Aug 6

/

Victor Arduin

Japan's rate hikes could lead to the depreciation of emerging market currencies

Back to main blog page

If conditions prove favorable, the Real could appreciate

- In recent weeks, there has been an increase in uncertainties regarding Brazil, mainly in the country's monetary and fiscal issues, resulting in a sharp depreciation of the Real.

- Achieving fiscal balance has been one of the main challenges facing the Brazilian economy, resulting in high interest rates to control inflation. Although bitter, it has been one of the most effective instruments in guaranteeing price stability in the country.

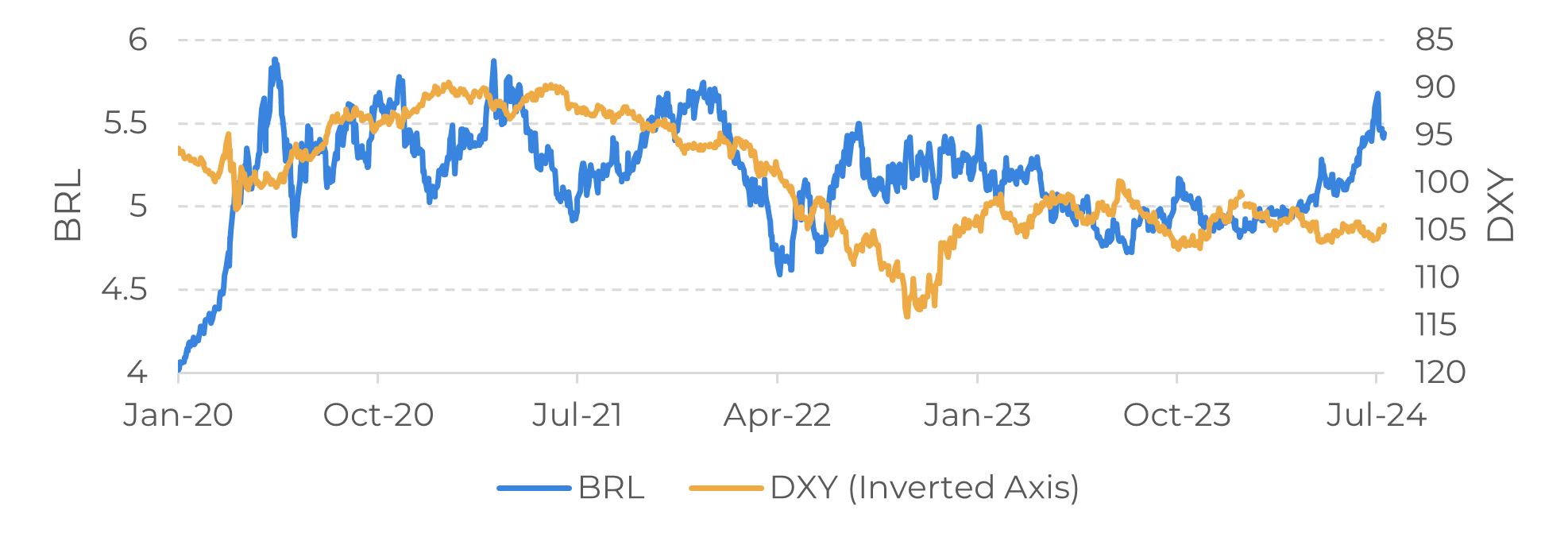

- To complicate matters further, during the first half of the year the external environment did not favor emerging countries, as there was no interest rate cut in the US, which resulted in a strengthening of the dollar.

- However, this could change in the coming months as the fundamentals for the appreciation of the Real come to fruition. The easing of US monetary policy will be welcome, but compliance with the framework is essential for the dollar to return to a level close to R$5.15.

Introduction

The exchange rate is one of the most sensitive indicators of an emerging country's economy. Although external factors shape the trajectory of the appreciation or devaluation of a country's currency, it is the domestic pillars that generally define its attractiveness to the market. These pillars, under the direct control of government policies, when used well, help to boost investor confidence in the country.

Faced with growing uncertainties regarding monetary policy and questions about the government's fiscal commitment, the Brazilian Real (BRL) has become one of the most devalued currencies in the world in 2024. Since the beginning of the year, the BRL has accumulated a devaluation of approximately 11.58%.

However, recent economic policy signals and the expectation of an interest rate cut in the US could partially mitigate this scenario, as long as the country remains firm in its commitment to stabilizing the upward trajectory of its public debt. We'll go into more detail about the grounds for exchange rate appreciation in this report.

Image 1: BRL Vs. Terms of Trade

Source: Bloomberg

Image 2: BRL Vs. DXY

Source: Bloomberg

Fiscal imbalance is the country's main economic challenge

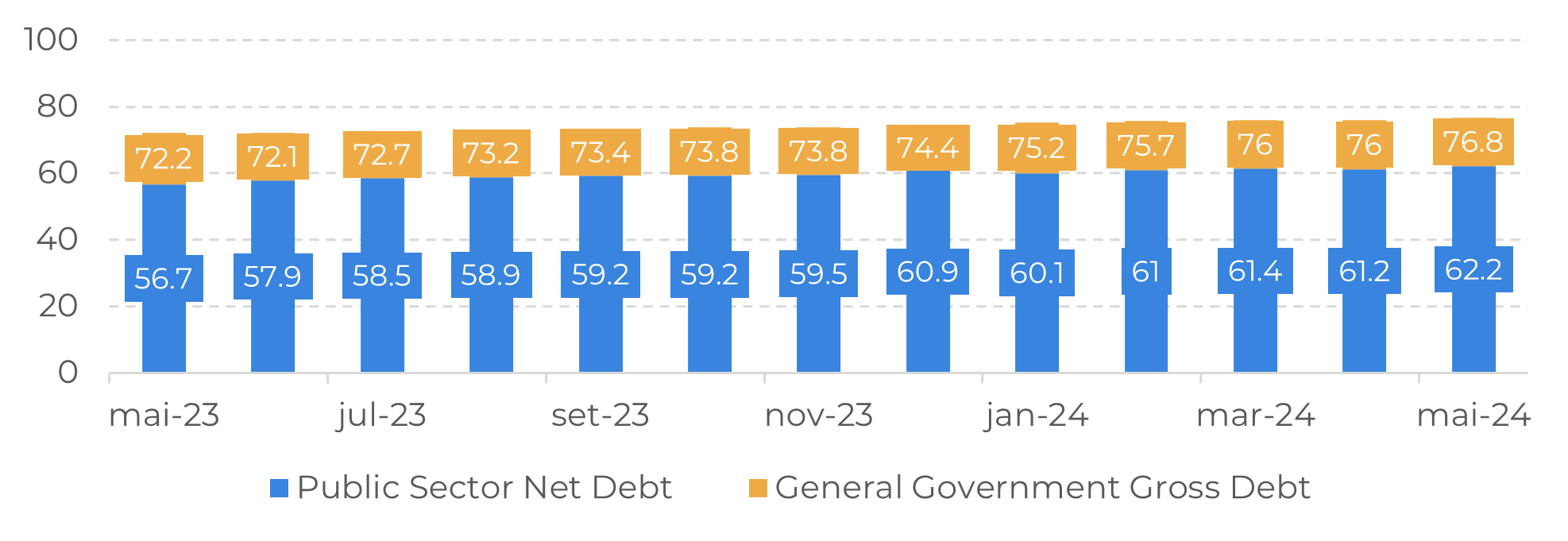

The country's nominal deficit exceeds 6% of GDP, a high level for an emerging country and one that contributes to the increase in public debt. Some figures, for example, highlight Brazil's delicate fiscal situation, which in the last twelve months has accumulated a deficit of R$280.2 billion, equivalent to 2.53% of GDP.

Bringing public accounts into balance has been one of the country's biggest challenges in recent years. So far, the government's strategy has been to increase revenue by increasing the tax burden, but this has led to friction with Congress and sectors of the economy. To make the scenario even more complex, a large part of federal spending, such as health, education and parliamentary amendments, is linked to revenue growth. This means that when there is an increase in revenue, there is also an increase in spending.

Despite the reforms implemented to increase tax collection and the good performance of the trade balance last year, which generated additional revenue for the government, the upward trajectory of Brazil's public debt remains worrying, reaching 76.8% of GDP in May 2024.

Image 3: BR - Public Sector Debt (%, GDP)

Source: Refinitiv

Uncertain external environment also hurt the Real

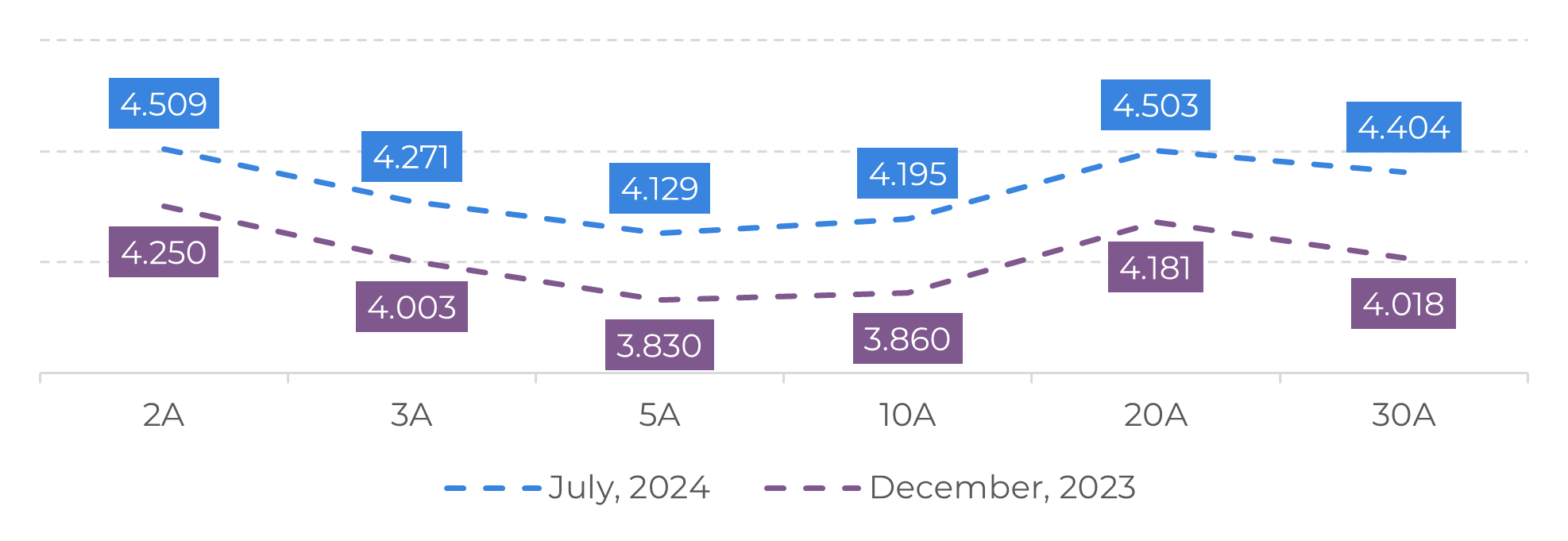

The first half of 2024 was marked by a deterioration in the external scenario for emerging countries, especially commodity exporters. Persistent inflation in the US did not allow the Federal Reserve (Fed) to start easing monetary policy, resulting in support for US bond yields.

As the dollar strengthens, commodities, which are generally traded in the US currency, become more expensive for those who hold other currencies, which has an impact on their consumption. However, this scenario could begin to be reversed in the coming months, as data on the US labor market and economic activity show that inflation is slowing down, resulting in an improvement in the main inflation indices, such as the core PCE, which in 12 months went from 2.8% to 2.6%.

With the US interest rate cut approaching and if Brazil demonstrates a clear commitment to controlling public accounts, especially reforms that reduce state spending, South America's largest economy could experience a period of currency appreciation.

As the dollar strengthens, commodities, which are generally traded in the US currency, become more expensive for those who hold other currencies, which has an impact on their consumption. However, this scenario could begin to be reversed in the coming months, as data on the US labor market and economic activity show that inflation is slowing down, resulting in an improvement in the main inflation indices, such as the core PCE, which in 12 months went from 2.8% to 2.6%.

With the US interest rate cut approaching and if Brazil demonstrates a clear commitment to controlling public accounts, especially reforms that reduce state spending, South America's largest economy could experience a period of currency appreciation.

Image 4: USA - Forward Treasury Yields (%)

Sources: Refinitiv

Uncertain external environment also hurt the Real

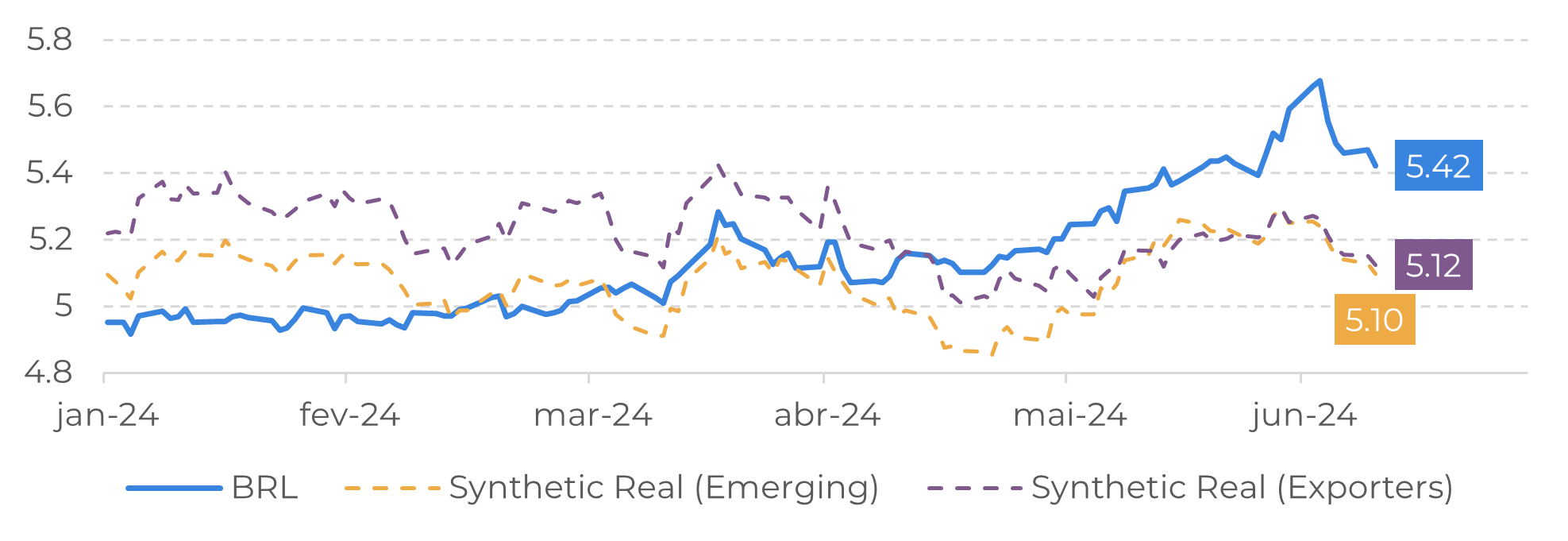

In recent days, the government's signaling that it will seek revisions to mandatory spending in order to achieve compliance with the fiscal framework has helped to relieve the great pressure on the BRL, which reached R$5.70 on July 2. Thinking about possible scenarios for the Brazilian currency, and considering an interest rate cut in the US in 2024, there are a few scenarios ahead, but the main ones are:

Appreciative scenario: BACEN's new president strengthens credibility with the market, signaling that he will pursue the center of the inflation target, even with more restrictive interest rates, while the government manages to implement a set of measures that stabilize the growth of public debt.

Downbeat scenario: Brazil's monetary policy is moving away from the center of the target, albeit within the tolerance range, and the government is finding it difficult to revise spending, given that part of the revisions will depend on coordination with the legislature.

In the first scenario, there will be room for the Real to appreciate, reaching around USD/BRL 5.15 before the end of the year. On the other hand, in the second scenario, the Brazilian currency should depreciate to levels similar to those we've seen in recent weeks, around USD/BRL 5.65.

Image 5: Statistical Modeling for BRL

Sources: Hedgepoint

In Summary

Brazil's high fiscal deficit has been one of the main problems in the economy in recent years, resulting in increased public indebtedness and uncertainty about compliance with the fiscal framework.

Although the fiscal situation presents considerable challenges, it also opens doors to opportunities. By implementing reforms that stabilize public spending, the Brazilian government will be able to attract more foreign investment, relieving pressure on the Real and boosting economic growth.

Not only did domestic issues affect the BRL's performance in the first half of the year, but the worsening external environment was also significant. However, in the coming months, if there is an interest rate cut in the US, there will be room for the Real to appreciate.

Our projections indicate that there is room for the Brazilian currency to appreciate, but a significant appreciation will depend mainly on the success of the Brazilian state in achieving fiscal balance

Sources: Refinitiv

Weekly Report — Macro

Written by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Reviewed by Ignacio

ignacio.espinola@hedgepointglobal.com

ignacio.espinola@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.