Jul 10

/

Alef Dias

Elections in France reduce short-term risks, but long-term remains challenging

Back to main blog page

Elections in France reduce short-term risks, but long-term remains challenging

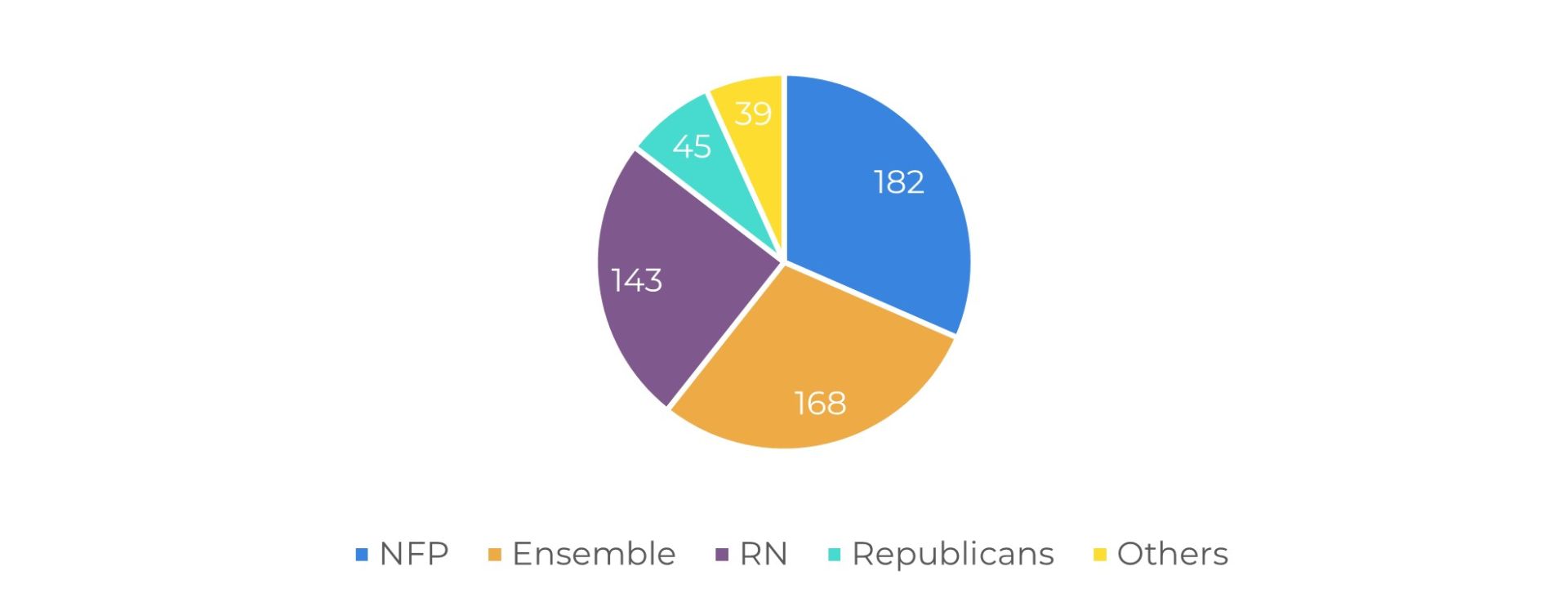

- The left-wing NFP alliance won the largest number of seats in France's legislative elections, with Emmanuel Macron's Ensemble in second place and the right-wing RN well below expectations in third.

- This result eliminated the most serious short-term economic and fiscal risks posed by an absolute majority for the RN or the NFP, but the long-term consequences of the vote could still be significant. The debt was already on an unsustainable path and the economic growth trend is sluggish.

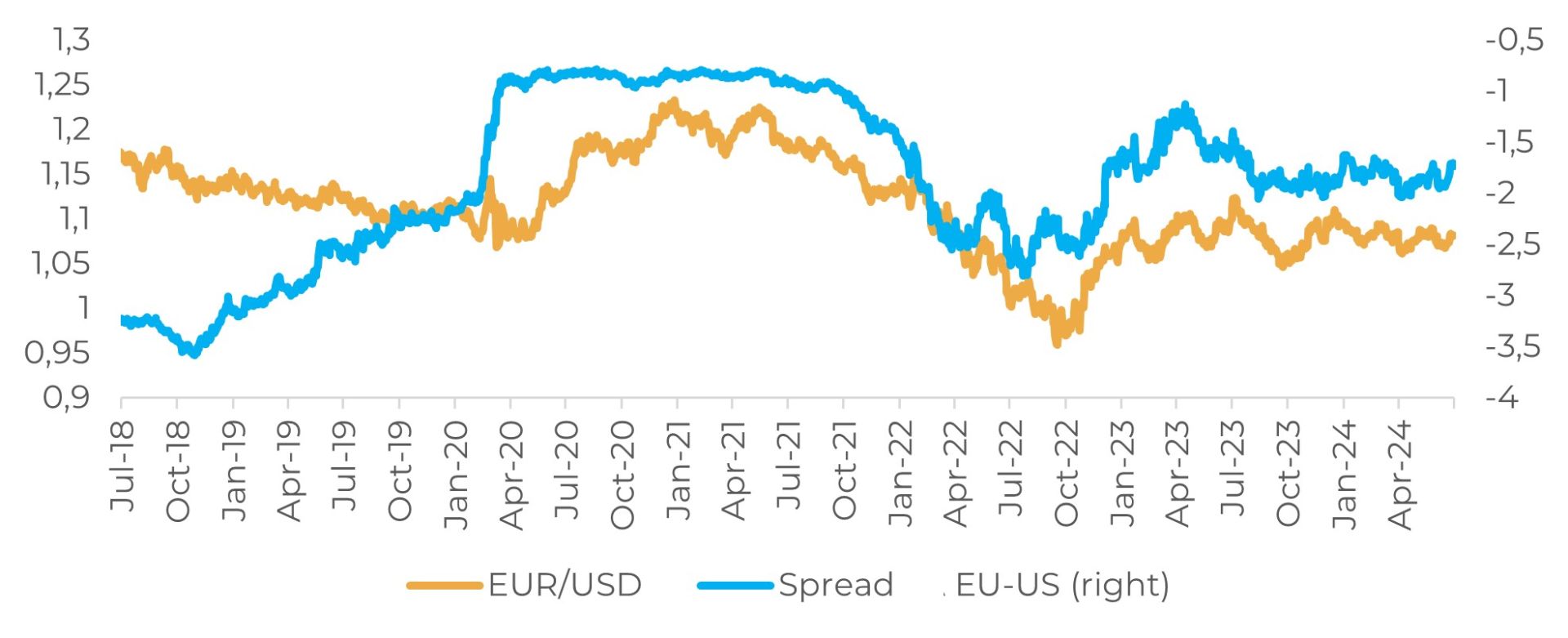

- With the reduction in short-term risks, the euro could continue to be heavily influenced by expectations of the Fed starting to cut interest rates. In the long term, the French election is likely to put further pressure on the euro, as yet another economy in the bloc remains far from resolving its fiscal imbalances.

Introduction

After strong results for Marine Le Pen's right-wing Rassemblement National (RN) party in the first round of the French legislative election, the results of the second round brought a very different scenario. The left-wing NFP alliance won the most seats in the election, with Emmanuel Macron's Ensemble in second place and the RN in third. With no group able to command a majority, this probably means that the left and center parties will need to form a coalition government or jointly support a more technocratic administration.

Given this situation, we will analyze the possible scenarios for the future of French economic policy and how they could affect the euro.

Given this situation, we will analyze the possible scenarios for the future of French economic policy and how they could affect the euro.

Image 1: New Composition of the French Parliament

Source: G1

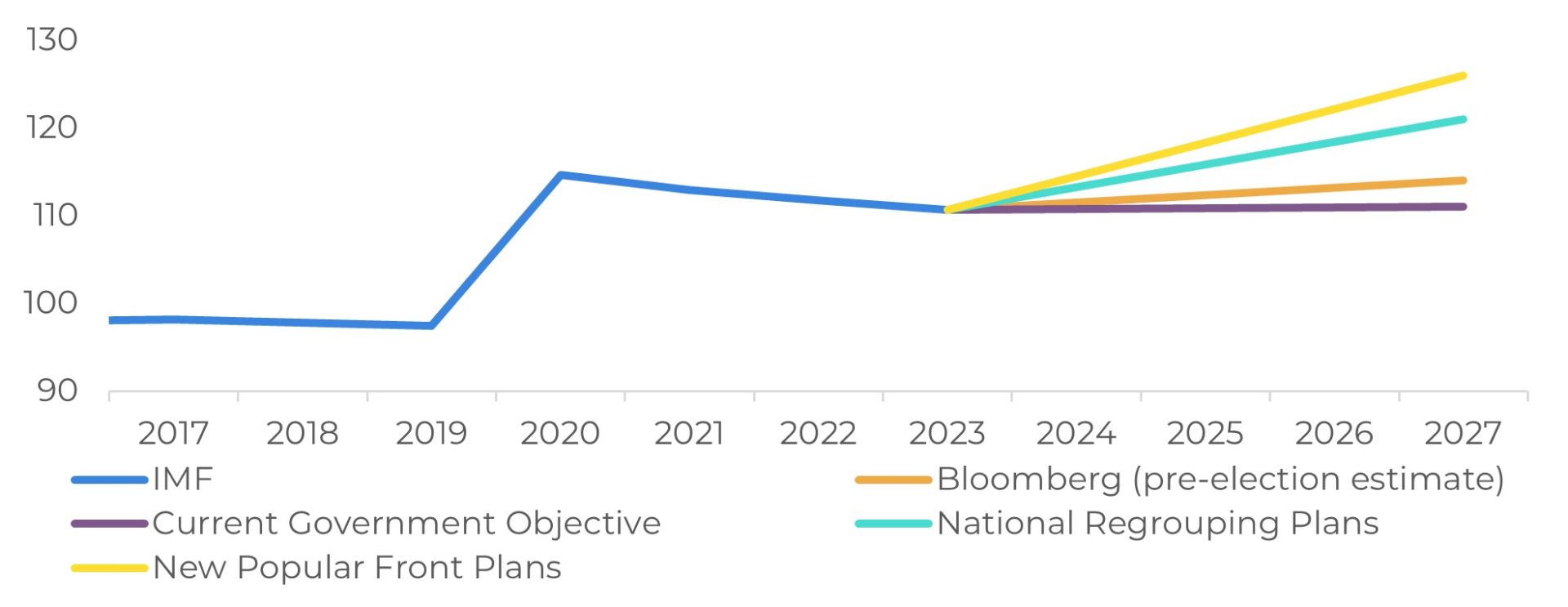

Image 2: Debt/GDP estimates - France

Source: Bloomberg

Tail risks have been diminished, but the fiscal scenario remains worrying

Any opinion on the new government's policies is necessarily speculative at this point. What is clear is that, with an expected deficit close to 5% of GDP in 2024 and a debt of around 111% of GDP, France is starting from a tense fiscal position.

With no group capable of commanding a majority, France now faces a period of political uncertainty. Whatever configuration is agreed, it is likely to be supported by the left, which advocates an increase in spending. Even so, neither the far right nor the left-wing alliance won an absolute majority, taking extreme fiscal stimulus off the table.

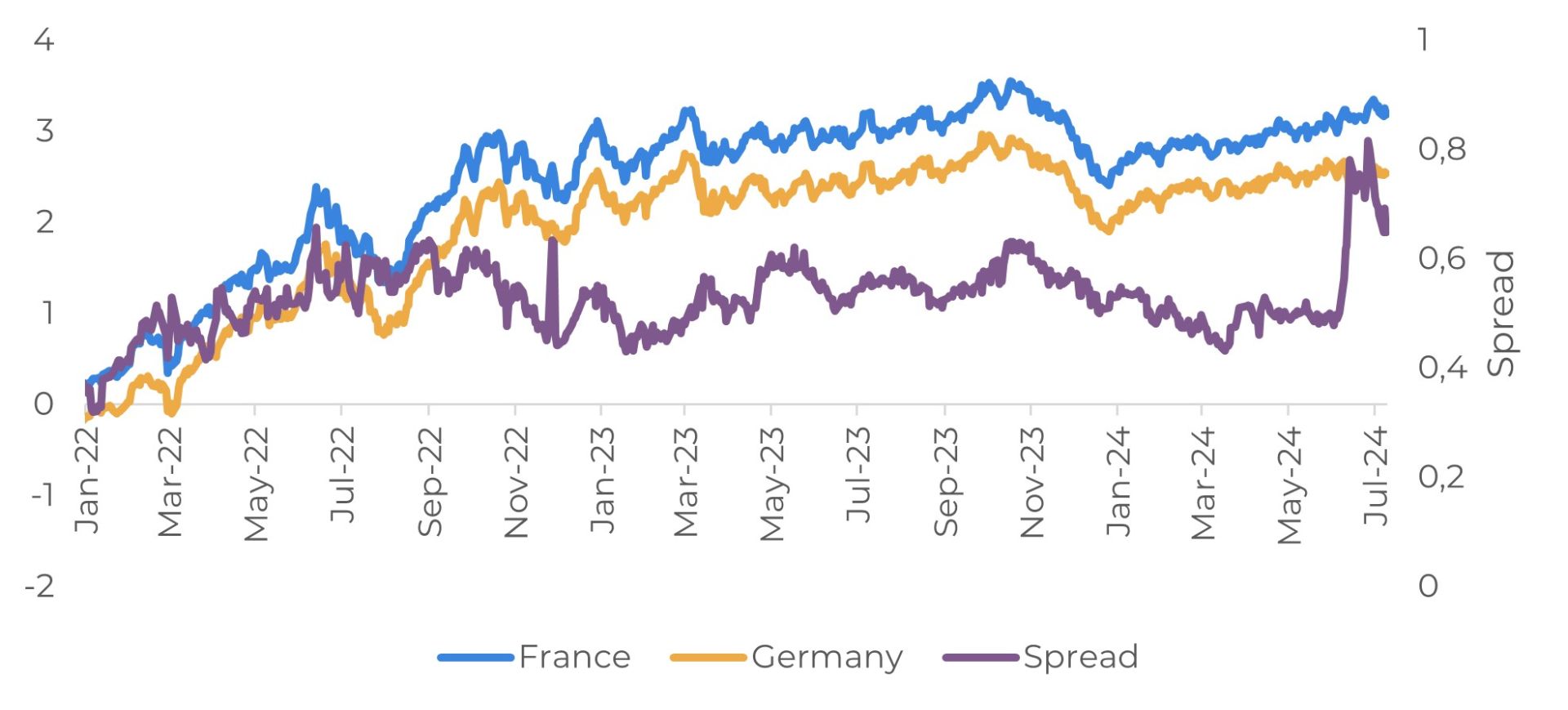

As an illustrative scenario, let's consider if the new government accepts President Macron's stability program, with a deterioration in the deficit of 0.5% of GDP, keeping the spread against German bond yields at around 75 basis points.

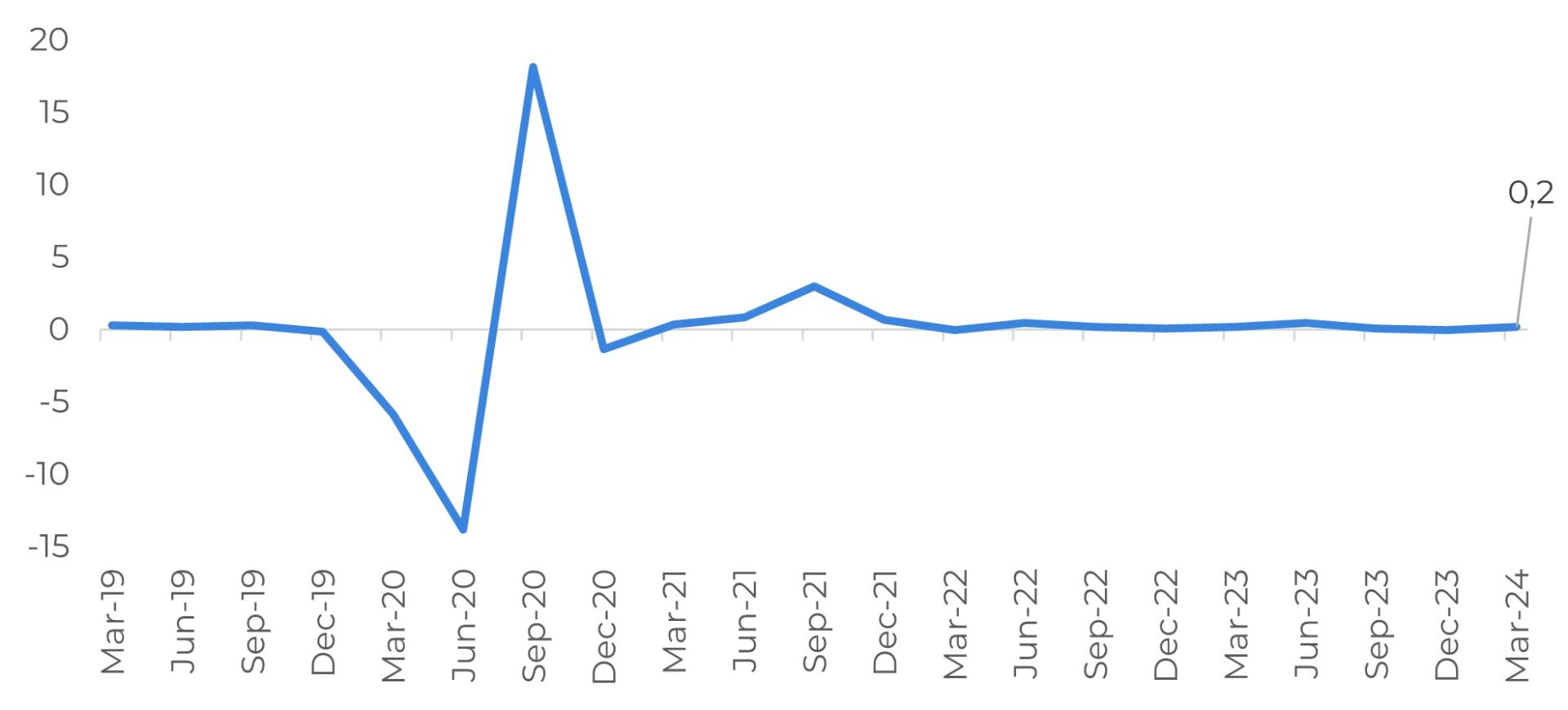

Image 3: Quarterly GDP growth France (%)

Source: Refinitiv

Image 4: 10-year Yields (%)

Source: Refinitiv

Short-term trends could continue

The French economy has proved resistant to rising interest rates, expanding in almost every quarter since the European Central Bank (ECB) began tightening monetary policy in mid-2022.Even so, growth has been slow and is not yet showing many signs of recovery. Growth fell slightly to 0.2% in 1Q24, from 0.3% in 4Q23, and weak business sentiment suggests it will remain subdued in 2Q. Bloomberg estimates point to GDP growth of 0.2% again, while the Banque de France's latest forecast is more pessimistic, at 0% to 0.1%.

On the price side, French inflation fell in June to 2.5% from 2.6% in May, mainly due to energy and food. Eurostat data showed that increases in energy prices fell to 4.5% from 5.5% in May, probably due to a reduction in fuel prices. Food inflation also fell, mainly due to base effects. Meanwhile, core goods inflation remained stable and price gains in services increased, bringing core HICP inflation to 2.4% from 2.3% in May.

With inflation slowing and the ECB having started to cut rates, the increase in consumer spending and the recovery in investments could support a gradual strengthening of growth prospects. However, the elections and political uncertainty could weigh on confidence and add some downside risks.

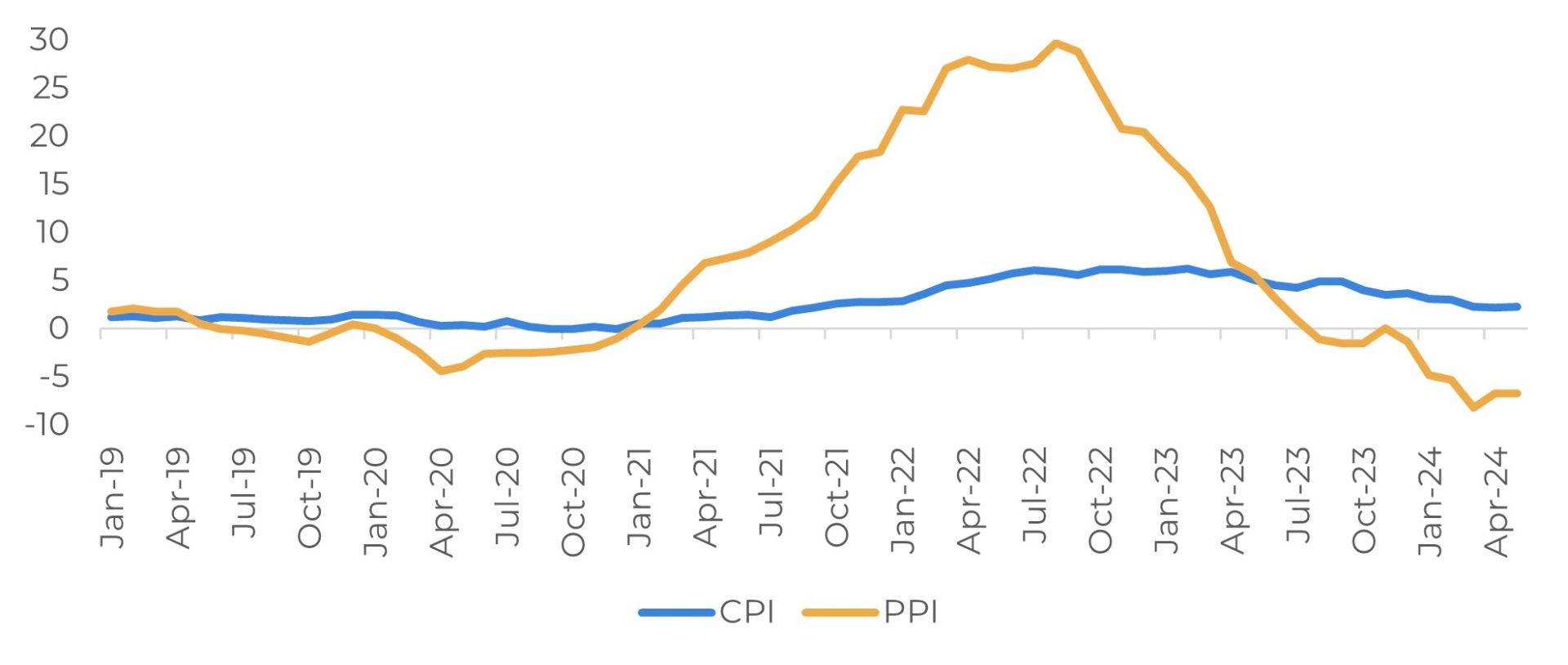

Image 5: Price Indexes France (YoY, %)

Sources: Refinitiv

In Summary

The left-wing NFP alliance won the largest number of seats in France's legislative elections, with Emmanuel Macron's Ensemble in second place and the right-wing RN well below expectations in third.

This result eliminated the most serious short-term economic and fiscal risks posed by an absolute majority for the RN or the NFP, but the long-term consequences of the vote could still be significant. The debt was already on an unsustainable path and the economic growth trend is sluggish. With the chances of fiscal deterioration and political paralysis increasing, the likelihood of these problems being resolved has decreased.

With the reduction in short-term risks, the euro could continue to be heavily influenced by expectations of the Fed starting to cut interest rates - if the data continues to show economic activity close to stagnation in the euro zone and inflation continues to converge towards the ECB's 2% target. In the long term, the French election is likely to put further pressure on the euro, given that yet another economy in the bloc is still a long way from resolving its fiscal imbalances.

Image 6: Price Indexes France (YoY, %)

Sources: Refinitiv

Weekly Report — Macro

Written by Alef Dias

alef.dias@hedgepointglobal.com

alef.dias@hedgepointglobal.com

Reviewed by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.