May 22

/

Alef Dias

Macroeconomics Weekly Report - 2024 05 23

Back to main blog page

Raisi's death and its long-term implications

- The unexpected death of Iran's president, Ebrahim Raisi, is unlikely to change the country's policies in the short term. But it will change the plans for the succession of the supreme leader, the most important post in the Islamic Republic - which could have important implications in the long term.

- The change in the Iranian presidency and the succession of the supreme leader could alter how the country deals with its main challenges: Externally, the main concern is the violent war in Gaza. Internally, domestic dissatisfaction with social policies and economic performance has been simmering.

- A change in the direction of Iran's foreign policy from a more "reformist" supreme leader focused on the country's internal problems could make the Middle East less unstable. A less "aggressive" supreme leader could also lead to a reduction in American sanctions, further boosting Iran's oil production.

Introduction

The unexpected death of Iran's president, Ebrahim Raisi, is unlikely to change the country's policies. But it will change the plans for the succession of the supreme leader, the most important post in the Islamic Republic. Political analysts believed that Raisi was among the main candidates.

The change in the Iranian presidency and the succession of the supreme leader could alter how the country deals with its main challenges: Externally, the main concern is the violent war in the region. Internally, domestic dissatisfaction with social policies and economic performance has been simmering.

Given Iran's relevance in global geopolitics and the energy markets, we will analyze how the country should address these challenges after Raisi's death and how this could impact the commodities markets.

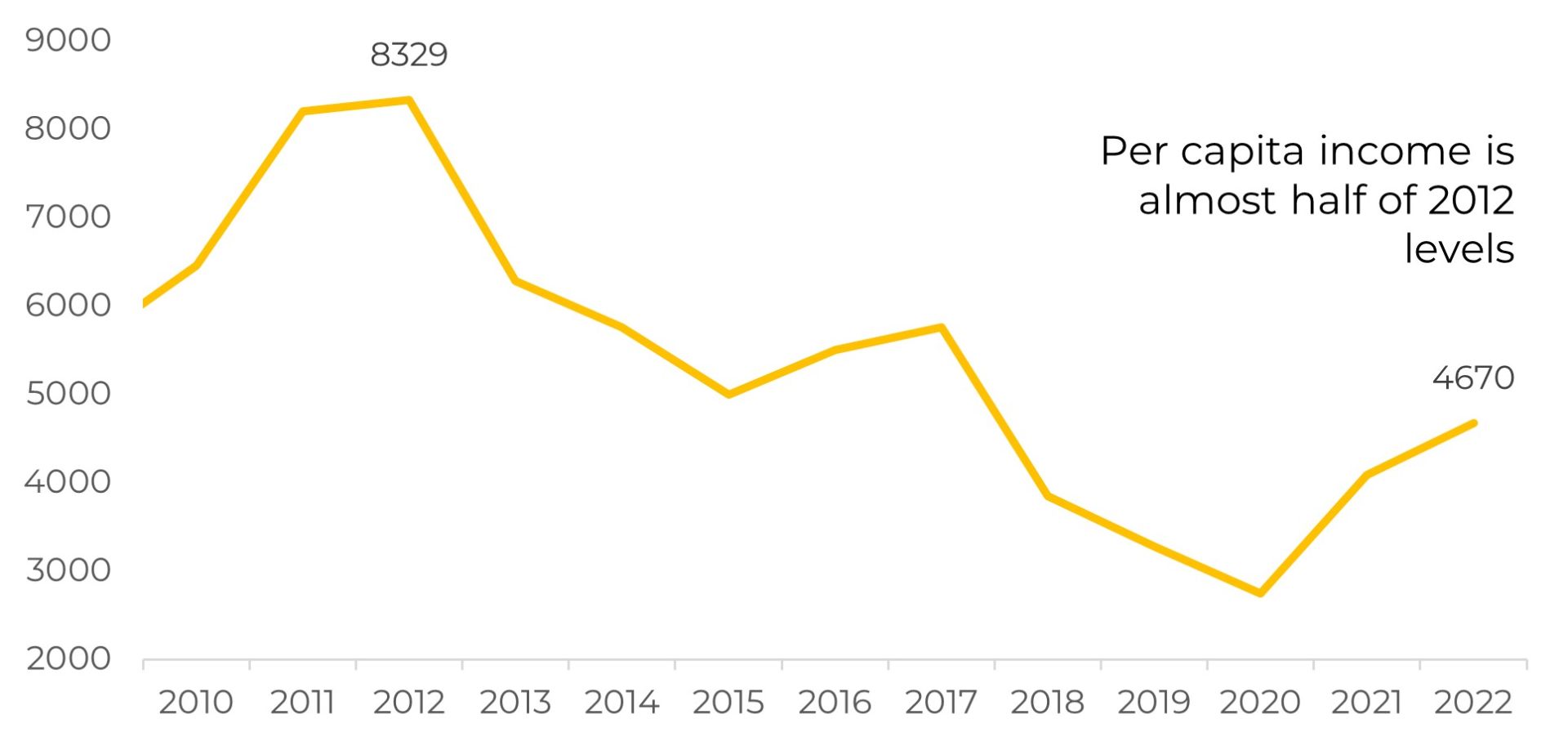

Image 1: GDP per capita - Iran (current USD)

Source: World Bank

How does Raisi's death change the political landscape?

The supreme leader is chosen by a non-transparent council of high-ranking clerics. Although the president, elected in an administered vote, has no direct say, the presidency is still a powerful platform with high public visibility.

Raisi, a conservative and ally of Khamenei, was appointed to sideline the reformist figures who have gained popularity in recent years as the Iranian revolution struggles to find new sources of legitimacy after 45 years in power. Raisi himself was even considered a possible successor to Khamenei.

With Raisi's departure, the conservative wing loses one of its main assets. This creates more uncertainty about the regime's ability to manage the transition smoothly amid widespread public discontent, an anemic economy and a growing regional crisis.

Death shouldn't change the scenario of the war, but the country's actions in the region could change in the long term

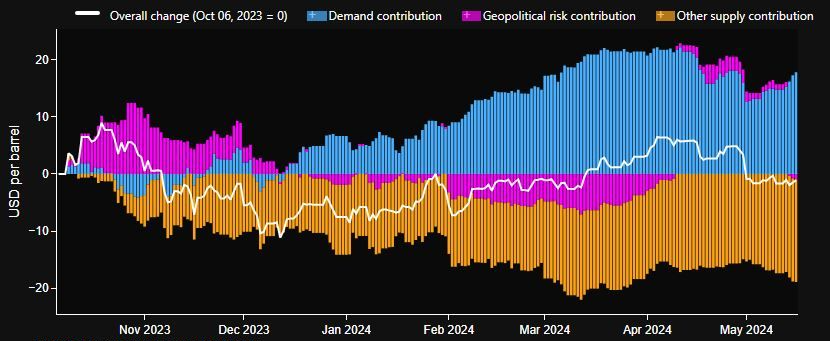

Raisi's death is unlikely to change the course of the war in the Middle East in the short term. Our baseline scenario is of a conflict that remains largely confined to Gaza and the Red Sea. According to Bloomberg estimates, the geopolitical risk premium on oil prices is close to zero, down from $12 a barrel in October and $2 in April, when tensions between Iran and Israel escalated, resulting in direct attacks but no major casualties.

Image 2: Main drivers of Oil prices

Source: Bloomberg

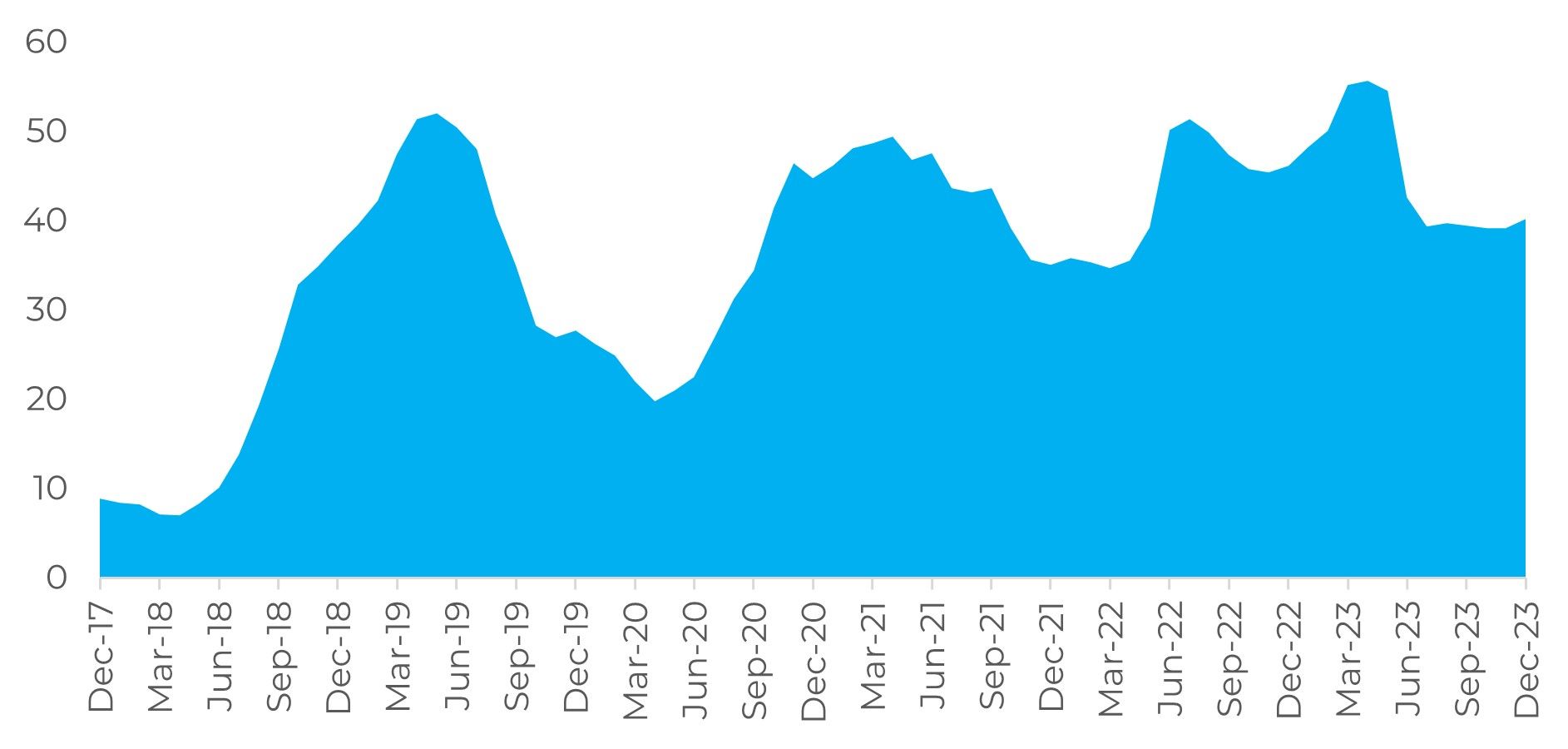

In addition, a change in the direction of Iran's foreign policy from a more "reformist" supreme leader focused on the country's internal problems could make the region less unstable. The Iranian economy has faced several challenges in recent decades, which have resulted in a series of consequences for the state and its citizens. Persistent inflation and low growth have affected the livelihoods of ordinary Iranians.

The state's strategic choices, which intensified adversarial relations with the West, led to an extension of US-led sanctions and required the Iranian government to allocate resources to support regional proxies and friendly states within the global anti-American network. The budget deficit, due to low government revenues, has caused the government to prioritize the allocation of resources to promote strategic objectives rather than address key domestic economic challenges.

Iran's increasing involvement in the region, which requires it to allocate financial and military support to various proxy groups, has undoubtedly put financial pressure on the government. There is no exact estimate of the financial cost of Iran's support for its proxies, but the US State Department estimated in 2019 that Iran spends around $700 million a year on its regional representatives. A former member of parliament, Heshmatollah Falahatpisheh, told local media last year that Iran spent between 20 and 30 billion dollars on the war in Syria alone.

Image 3: Consumer inflation - Iran (YoY, %)

Source: IMF

A less "aggressive" government could further boost the country's oil production

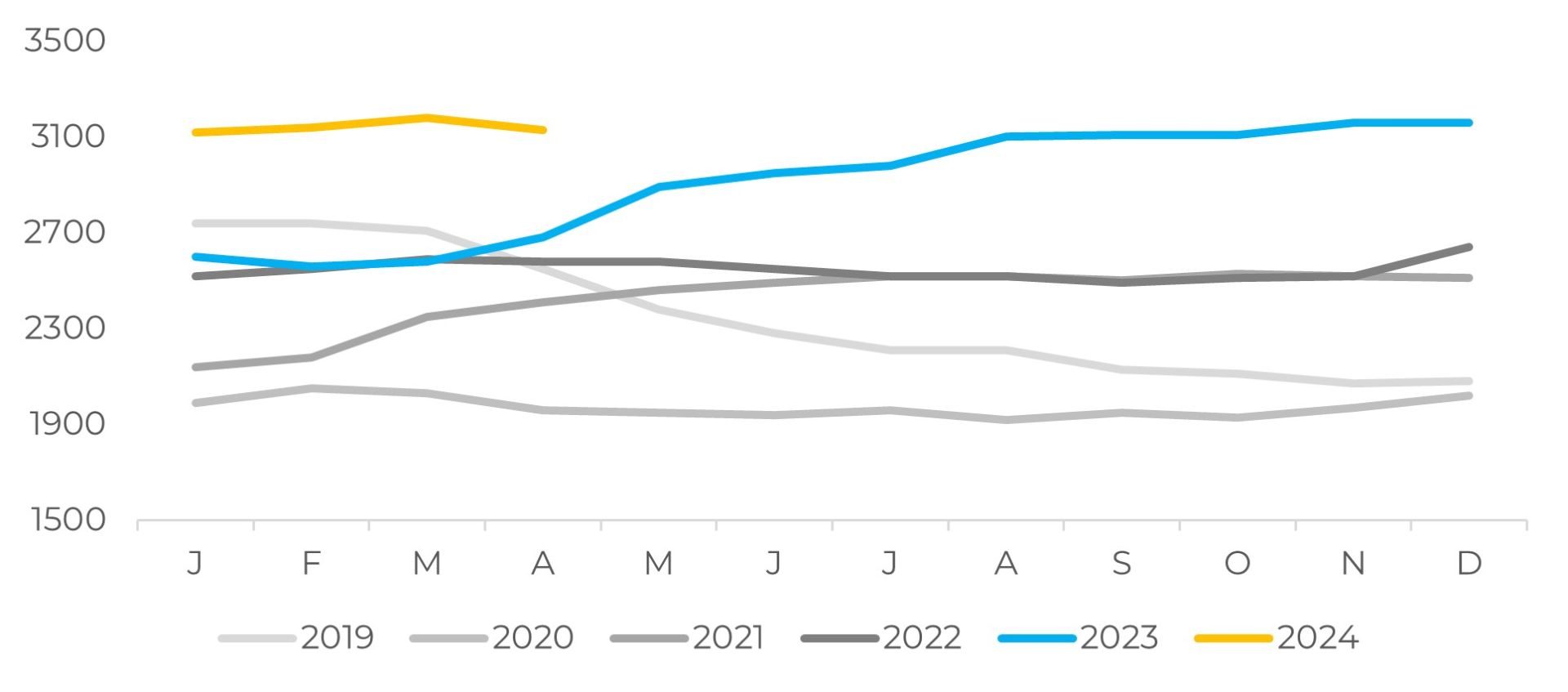

The less stringent application of US sanctions has boosted Iran's oil production. Production reached 3.1 million barrels per day in April, up from 2.6 million at the end of 2022. The war in the Middle East has not reduced Tehran's flows - production has remained unchanged compared to the pre-war level. A less "aggressive" supreme leader could lead to a reduction in US sanctions, further boosting production and bringing important resources to Iran's economic recovery.

Iran has been offering discounted prices to the largest buyer of its hydrocarbon exports, China, and free supplies to Syria, as part of its ongoing assistance to the Assad government. In addition, the country has faced a substantial evaporation of oil revenues due to financial mechanisms involving various intermediaries and front companies - which buy Tehran's oil at below-market prices - used to avoid banking sanctions. In addition, the country has faced a substantial evaporation of hydrocarbon income through financial mechanisms involving various intermediaries and front companies to circumvent banking sanctions.

Image 4: Oil Production - Iran (thousand barrels per day)

Source: Bloomberg

In Summary

The unexpected death of Iran's president, Ebrahim Raisi, is unlikely to change the country's policies in the short term. But it will change the plans for the succession of the supreme leader, the most important post in the Islamic Republic - which could have important implications in the long term.

The change in the Iranian presidency and the succession of the supreme leader could alter how the country deals with its main challenges: Externally, the main concern is the violent war in the region. Internally, domestic dissatisfaction with social policies and economic performance has been simmering.

Raisi, a conservative ally of Khamenei, was appointed to sideline the reformist figures who have gained popularity in recent years as the Iranian revolution struggles to find new sources of legitimacy after 45 years in power. With Raisi's departure, the conservative wing loses one of its main assets.

The Iranian economy has faced several challenges in recent decades, which have resulted in a series of consequences for the state and its citizens. Persistent inflation and low growth have affected the livelihoods of ordinary Iranians. A change in the direction of Iran's foreign policy from a more "reformist" supreme leader and a focus on the country's internal problems could make the Middle East less unstable. A less "aggressive" supreme leader could also lead to a reduction in American sanctions, further boosting Iran's oil production.

Weekly Report — Macro

Written by Alef Dias

alef.dias@hedgepointglobal.com

alef.dias@hedgepointglobal.com

Reviewed by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.