Sep 3

/

Victor Arduin

The Colombian peso has outperformed its peers: why and for how long?

Back to main blog page

The Colombian peso has outperformed its peers: why and for how long?

- Colombia's inflation rate reached 6.86% YoY in July, making it one of the highest in the region. In contrast, Brazil's inflation is at 4.5% YoY, and Mexico's at 5.57% YoY.

- Recent data shows that prices in the South American country are gradually converging towards the 3% target, thanks to the restrictive monetary policy implemented in late 2021.

- While monetary trends are positive, Colombia's fiscal situation is concerning. Markets are worried about the fiscal framework due to lower-than-expected revenues and spending pressures.

- Our fair-value model shows that the Colombian peso has been overvalued compared to its peers. In the second half of the year, there may be a more pronounced depreciation of the currency due to fiscal challenges and lower commodity prices.

Introduction

Latin American currencies have experienced significant losses in recent weeks due to a combination of factors, including commodity price fluctuations and political instability. Unlike last year, Mexico and Brazil, which had previously performed well against other emerging countries, are now facing poor performance in 2024. While Mexico is implementing new reforms affecting the confidence of the market, Brazil has increased concerns regarding its fiscal situation.

In this context, Colombia has outperformed its regional peers. Despite having one of the highest inflation rates in the Latin America countries and facing macroeconomic challenges, its currency has depreciated by only -2,05% year-over-year (YoY), while other currencies, such as Brazil (-12,86%), Mexico (-15,13%), and Chile (-6,87%), have experienced more significant declines.

Diving deeper into the emerging market currency market, we'll now explore the prospects for the Colombian peso.

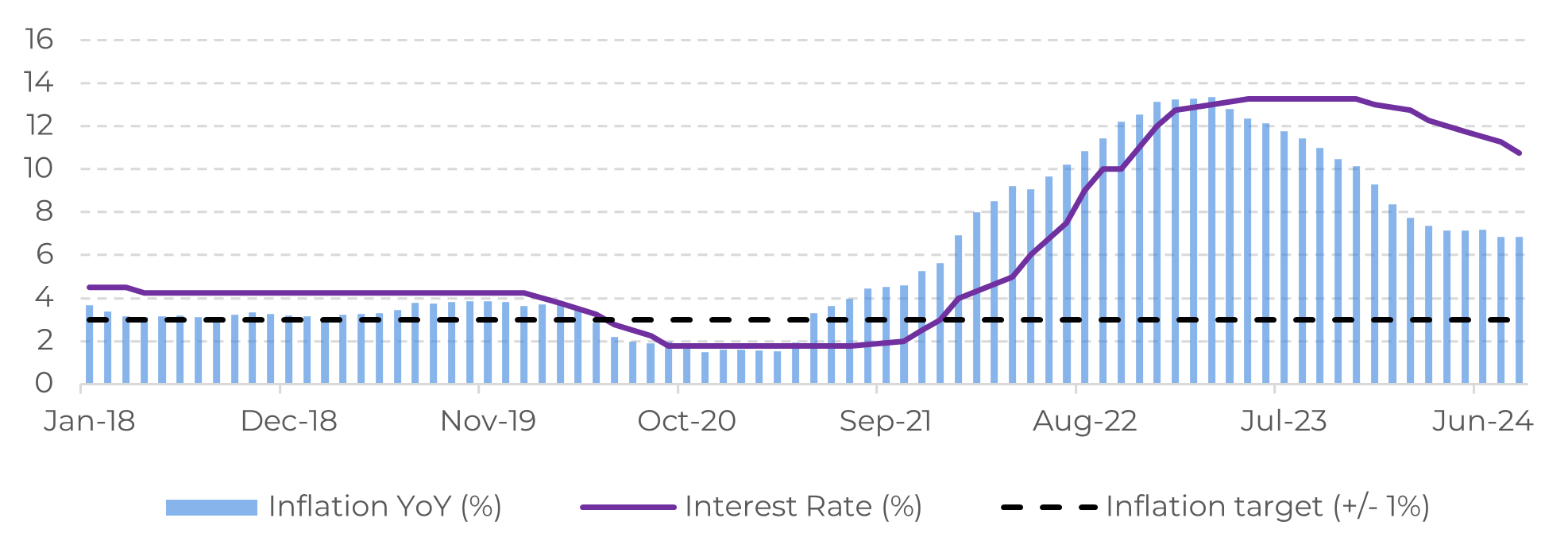

Image 1: Colombia – Inflation and Interest Rate (%)

Source: Refinitiv

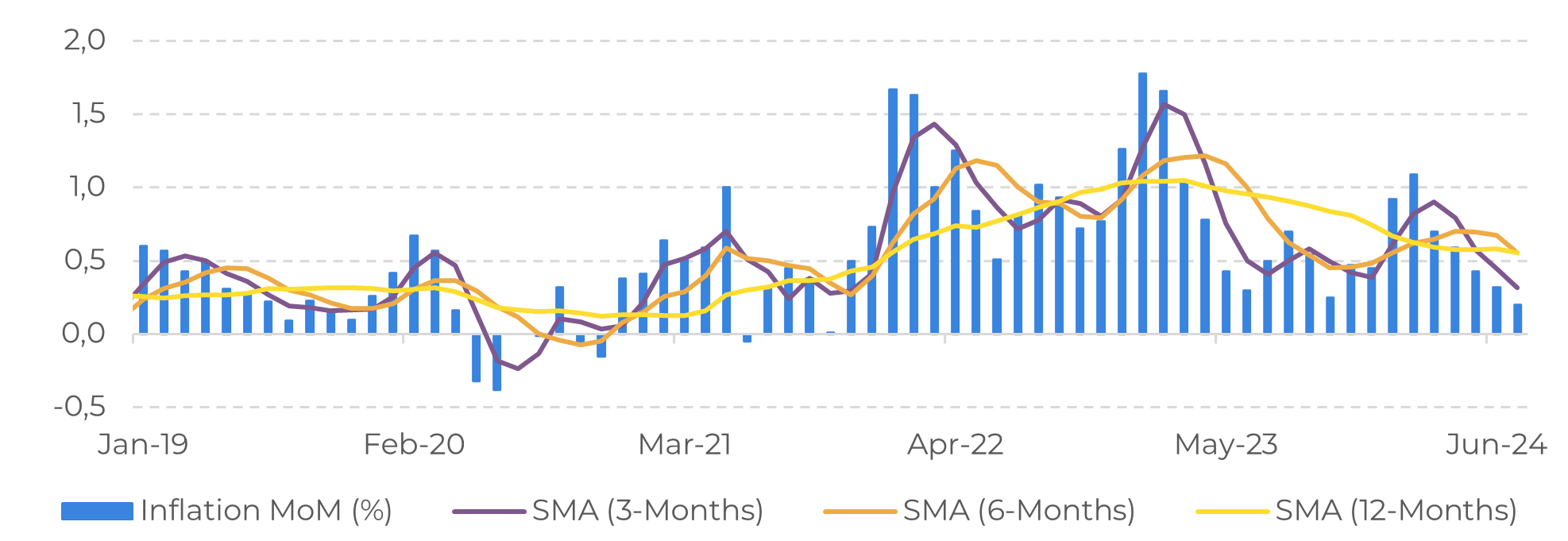

Image 2: Colombia – Monthly Inflation (%)

Source: Refinitiv

Colombia has one of the highest inflations in the region

Colombia's inflation rate is one of the highest in the region, reaching YoY 6.86% in July. In comparison, Brazil has experienced a price increase of YoY 4,5%, while Mexico's is at YoY 5,57%. However, recent data indicates that prices in the South America country are gradually converging toward the target of 3%, a result of the restrictive monetary policy that has been in place since late 2021.

A potential interest rate cut by the Federal Reserve in September could widen the interest rate differential between Colombia and U.S., potentially strengthening the Colombian Peso in the short term. This appreciation could help mitigate inflationary pressures in the economy. Also, the dollar's weakening may potentially favor emerging markets' currencies as well as those of commodity-exporting nations like Colombia.

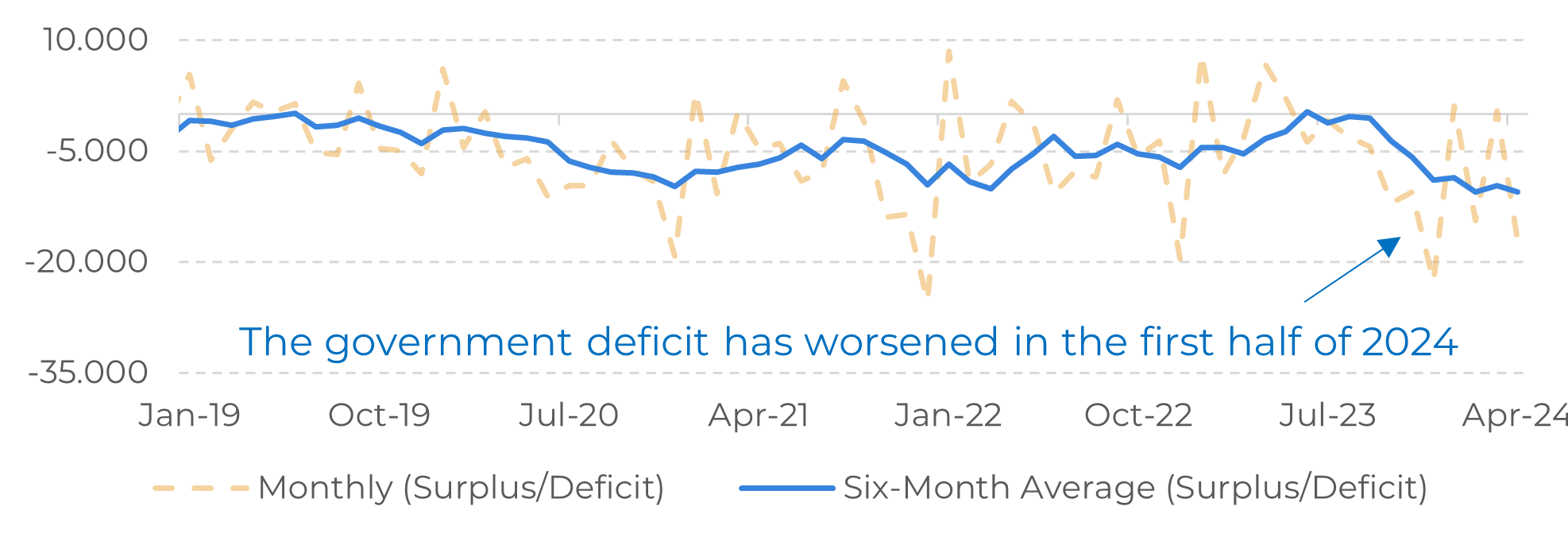

While recent monetary trends provided positive signals for authorities, the fiscal situation presents a different picture. As with other countries in the region, market has expressed concerns about the fiscal framework, particularly given lower-than-expected revenues and spending pressures.

Image 3: Colombian Central National Government Deficit or Surplus (Billions of Pesos)

Source: Refinitiv

Despite fiscal consolidation challenge, the Colombian peso performs well in 2024

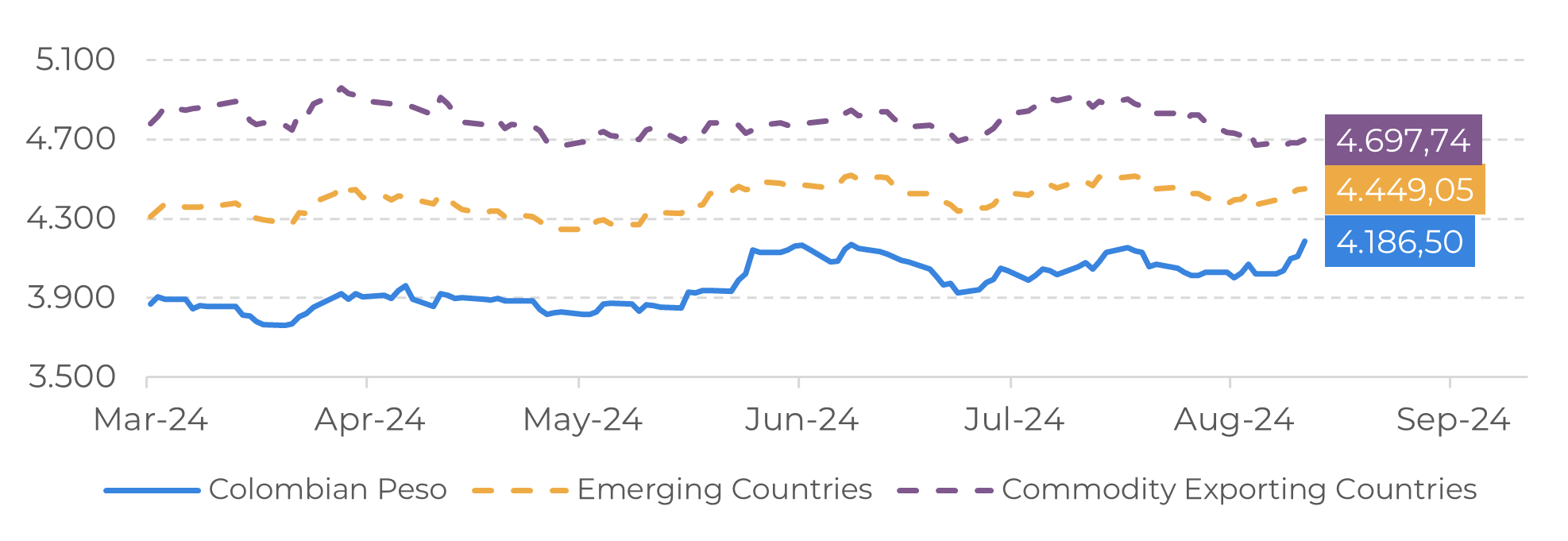

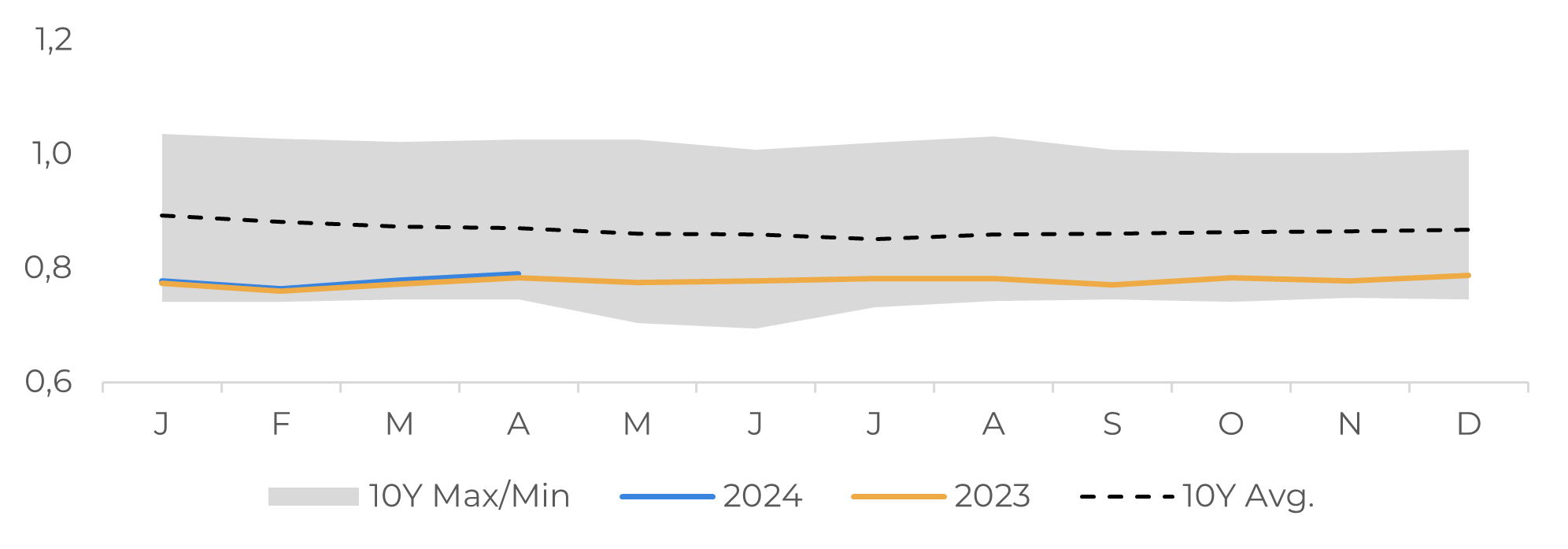

Despite significant fiscal challenges, Colombia’s currency has performed better than some of its peers in 2024. Our econometric analysis, which decomposes volatility in emerging markets and commodity-exporting nations, enabled us to estimate a fair value for the Colombian peso by comparing it with countries that share similar characteristics. By comparing the current value of the currency with this fair value, we find that the Colombian peso is overvalued relative to the fundamentals observed in other countries.

However, it is important to note that the recent depreciation of the currency, driven mainly by the government's expansionary fiscal policies, may put additional pressure on the exchange rate in the 2H2024, even in a context of less restrictive monetary policy in the United States and Europe.

In this scenario, monetary policy fundamentals may support the currency in the short term. However, the trajectory of public debt and a high fiscal deficit will gradually increase market uncertainties, leading to depreciative pressures on the currency.

Image 4: Colombian Peso Pair Model

Source: Hedgepoint, Refinitiv

Data from the trade balance also raises concerns

Image 5: Colombian Crude Oil Production (Million Barrels per Day)

Source: Bloomberg

Despite significant fiscal challenges, Colombia’s currency has performed better than some of its peers in 2024. Our econometric analysis, which decomposes volatility in emerging markets and commodity-exporting nations, enabled us to estimate a fair value for the Colombian peso by comparing it with countries that share similar characteristics. By comparing the current value of the currency with this fair value, we find that the Colombian peso is overvalued relative to the fundamentals observed in other countries.

However, it is important to note that the recent depreciation of the currency, driven mainly by the government's expansionary fiscal policies, may put additional pressure on the exchange rate in the 2H2024, even in a context of less restrictive monetary policy in the United States and Europe.

In this scenario, monetary policy fundamentals may support the currency in the short term. However, the trajectory of public debt and a high fiscal deficit will gradually increase market uncertainties, leading to depreciative pressures on the currency.

Summary

While Latin American countries like Mexico and Brazil face more pronounced depreciation of their currencies in 2024, the Colombian peso has outperformed.

This does not mean that domestic fundamentals are not concerning. The country's fiscal situation remains complex, and the drop in commodity prices, particularly oil, may pose additional challenges.

The interest rate cut in the US will provide relief to monetary authorities in various countries, including Colombia, where the interest rate differential is likely to strengthen the Colombian peso and help reduce inflation.

However, these gains may be outweighed by domestic factors that bring concern and may reduce the inflow of dollars into the country.

Written by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Reviewed by Livea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.