Apr 23

/

Alef Dias

Macroeconomics Weekly Report - 2024 04 23

Back to main blog page

The "end" of the Fiscal Framework and what it means for the BRL

- Just four months into the new Fiscal Framework, the Federal Government announced a loosening of the targets set last year - contributing to a sharp devaluation of the Real.

- The 2025 Budget Guidelines Bill (PLDO), recently presented to the National Congress, proposes achieving fiscal balance in public accounts for next year, while maintaining the same target set for this year. Initially, the projection for next year was a surplus of 0.5% of GDP, but now a zero deficit is being sought.

- The targets for 2026, 2027 and 2028 have also been changed to 0.25% of GDP, 0.5% of GDP and 1% of GDP, respectively. Prior to the revision, the government was aiming for a surplus of 1% of GDP by 2026.

- Since its approval last year, the market had already questioned the federal government's ability to achieve the fiscal surplus targets set out in the Fiscal Framework, and the changes made in the last week have shaken that confidence even more.

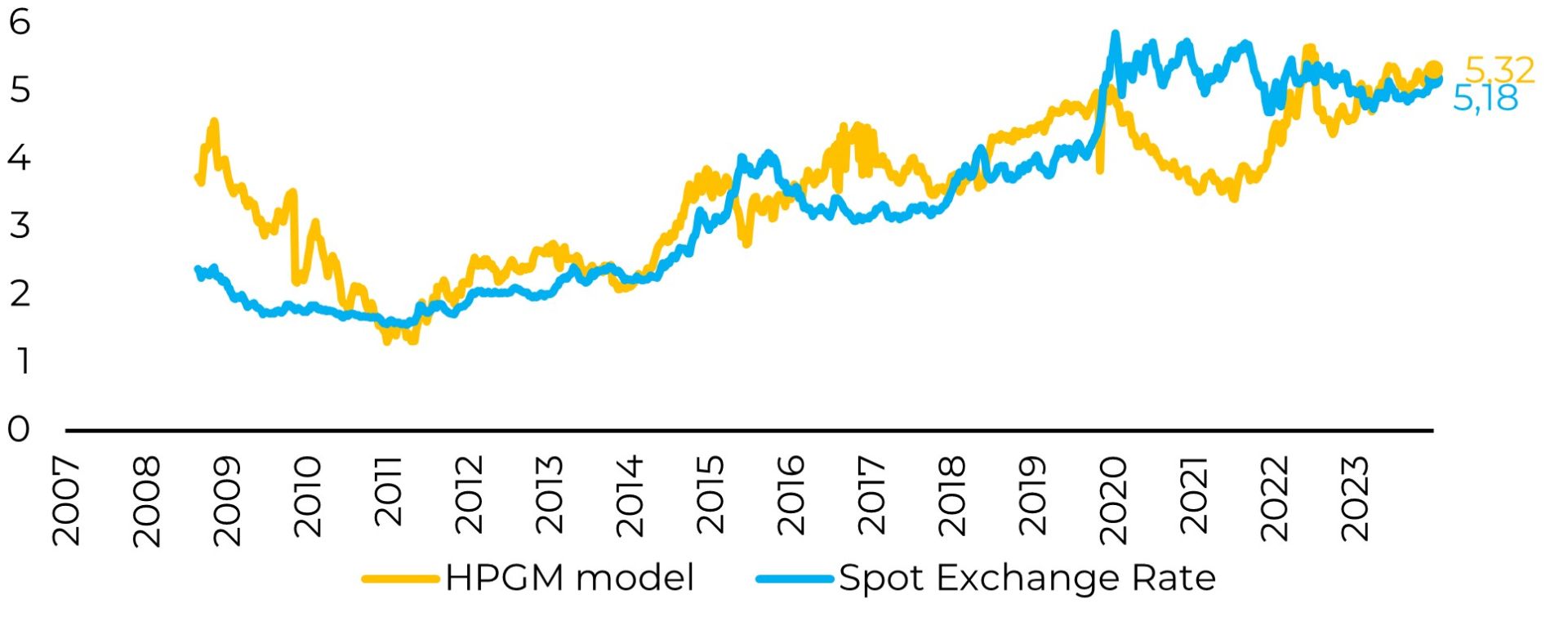

- Fiscal stability is essential for the Real to appreciate, so the current scenario should keep the currency under pressure in the short and medium term.

Introduction

Just four months into the new Fiscal Framework, the Federal Government has announced a loosening of the targets set last year - leading to a sharp devaluation of the Real. In this report we will analyze the main changes and their medium and long-term effects on the Brazilian economy and the Real.

Image 1: USD/BRL Exchange Rate - Spot and Fair Value

Source: Bloomberg, Hedgepoint

But what has changed?

The 2025 Budget Guidelines Bill (PLDO), recently presented to the National Congress, proposes achieving fiscal balance in public accounts for next year, while maintaining the same target set for this year. Initially, the projection for next year was a surplus of 0.5% of GDP, but now a zero deficit is being sought.

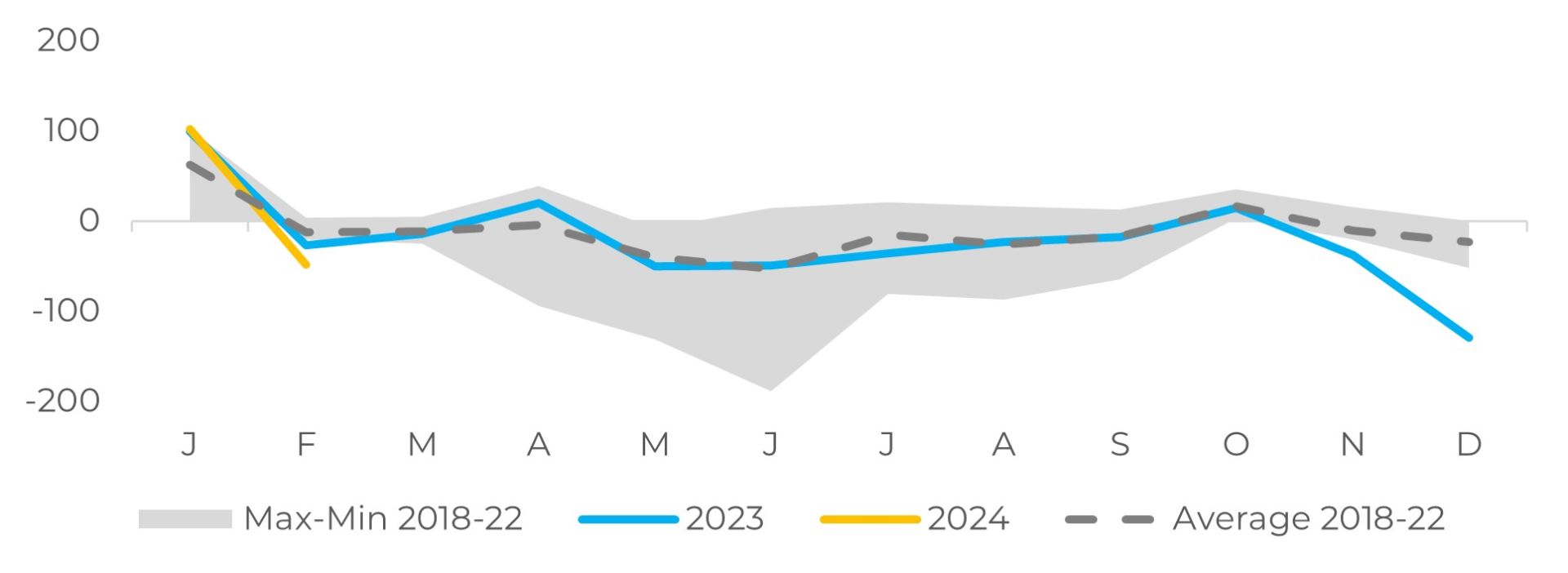

Thus, there is a possibility that the government will end next year with a deficit again, which could reach up to R$31 billion, considering the tolerance margin of 0.25% of GDP more or less according to the fiscal framework.

The government is still relying on a decision by the Federal Supreme Court (STF) which allows it to exclude the surplus from precatory payments from the calculation of the fiscal target until 2026. Otherwise, the deficit for 2025 would initially be R$29.1 billion (0.23% of GDP). The targets for 2026, 2027 and 2028 were also changed to 0.25%, 0.5% and 1% of GDP, respectively. Prior to the revision, the government aimed to achieve a surplus of 1% of GDP by 2026.

The government is still relying on a decision by the Federal Supreme Court (STF) which allows it to exclude the surplus from precatory payments from the calculation of the fiscal target until 2026. Otherwise, the deficit for 2025 would initially be R$29.1 billion (0.23% of GDP). The targets for 2026, 2027 and 2028 were also changed to 0.25%, 0.5% and 1% of GDP, respectively. Prior to the revision, the government aimed to achieve a surplus of 1% of GDP by 2026.

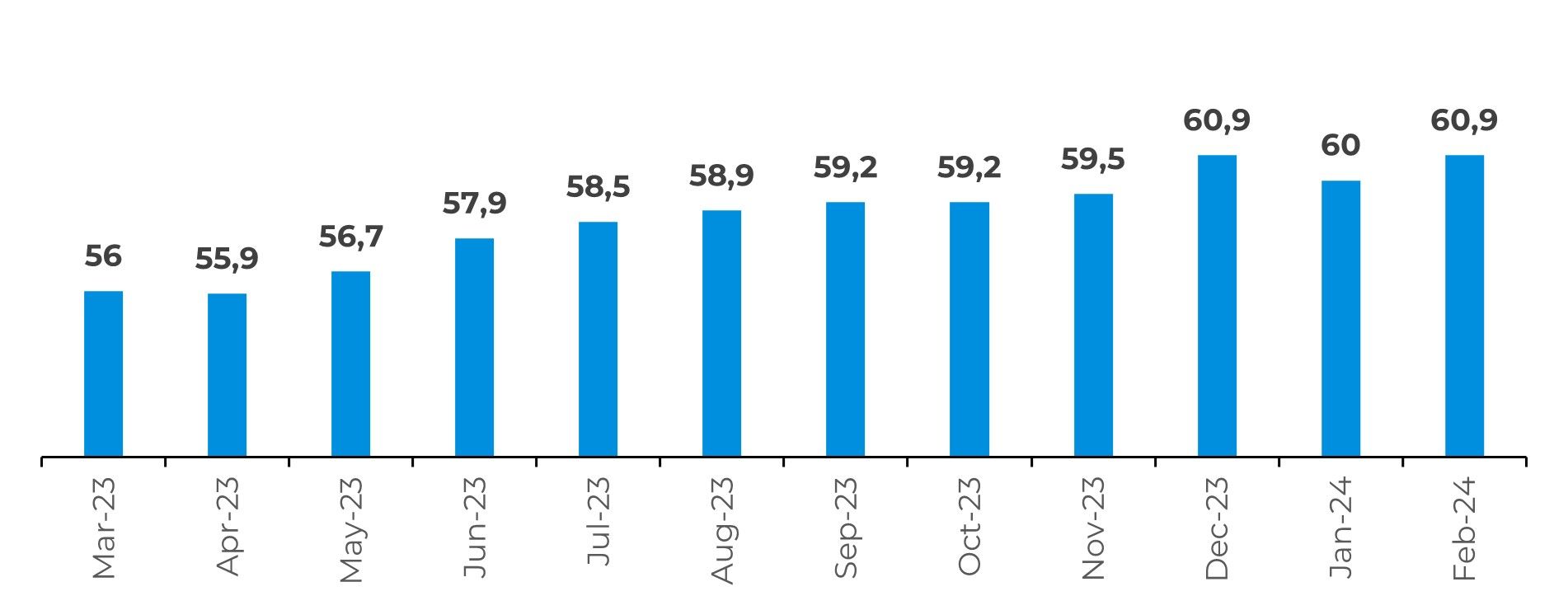

Image 2: Net public debt in Brazil (% of GDP)

Source: Bloomberg

A plan that was already questionable loses even more credibility

Since its approval last year, the market had already questioned the federal government's ability to achieve the fiscal surplus targets set out in the Fiscal Framework, and the changes made in the last week have shaken that confidence even more.

The framework was developed in an attempt to reconcile the containment of spending increases with the commitments made by Lula during the campaign, such as the policy of raising the minimum wage above inflation and the hiring of public workers. All of this was structured with primary result targets, i.e. pre-established deficit or surplus objectives.

According to statements made by Finance Minister Fernando Haddad, the set of rules was designed to be politically viable. In other words, it was created to deal with the pressure to increase spending and, in an ideal scenario, demonstrate a certain commitment to fiscal responsibility.

According to statements made by Finance Minister Fernando Haddad, the set of rules was designed to be politically viable. In other words, it was created to deal with the pressure to increase spending and, in an ideal scenario, demonstrate a certain commitment to fiscal responsibility.

In addition to the mathematical discrepancy between the increase in spending established by campaign promises and the limit of spending growth to 2.5% per year, the government has also issued other indications that public finances could be overstretched:

1. The formulation of the budget law with underestimated expenses and overestimated revenue;

2. The limitation of budget cuts to R$23 billion, below what economists have calculated as necessary to guarantee a zero deficit by 2024 - around R$40 billion;

3. The provision that allowed the government to bring forward the expansion of this year's spending limit - a change in the framework itself - and which allows for extra spending of R$15.7 billion, in practice reversing the contingency. And now on the agenda is a possible readjustment for civil servants amid threats of strike action.

Image 3: Brazil's Fiscal Result (Billions BRL)

Source: Refinitiv

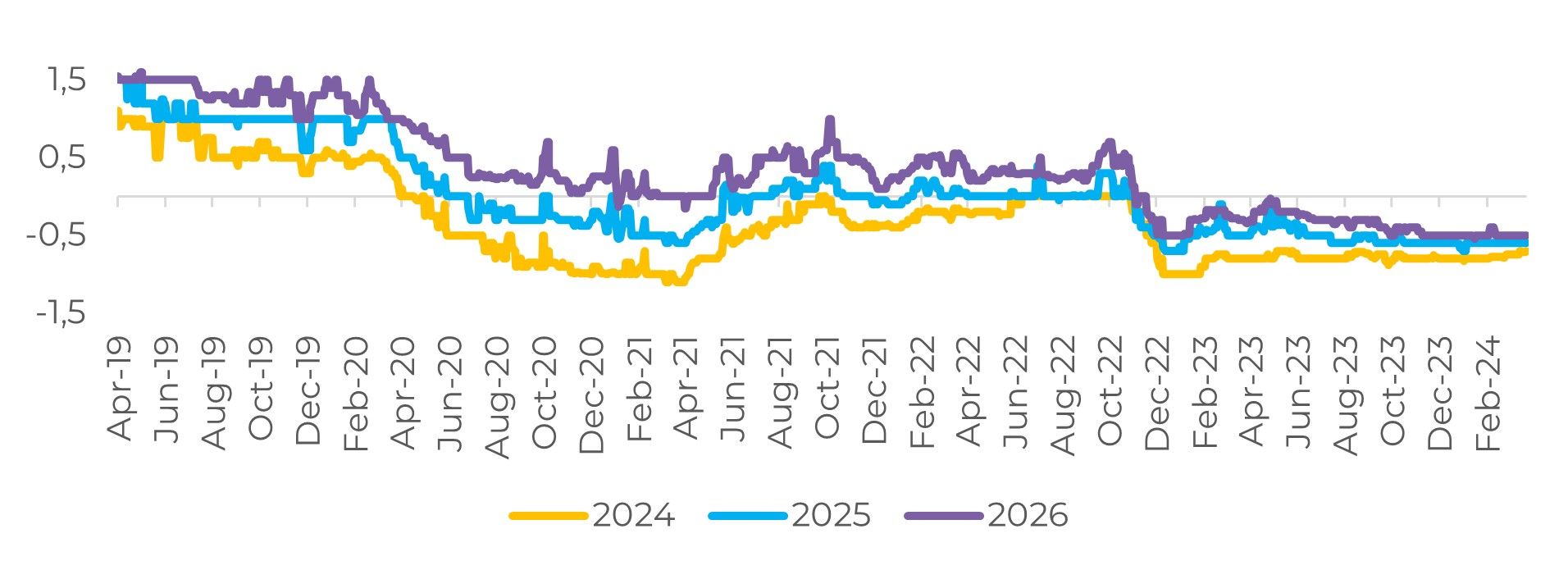

Image 4: Brazil's Expected Consensus Deficit (% of GDP)

Source: Bloomberg

In Summary

Although the market has never really "bought" the targets of the new Fiscal Framework, such a premature revision of the targets set out in it brings even more uncertainty regarding fiscal stability and the trajectory of Brazil's public debt. It is even clearer that the government will not make much effort to cut spending, and projects to increase revenue with a high political cost will likely be avoided.

As we have commented in previous reports, fiscal stability is essential for the Real to appreciate, so the current scenario should keep the currency under pressure in the short and medium term. Fiscal uncertainty could also bring inflationary pressure and raise Brazil's neutral interest rate (an interest rate that doesn't accelerate or decelerate inflation) - reducing Brazil's long-term growth potential.

In addition to domestic issues, the international environment is increasingly challenging for emerging currencies due to signs of higher interest rates for even longer in the US.

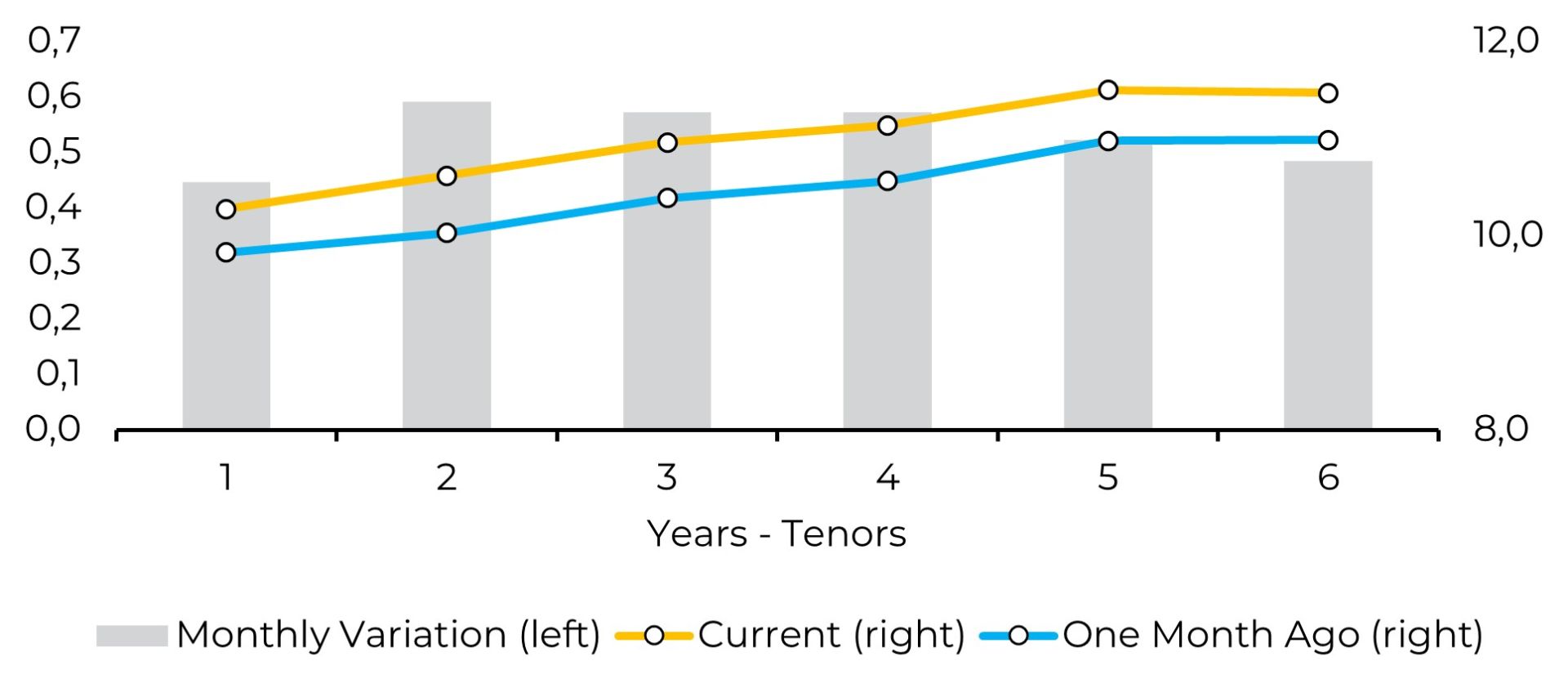

Image 5: Brazil's Yield Curve (%)

Source: Bloomberg

Weekly Report — Macro

Written by Alef Dias

alef.dias@hedgepointglobal.com

alef.dias@hedgepointglobal.com

Reviewed by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.