Sep 12

/

Victor Arduin

Interest rate cuts create room for stronger growth in Asia in 2025

Back to main blog page

Interest rate cuts create room for stronger growth in Asia in 2025

- Emerging markets, particularly in Asia-Pacific, stand to benefit from US monetary policy easing, with countries like the Philippines and China already lowering interest rates.

- China may further expand its monetary policy to boost domestic consumption and investment, as it faces challenges in achieving its 5% growth target this year.

- Favorable market conditions and dovish monetary policies are creating room for further growth in the coming months, potentially leading to a more favorable outlook for commodities in 2025.

- However, there are upside risks for the dollar. A high public deficit, combined with potential tax cuts next year, could raise U.S. Treasury yields, supporting the dollar.

Introduction

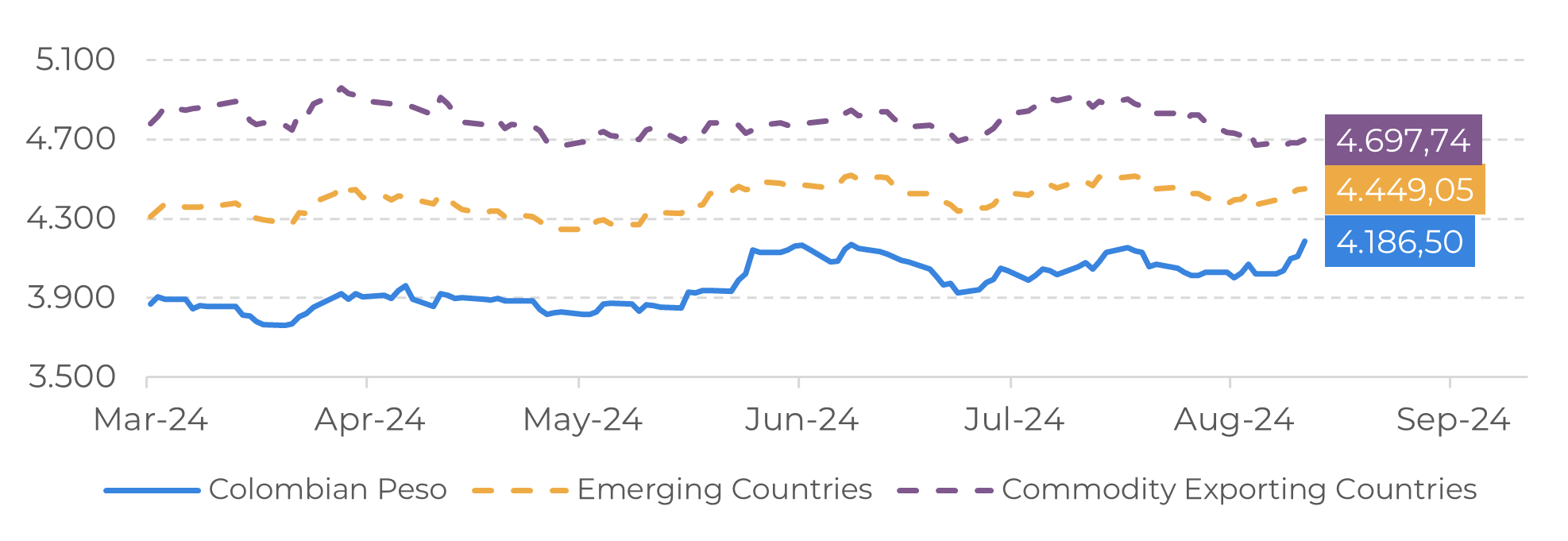

In recent weeks, we have observed a weakening of the dollar, as represented by the DXY, which has accumulated a 4% decline for the quarter. Not only is the likely interest rate cut in the U.S. impacting the U.S. dollar, but fundamentals have also favored the appreciation of other currencies, such as the Swiss franc and the Japanese yen.

In this context, economies in Asia are gaining relevance, now seeing a more favorable environment for growth in 2025. Inflation in several countries is converging toward targets, while the currencies of many nations are appreciating. As a result, we may see an increase in demand for commodities in 2025, although some of them, such as oil, have market-specific fundamentals that could offset the gains from the improved macro environment.

In today’s report, we will discuss how central banks in Asia are cutting interest rates and the impact of this on the commodities market for 2025.

Image 1: US Fed Funds Target Vs. DXY

Source: Refinitiv

Image 2: Selected Inflation Rates in Asia (%)

Source: Refinitiv

Asian currencies to strengthen in 2024

Emerging markets are poised to benefit from the easing of US monetary policy, which could pave the way for interest rate cuts in many countries. As inflation in the Asia-Pacific region continues to decline, the likelihood of further interest rate reductions in many countries increases. The Philippines has taken the lead among Asian central banks, following the People's Bank of China (PBOC), by reducing its interest rate by 25 basis points last month.

China could implement another expansion of its monetary policy, as it is becoming increasingly difficult for the country to achieve its 5% growth target by relying solely on the increase in exports and industrial production. With a sharp slowdown in the real estate sector, the country needs more domestic consumption, for which a low-interest-rate environment can stimulate both investiment and consumption.

Meanwhile, Japan stands out as a major central bank with a divergent monetary policy in the region, as it has been raising interest rates to combat inflation that has exceeded its 2% target. While further rate hikes are plausible, the market should be prepared for such moves, unlike the surprise increase in August that led to strong devaluation in emerging countries such as Brazil and Mexico.

Image 3: Colombian Central National Government Deficit or Surplus (Billions of Pesos)

Source: Refinitiv

Outlook for commodities improves for 2025

Favorable market conditions have created opportunities for Asian currencies to appreciate year-over-year. This valuation, combined with increased purchasing power and economic growth driven by dovish monetary policies, could promote a favorable environment for commodities in 2025.

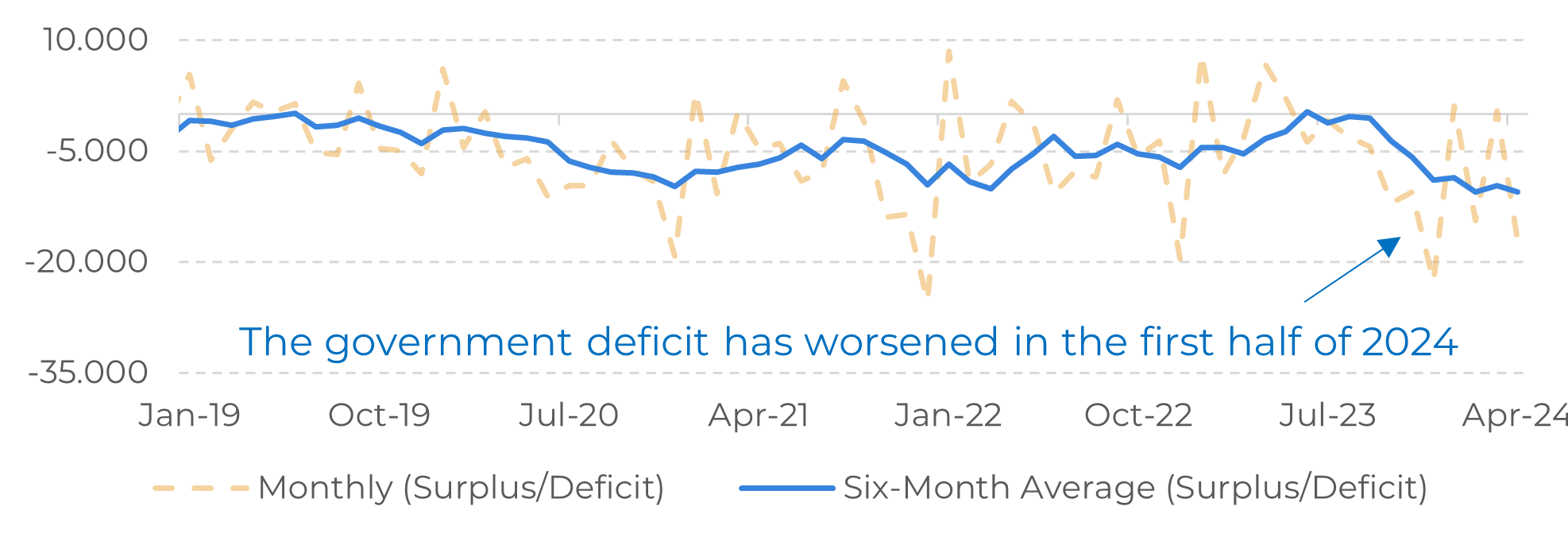

It is important to consider that there are risks in the market. The weakening of the dollar will occur, but it will be gradual and non-linear. After interest rate cuts in the U.S., the market may react to macroeconomic data with risk aversion. The high public deficit, especially in a scenario of tax cuts next year, could lead to higher yields on U.S. Treasuries, which would provide support to the dollar.

Despite the improvement, several countries still face the risk of rising inflation, such as India, which is under significant pressure from food prices. This could increase the caution of central banks in the region, leading them to opt for a slower pace of interest rate cuts and, consequently, lower growth the next year.

Image 4: Quarterly Asia (Excluding Japan) GDP YoY (%)

Source: Hedgepoint, Refinitiv

Summary

The shift in U.S. monetary policy is paving the way for interest rate cuts in Asia, with some countries already starting this process. The fact that the Philippines, which cut rates in August, did not experience a significant currency devaluation serves as an incentive for other countries in the region to follow suit.

China, which has experienced deflationary pressures in recent months, has been adopting monetary stimulus measures to strengthen its economy. It is possible that the country will make further adjustments to its interest rates to achieve its 5% growth target.

In this context, several Asian currencies are appreciating against the dollar, which enhances purchasing power for these countries and could lead to increased demand for commodities, particularly agricultural ones.

However, the weakening of the dollar is expected to be gradual and non-linear, meaning we will likely see periods of dollar appreciation as well.

Written by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Reviewed by Livea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.