May 31

/

Alef Dias

Macroeconomics Weekly Report - 2024 05 31

Back to main blog page

Pace of ECB interest rate cut likely to put pressure on Euro

- It is almost certain that the European Central Bank will cut interest rates by 25 basis points at its next meeting on June 6. The focus of the press conference is likely to be on what happens in the coming months. The debate has moved on to July and we don't think Christine Lagarde (ECB's president) will be taking sides publicly any time soon.

- Inflation is slowing down, boosting real incomes, and PMIs are rising without putting pressure on wages. This will probably allow the European Central Bank to continue cutting interest rates in the second half of the year.

- Despite the improvement in inflation and economic activity in Europe in recent months, the ECB's faster pace of interest rate cuts compared to the Fed's will likely to push up yield differentials and weaken the Euro

Introduction

It is almost certain that the European Central Bank will cut interest rates by 25 basis points at its next meeting on June 6. The focus of the press conference is likely to be on what happens in the coming months.

It is unlikely that President Christine Lagarde will explicitly signal another move in July, but she may give a slight nod to more action in September. The financial markets have fully priced in a reduction in June and one more before the end of the year.

The market's focus is now on the number of cuts in 2024

The members of the ECB's Governing Council haven't left many surprises for June - even the "hawks" have indicated that a cut is very likely. The debate has moved on to July and we don't think Lagarde will take sides publicly any time soon.

Lagarde is likely to present a picture of price pressures being reduced by the slowdown in wage and profit growth. She is likely to downplay the acceleration in negotiated wage growth in 1Q24 shown by the ECB's official time series.

Lagarde is likely to present a picture of price pressures being reduced by the slowdown in wage and profit growth. She is likely to downplay the acceleration in negotiated wage growth in 1Q24 shown by the ECB's official time series.

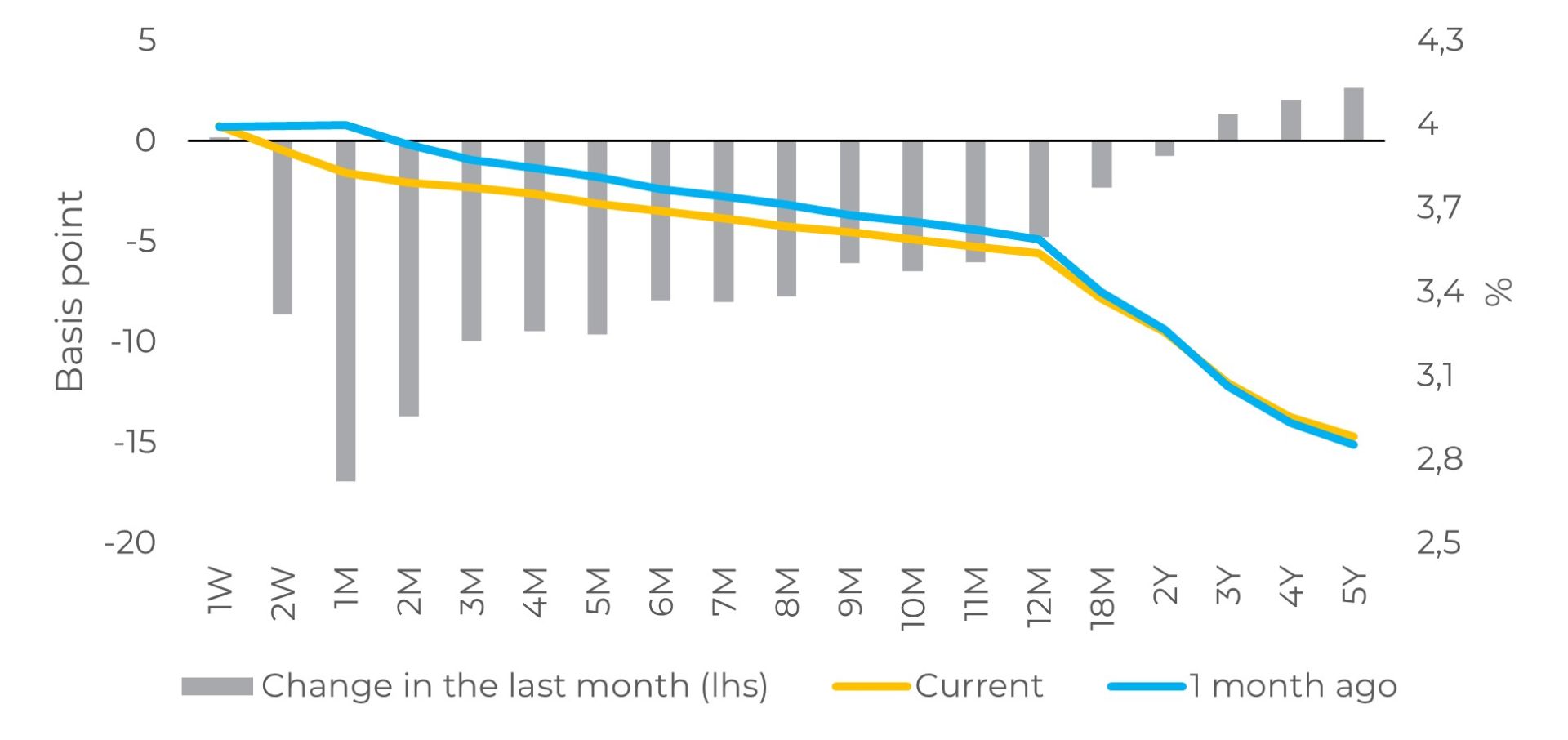

Graph #1: Eurozone yield curve

Source: Bloomberg

The short-term outlook remains positive for the EU economy

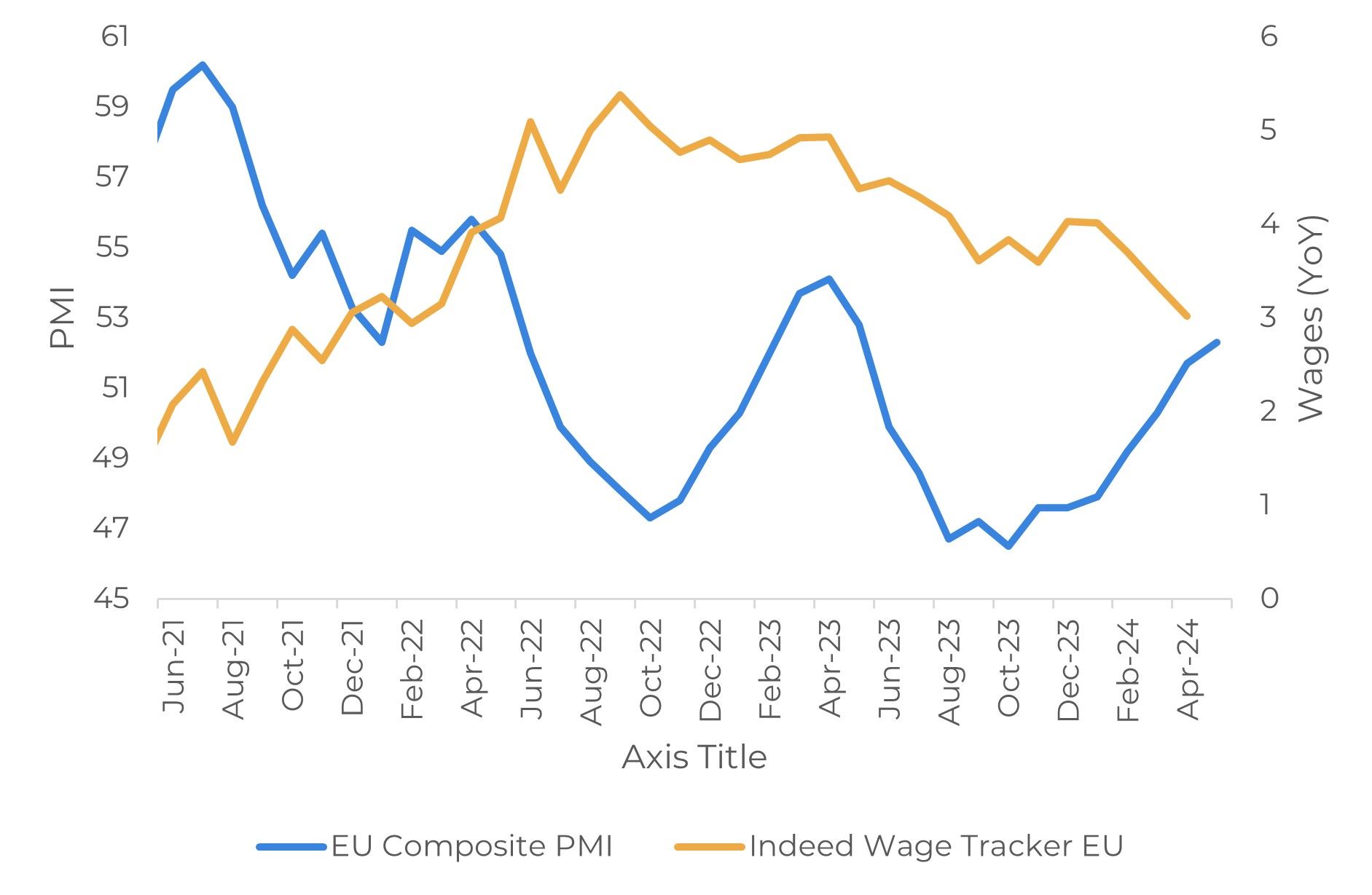

Inflation is slowing, boosting real incomes, and PMIs are rising without putting pressure on wages - so GDP growth is likely to continue accelerating in 2Q24. This will allow the European Central Bank to start cutting interest rates in June and should allow the Governing Council to continue cutting interest rates in the second half of the year.

With regard to the Composite PMI, the main reading rose to 52.3 in May, from 51.7 in April, beating the median forecast of economists surveyed by Bloomberg News of an increase to 52.0. The average of 52.0 in the last two survey periods is above the average of 49.2 from January to March. This suggests that GDP growth is accelerating in 2Q24 and is consistent with the 0.2% expansion of the economy in this quarter.

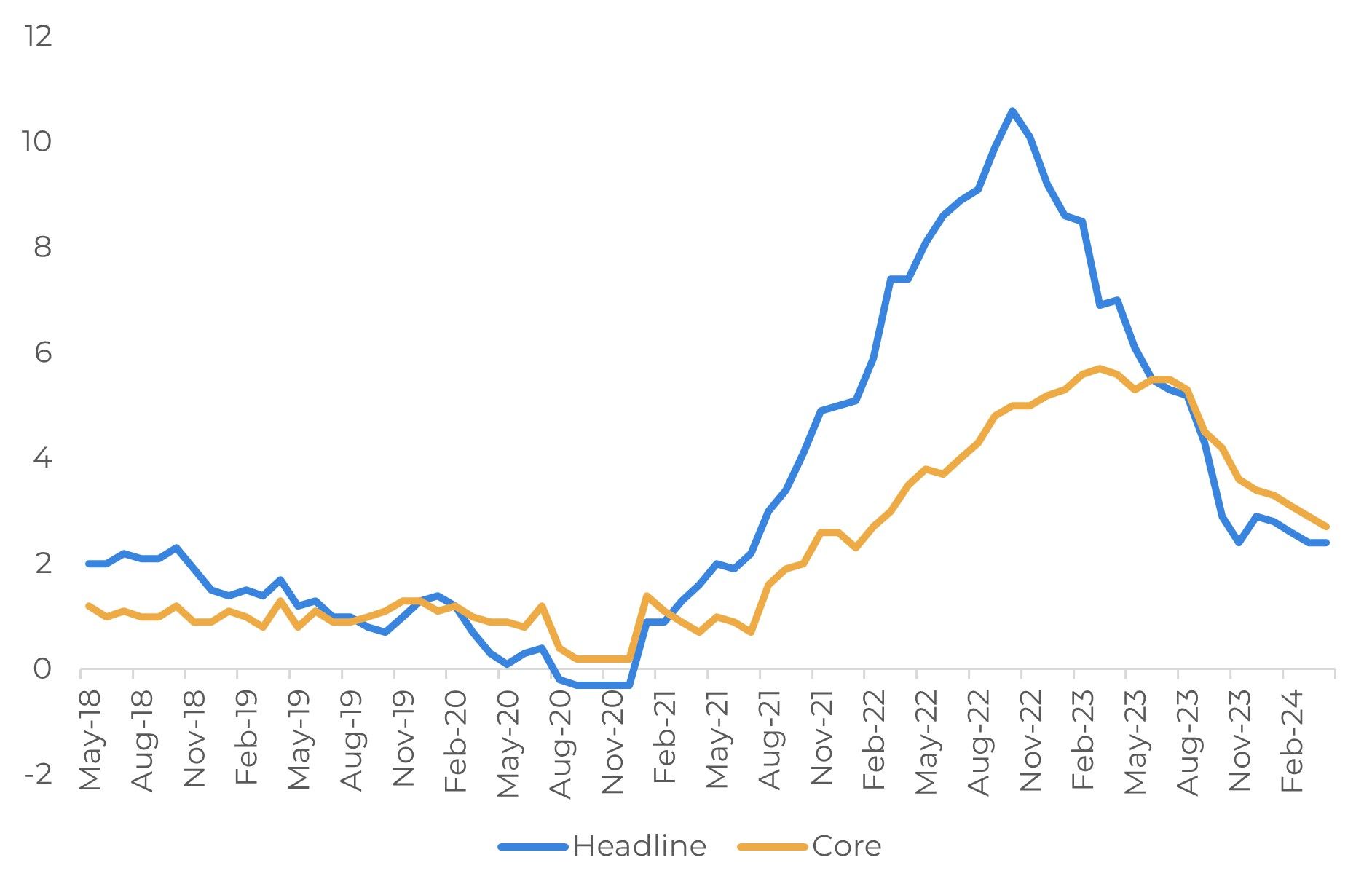

The pace of inflation slowed in May and was the weakest since November 2023. A slower increase in services prices was partially offset by a weaker decline in industrial sector selling prices. We expect HICP inflation to slow to 2.4% in 2Q24, from 2.6% in 1Q24, and we believe it will fall below the ECB's 2% target this summer.

The pace of inflation slowed in May and was the weakest since November 2023. A slower increase in services prices was partially offset by a weaker decline in industrial sector selling prices. We expect HICP inflation to slow to 2.4% in 2Q24, from 2.6% in 1Q24, and we believe it will fall below the ECB's 2% target this summer.

EU - Headline and core inflation (YoY, %)

Source: Refinitiv

Eurozone GDP grew by 0.3% in 1Q24. Falling inflation should continue to reduce pressure on real household incomes, supporting consumer spending. And as the ECB cuts interest rates, this should boost sentiment and investment. We expect GDP growth to expand by 0.2% in 2Q24 and continue to gain momentum until the end of the year. The economists on the ECB team predict the same result for this quarter.

The slowdown in inflation should allow the ECB to act cautiously. We expect the European monetary authority to make 3 more interest rate cuts after July.

EU - PMIs and Wages

Source: Bloomberg

In Summary

The short-term outlook remains very positive for the EU economy. Inflation is slowing, boosting real incomes, and PMIs are rising without putting pressure on wages - so GDP growth is likely to continue accelerating in 2Q24. This will allow the European Central Bank to start cutting interest rates in June and should allow the Governing Council to continue cutting interest rates in the second half of the year.

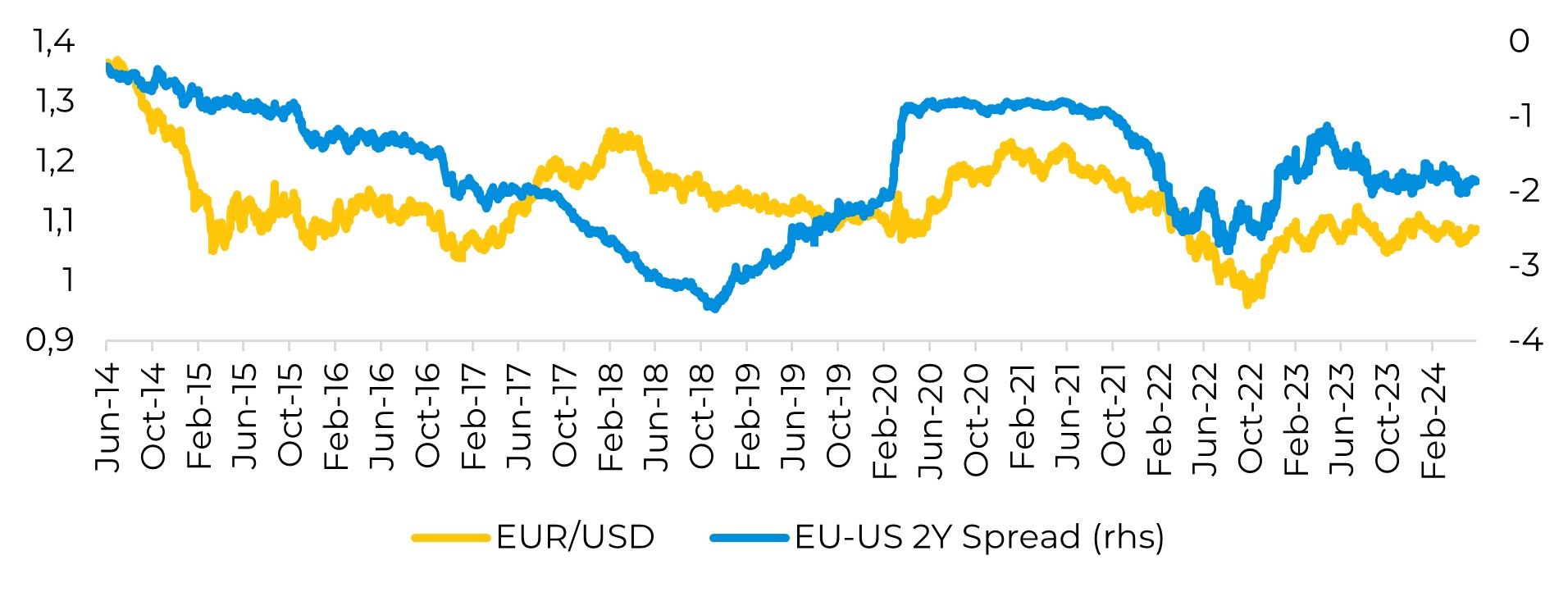

Despite the improvement in inflation and economic activity in Europe in recent months, the ECB's faster pace of interest rate cuts compared to the Fed's are likely to push up yield differentials and weaken the euro. The widening gap between yields lines up with expectations for diverging monetary policies in the US and euro area. Consensus forecasts see the Fed cutting rates by 50 bps by the end of 2024, while the ECB is predicted to cut its deposit rate by 85 bps.

Despite the improvement in inflation and economic activity in Europe in recent months, the ECB's faster pace of interest rate cuts compared to the Fed's are likely to push up yield differentials and weaken the euro. The widening gap between yields lines up with expectations for diverging monetary policies in the US and euro area. Consensus forecasts see the Fed cutting rates by 50 bps by the end of 2024, while the ECB is predicted to cut its deposit rate by 85 bps.

Image 4: 2-year yield spread (US vs. EU) and EUR/USD

Source: Refinitiv

Weekly Report — Macro

Written by Alef Dias

alef.dias@hedgepointglobal.com

alef.dias@hedgepointglobal.com

Reviewed by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.