Jun 21

/

Alef Dias

Macroeconomics Weekly Report - 20240621

Back to main blog page

Even with Copom's unanimous decision, fiscal policy continues to weigh on the BRL

- The unanimous maintenance of the interest rate and the post-meeting communiqué - released last Wednesday (19) - suggest that Brazil's Central Bank (BCB) may leave the Selic rate as it is for longer than analysts expect.

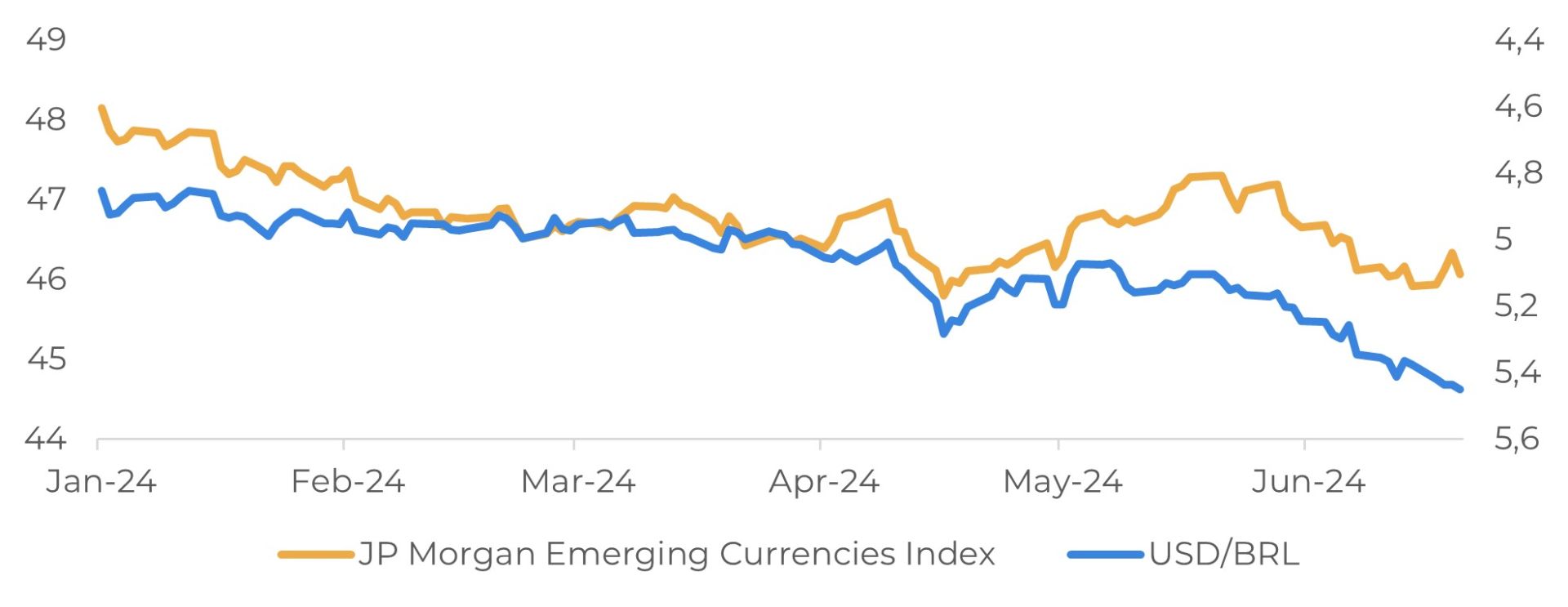

- We believe that the BCB's statement was less hawkish than the markets had expected, which could weigh on the currency. In addition, the market has reacted negatively to fiscal policy measures and news, discouraging expectations of a stability of Brazil's public debt.

- Added to this is the appreciation of the dollar on the international stage and the acceleration of inflation and slowdown in economic activity on the domestic stage, contributing to a negative outlook for the BRL in the coming months - even considering the already strong devaluation observed in 2024.

Introduction

The unanimous maintenance of the interest rate and the post-meeting communiqué - released last Wednesday (19) - suggest that Brazil's Central Bank (BCB) may leave the Selic rate as it is for longer than analysts expect. At the same time, this does not indicate that policymakers are considering the rate increases that were priced into the yield curve.

We believe that BCB's statement was less hawkish than the markets had expected, which could weigh on the currency. In addition, the market has reacted negatively to fiscal policy measures and news, discouraging expectations of a stability of Brazil's public debt. Recent activity and inflation data have also increased the negativity towards the Brazilian currency. In this report we will address these issues and update our outlook for the BRL.

Image 1: USD/BRL and Emerging Currencies Index

Source: Refinitiv

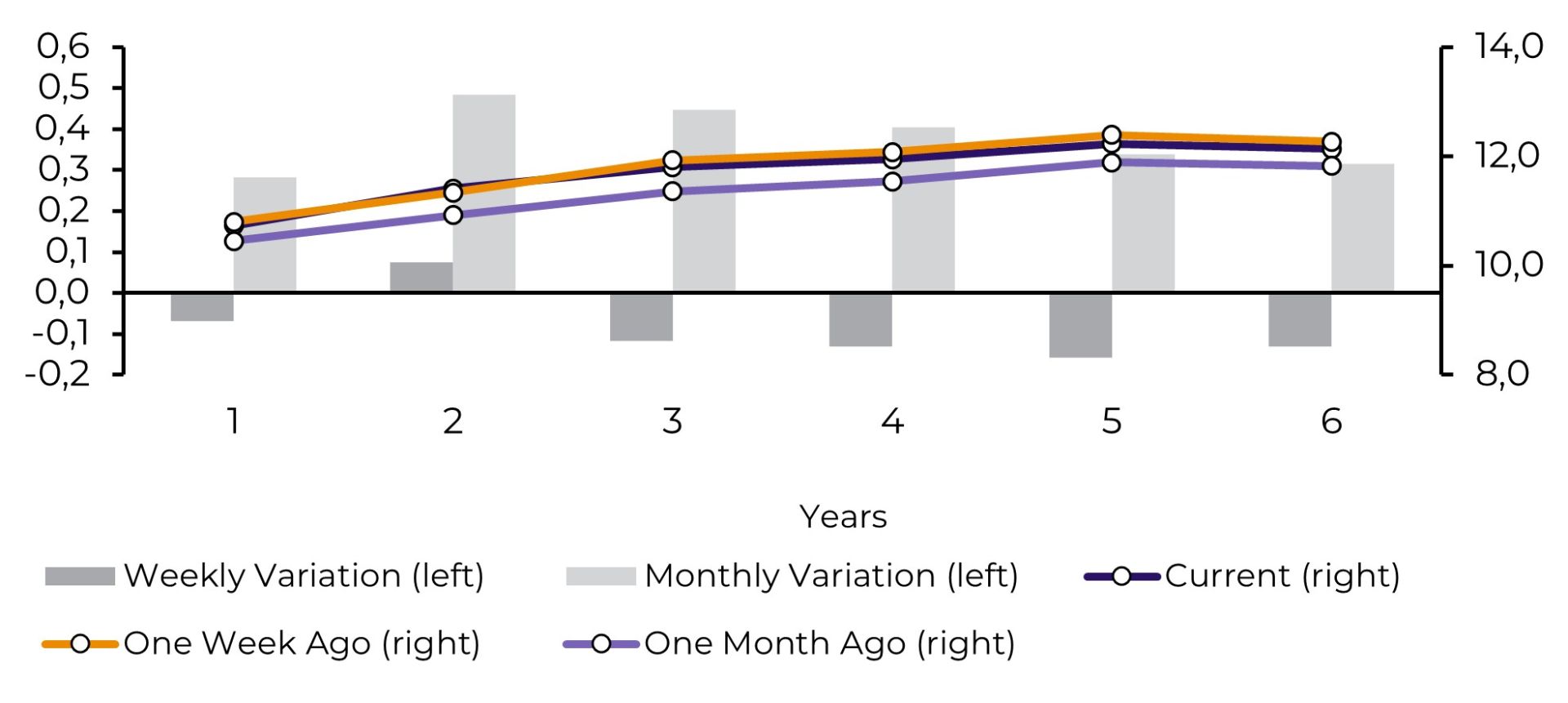

Image 2: Interest Rate Curve - Brazil (%)

Source: Bloomberg

Unanimity reduces risks of changes in monetary policy

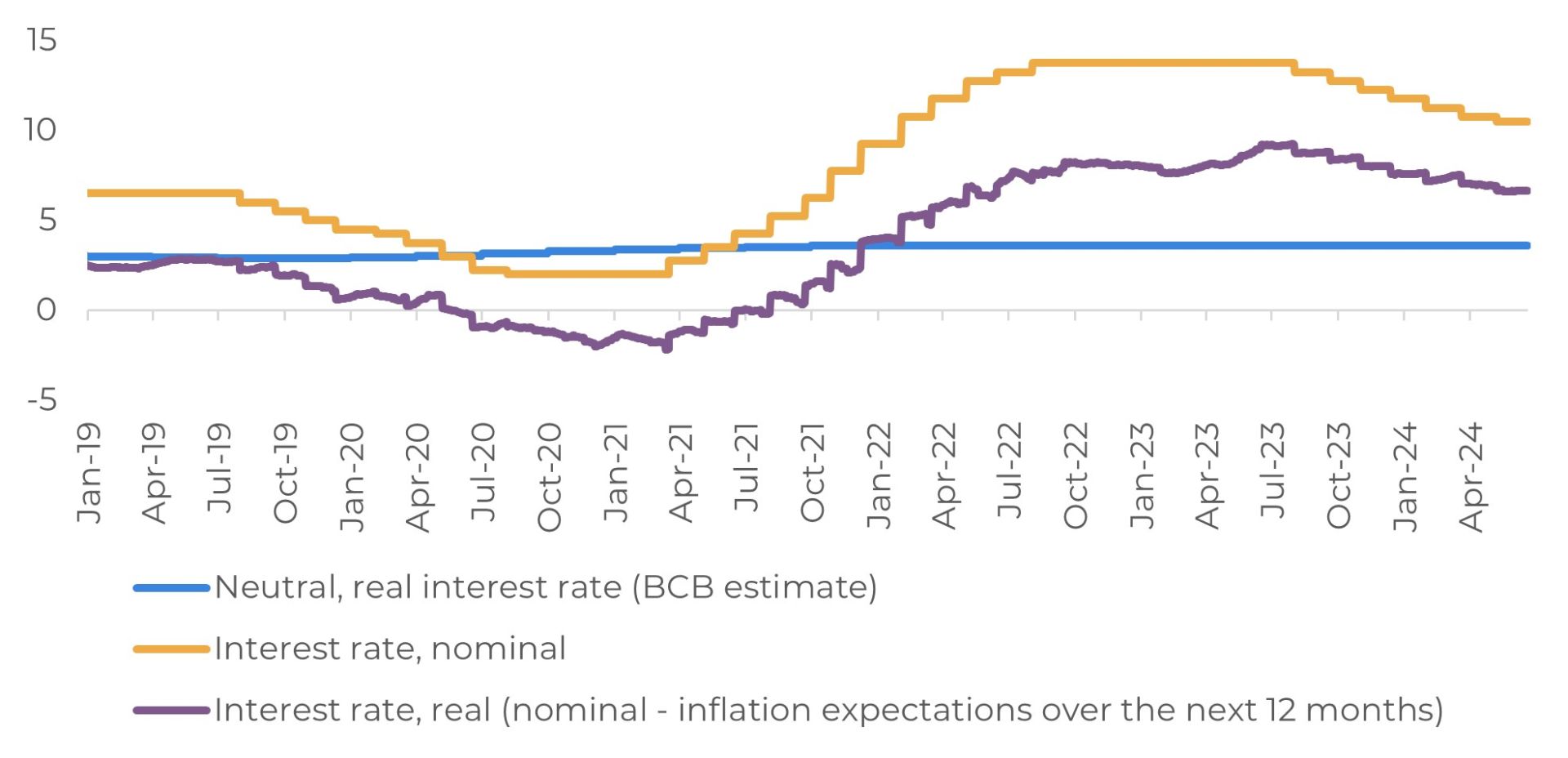

The BCB's Monetary Policy Committee (Copom) kept the Selic rate at 10.50% on Wednesday, in line with our expectations and the consensus of analysts. The vote was unanimous. This measure interrupted the easing cycle that began in August. The BCB had cut the rate by 325 basis points in seven consecutive meetings.

Monetary policy remains restrictive. The real ex-ante rate - which is discounted by expected inflation over 12 months - is 6.6%, well above the neutral level of 4.5% that the BCB has assumed since the beginning of 2022.

In our opinion, the statement tried to convey that the BCB will keep rates at the current level for as long as necessary to consolidate the disinflation process and anchor inflation expectations. The statement said that if rates remained stable until the end of 2025 - instead of being cut to 9.5%, as analysts expect - inflation would end next year only slightly above the 3% target.

The markets received the unity around the decision and the statement positively - the yield curve erased some of the interest rate increases that were priced in before the meeting. Even so, we understand that this will not be enough to control inflation expectations.

The markets received the unity around the decision and the statement positively - the yield curve erased some of the interest rate increases that were priced in before the meeting. Even so, we understand that this will not be enough to control inflation expectations.

Image 3: Interest rate - Brazil (%)

Source: Bloomberg

Inflation and activity worry

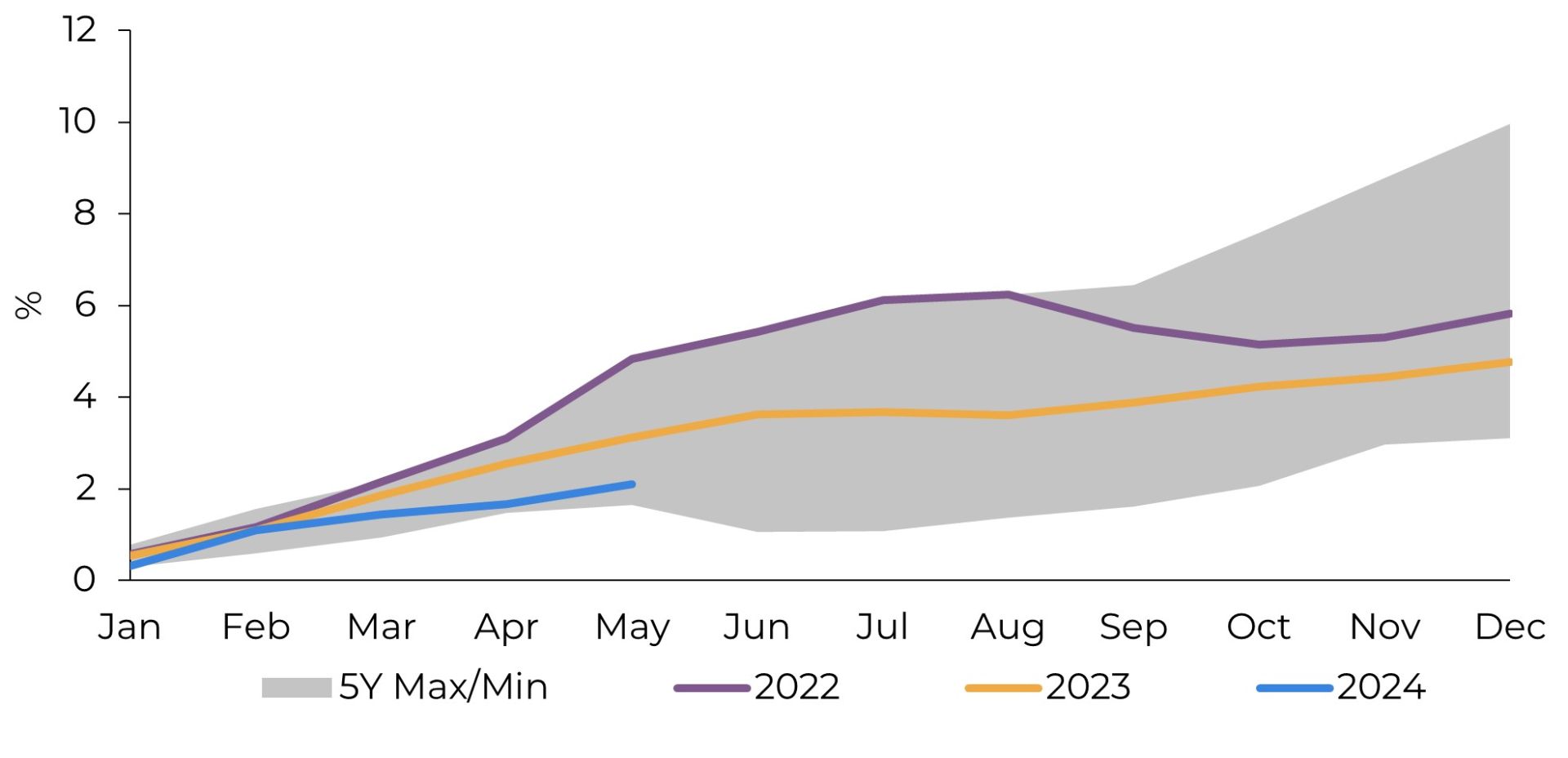

Last week's inflation and activity data also brought more fragility to the Real. Brazilian inflation accelerated to 3.93% year-on-year in May from 3.69% in April, remaining above the 3% target but within the tolerance range of +/- 1.5 percentage points. Bloomberg's inflation decomposition model suggests that the increase can be attributed mainly to deteriorating supply conditions and slightly stronger demand.

Not only has inflation accelerated, but inflationary expectations have also deteriorated since mid-April, which has also contributed to the devaluation of the Brazilian currency, and the expectation of a more expansionary fiscal policy has been the main factor contributing to this phenomenon.

With regard to activity, the IBC-Br was stable in April compared to March, against a consensus estimate of 0.3% growth, reinforcing the view that the Brazilian economy is slowing down. The continuation of the restrictive monetary policy and the impact of the floods in the south of the country should help to maintain this trend

With regard to activity, the IBC-Br was stable in April compared to March, against a consensus estimate of 0.3% growth, reinforcing the view that the Brazilian economy is slowing down. The continuation of the restrictive monetary policy and the impact of the floods in the south of the country should help to maintain this trend

Image 4: Accumulated CPI

Sources: Refinitiv

The trajectory of public debt is worrying

Market analysts heard monthly by the Ministry of Finance's Economic Policy Secretariat (SPE) project that the government will deliver a primary deficit of R$79.715 billion in 2024. The estimate is worse than the previous document from May, which projected a deficit of R$76.825 billion.

The government intended to bring the deficit to zero this year with the new fiscal framework approved last year. Although the 2024 Annual Budget Law foresaw a small surplus of R$2.8 billion in 2024, within the desired neutral result, the bimonthly expenditure and revenue report released in May revised the primary result to a deficit of R$14.5 billion (equivalent to 0.1% of GDP).

For 2025, the projection has also worsened: the market expects a deficit of R$90.134 billion, compared to R$87.458 billion the previous month. As we commented in previous reports, the government changed the fiscal target for 2025 when it sent the budget guidelines bill (PLDO) to Congress: from a surplus equivalent to 0.5% of Gross Domestic Product (GDP) next year, the target is now to repeat the neutral result of 0% of GDP.

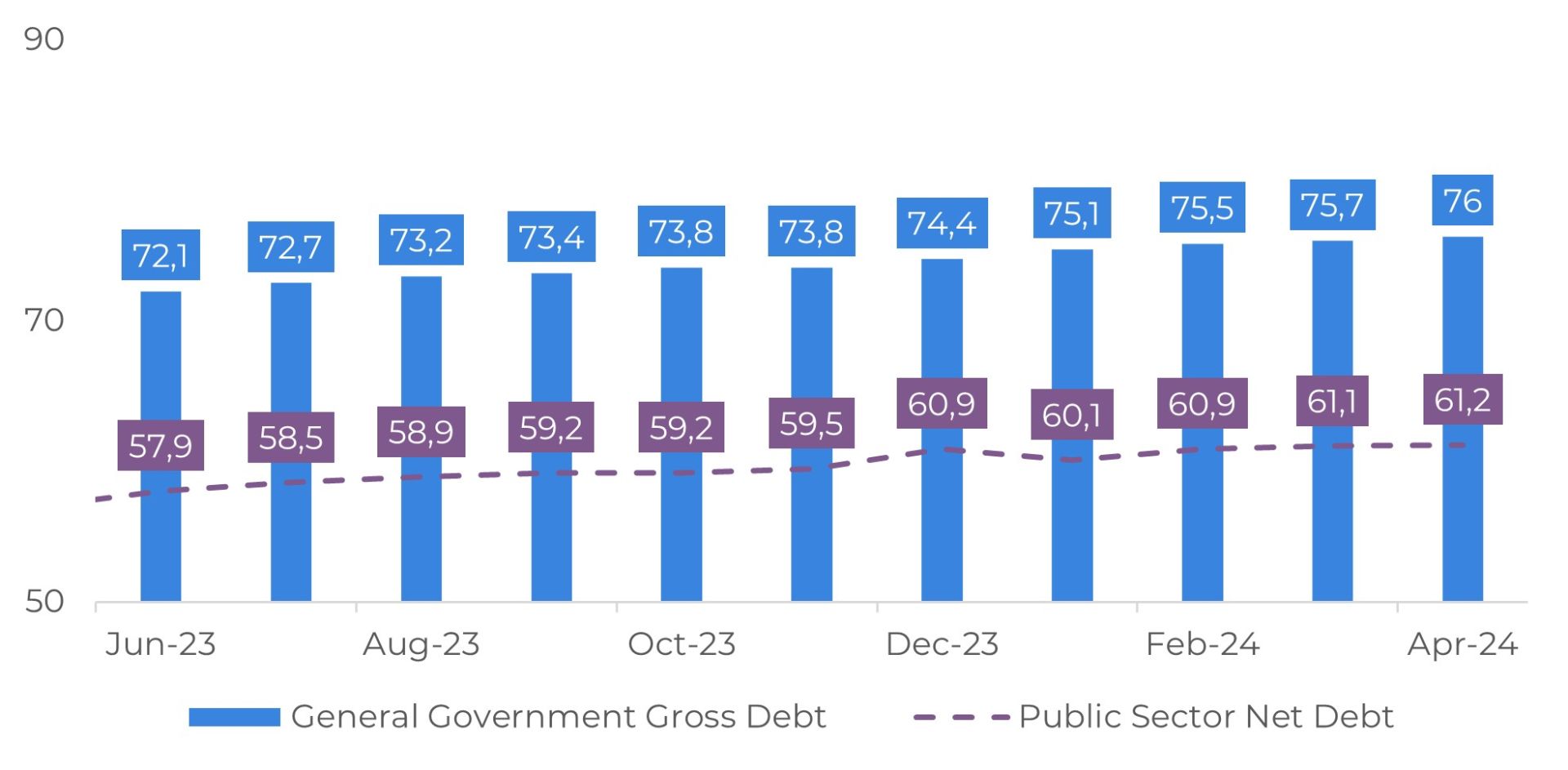

The trajectory of the public debt continues to be one of the most relevant factors for the Real's exchange rate, and even with the strong recent devaluation, there is still room for further weakening of the Brazilian currency if the government doesn't move forward with plans to review public spending. Increased tax collection may be one way out, but society has shown increasing resistance to these projects - increasing their political costs.

Image 5: Gross General Government Debt and Net Public Sector Debt - Brazil (% of GDP)

Sources: Refinitiv

In Summary

Although it was well received by the market, the unanimity surrounding the latest Copom decision should have little impact on the Real's current situation. The outlook for fiscal results continues to deteriorate while the central government continues to make little or no progress on agendas to reverse this situation, especially on the spending cut front.

Added to this is the appreciation of the dollar on the international stage and the acceleration of inflation and slowdown in economic activity on the domestic stage, contributing to a negative outlook for the BRL in the coming months - even considering the already strong devaluation observed in 2024.

Weekly Report — Macro

Written by Alef Dias

alef.dias@hedgepointglobal.com

alef.dias@hedgepointglobal.com

Reviewed by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.