Apr 15

/

Victor Arduin

Macroeconomics Weekly Report - 2024 04 15

Back to main blog page

Where the Chinese economy is heading

- The impacts of the Chinese economy are being felt both directly and indirectly in various countries. As a major importer of commodities and exporter of industrialized goods, the market is closely watching its economic data to determine whether the country will achieve its growth target of around 5%.

- In this sense, the industrial segment has been a positive highlight, showing annual growth. In addition, in terms of volume, the country's exports have increased, demonstrating that even in a restrictive global environment, China has found markets for its products.

- However, there are challenges ahead. Domestic demand remains subdued amid a crisis of confidence and very low inflation. In addition, the crisis in the real estate sector remains an obstacle for the country's economy, increasing pressure for stimulus from Beijing.

Introduction

In recent years, there have been significant changes in China. Its economy, which for a long time was focused on infrastructure and real estate, is now shifting towards relying more on its exports and domestic consumption.

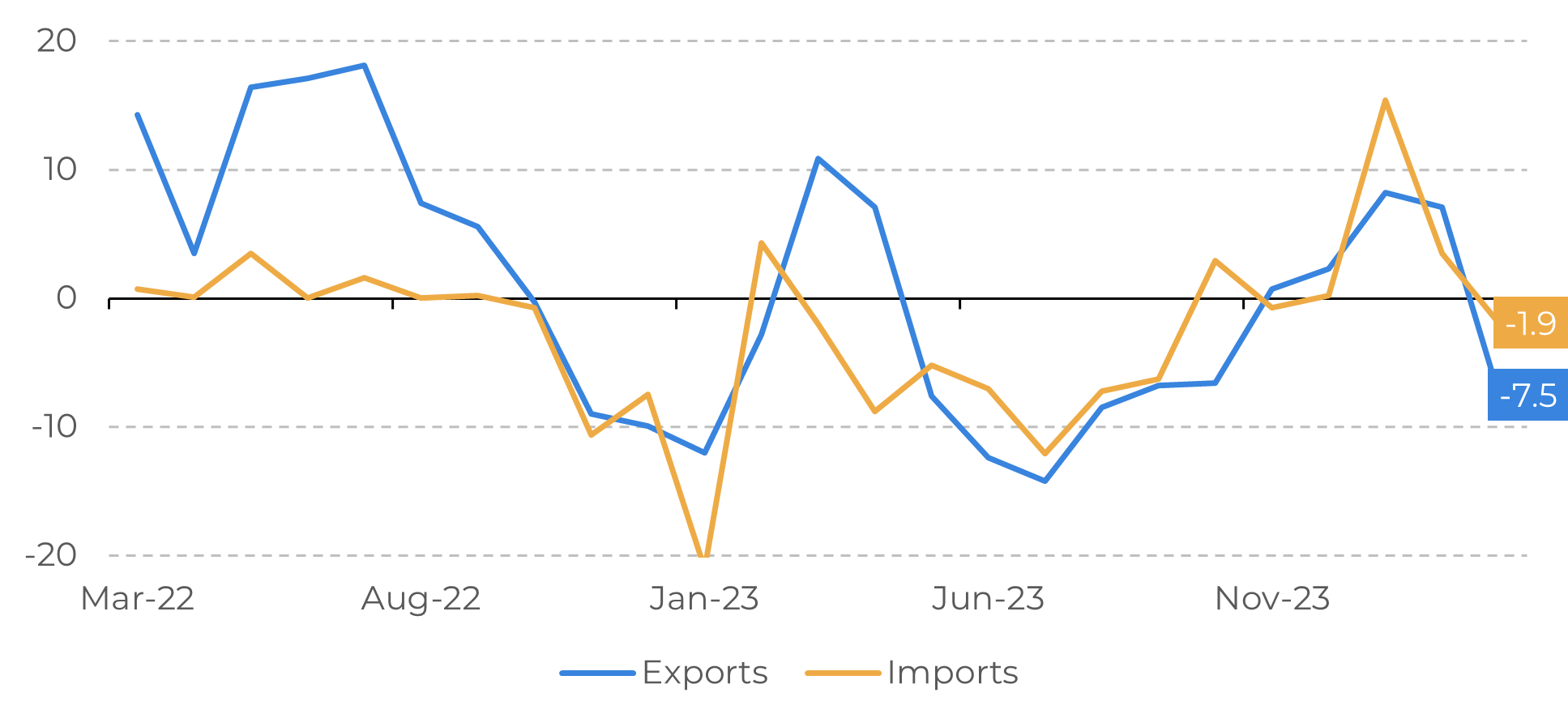

In this scenario, the performance of its industry will be very important in 2024 to determine whether the country achieves its growth target of around 5%. In addition, the country's international trade shows signs of caution. Although the volume of exports is growing year-on-year in dollars, the figures for March show a fall of 7.5%. Imports also fell by 1.9%.

Therefore, this report will analyze what has been happening in Chinese industry, the consequences for its trade balance and what could happen over the course of this year in relation to its economic growth.

Image 1: China - Exports and Imports YoY (%)

Source: Refinitiv

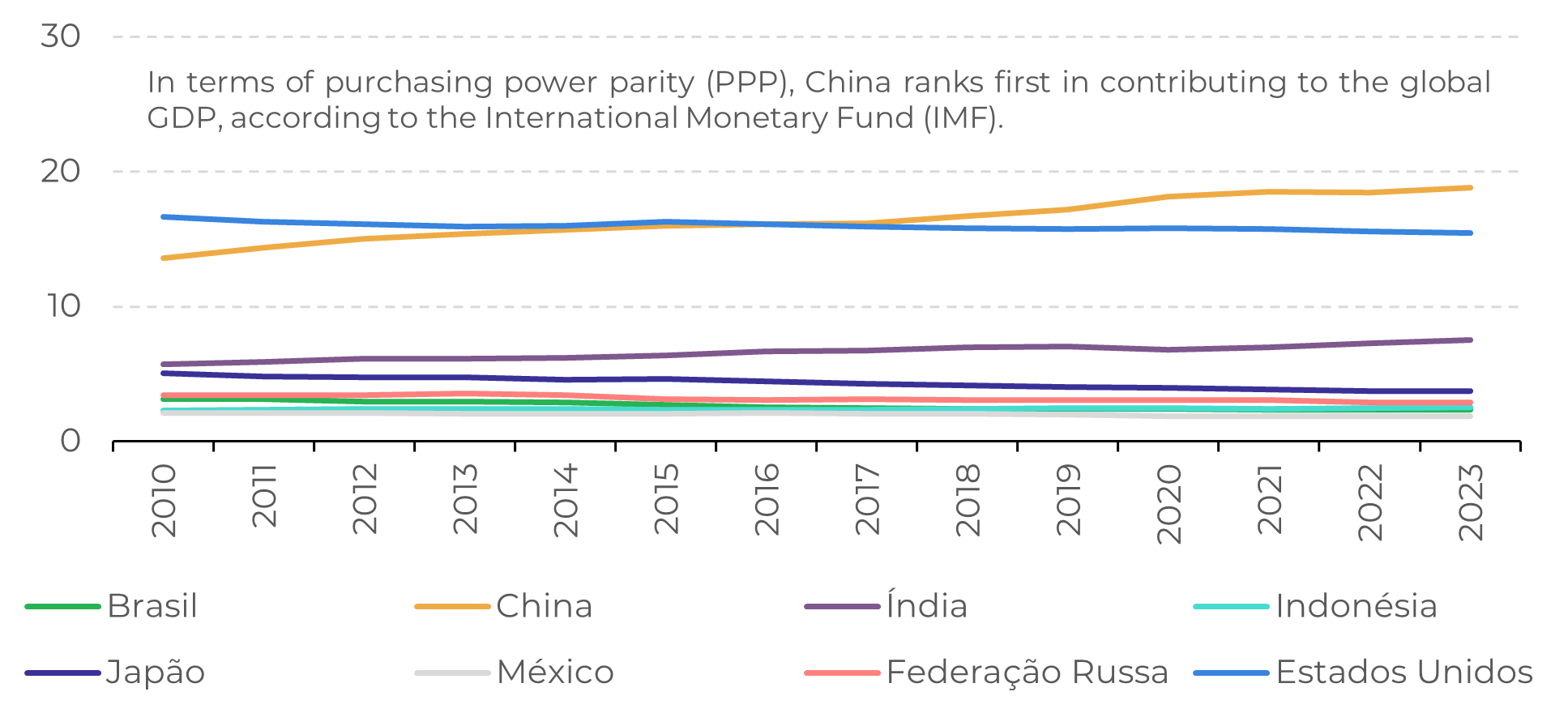

Image 2: GDP based on PPP, world share (%)

Source: IMF

Idle industrial capacity has put pressure on industrial prices

China's industry has been surprising, even in the face of internal structural challenges such as the economic slowdown and an aging population. In addition, the external sector also imposes limits on international trade due to the contractionary monetary policies implemented by the world's main economies. Even so, industrial production grew by 7% in January and February compared to the same period last year, above Reuters' projections for a 5% increase. In March, the manufacturing PMI, an important indicator for the sector, reached 50.8, signaling expansion for the first time since September last year.

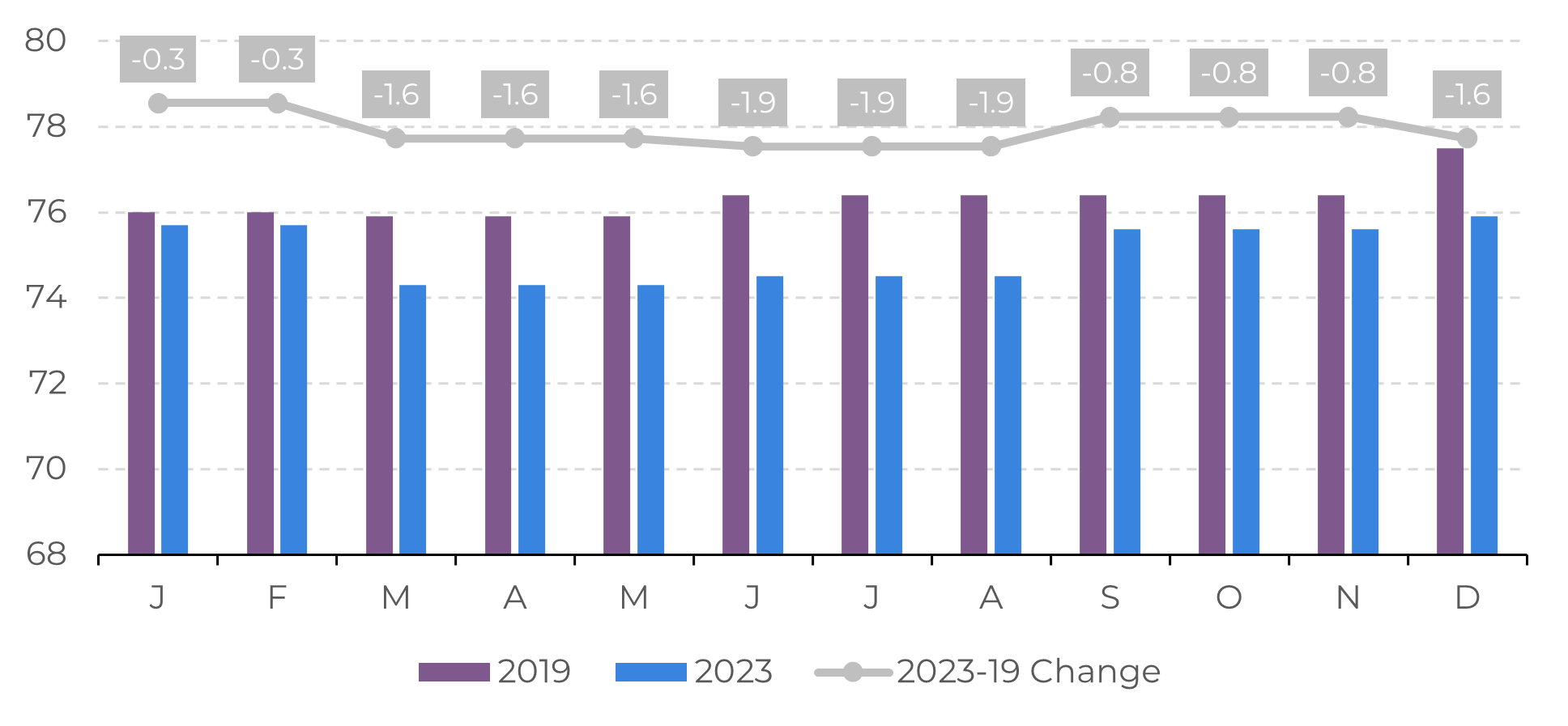

However, other data draws attention. While the deflation of producer prices (PPI) has helped to make the country's products more competitive internationally, this explains why exports are falling when measured in dollars, but expanding in volume. On the other hand, this result has been achieved by the idleness of the country's industrial complex and lower domestic demand, a major challenge for the Chinese authorities.

However, other data draws attention. While the deflation of producer prices (PPI) has helped to make the country's products more competitive internationally, this explains why exports are falling when measured in dollars, but expanding in volume. On the other hand, this result has been achieved by the idleness of the country's industrial complex and lower domestic demand, a major challenge for the Chinese authorities.

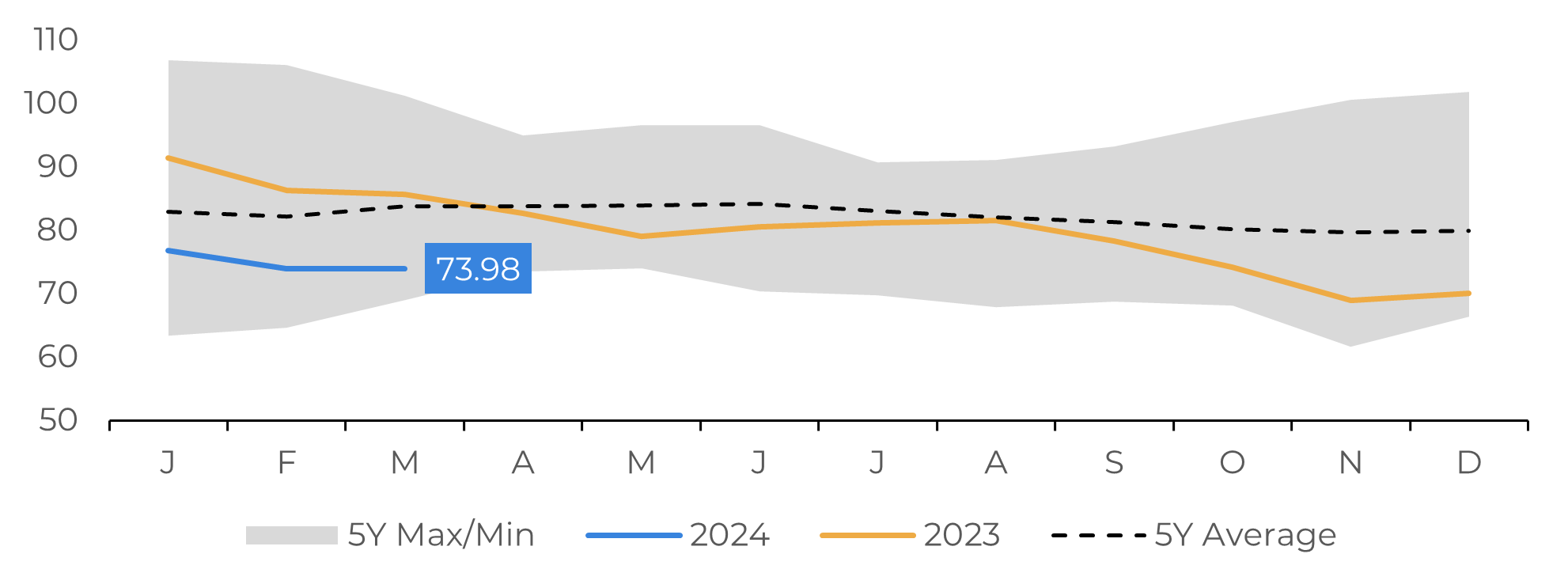

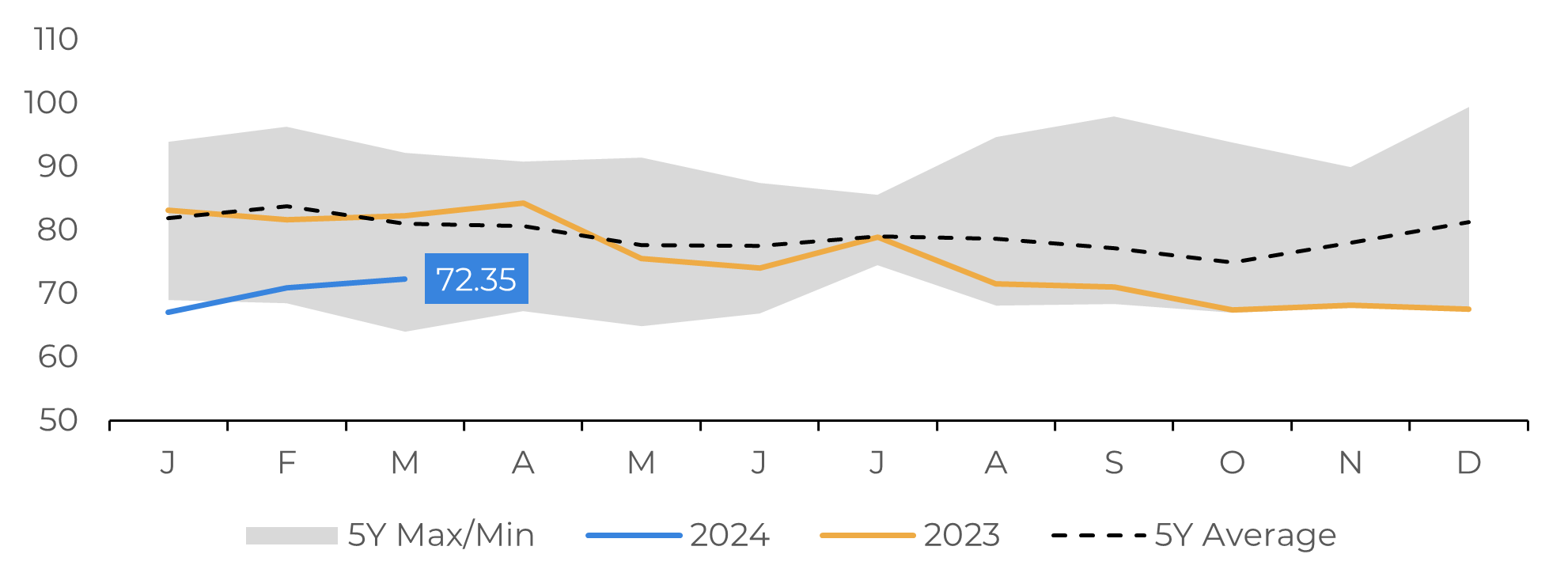

Image 3: China - Industrial Capacity Utilization (%)

Source: Refinitiv

The real estate sector will influence GDP, but from a different perspective

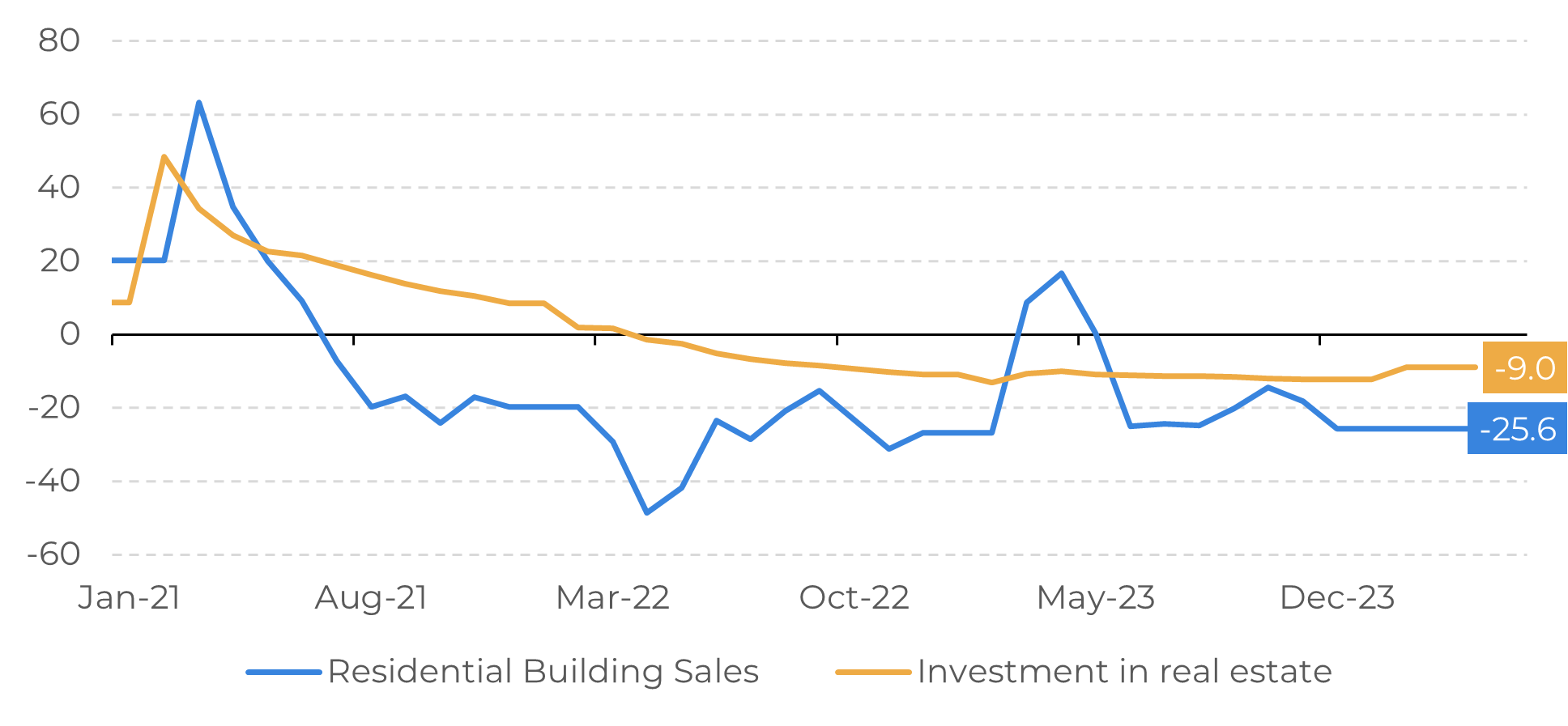

Real estate development has been one of the main drivers of the Chinese economy in recent decades. Despite the current crisis, the sector will be crucial in determining whether China reaches its growth target of around 5% by 2024. However, its relevance is now associated with the pace of its slowdown, rather than its contribution to GDP growth.

The first few months of 2024 continue to show downward trends for the Chinese real estate sector, with residential property sales down by more than 25% and investments falling. In 2013, the real estate sector accounted for 12% of the country's GDP, while this year projections indicate a figure of just over 5%. However, recent data has revealed challenges in both areas, with exports in dollars falling and domestic consumption moderating.

In view of this, pressure is growing on Beijing to implement more stimulus, whether fiscal or monetary, in order to boost the country's economy.

Image 4: China - Real Estate Indicators YoY (%)

Source: Refinitiv

In Summary

Understanding the performance of the Chinese economy is one of the most important challenges for the global market. As a major importer of commodities such as minerals, oil and soybeans, and exporter of industrialized goods such as electronics, machinery and vehicles, China has a significant influence on the world economy.

In this sense, the market is closely watching China's economic indicators, which determine the pace of GDP growth. While the real estate sector continues to show weakness, industrial production has been surprising and will contribute to the country's growth.

In addition, the country's exports are reflecting low prices due to the country's idle capacity. Despite increasing the competitiveness of their products, they point to lower domestic demand and a reduction in company profits.

Expectations are therefore growing of stimulus from Beijing to support the economy, provided, of course, that the government maintains its growth target of around 5%.

Image 1: China - Monetary Conditions Index (Base = 2007)

Source: Bloomberg

Image 2: China - GS Tax Stimulus Basket Index

Source: Bloomberg

Weekly Report — Macro

Written by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Reviewed by Alef Dias

alef.dias@hedgepointglobal.com

alef.dias@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.