Jun 10

/

Victor Arduin

Macroeconomics Weekly Report - 20240610

Back to main blog page

An interest rate hike in the US in 2024 is looking more and more likely

- There is growing apprehension in the market about the direction of inflation in the US, which has shown no progress in recent months.

- The labor market is still showing strength, GDP continues to grow and the government is implementing a robust fiscal expansion, removing the risk of recession but making the fight against inflation more uncertain.

- In this context, are US interest rates at a restrictive enough level to bring prices back to the 2% target? Although it's not likely, it's increasingly plausible to believe that there could be an increase in interest rates in 2024.

- This poses challenges for markets such as commodities, whose demand is strongly linked to the value of the dollar and could suffer further appreciation in the event of an increase in interest rates

Introduction

One of the most anticipated events for 2024 is the easing of monetary policy in the US, which is at one of the tightest levels in its history. With more than half the year gone by, apprehension is growing about the course of inflation in the world's largest economy.

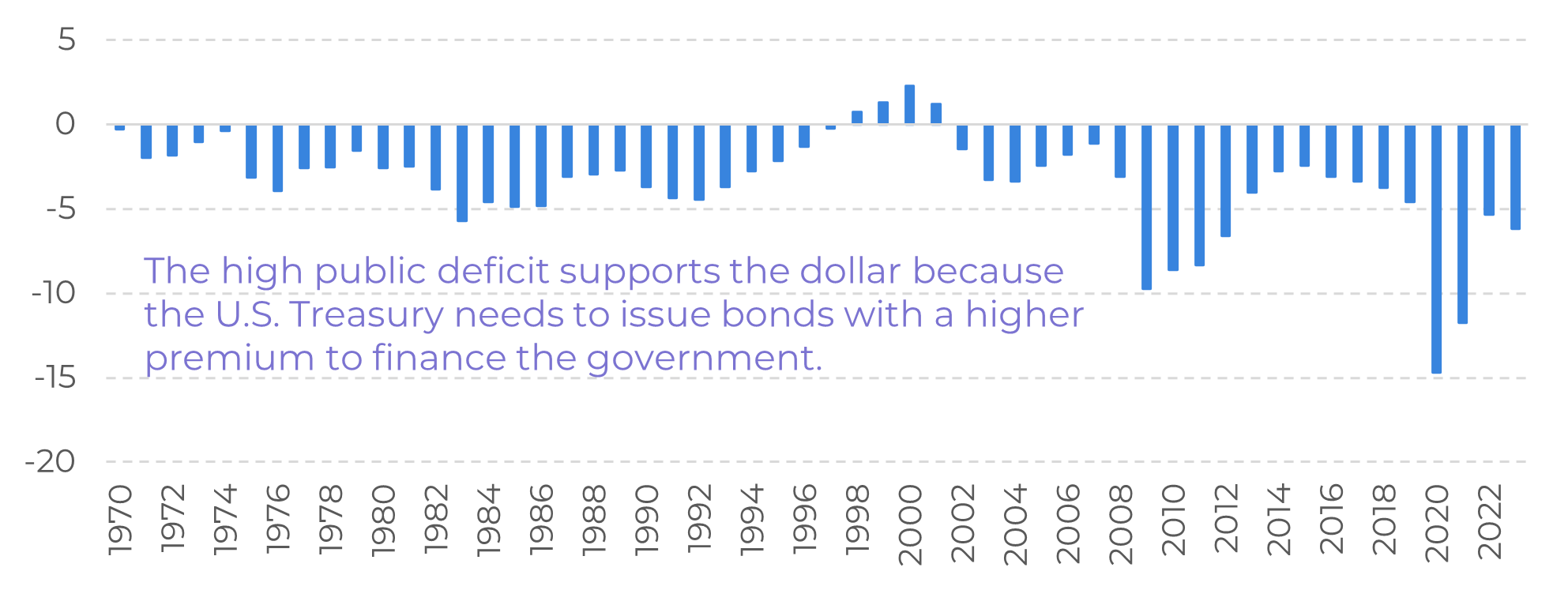

The US economy remains resilient, showing growth of 1.3% in the last quarter. The government's fiscal deficit stands at 6.19% of GDP in 2023, equivalent to US$1.7 trillion. Even with a slowdown and high interest rates, the risk of recession is currently ruled out given the country's strong fiscal expansion.

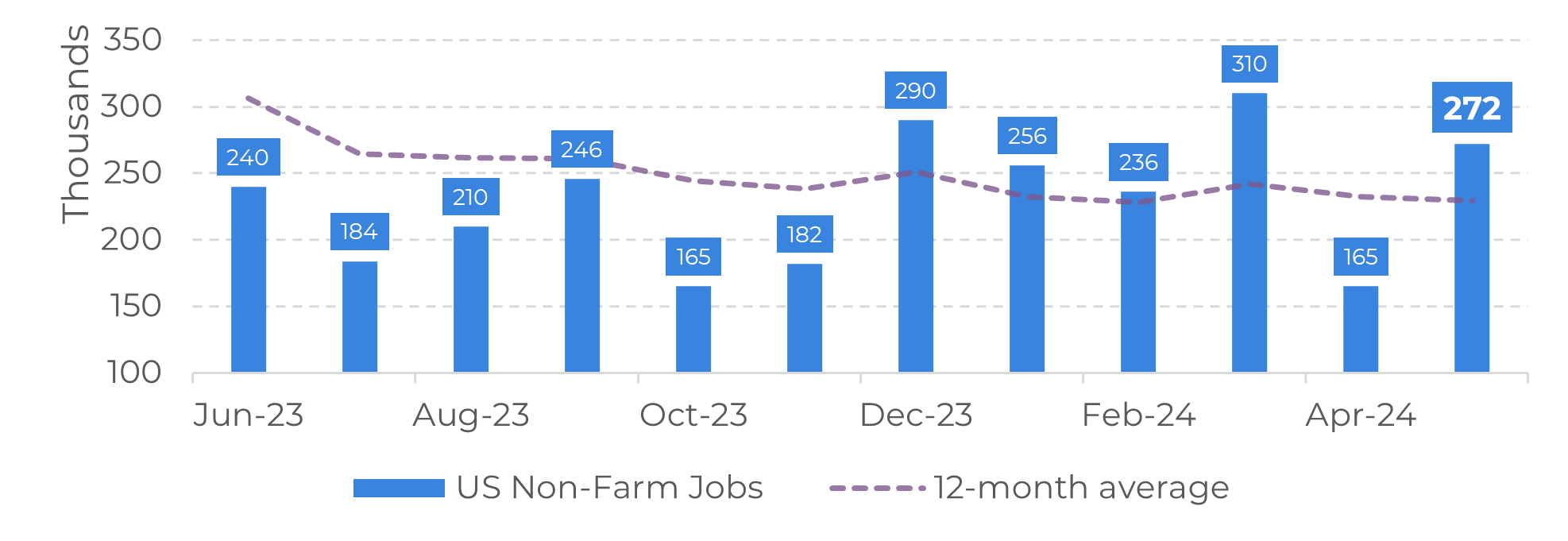

Recent data from the US labor market reinforces the view that US inflation is still far from the 2% target. In view of this, the theory that the Fed could raise interest rates is becoming increasingly plausible, and that's what we'll be addressing in this report.

Image 1: US - Surplus/Deficit as a Percentage of GDP

Source: Federal Reserve Bank St. Louis

Image 2: US - Non-Agricultural Payrolls

Source: Bureau of Labor Statistics

Lack of progress in recent months causes apprehension in the market

Guided by a dual mandate, the Fed seeks to promote price stability and achieve full employment in the American economy. Although labour market data indicates progress towards full employment, persistent inflation reveals that there is still work to be done to stabilize prices.

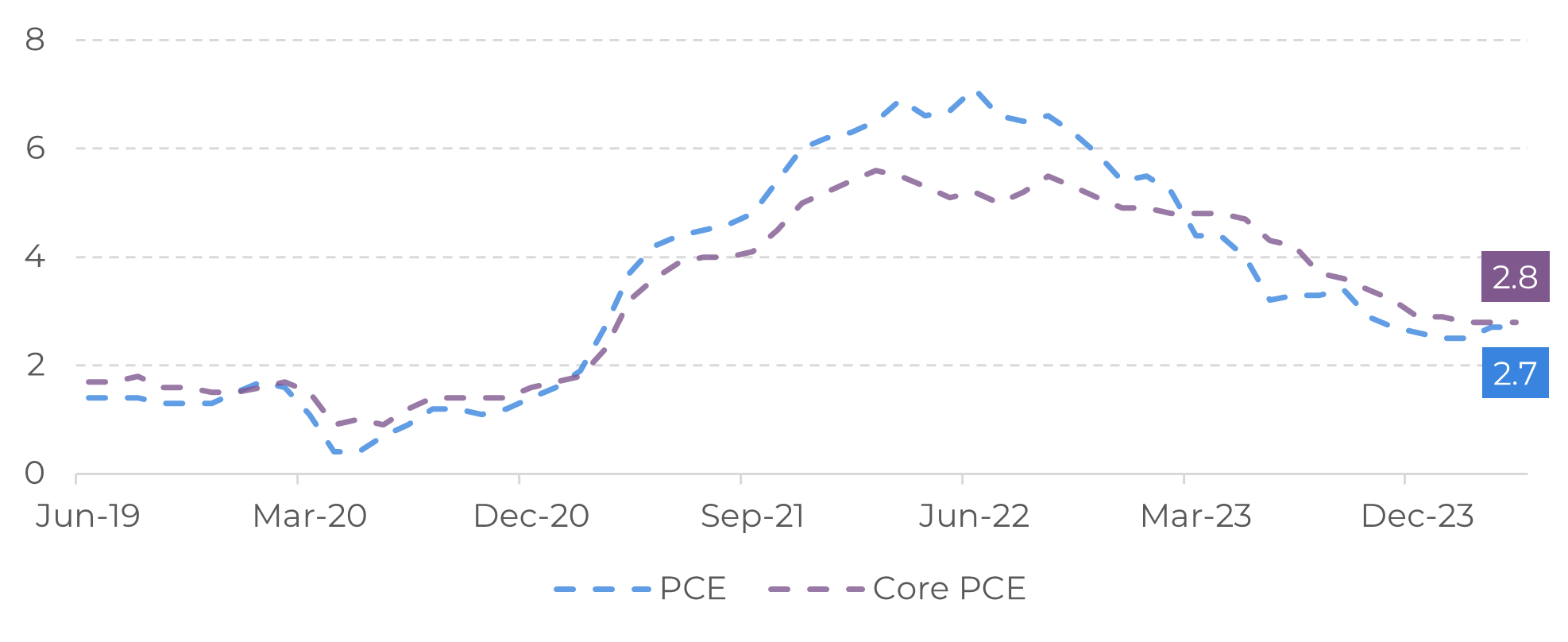

The US central bank has done a difficult and arduous job so far. Raising interest rates to 5.25-5.50% has brought uncertainties, especially the risk of recession, as various projections pointed out in 2023. Although the risks of an abrupt slowdown in the economy have been reduced in recent months, speculation is growing in the market that monetary policy may not be at a restrictive enough level to bring inflation to the 2% target.

The PCE is the main inflation indicator used by the Fed to make monetary policy decisions, as it is less susceptible to fluctuations in volatile items such as energy and food, providing a more accurate picture of household spending. However, the recent rise to 2.7% in March and April 2024 creates uncertainty about the future of inflation and the measures that will be taken to combat it. The rise in the PCE could lead the Fed to take more aggressive measures, such as raising interest rates.

Image 3: US – Monthly Retail Sales (%)

Source: Bureau of Economic Analysis

There are still no conditions for an interest rate cut

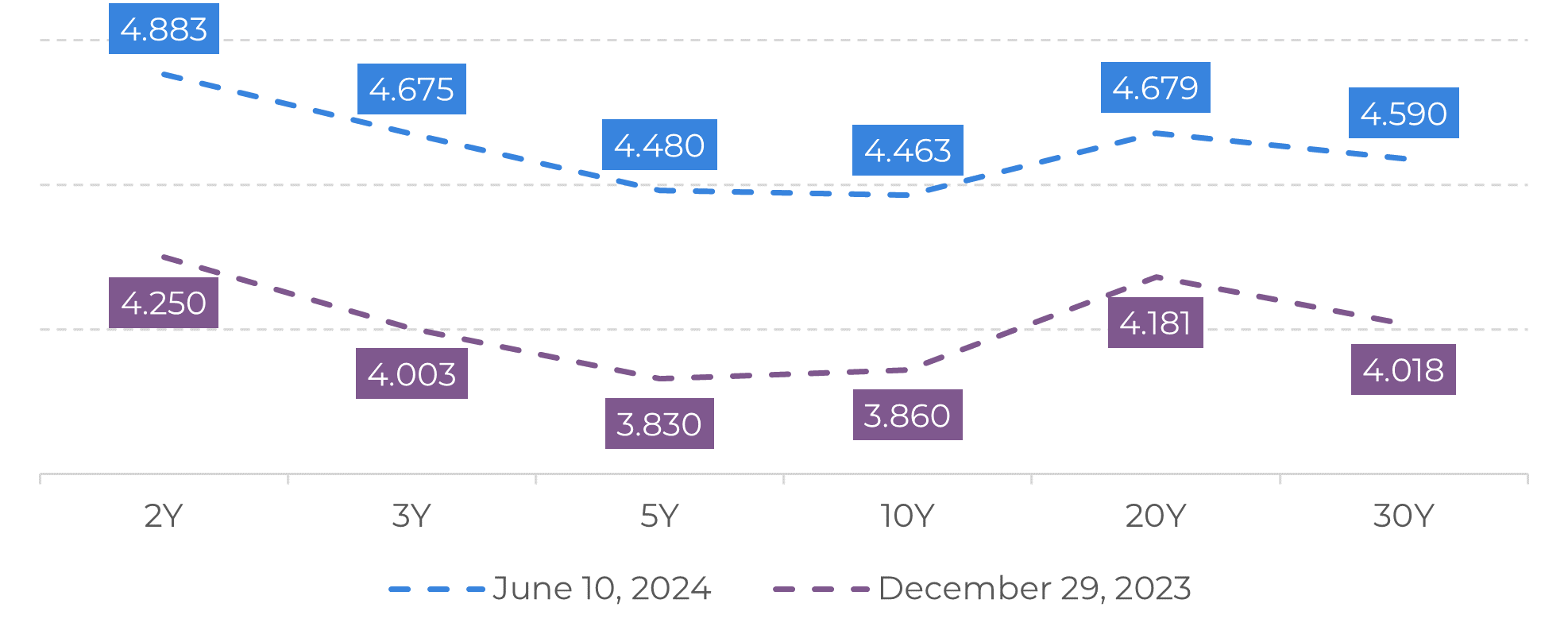

Considering the possibility of another interest rate hike in the US economy, US bond yields are expected to rise further in 2024, surpassing the 5% mark again. As a result, we could see further support for the dollar, already strengthened by the current macroeconomic conditions.

The scenario is becoming increasingly adverse for risky assets, especially commodities, whose demand is linked to the value of the dollar. The more the US currency appreciates, the more expensive it becomes for holders of other currencies to buy commodities. While supply-side fundamentals continue to benefit some sectors, demand remains subdued in an increasingly risk-averse environment.

Forecasts still indicate the possibility of two interest rate cuts by the Fed this year, starting in September. However, this depends very much on an improvement in the inflationary environment in the US, which has proved challenging. As progress towards the inflation target loses momentum, the plausibility of seeing a further increase in interest rates in the world's largest economy grows.

Image 4: US - Treasury Yields (%)

Sources: Refinitiv

There are external risks that could put pressure on inflation

There are other events that could put pressure on prices in 2024, but not as likely - something known in the field of statistics as "outliers". These risks are beyond the reach of the Fed's monetary policy and could push inflation above 4% in an extreme situation.

In recent years, we have witnessed problems in the supply chain, leading to a rise in the cost of several essential materials for industry in various sectors. We have seen an increase in sea freight costs, as well as a risk premium associated with energy costs, as a consequence of the problems in the Red Sea.

Climatic issues have also posed challenges, such as the low level of Lake Gatún in Panama, which has restricted the number of vessels that have been able to use the Central American route for cargo transportation since last year.

Therefore, not only domestic issues hinder the Fed's success in fighting inflation, but external challenges as well.

In Summary

The lack of progress on inflation in recent months has increased apprehension in the market that the Fed may need to tighten monetary policy further to bring prices back to its 2% target.

One of the reasons that has hampered the work of the American central bank is the strong fiscal expansion that the government has carried out in recent years, resulting in support for economic activity.

In this context, where GDP continues to grow and the labor market remains resilient, the theory that interest rates will need to rise again in 2024 to ensure that the disinflationary process continues is gaining strength.

The market is expecting two interest rate cuts starting in September, but the scenario remains uncertain. The FOMC (Federal Open Market Committee), as always, emphasizes that its decisions will be based on future data, which means that an interest rate increase is still possible, even with the expectation of cuts.

Weekly Report — Macro

Written by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Reviewed by Alef Dias

alef.dias@hedgepointglobal.com

alef.dias@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.