Oct 1

/

Victor Arduin

The effects of US monetary easing on commodity prices

Back to main blog page

The effects of US monetary easing on commodity prices

- After a frustrating first half of the year waiting for an interest rate cut in the U.S., the FOMC delivered the loosening of American monetary policy in September with an aggressive 50-basis-point cut.

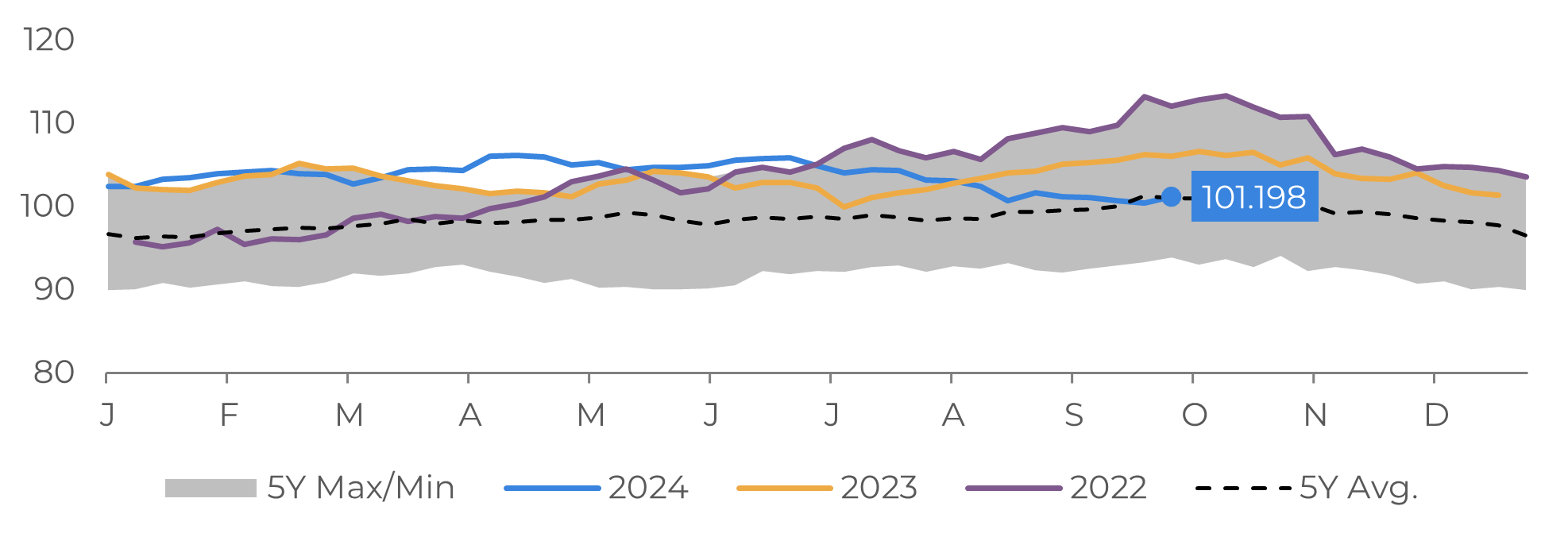

- Due to lower interest rates, the U.S. dollar has weakened, which represents a bullish fundamental for commodities, as most raw materials are priced in dollars and are now cheaper for holders of other currencies.

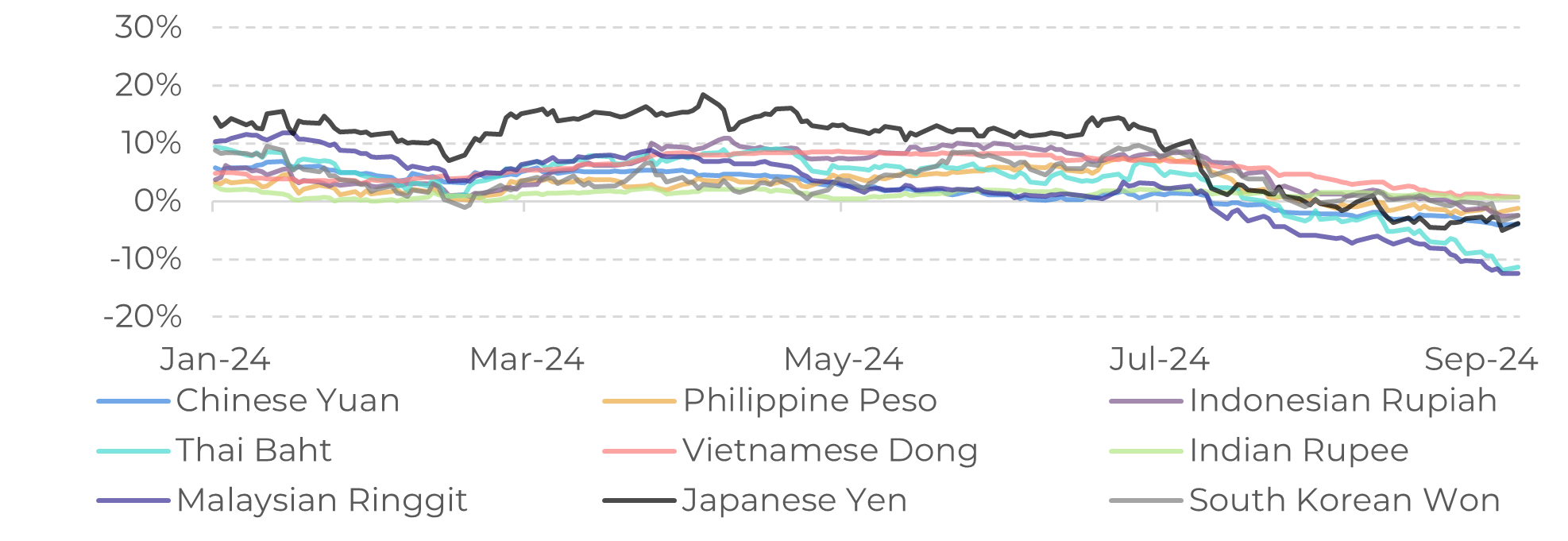

- Additionally, following the decline in U.S. interest rates, Asian economies are finding room to loosen their restrictive monetary policies, generating prospects for greater growth on the continent in 2025.

- However, some significant risks remain in the market and warrant attention, such as structural issues in the Chinese economy and the labor market in the U.S.

Introduction

In recent years, due to high global inflation, several central banks have been forced to raise interest rates to curb price rises, which has impacted volatile markets such as stocks and commodities. In the context of tighter monetary policies, borrowing costs in the US stood out as one of the main factors limiting a more bullish market for raw materials, especially grains and soft commodities. This is because most of these commodities are traded in dollars, and the US currency tends to appreciate when US interest rates are high.

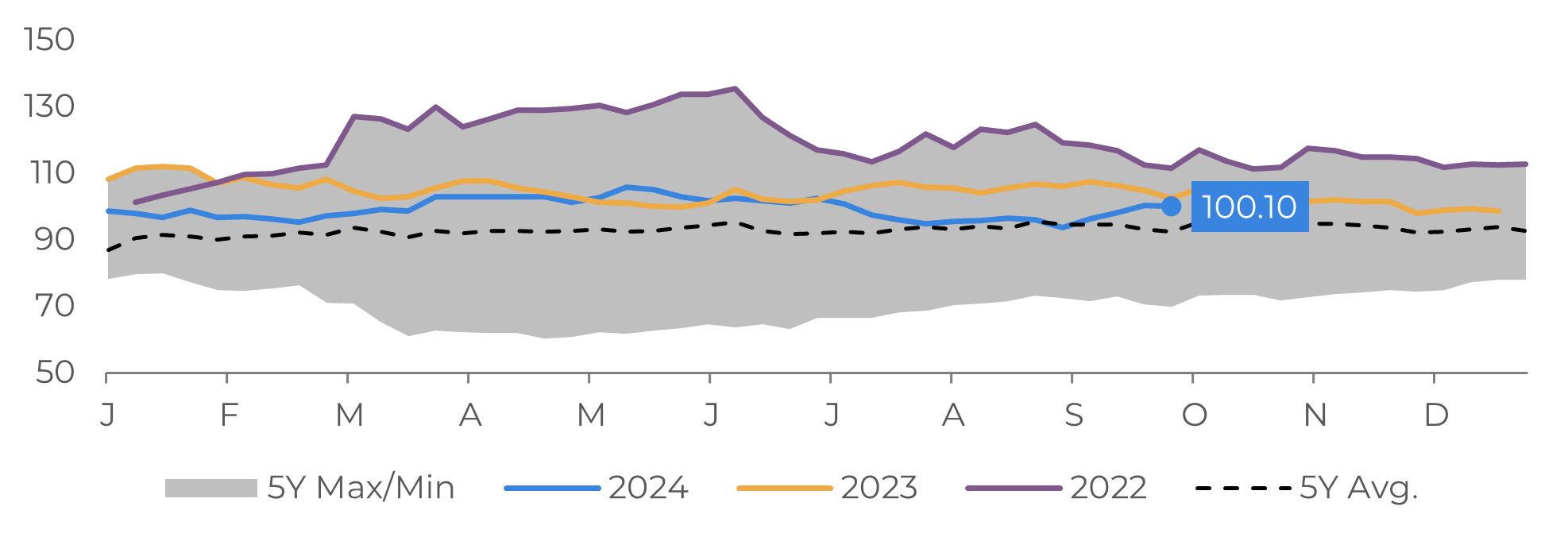

However, with the start of the interest rate cut cycle in September in the world's largest economy, we are already seeing bullish reflexes in the market, as demonstrated by the BBG Index, which has risen by 2.97 points (+3.06%) since the Fed’s decision.

Because of these developments, we're going to explore some scenarios that could benefit commodities in the coming months.

Image 1: BBG Commodities Index

Source: Refinitiv

Image 2: US Dollar Index

Source: Refinitiv

Asian economies can boost demand for agricultural commodities

After expectations for an interest rate cut in the US were frustrated in the first half of 2024, the FOMC (Federal Open Market Committee) delivered the long-awaited beginning of the loosening of American monetary policy. Moreover, it implemented an aggressive 50-basis-point cut, surprising part of the market that had expected monetary authorities to be more conservative in their decision.

Since most commodities are traded in dollars, the weakening of the U.S. dollar makes these raw materials cheaper for holders of other currencies, resulting in increased demand in the market. Some commodities were already experiencing an upward trend due to supply-related factors, such as coffee, which has seen a deficit greater than expected in the 2024/25 harvest.

Now, new bullish fundamentals are developing for other commodities, such as grains, which could benefit from a more favorable growth environment in emerging economies. The monetary easing in the U.S. has created room for Asian central banks to cut interest rates, which, coupled with the appreciation of their currencies, could result in increased demand for agricultural commodities in 2025.

Image 3: Ex. Rate Changes of Selected Asian Currencies Against the Dollar (YoY, %)

Source: Refinitiv

Significant risks remain in the market

Recently, China announced a new stimulus package to strengthen its economy, which is perilously close to deflation and could face difficulties in achieving its growth target of 5%. Although some sectors of the country, such as exports and industrial production, are performing well, the Chinese real estate sector continues to decelerate and poses significant risks to the commodities market, especially for energy products like crude oil.

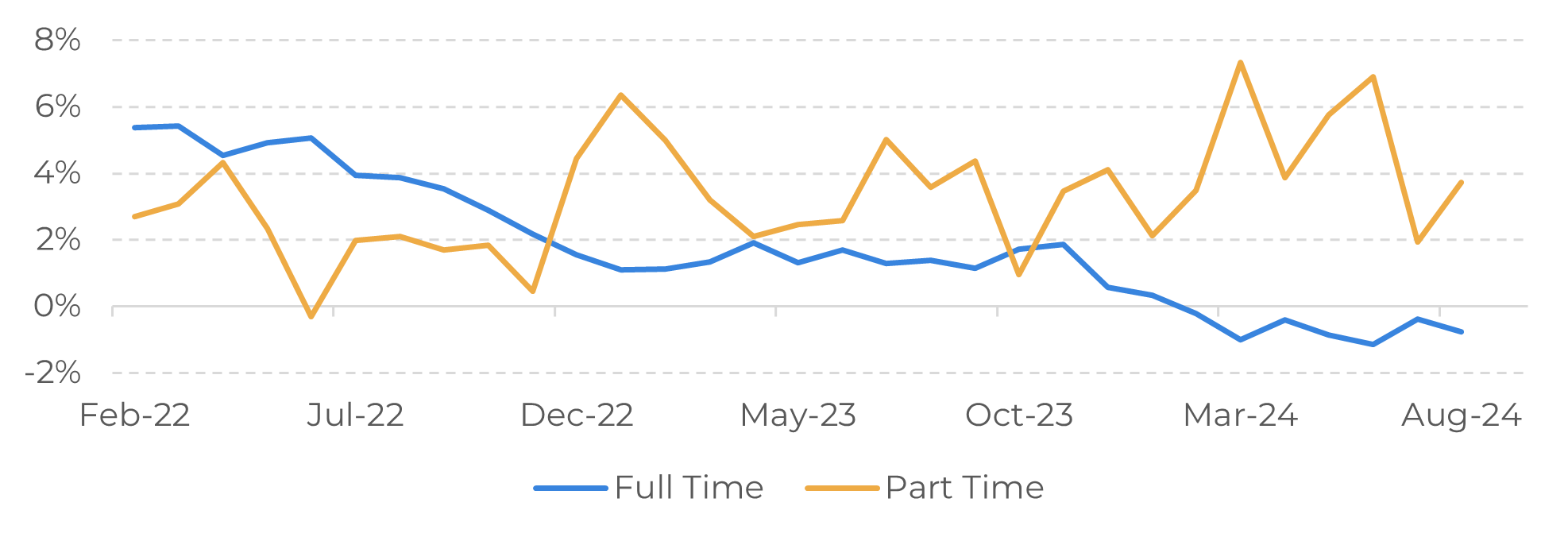

While in the East, the most significant risk vector for the commodities market comes from China, in the West, signals from the U.S. labor market are also concerning. The effects of American interest rates are still rippling through the economy, which could raise the unemployment rate in the country to nearly 5%. Although the likelihood is low, the risk of a recession cannot be completely dismissed. Additionally, the growth of part-time employment and the decline of full-time positions raise red flags.

In this context, we may gradually observe improvements in the commodities market amid strengthening demand fundamentals from Asia, while macroeconomic data from the U.S. could lead to corrections in the coming months.

Image 4: US – Labor Market Type of Occupancy (YoY, %)

Source: Bloomberg

Summary

US monetary policy has a broad impact on the commodities market, as it directly influences the value of the dollar and indirectly affects the demand for commodities.

In the energy complex, risk premiums are emerging in the Middle East as the conflict between Hamas and Israel unfolds. This could result in short-term support for oil prices.

In this context, Asian economies are benefiting from the downward outlook for the US dollar, resulting in greater purchasing power and room for interest rate reductions in their economies, which could particularly benefit agricultural commodities.

In the energy complex, risk premiums are emerging in the Middle East as the conflict between Hamas and Israel unfolds. This could result in short-term support for oil prices.

However, there are important risks to monitor in the market, such as the structural issues in the Chinese economy that could frustrate growth expectations and, consequently, consumption of commodities, as well as signals from the U.S. labor market.

Written by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Reviewed by Ignacio Espinola

ignacio.espinola@hedgepointglobal.com

ignacio.espinola@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.