Apr 3

/

Victor Arduin

Macroeconomics Weekly Report - 2024 04 03

Back to main blog page

Some relief for the commodity market

- After some upward surprises in US inflation, the February PCE came below market expectations, bringing more optimism about the start of the US interest rate cut in June this year.

- In addition, upward revisions to global GDP and the expansion of industrial activity in the world's main regions indicate that commodity consumption this year could be higher than initially expected.

- Stimulus from China is fueling this optimism, and the country could spring a surprise in 2024, as Beijing becomes more willing to use the necessary instruments to achieve growth of more than 5%.

- However, this relief for commodities, which had been under a lot of pressure from the restrictive monetary environment until then, could be limited by the high US public deficit.

Introduction

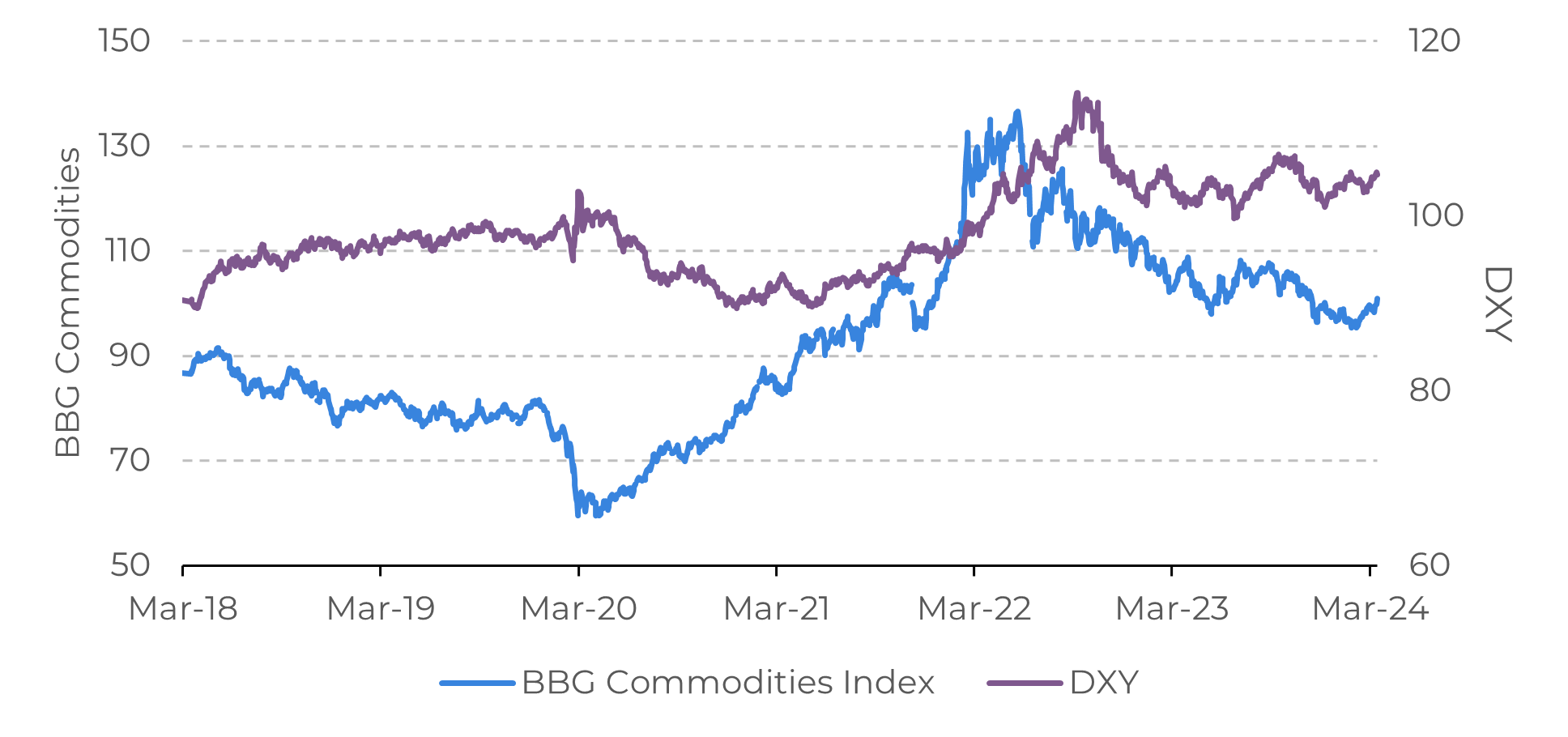

Commodities represent one of the most fundamental asset classes in the economy, influenced by the dynamics of supply and demand in the market and susceptible to the volatility of macroeconomic events. In this sense, in recent months we've seen a bearish scenario for commodities amid a very appreciated dollar and an intense restrictive monetary policy in the world's main economies aimed at fighting inflation.

Although some risks still persist in the market, there are signs bringing more optimism to prices in 2024. Stimulus from China, more positive revisions to global GDP, geopolitical concerns and a possible soft landing in the world's largest economy are some examples that favor a more bullish outlook for these assets. Therefore, our report will focus on discussing the factors that are providing some relief to the commodities market.

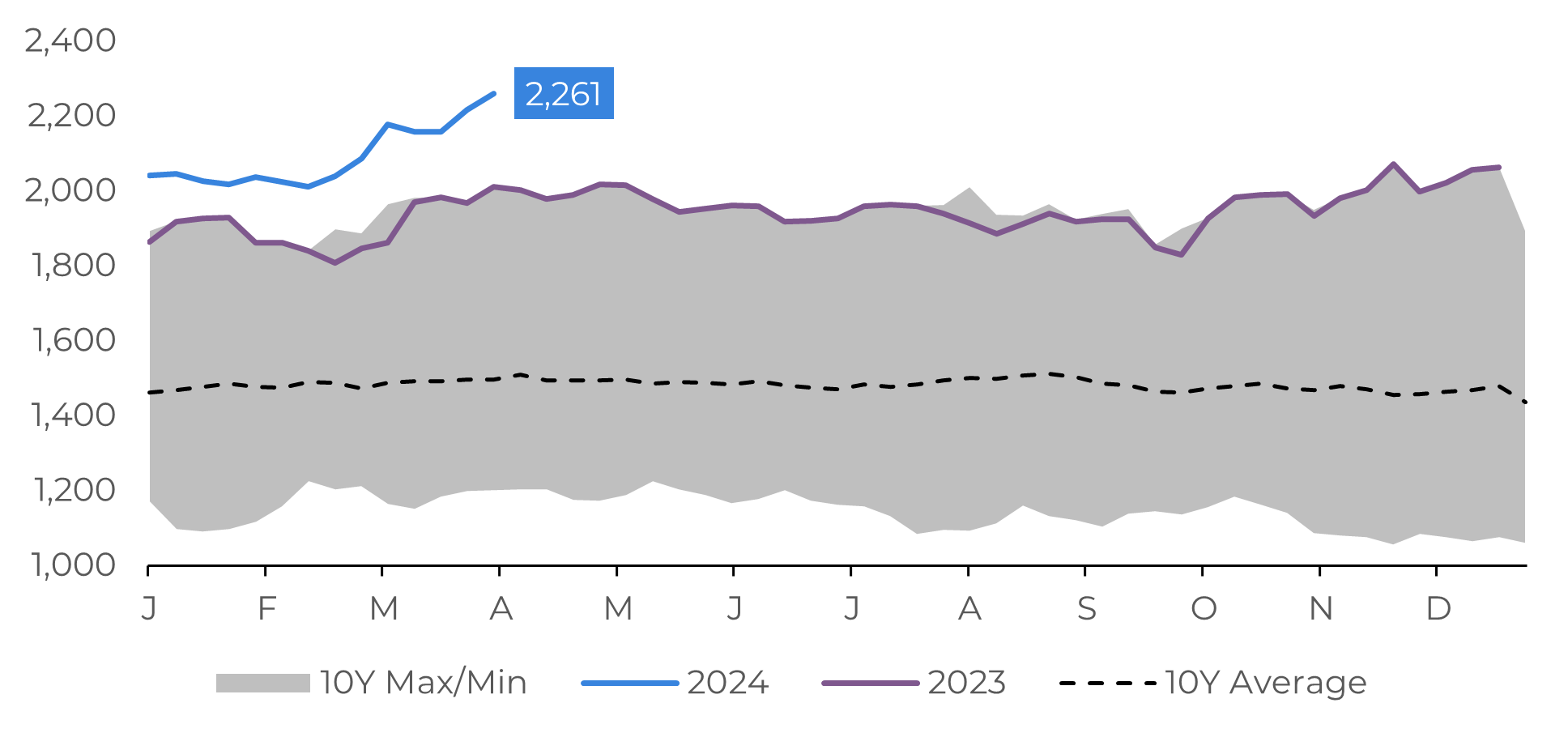

Image 1: Gold (US$/Ounce)

Source: Refinitiv

Image 2: BBG Commodities Index Vs. DXY

Source: Refinitiv

Global GDP shows improvement at the end of the first quarter of the year

The most eagerly awaited event this year is undoubtedly the start of the easing of restrictive monetary policy in the US. Although some data has brought an increase in risk aversion, the latest PCE, a metric most used by the Fed, showed an increase of 0.3% in February, below the market's estimate of 0.4%. As a result, the annual variation rose from 2.4% to 2.5%. If labor market data continues to show moderation, we have a better scenario for reducing the country's interest rate, currently in the 5.50%-5.25% range.

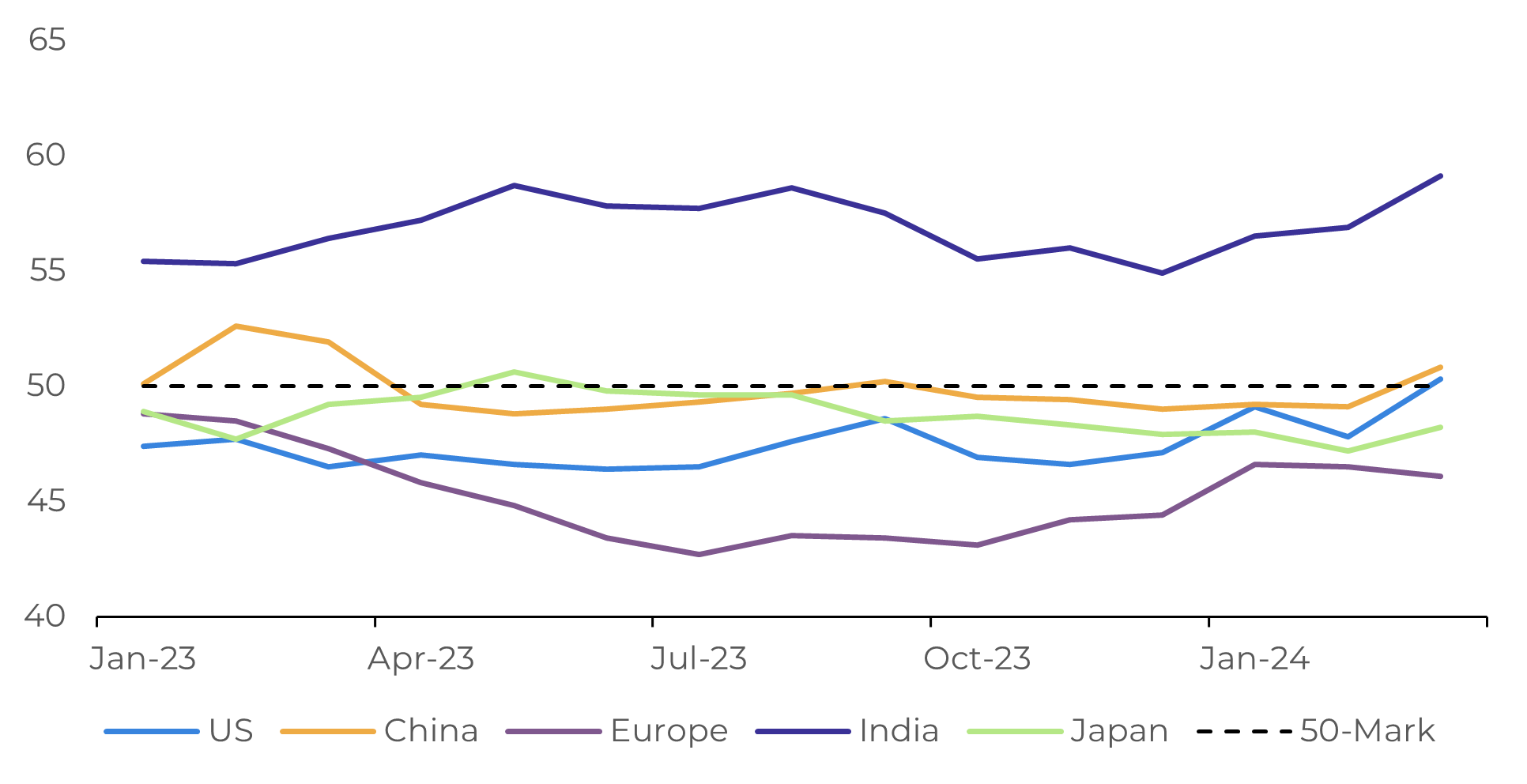

It appears likely that the US central bank will achieve a "soft landing," converging inflation to the target without triggering a recession. The recession scenario would likely be the worst outcome for the commodities market, but it appears unlikely at present. Additionally, bullish revisions to GDP - with the IMF projecting 3.2% growth - and manufacturing PMIs in both the US and China exceeding 50 (indicating expansion) are indicating to the market the prospect of higher raw material consumption than initially anticipated.

Image 3: Manufacturing PMIs in Selected Regions

Source: Refinitiv

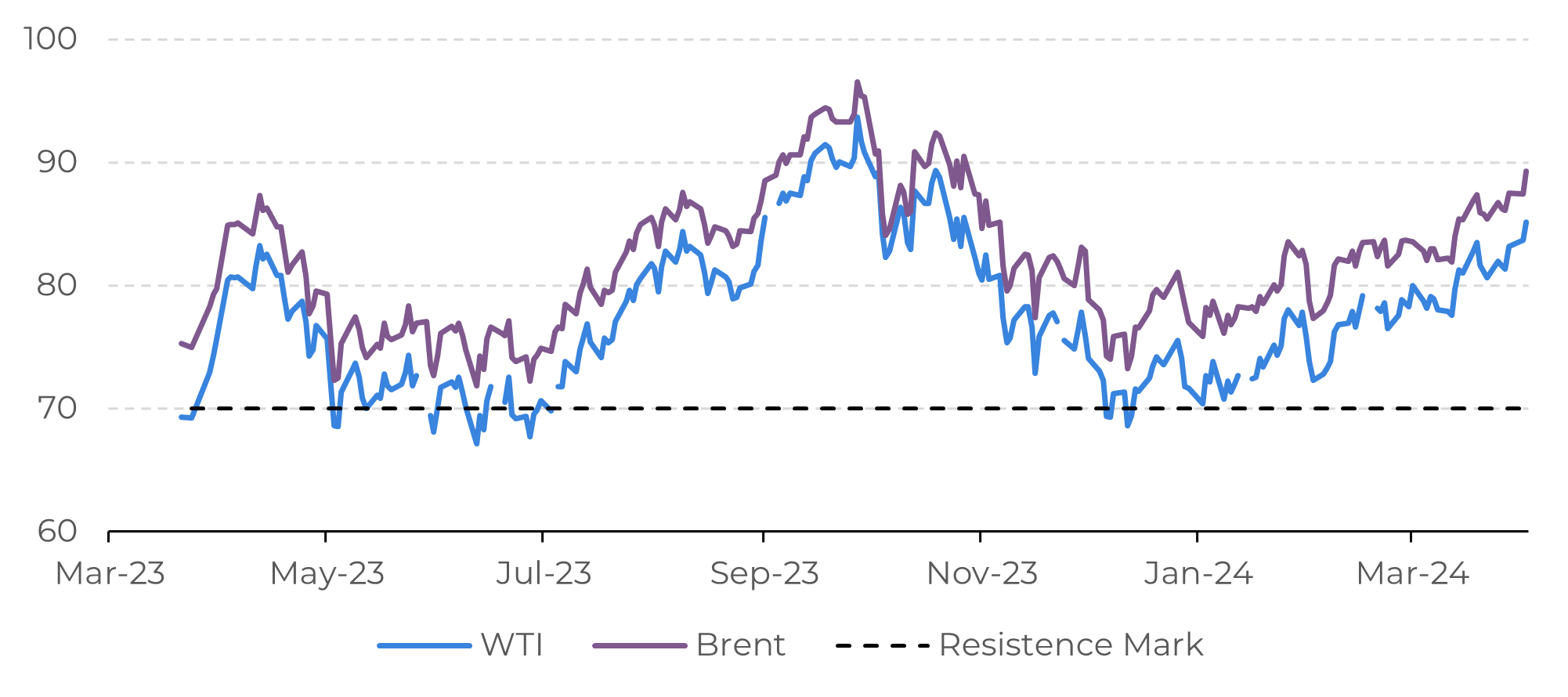

Energy commodities face a confluence of supply risks. These range from difficulties experienced by ships using the Suez Canal to Ukrainian drone attacks on Russian refineries. Additionally, low US stockpiles have resulted in wider oil derivative cracks, while higher oil premiums reflect heightened geopolitical tensions in the Middle East. Looking to metal and grain commodities, China's recent stimulus measures offer positive news. The country's decision to cut its 5-year Loan Prime Rate by 25 basis points to 3.95% signals Beijing's willingness to utilize policy tools to promote economic growth exceeding 5% this year.

In addition, when analyzing the current scenario, one asset that has benefited from this environment of greater geopolitical risk and interest rate cuts is gold. Gold, which also serves as a store of value, has accumulated a rise of approximately 10% in 2024 (+US$194/ounce). However, it's important to note that although the reduction in interest rates weakens the dollar, the US public deficit will likely cause the dollar to strengthen due to higher yields in its treasuries. Therefore, current events will bring relief to commodities, but other fundamentals, such as a still-strong dollar and the slow global economic recovery, especially in Europe, should limit gains.

Image 4: Main Oil Benchmarks (US$/bbl)

Source: Refinitiv

In Summary

Recent events favor an appreciation of commodities, especially with the interest rate cut that will come sooner or later in the United States, reducing the cost of stockpiling and stimulating demand.

The upward revisions to world GDP, as well as the expansion of industrial activity, are also good signs that consumption will grow in 2024. In addition, when analyzing assets in the energy sector, geopolitical risks are favoring oil and its derivatives.

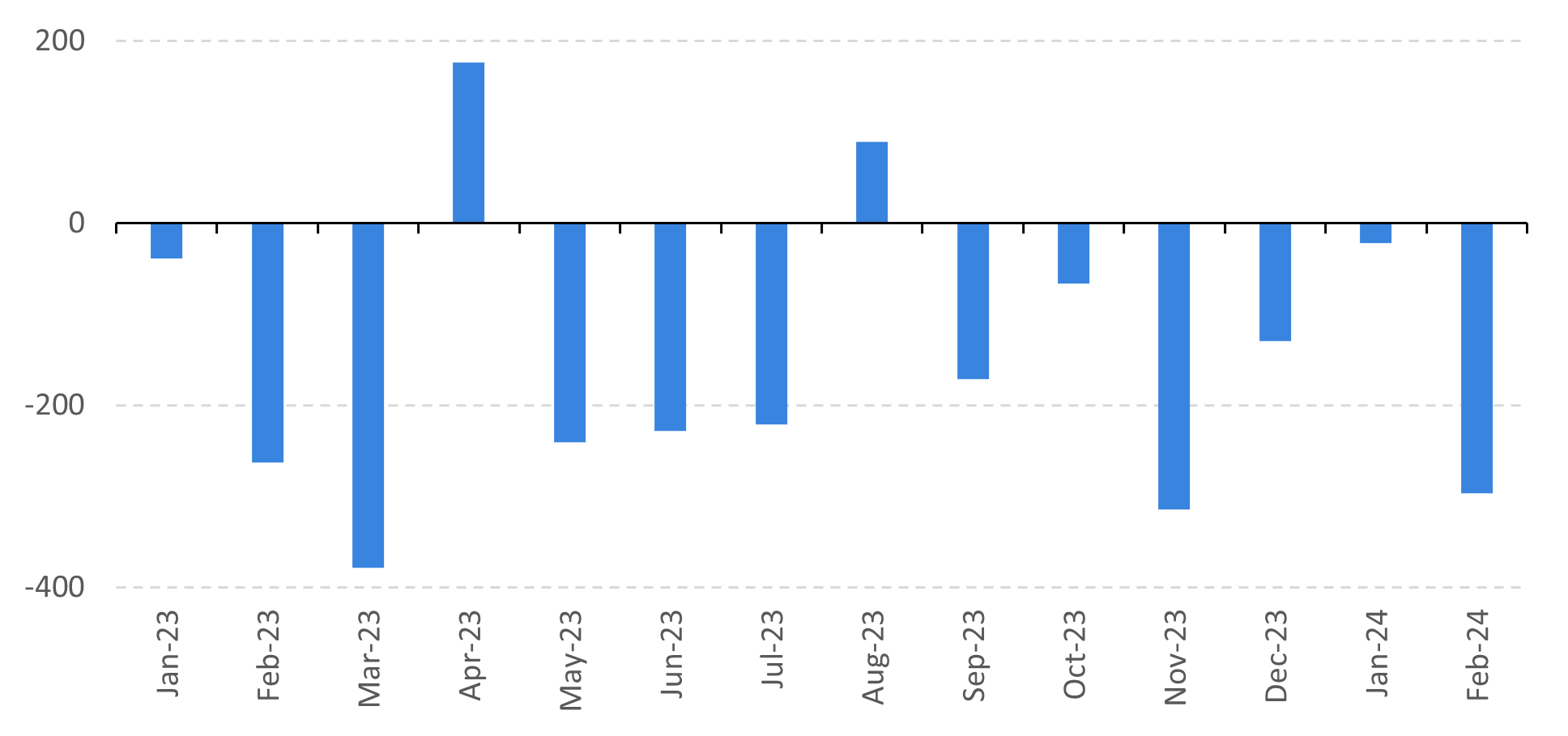

However, some factors could limit commodity gains. One such factor is the high public deficit in the US. This deficit is likely to lead to higher yields (rather than premiums) on US Treasuries, which would in turn strengthen the dollar.

Image 5: US Treasury Federal Budget Debt Summary (Billion USD)

Source: Bloomberg

Weekly Report — Macro

Written by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Reviewed by Thais Italiani

thais.italiani@hedgepointglobal.com

thais.italiani@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.