Apr 9

/

Alef Dias

Macroeconomics Weekly Report - 2024 04 09

Back to main blog page

Another decisive week for the Fed

- The March jobs report - with payroll figures surpassing estimates and the unemployment rate falling - increased the risks that the start of the interest rate cut cycle will be postponed.

- The focus now turns to the trajectory of inflation, currently a more critical factor in the Fed's reaction function. The CPI for March is expected to show a modest slowdown in the monthly pace of inflation, despite the acceleration in the year-on-year comparison.

- If the data comes in line with expectations, recent market behavior points to a rise in US bond yields and the DXY in the short term, given that core inflation is still expected to accelerate in the annual figures.

- The minutes of Fed's last meeting will also be released this week and deserves attention. It should reveal how the FOMC members interpreted the mixed data leading up to the meeting

Introduction

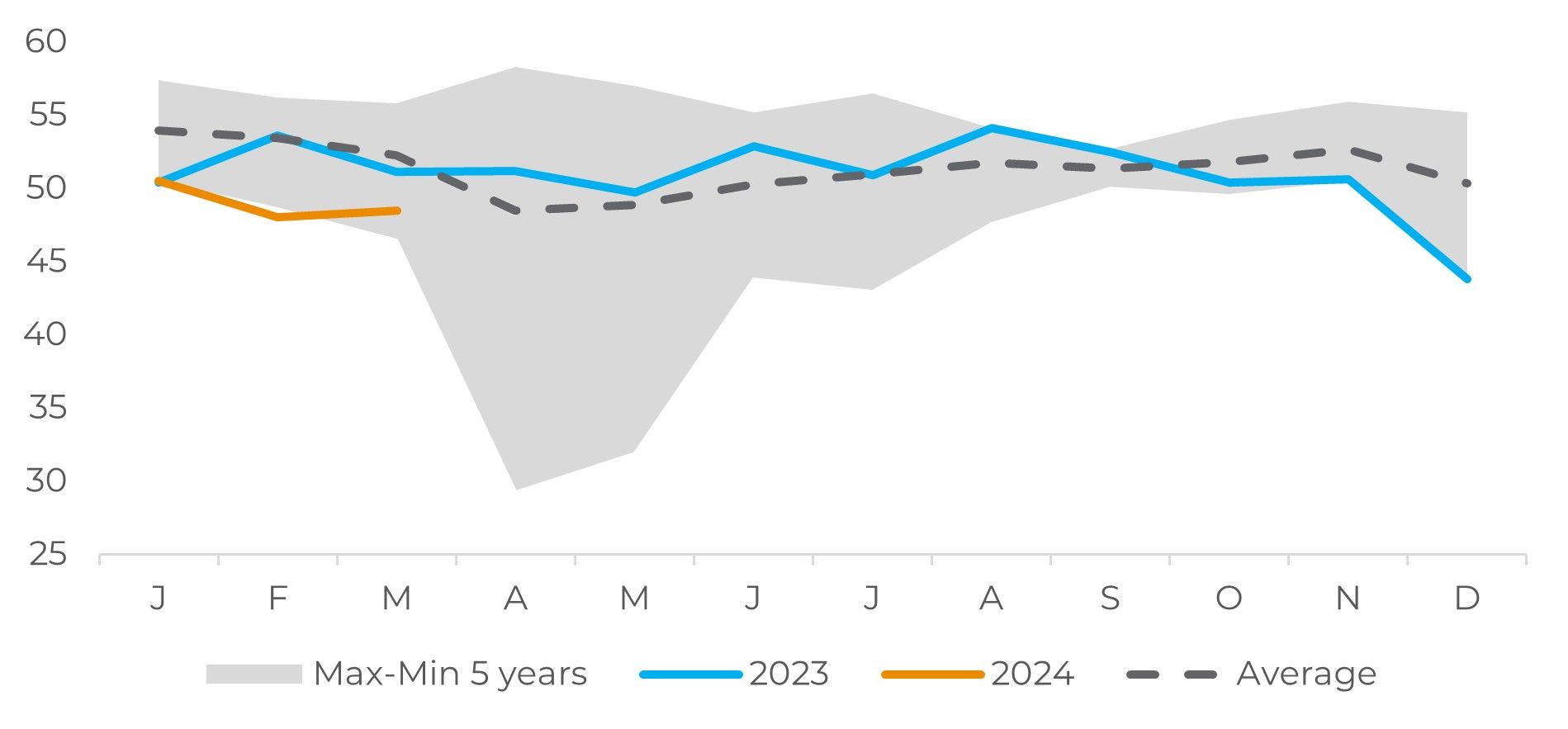

The March jobs report - with hiring exceeding estimates and the unemployment rate falling - increased the risks that the start of the rate cut cycle will be delayed. Even so, caution is needed with long lags and other monetary policy variables. The employment components of the ISM surveys indicate persistent weakness in both the services and industrial sectors.

The focus now turns to the trajectory of inflation, currently a more critical factor in the Fed's reaction function. The March CPI (to be released on Wednesday) is expected to show a modest slowdown in the monthly pace of core and headline inflation to 0.3% for the month - consistent with the Fed's annual target of 2.0% for core PCE inflation.

The minutes of Fed's last meeting will also be released this week and deserve attention. It should reveal how the members of the FOMC (Fed's Monetary Policy Committee) interpreted the mixed data leading up to the March 19-20 meeting and how convincing they consider the "no landing" forecasts to be.

Employment data masks "heterogeneity" of growth between sectors

The headline figures from the March jobs report generally surprised positively, with hirings, total employment, participation and weekly earnings all beating expectations. This increases the chances that the Fed will remain patient in its fight against inflation, further delaying the first rate cut.

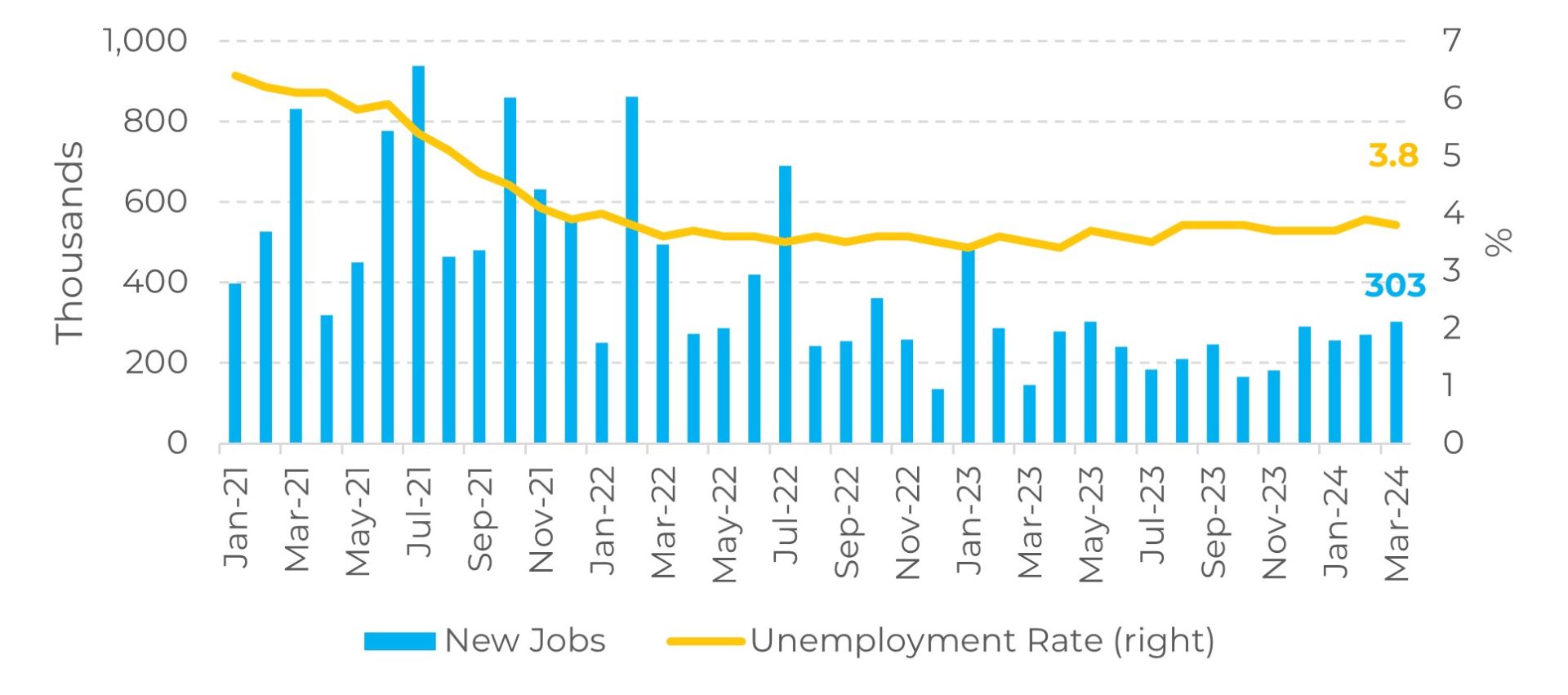

Image 1: New Jobs and Unemployment Rate - US

Source: Refinitiv

However, the details were not so solid, with hiring concentrated in acyclical sectors and unemployment rising in parts of the economy. The duration of unemployment increased in March, reflecting a skills mismatch that cannot be corrected even by a patient Fed. Those with skills in high demand - especially in acyclical sectors or sectors that benefit from the spending of wealthier families - continue to find work, but others may be left behind.

Even so, the strong headline figures tilt the risk towards a slower pace of rate cuts this year. Jobs grew by 303,000 in March, up from a downwardly revised 270,000 in February. This far exceeded consensus estimates of 214,000. Employment gains were mainly concentrated in the health (72,000), government (71,000) and construction (39,000) sectors. Employment levels were little or unchanged in most other major sectors, including mining, manufacturing, wholesale trade, transportation and warehousing, information, financial activities and professional and business services.

The increase in total jobs reduced the unemployment rate from 3.9% to 3.8%. Average hourly earnings increased at a monthly rate of 0.3%, compared to the upwardly revised 0.2% in February.

Image 2: ISM service sector employment indicator - US

Source: Bloomberg

Inflation data should bring more volatility

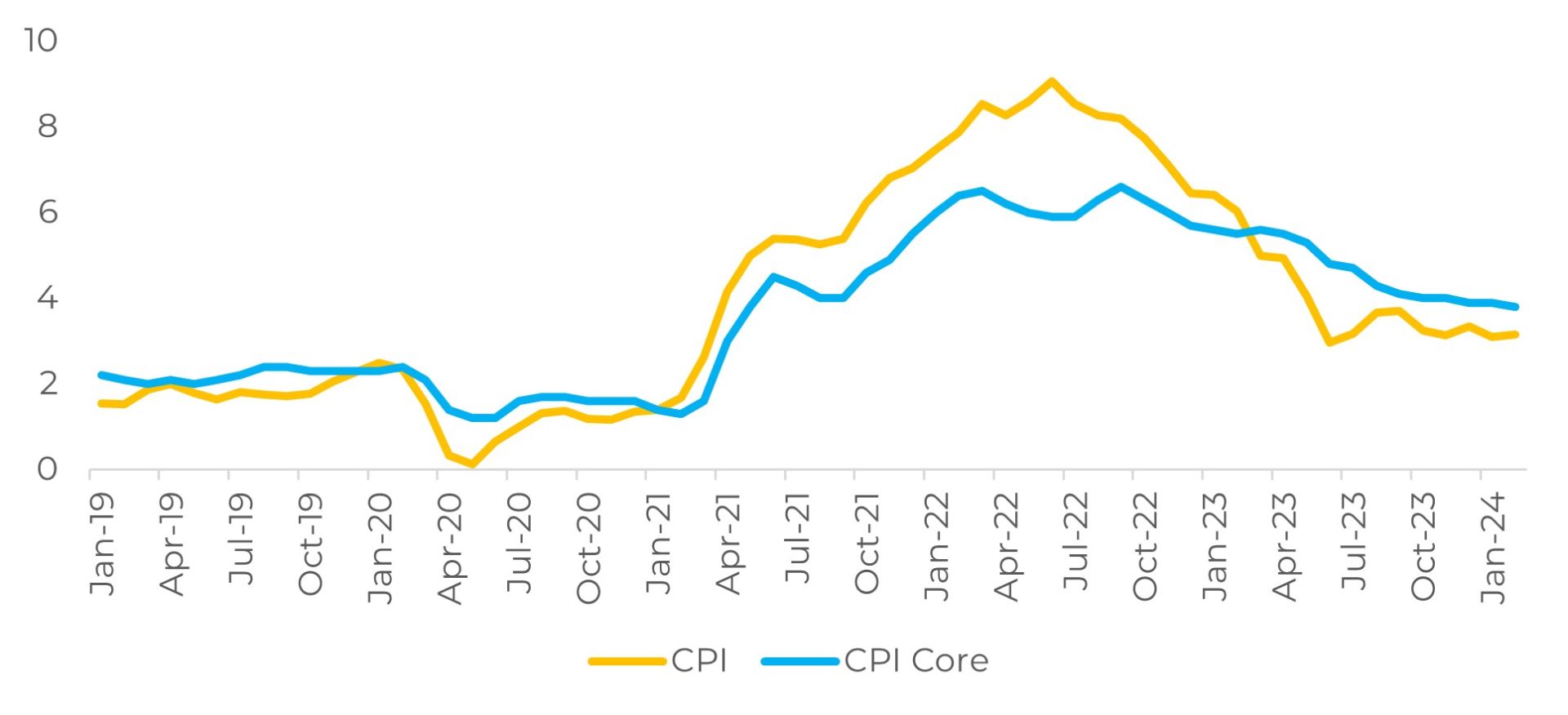

As highlighted by Fed Chairman Jerome Powell in his April 3 speech, the disinflation process is uneven, and the March CPI report is expected to illustrate this point. After two "hot" inflation reports at the start of the year, rising energy prices should keep the core CPI under pressure, even as core inflation slowly moderates.

In the monthly figures, both should slow down to 0.3%. On an annual basis, this means that the main index will increase to 3.3% (compared to 3.2% previously) and the core should fall modestly to 3.7% (compared to 3.8% previously). Finally, annual inflation is expected to be around 3.0% throughout 2024 - low enough for the Fed to start cutting rates, but not low enough to end the battle against inflation this year.

Image 3: US inflation (%)

Source: Refinitiv

Minutes of the March meeting also deserve attention

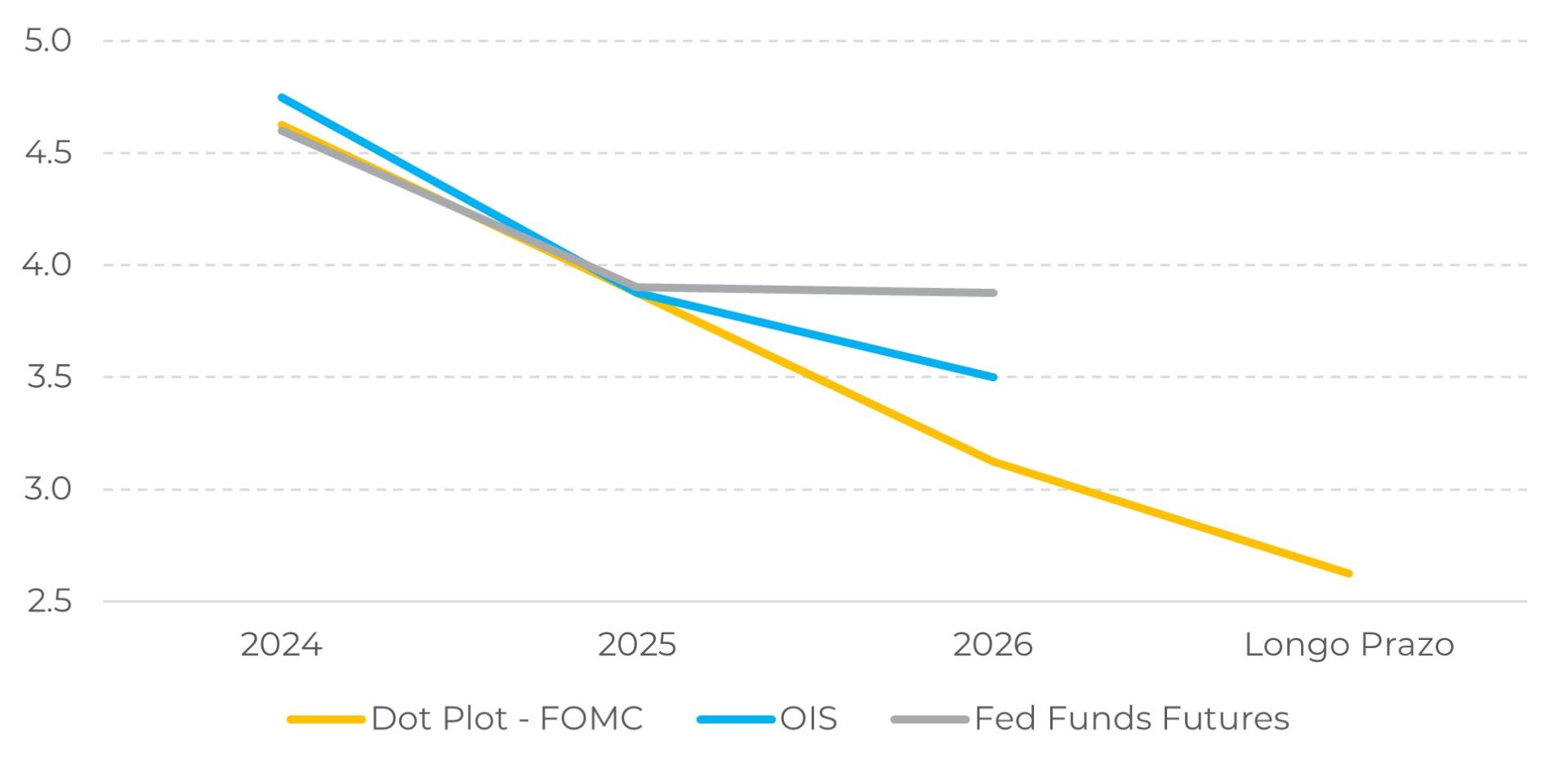

The minutes of the March FOMC meeting are likely to explain why the dot plot has changed to fewer cuts in 2024. We expect to see a discussion of the reasons behind the strength of the economy, including the role of supply-side factors such as immigration in driving long-term growth and the long-term neutral interest rate.

The majority of FOMC members forecast three rate cuts in 2024, hoping that inflation will continue to moderate this year. But sustained strong demand due to increased immigration and the first signs of new problems in the supply chain could make the Fed more cautious than usual.

Image 4: FOMC Dot Plot - US

Source: Bloomberg

In Summary

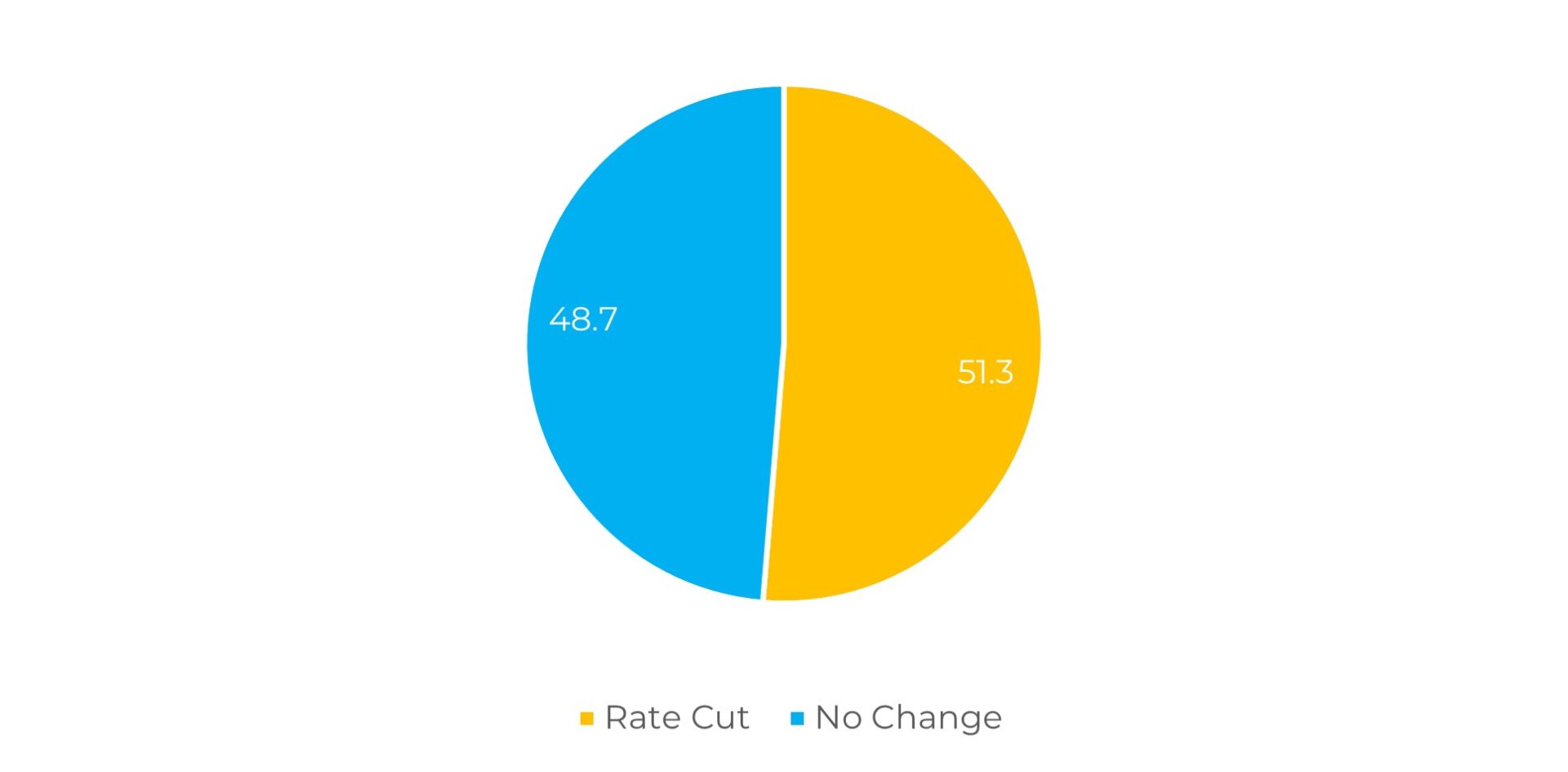

The strong market data on the US economy released last week had a strong impact on expectations regarding the start of the US interest rate cut cycle. The market is practically split on the first cut in June, pricing in a chance of around 51% at the time of the elaboration of this report.

This week will also bring important fundamentals for this discussion, with the release of the latest inflation data ahead of the next Fed meeting (on May 1st). If the data comes in line with expectations, recent market behavior points to a rise in US bond yields and the DXY in the short term, given that headline inflation is still expected to accelerate YoY.

However, confirmation of a slowdown in core inflation could be an indication that the market is more pessimistic than necessary about the US inflationary trend. The minutes of the Fed's last meeting should also be monitored, as they provide important "clues" about the US' monetary authority next steps.

Image 5: Interest Rate Decision Probability - June 12th Meeting (%)

Source: CME *Probabilities on 08/04/2024

Weekly Report — Macro

Written by Alef Dias

alef.dias@hedgepointglobal.com

alef.dias@hedgepointglobal.com

Reviewed by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.