Aug 20

/

Victor Arduin

Asian central banks are starting to ease interest rates

Back to main blog page

Asian central banks are starting to ease interest rates

- A potential interest rate cut by the US Federal Reserve in September could have major global effects. It may lead to a gradual depreciation of the US dollar, boosting demand for dollar-denominated commodities.

- Additionally, this could encourage central banks globally to implement more dovish monetary policies, especially in Asian countries that have not yet started their easing cycles.

- Last week, the Bangko Sentral ng Pilipinas (BSP) made a bold move by cutting its policy rate by 25 basis points to 6.25%. Anticipating potential Federal Reserve rate cuts, the BSP has started easing its monetary policy.

- Indonesia's central bank, Bank Indonesia (BI), will decide its policy rate this week. Despite fiscal concerns and potential pressure on the rupiah, speculation is rising that BI may lower rates to boost economic growth.

Introduction

Central banks in Asia have been in the macroeconomic spotlight over the past few weeks. China, which has already lowered interest rates this year, continues to expand its monetary stimulus to support its economy. Meanwhile, India is adopting a more cautious approach as food price pressures continue to weigh on inflation.

However, last week's interest rate cut by the Philippine central bank surprised many observers. While aimed at stimulating the domestic economy, the decision caught some analysts off guard. The relative calm in the markets, evidenced by the stability of the Philippine peso (PHP), might encourage other Asian central banks to follow suit. Indonesia's central bank is set to announce its policy rate decision this week, with expectations for a potential inaugural rate cut.

Our analysis today will focus on the Asian monetary landscape and its implications for upcoming interest rate policy decisions.

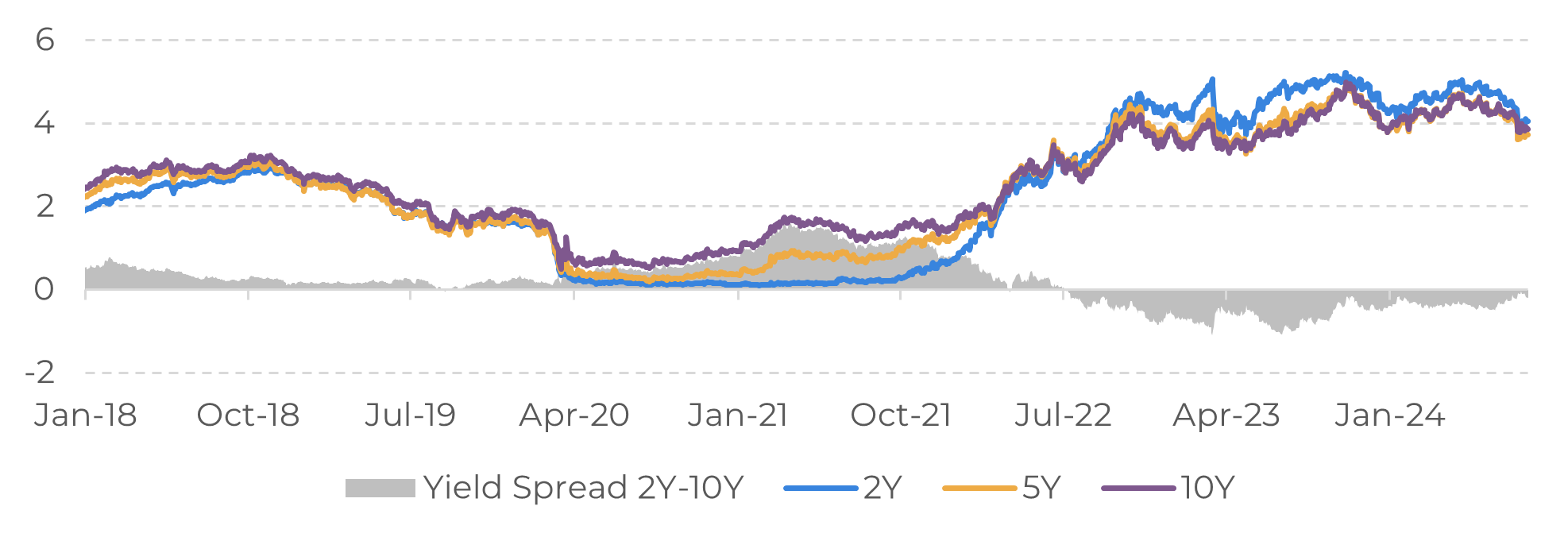

Image 1: US – Treasury Yields (%)

Source: Refinitiv

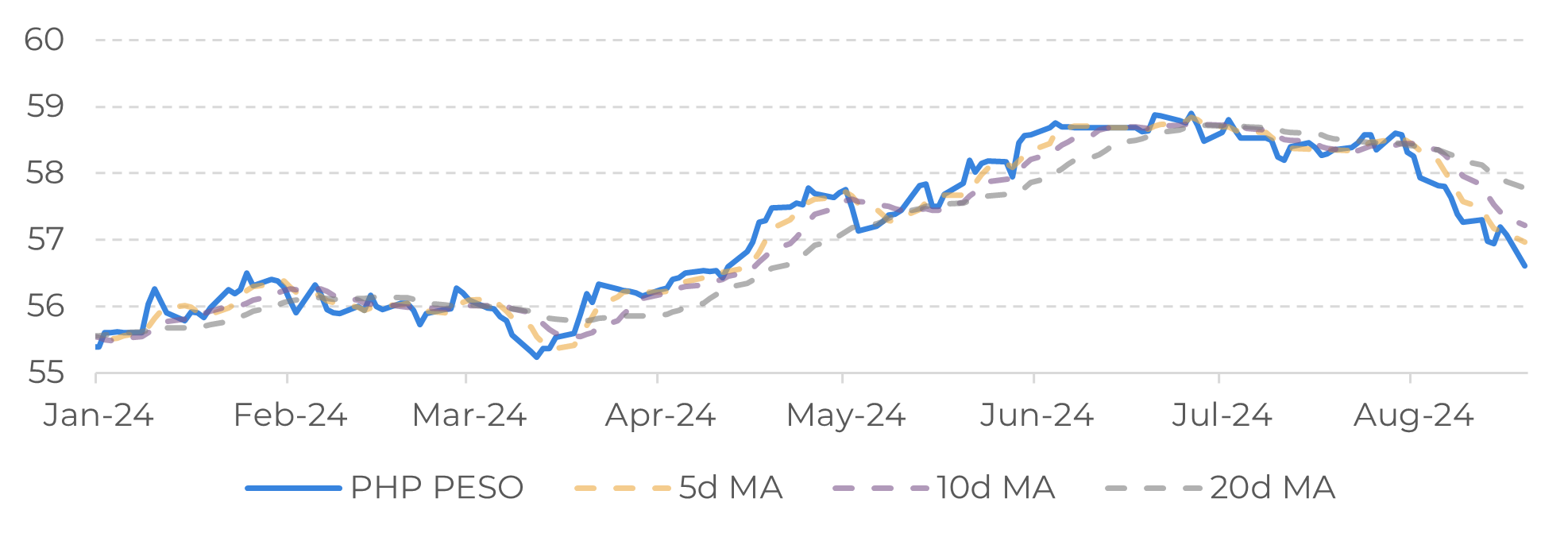

Image 2: FX Spot Rate - US Dollar/Philippine Peso

Source: Refinitiv

One of the first central banks in Asia to cut interest rates

A potential interest rate cut by the US Federal Reserve (Fed) in September is expected to have a significant impact on the global economy. Directly, this could trigger a gradual depreciation of the US dollar, potentially boosting demand for commodities primarily traded in the American currency. Moreover, it may embolden central banks worldwide to initiate or accelerate their own monetary easing policies.

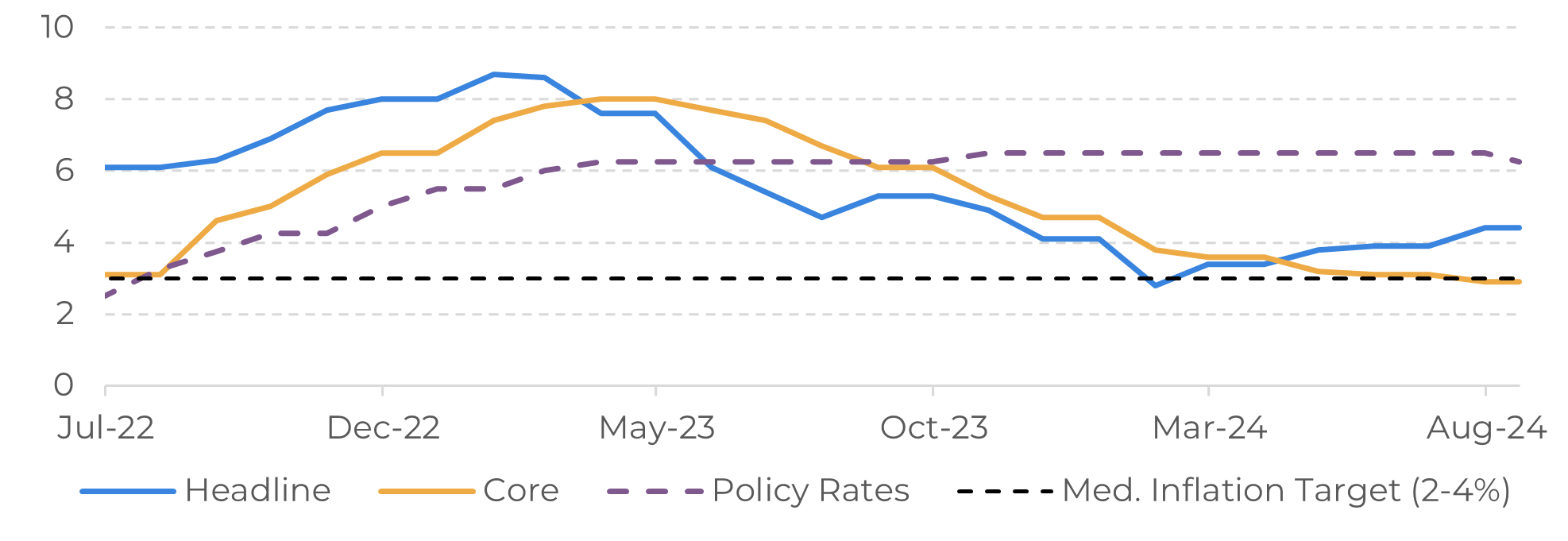

Last week, in a bold move, the Bangko Sentral ng Pilipinas (BSP) reduced its policy rate by 25 basis points to 6.25%. In anticipation of possible rate cuts by the US Federal Reserve, the BSP has started to ease its monetary policy. While some central banks have adopted a more cautious wait-and-see approach, the Philippines has taken a proactive stance in shifting to a more dovish monetary environment to support its economy.

Recent cuts in rice tariff have likely bolstered monetary authorities' confidence that inflation will gradually converge to the target range of 2-4%. Also, the market, has reacted relatively calmly to the decision, with the Philippine peso appreciating by nearly 3% since the beginning of the month.

Image 3: Philippine – Inflation & Interest Rates (%)

Source: Refinitiv

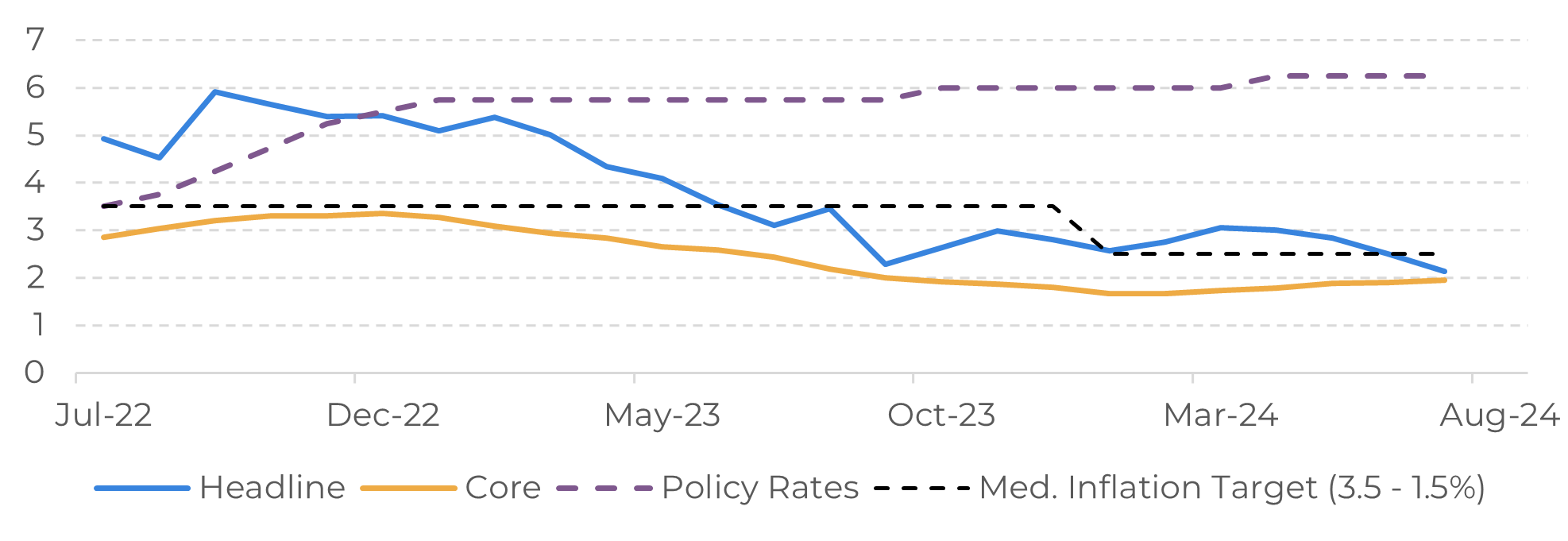

On August 21st, Indonesia decides its policy rate

Recently, the country approved a 3.6 quadrillion rupiah (US$230 billion) budget for the coming year. Combined with a less restrictive monetary policy, this could stimulate consumer spending. The Jakarta Stock Exchange Composite Index has already captured gains in this more dovish environment, hovering near its all-time high.

Following the recent rate cut by the Bangko Sentral ng Pilipinas (BSP), Indonesia's central bank, Bank Indonesia (BI), is set to make its policy rate decision this week. Despite lingering fiscal concerns and potential pressure on the rupiah, there is growing speculation that the monetary authority may opt for a rate reduction to stimulate economic growth.

If Bank Indonesia confirms this measure, we can expect an increasingly favorable economic environment for expansion in Asia, which, in turn, should boost demand for commodities. This trend may be partly attributed to the adoption of more expansionary monetary policies by other central banks in the region, as well as the potential for a sharper depreciation of the US dollar, which would make dollar-denominated commodities more attractive to holders of other currencies.

Image 4: Indonesia – Inflation & Interest Rates (%)

Summary

The market is alredy pricing a Fed rate cut in September. As US Treasury yields decline, more central banks will find room to lower their interest rates without causing inflationary pressures or significant currency depreciation.

The most recent example was the central bank of the Philippines, which, despite some concerns about inflation, decided to cut rates last week. In this context, a similar move might happen this week with Indonesia, which also has high interest rates.

A less restrictive monetary environment in Asia could stimulate economic growth, thereby increasing demand for products such as oil, grains, sugar, coffee, and others. Combined with a gradual depreciation of the dollar, this could create a more bullish outlook for commodity prices.

Written by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Reviewed by Laleska Moda

laleska.moda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.