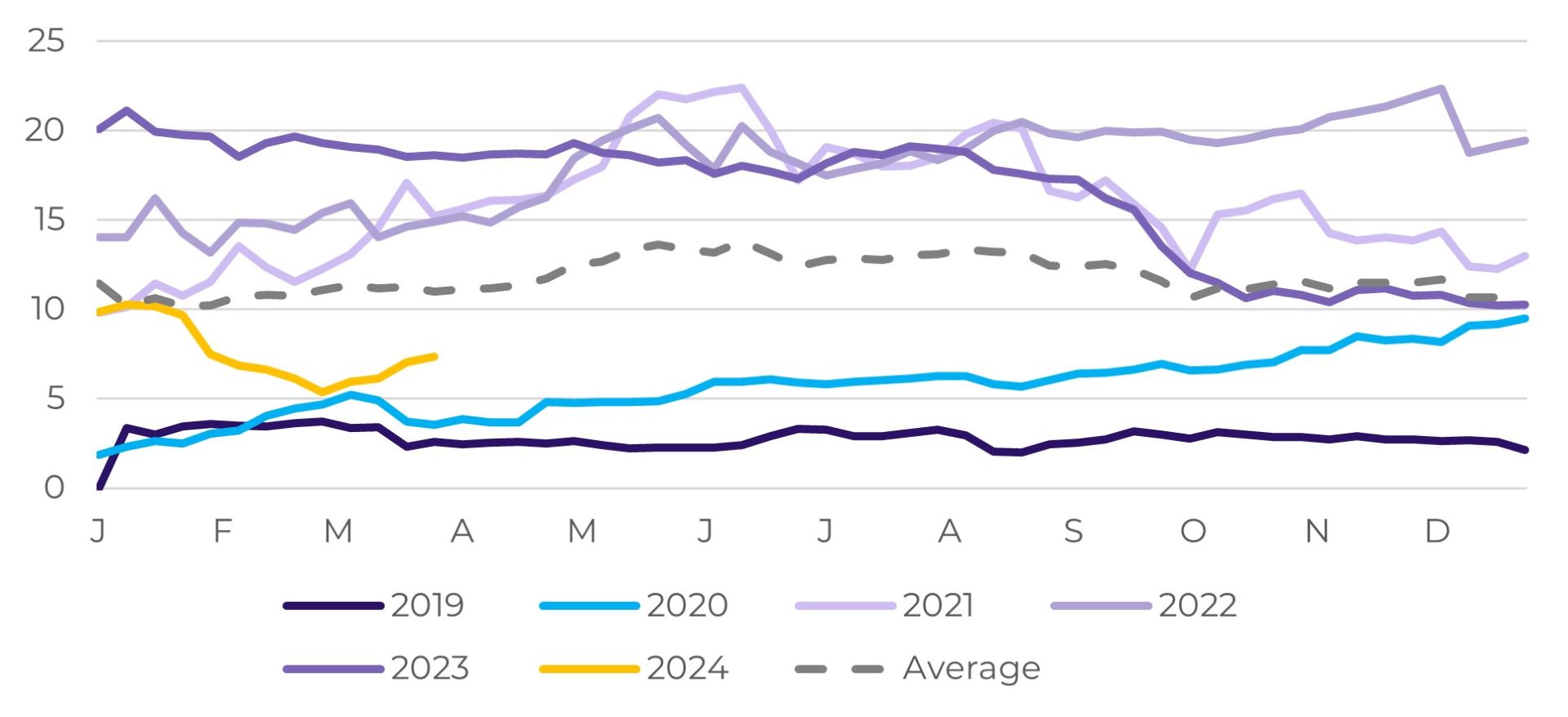

Renewable Volume Obligation (RVO, USc/USG)

Source: Bloomberg

In Summary

History shows that US presidents are usually re-elected if the economy avoids a recession. The latest data was softer than expected. However, Fed chairman Jerome Powell has reiterated plans to cut rates later this year if the current disinflationary trend persists, which should help support growth.

A favorable scenario for risk assets tends to be positive for commodities in general. The biggest specific impact should be on the energy complex: Trump's policies seem to be more favorable to fossil fuels, while renewables could benefit relatively in a Biden victory scenario.

Despite Trump's lead in the polls and other indicators, we are still only at the beginning of the electoral race, and the unpopularity of both candidates means that there will be high volatility during the electoral process. However, American markets tend to be resistant to political volatility. Analyzing the performance of the S&P 500 from 1937 to 2022, for example, it can be seen that the average annual return is 9.9% in presidential election years and 12.5% in non-election years. The S&P 500 has not fallen during a presidential re-election year since 1952.

A favorable scenario for risk assets tends to be positive for commodities in general. The biggest specific impact should be on the energy complex: Trump's policies seem to be more favorable to fossil fuels, while renewables could benefit relatively in a Biden victory scenario.

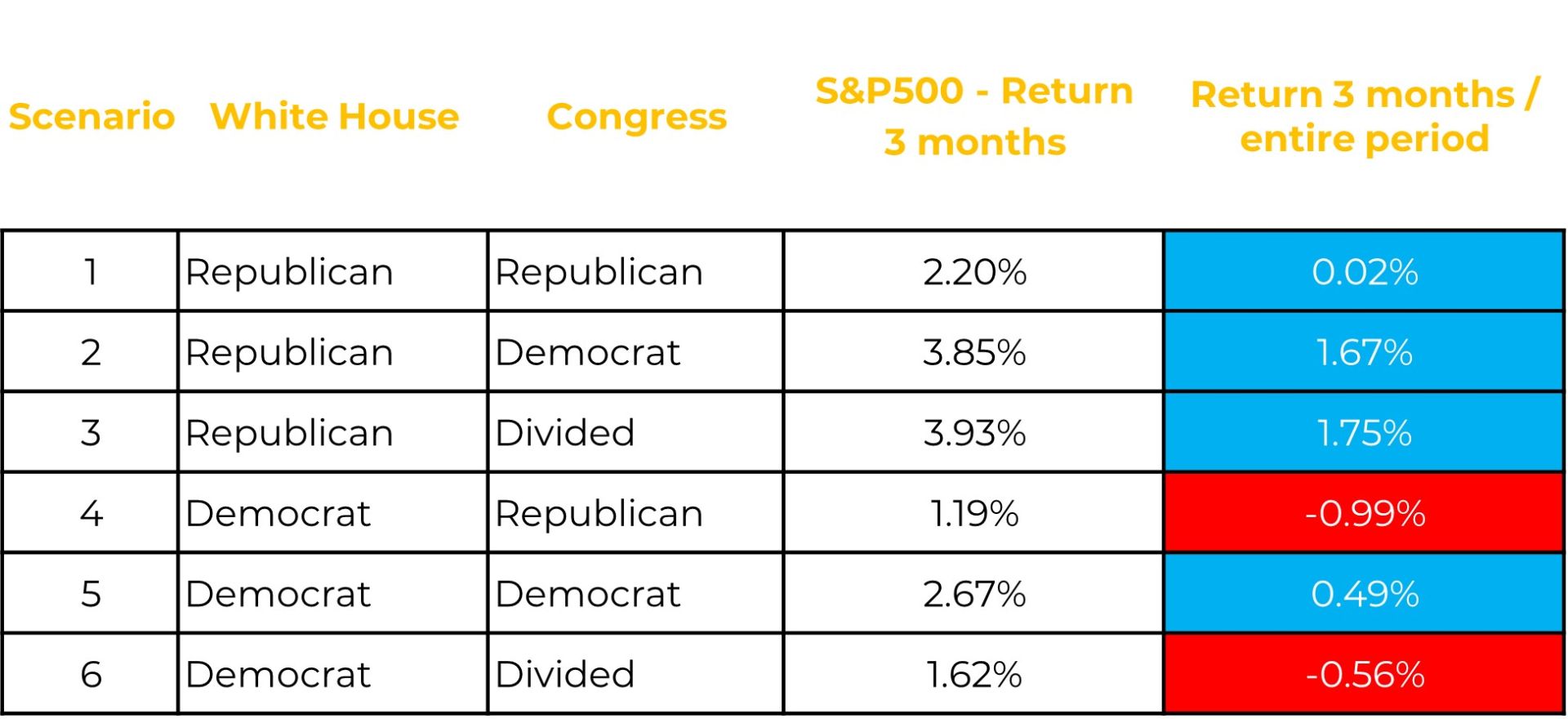

S&P500 returns after elections

Source: US Bank Asset Management Group

Weekly Report — Macro

Written by Alef Dias

alef.dias@hedgepointglobal.com

alef.dias@hedgepointglobal.com

Reviewed by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.