Jul 2

/

Victor Arduin

Macroeconomics Weekly Report - 20240702

Back to main blog page

US interest rate cut in September gains momentum

- Throughout 2024, the US interest rate cut was postponed due to resilient inflation and bullish data on employment and US economic activity.

- However, last week's PCE data raised hopes that in the coming months there could be an easing of US monetary policy, something that could have a profound impact on the commodities market.

- One of the biggest challenges ahead is to see a softening in the labor market, one of the main drivers of inflation due to the increase in employment and real wage gains. However, a slowdown could be evident in the July 5th report.

- In addition, the US election brings uncertainty about the direction of the world's largest economy, where a persistent budget deficit provides grounds for the appreciation of the dollar, even in an environment of interest rate cuts.

Introduction

US monetary policy, conducted by the Federal Reserve (Fed), has a profound impact on the global economy. The current restrictive level of interest rates provides grounds for appreciation for the dollar, one of the world's main currencies, but also poses challenges for international trade.

In the commodities market, for example, where most contracts are traded in dollars, an appreciation of the American currency could mean a reduction in demand from holders of other currencies who now have less purchasing power. Because of this, the market is closely watching for signs of a possible easing of monetary policy in the world's largest economy.

In this regard, we will discuss in this report the main variables to watch out for in the coming weeks that will be decisive for a change in the American monetary scenario.

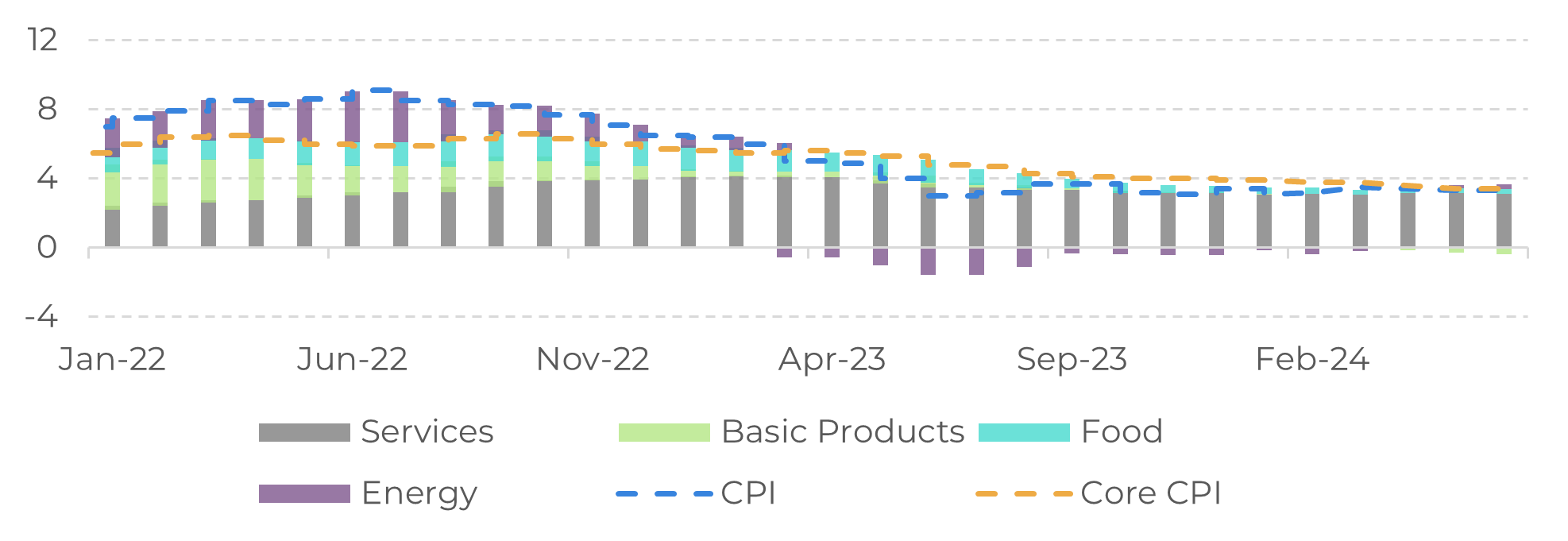

Image 1: US - CPI inflation (%)

Source: Bureau of Labor Statistics

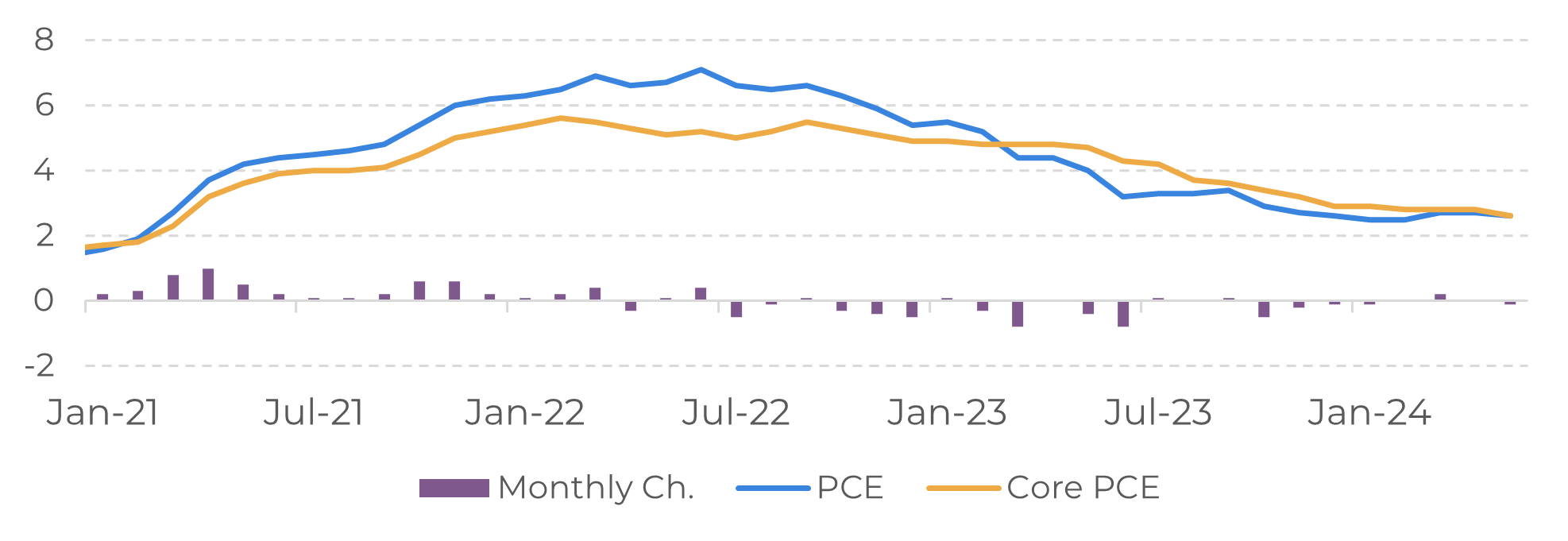

Image 2: US - PCE inflation (%)

Source: BEA

By mid-2024 there was a worsening perception of inflation in the country

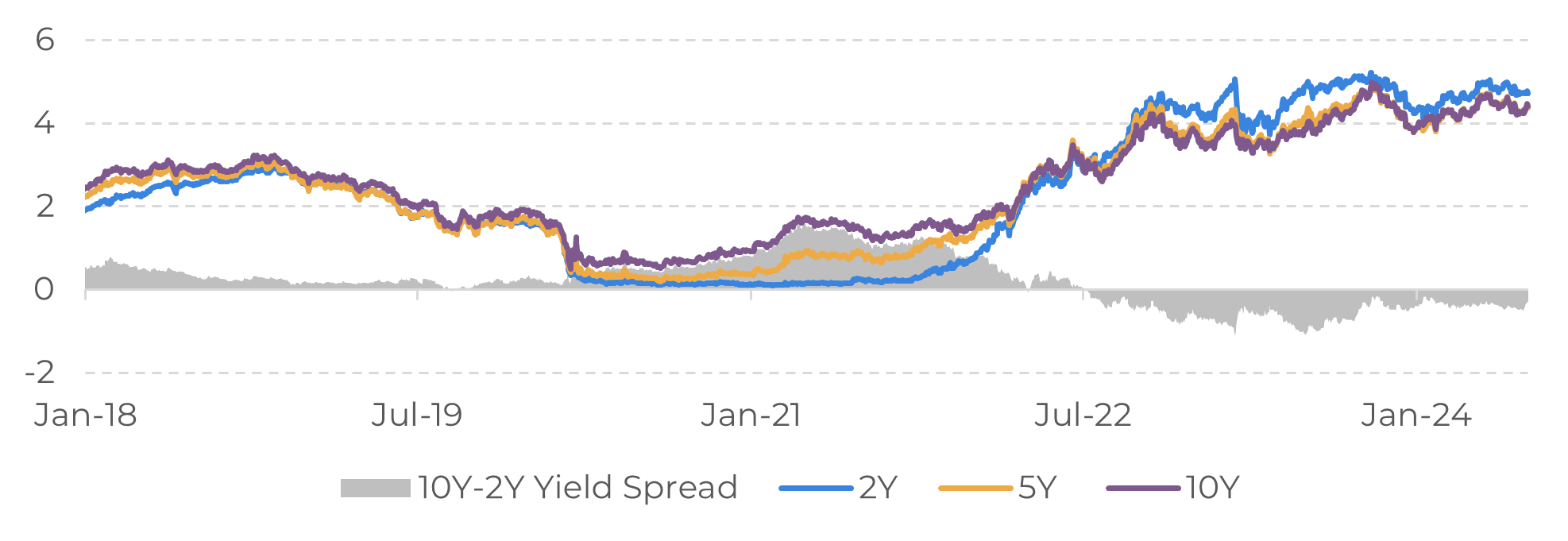

As commented on in previous reports, the US interest rate cut, one of the most eagerly awaited events of the year, was postponed due to various indicators showing resilience in inflation and economic activity throughout the first half of the year. The yield on the 2-year bond reached over 4.72%, an increase of 50 basis points compared to the end of 2023. This rise reflects the increased uncertainty and risk aversion in the market.

The latest data has raised hopes of monetary policy easing as early as September. Last week, PCE (Personal Consumption Expenditures), one of the metrics most closely monitored by the Fed, slowed from 2.8% in April to 2.6% in May. In addition, the ISM manufacturing data indicated a slight deepening of the sector's contraction, from 48.7 to 48.5 in June.

Although they are not enough to determine an easing of monetary policy, they are positive signs that the disinflationary process is continuing in the country. But perhaps one of the most important pieces of data is yet to come and will have an important impact on the perception of inflation in the country.

Image 3: US - US Treasury Yields (%)

Source: Bureau of Economic Analysis

Still strong, the job market is one of the main concerns

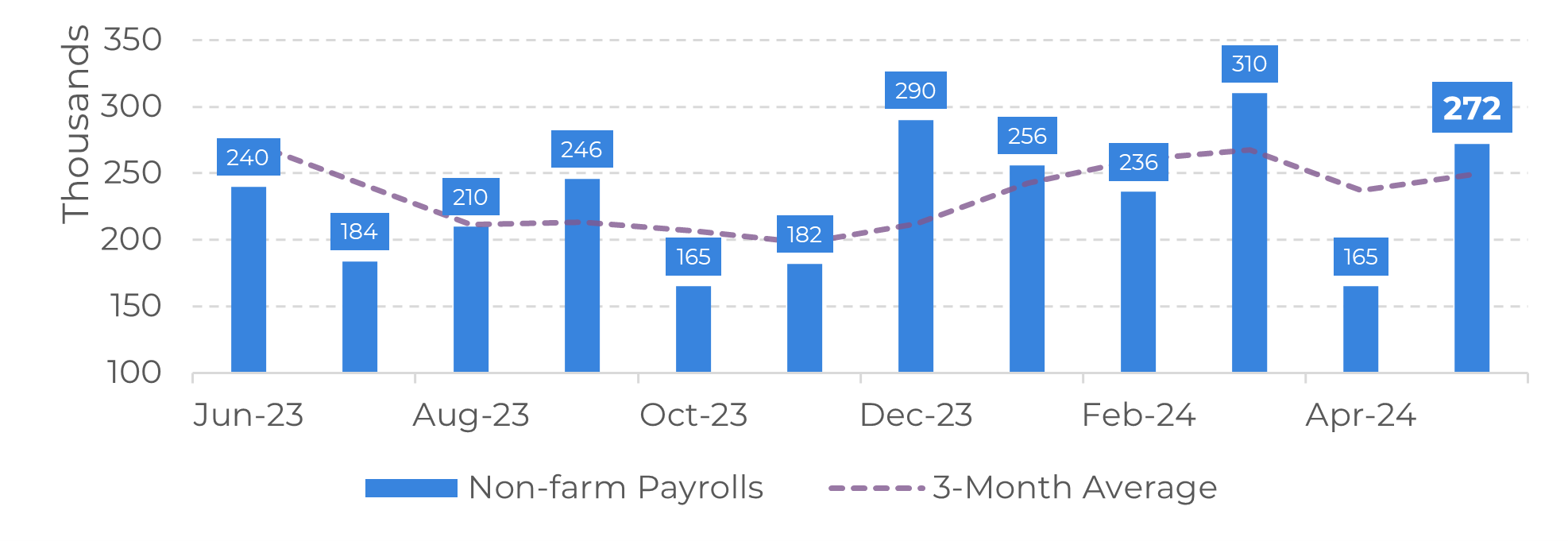

One of the biggest challenges for a change in US monetary policy has been the resilience of the country's labor market, especially in the services sector, which has been responsible for adding inflationary pressure due to job growth and real wage increases.

The monthly payroll, which tracks around 80% of the country's workforce, revealed the creation of 272,000 new jobs, the second highest number in the last six months. The Fed, as repeated by its chairman, needs more confidence to start cutting interest rates, a signal that doesn't seem to be coming from the labor market.

The next few weeks will be crucial in determining what actions the Fed decides to take at its meeting at the end of the month, with a focus on the payroll report on July 5. If inflation continues to show signs of cooling, the Fed could signal (forward guidance) an interest rate cut. However, if the inflationary scenario worsens, it is more likely that the current restrictive level will be maintained.

Image 4: US - Non-Farm Payroll Report

Sources: Refinitiv

Election period may bring more uncertainties than certainties

In the political sphere, there are also uncertainties that could have an impact on inflation and interest rates, as well as the trajectory of the dollar. Some possible scenarios we could see in a possible new Biden or Trump administration.

If, on the one hand, a Democratic administration is likely to maintain an energy policy focused on protecting the environment, resulting in higher energy costs, on the other hand, a lower level of protectionism will ease the pressure on goods and services, benefiting the American economy in greater integration with the world, especially China. A Trump administration could bring in deregulations that encourage the use of fossil fuels, making energy costs lower, but it could also increase protectionism in the country to encourage domestic economic activity, resulting in strong inflationary pressure.

Furthermore, regardless of the new president in the United States, there is a problem to be faced for the next few years. The gradual worsening of the American fiscal scenario persists, with a budget deficit of 6% of GDP and a public debt of over 34 trillion dollars. Even if the Fed finds room to lower interest rates in the future, the dollar could still strengthen due to the higher premiums offered by US Treasury bonds, which are used to finance government spending.

In Summary

The US interest rate cut is one of the most eagerly awaited events for 2024, but persistent inflation in the country has frustrated market expectations of an easing of US monetary policy as early as March.

Still highly uncertain, the latest figures suggest that the disinflationary process is still underway and gained momentum in May. If the payroll data shows a slowdown in the labor market in June, there's a good chance we'll see a more dovish statement at the next Fed meeting, suggesting that a cut of 25 basis points will take place in September.

However, the US presidential race could cast uncertainty over the trajectory of the country's economy for the coming year, which could force the Fed to adopt a more cautious stance.

Weekly Report — Macro

Written by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Reviewed by Alef Dias

alef.dias@hedgepointglobal.com

alef.dias@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.