Apr 29

/

Victor Arduin

Macroeconomics Weekly Report - 2024 04 29

Back to main blog page

Global manufacturing a bullish signal for commodities

- In the first half of 2024, commodities' prices are improving, some reflect the fundamentals of their markets, while others benefit from the improved economic environment.

- The industrial sector, heavily impacted by rising interest rates, is now showing signs of recovery as the market anticipates an improved economic environment despite uncertainty over the timing of monetary policy reversal in the US.

- Geopolitical risks are also prevalent in the market. While an escalation of the conflict in the Middle East is unlikely, the resulting uncertainty is driving up premiums in commodity prices.

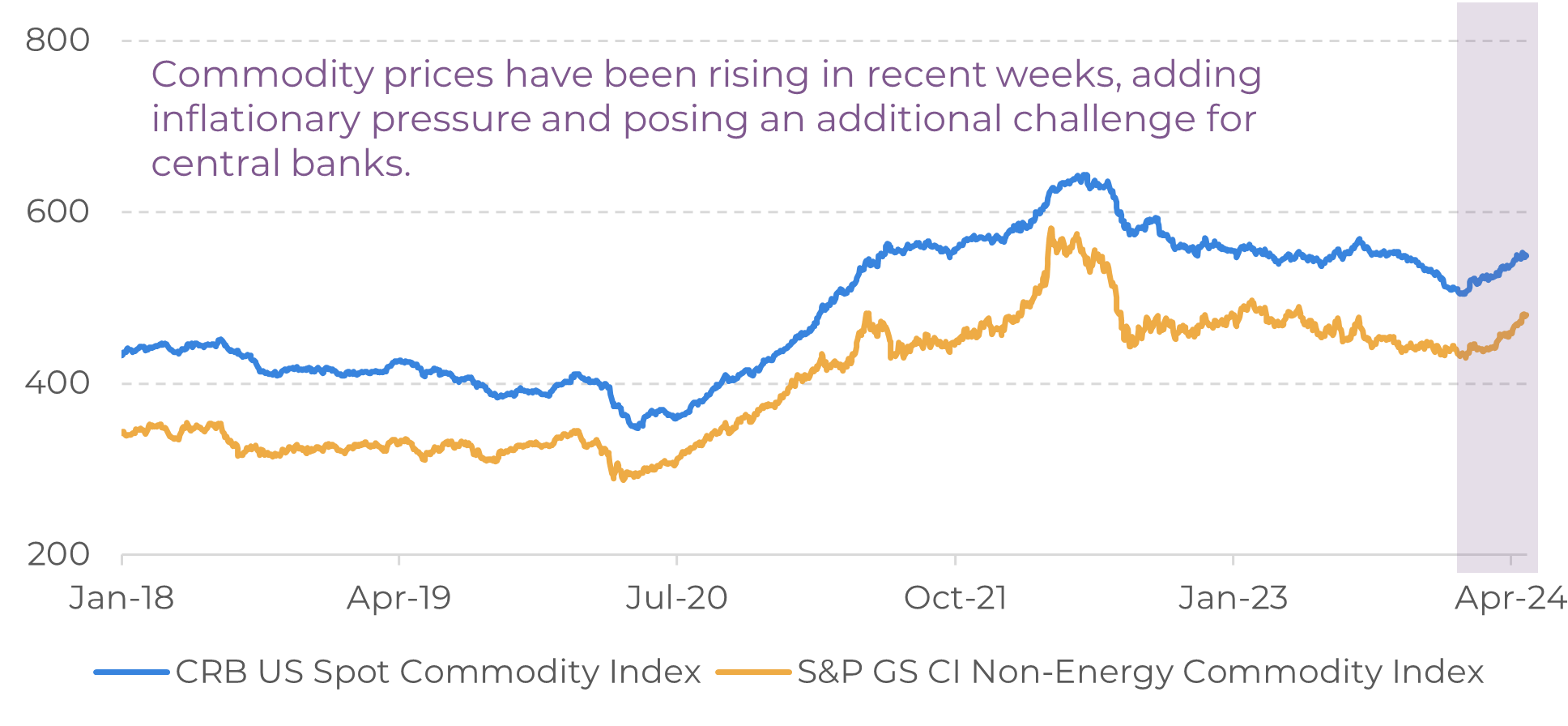

- With a higher commodities backdrop, central banks face an additional challenge in combating inflation, market's primary focus at the moment.

Introduction

Despite the restrictive monetary policy, world growth has shown resilience in recent months. The IMF projects a 3.2% GDP expansion for 2024, highlighting that risks are now more balanced compared to last year. While interest rate hikes have significantly curbed inflation, market focuses on monetary policy reversal timing.

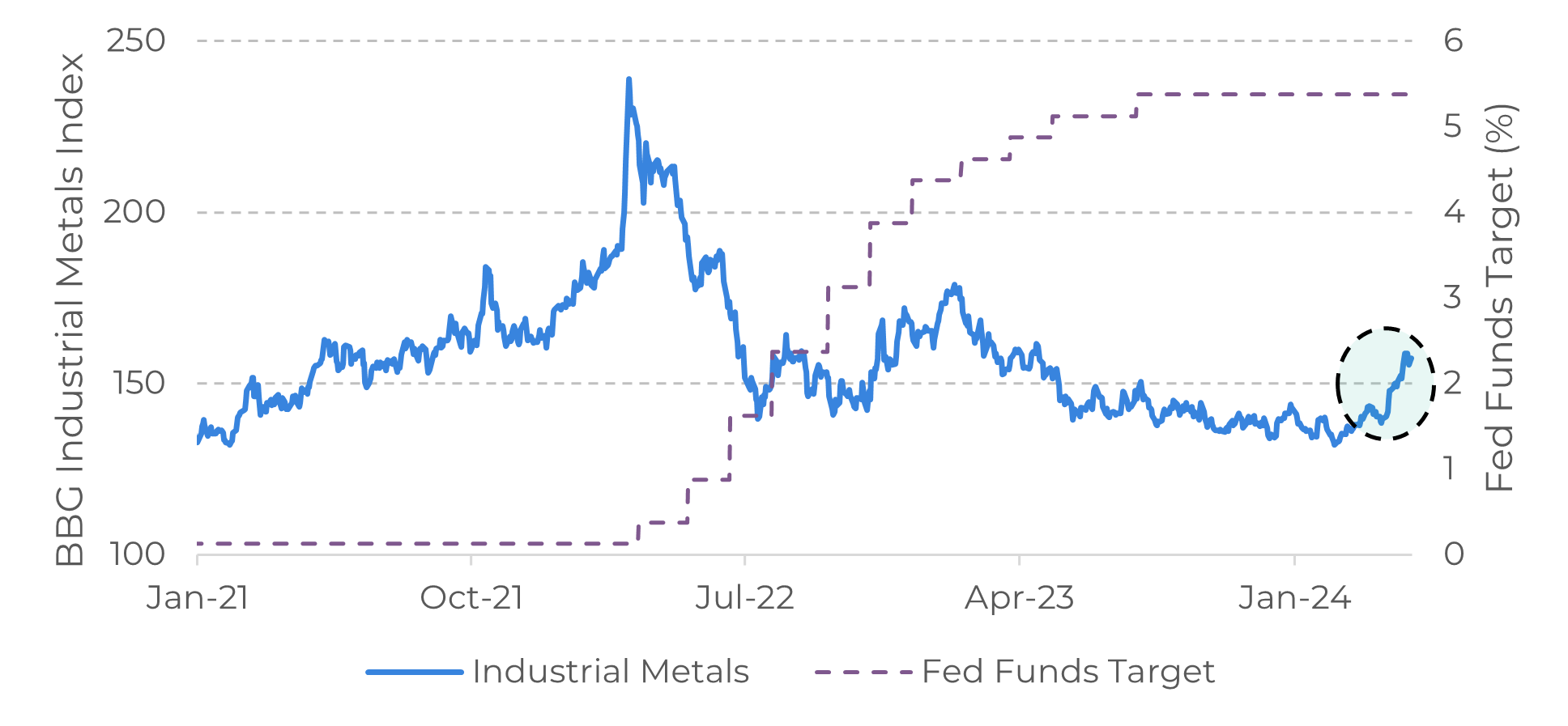

The Fed is likely to remain cautious, opting to keep borrowing costs elevated for an extended period compared to the ECB to prevent inflation resurgence. This may cause some constraint on commodities prices, but signs of an upward trend in the manufacturing sector offer some counterbalance. The BBG Industrial Metals Index, which fell during 2022 interest rate hikes, has recently reached its highest level since April 2023.

Given the latest recovery in industrial production, let's delve deeper into the current state of global industrial activity and how it relates to commodity prices.

Image 1: BBG Industrial Metals Index vs Fed Funds (%)

Source: Refinitiv

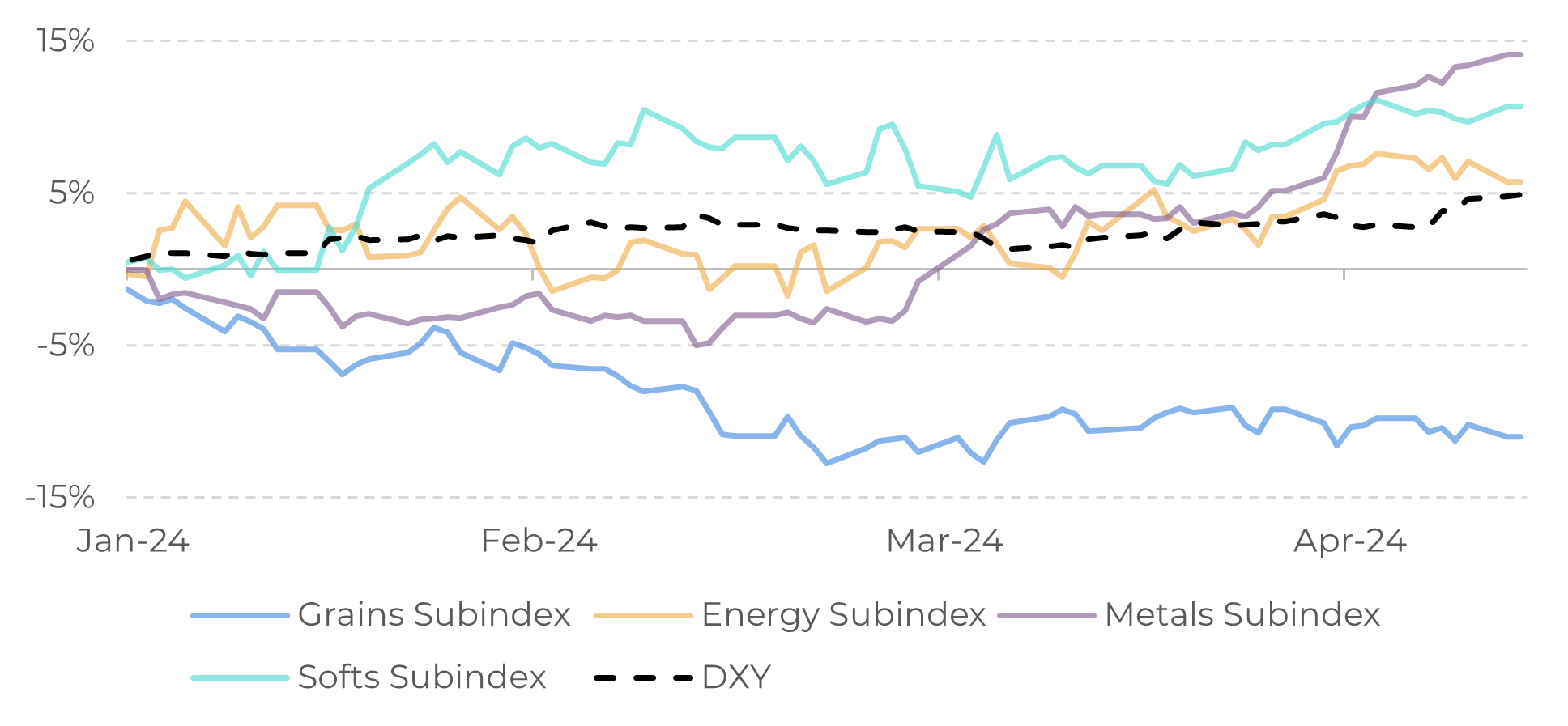

Image 2: Year-to-Date Performance of BBG Subindexes and DXY

Source: Refinitiv

Commodity markets mirroring an improved economic scenario

The first quarter of 2024 was marked by the appreciation of several commodities, with one of the main ones being gold, which saw a growth of over 13% year-to-date. Other commodities also experienced significant gains, driven by supply factors; for instance, oil was influenced by OPEC+ measures, while cocoa saw a significant drop Africa’s production. In April, the highlight of the second quarter so far is industrial metals, which have already accumulated a 12% increase during the fortnight, as indicated by the BBG sub-index.

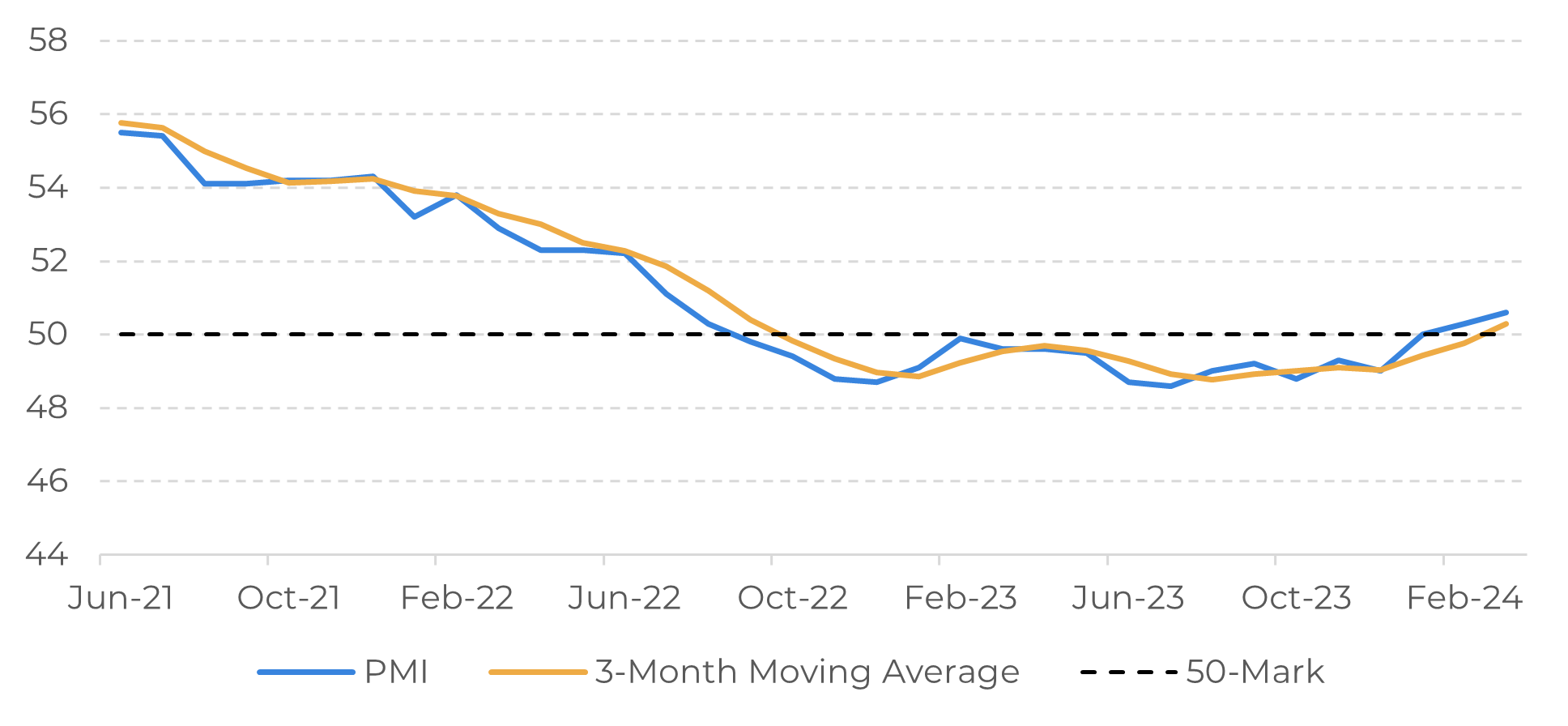

The industry was one of the sectors most affected by the rise in interest rates. Although there is still some uncertainty about when the reversal of restrictive monetary policy will occur in the US, the market is already pricing in an improvement in the economic environment, which has already impacted the industrial sector's recovery. One way to observe this is through PMIs, an index that indicates the pace of expansion or contraction of the sector. In March, both the US and China surpassed the 50 mark on the PMI index, indicating expansion, and it is expected that this pace of recovery will continue in April. This largely accounts for the surge in industrial metals consumption.

Image 3: JPMorgan Global Manufacturing PMI

Source: Bloomberg

Recovery underway, yet inflation risks persist

An uptick in manufacturing activity typically bodes well for commodities, particularly metals, minerals, and energy, given their integral role in factory production, alongside the reliance of logistics chains on fuels. Higher GDP revisions by organizations such as OPEC and the IMF further bolster the anticipation of a global economic rebound, fueling expectations of heightened demand. Additionally, some level of geopolitical uncertainty has manifested in the prices of various commodities, contributing to a bullish outlook for commodity prices.

Nevertheless, higher interest rates and a strong dollar remains a key topic for the market. Despite the US GDP growth in the last quarter recording 1.6%, which is below the expectations of 2.5%, inflation indicators still show risks. The PCE and Core PCE rose by 0.3%, in line with expectations, but the supercore of services, excluding housing, climbed to 0.39%. This remains elevated compared to the Fed's target interest rate of 2% annually, suggesting inflation might be more entrenched than anticipated.

Nevertheless, higher interest rates and a strong dollar remains a key topic for the market. Despite the US GDP growth in the last quarter recording 1.6%, which is below the expectations of 2.5%, inflation indicators still show risks. The PCE and Core PCE rose by 0.3%, in line with expectations, but the supercore of services, excluding housing, climbed to 0.39%. This remains elevated compared to the Fed's target interest rate of 2% annually, suggesting inflation might be more entrenched than anticipated.

Image 4: Commodity Prices Index

Source: Bloomberg

In Summary

Some commodity prices are responding positively to their market fundamentals. Among them, the energy complex, cocoa, coffee, and industrial metals stand out. The latter is responding directly to the ongoing recovery in the manufacturing sector.

Another factor influencing the market is sanctions. In recent weeks, the US and UK have enforced new restrictions on Russian metals, covering copper, aluminum, and nickel. This imposition has additionally bolstered metal prices in the last few days.

Inflation remains the market's primary focus. With worsening risk aversion in recent weeks and higher interest rates expected to persist, we've seen a rise in US Treasury yields and support for the dollar, theoretically impacting commodity performance.

Weekly Report — Macro

Written by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Reviewed by Alef Dias

alef.dias@hedgepointglobal.com

alef.dias@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.