Market Update

Market Update - Corn, Wheat and Soybean

Current Scenario

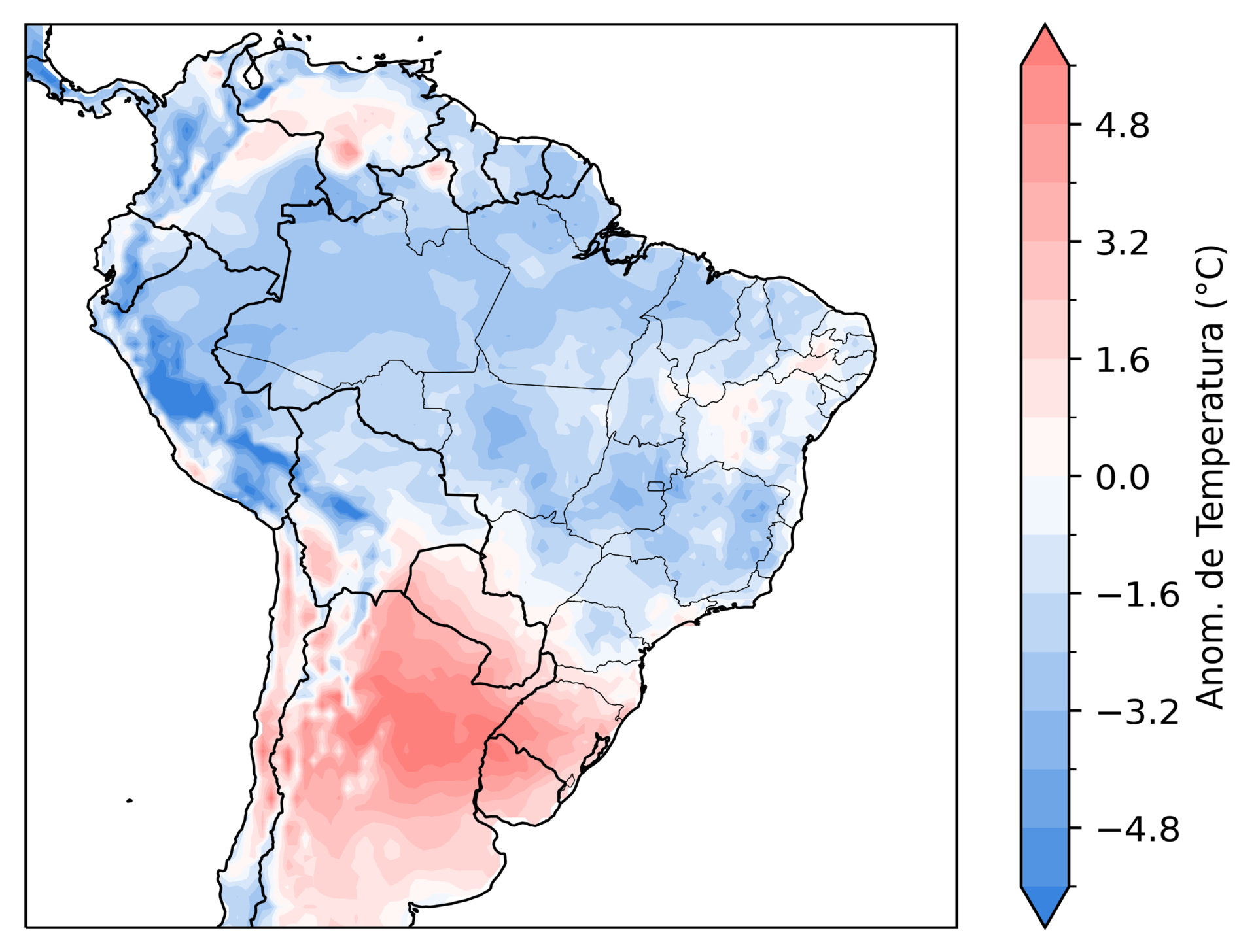

The market is going back to normality after the Lunar New Year celebrations in China. Regarding south America, recent rains will give some relief to Argentina and Brazil. Over the last weeks, Argentina, Uruguay and southern Brazil have experience above normal temperatures, which could damage the local corn and soybeans crop.

Market wise, weather premium will continue playing a key role along with the geopolitical situation. Donald Trump announced a tariff increase with Mexico and Canada and then, last Saturday, he announced that those tariffs are going to be delayed for a month. In addition, tariffs have also been imposed on products from China, which once again raises the alarm about a possible escalation of the trade war.

China, USA and tariffs: new trade war?

China started to work this Wednesday after the Lunar New Year celebrations. This is an important event because we should see an increased activity versus last week, which was quite calm in the markets.

Regarding the trade war, the Chinese government has decided to apply tariffs from 10% to 15% on various North American products including crude oil and natural gas. So far, they have not mentioned any new tariffs for either grains or soybean complex products.

This decision comes after the announced talk that the Chinese president and Donald Trump talk which has not taken place yet. Clearly is a sign from the Chinese government to show some muscle before any negotiation with the U.S.

The market's attention should be focused on this issue between the US and China in the coming months, as tensions could escalate. Let's remember that in 2018 China, in response to the tariffs imposed by Trump, also imposed tariffs on several US products, including soybeans. This had a direct impact on US soybean sales to the Asian country, which put great downward pressure on soybean futures contracts in Chicago. US soybean exports fell sharply in the 2018/19 and 2019/20 seasons, which led to the largest carryover stocks in US history (25.2 million tons in the 2018/19 season).

On the other hand, Brazilian soybean exports benefited directly, with China diverting even more of its purchases to Brazil. This resulted in record exports from Brazil and a sharp rise in domestic prices, which also hit record highs due to rising premiums and tightening stocks.

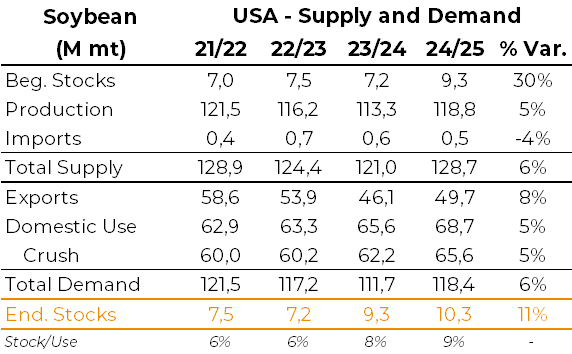

If trade tensions escalate and US soybeans once again suffer from Chinese tariffs, we could see a situation similar to the one that occurred in the 2018/19 and 2019/20 seasons, which deserves extra attention from players going forward. Currently, the USDA estimates that US soybean exports should reach 49.7 million tons in the 2024/25 season, while ending stocks should stand at 10.3 million tons.

US Soybean S&D

Source: Hedgepoint, USDA

Wheat and China

China is trying to sell 600k mt of Wheat previously bought mainly from Australia and Canada. Over those 600k mt, 240k Mt are already at the sea and the balance the Chinese government is trying to either sell it or roll the delivery. They have already rolled 8 to 10 shipments from Australia that were supposed to arrive in January and February and they are not expecting any delivery for march. This could mean that their consumption expectation will be lower mainly due to a good corn crop which releases pressure on their feed demands, or that their expectation is that the wheat cash market should be lower and therefore they want to cash some money and buy back those shipments in the future.

China represents 6% of the world wheat imports and usually China is very active on Q1 while Australia is ready to sell their wheat crop on Q1 due to the usual wheat seasonality. Over Q1 2024 China has imported a total of 1.7M mt of Australian wheat which is lower versus the 2.5 M mt imported in 2023. They have also imported 923k Mt from Canada in 2024 while in 2023 they imported 783k Mt.

This is something to keep an eye on, in the case they repeat the same situation for other products such as corn and soybeans.

Argentina: crop, weather and taxes

Argentina is experiencing some very-needed rains, especially for the west of Buenos Aires where the draught was more severe. Even though these rains should help the local crop, they have arrived late as some corn fields have already pas the point of no return and the draught damage is irreversible. Some analysts are reducing the corn crop close to 47M mt which is a 4M mt reduction versus the last WASDE number which today it seems too optimistic.

On the soybean side the forecast has also been falling to a similar number than corn, with many analysts already talking about a 48M mt crop versus 52M M reported on the last WASDE.

The good news for the Argentinean farmer comes from the tax reduction the government has implemented, with reductions from 33% to 26% tax for soybeans and from 12% to 9.5% tax for corn, which should help the farmers economy and incentivize the farmer selling and export market. It is too early to say if this tax reduction, which will go until June 2025, will be enough to help the Argentinean farmers or not. Only time will tell.

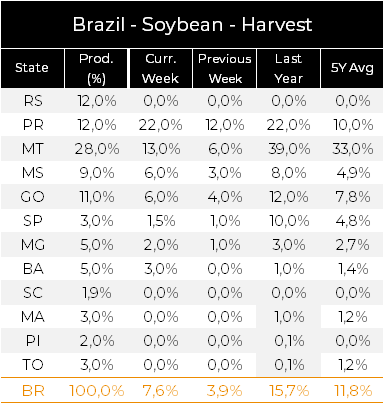

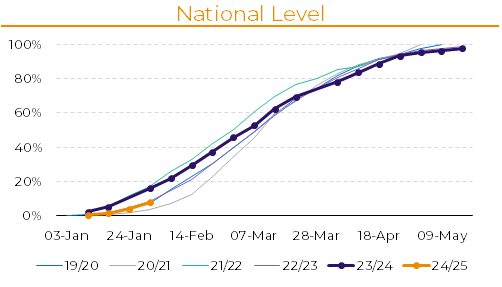

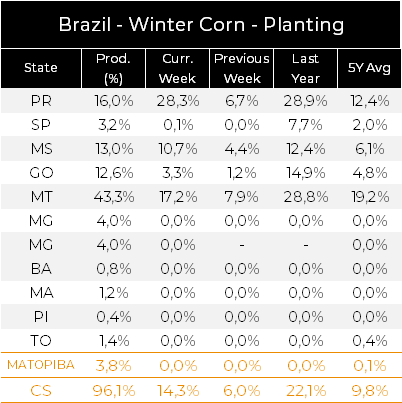

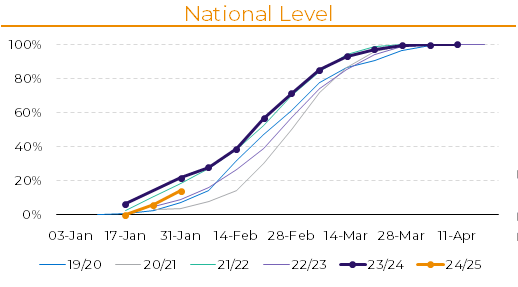

Brazil's soybean harvest and corn crop planting still behind schedule

Works on harvesting Brazil's new soybean crop and planting the new corn “second crop” is progressing across the country, but there are still delays compared to the average of recent harvests for the period. We remind you that these initial delays were already expected, as we had significant delays during the first weeks of soybean planting back in 2024, mainly in states in the Midwest and Southeast regions. This is the main factor behind the slower start to harvesting (soybean) and planting (corn) at the moment.

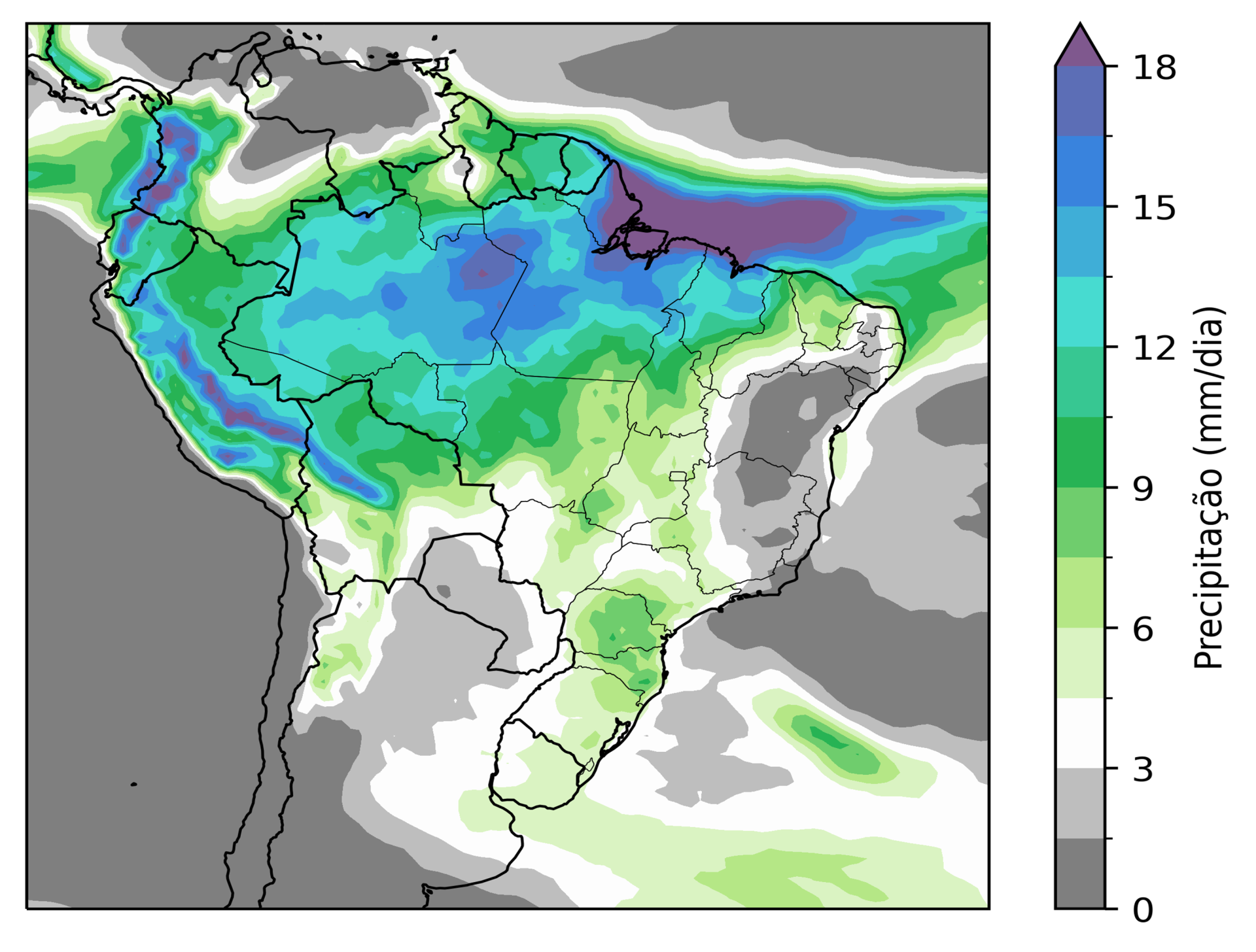

In any case, it is also necessary to keep an eye on the weather in the coming weeks so that the machines can progress at a more satisfactory pace. In addition, the weather is also an important factor for the intermediate and final development of crops sown later in the state of Rio Grande do Sul and in the states of the Northeast and North regions.

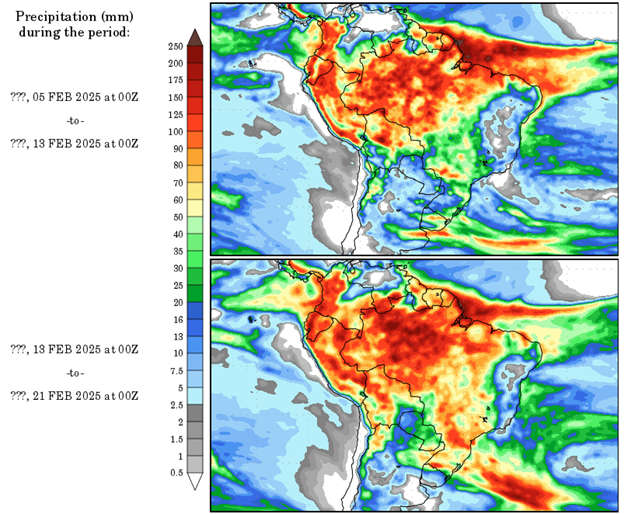

The weather maps now point to a period of some rain in the central part of the country between February 5 and 13, but without widespread excesses, which may allow harvesting and planting work to progress better. In Rio Grande do Sul, little moisture is expected for the period, which again raises concerns regarding the development of the state crops.

In the period between February 13 and 21, humidity is expected to increase across the country, which should be favorable for crops sown later, but unfavorable for works to progress.

Regarding the expected average yields for Brazil's main soybean producing states, on the positive side we would highlight the trend towards high yields in Mato Grosso, with a tendency for a new production record to be set in the country's largest producing state. As a result, we may have to make a new positive adjustment to Mato Grosso's production figure and, consequently, to Brazil's total production figure.

On the negative side, we would highlight the continued deterioration of crops in Rio Grande do Sul due to the low humidity and high temperatures that continue to hit the state. Faced with this factor, further production cuts may be necessary in the coming weeks, also impacting the national figure.

In any case, we would like to stress once again that even if losses increase in Rio Grande do Sul, we believe that a record crop is guaranteed in Brazil, given the high yields expected in states such as Paraná, Mato Grosso, Goiás, Minas Gerais and Bahia. Our current estimate points to a production of 170.7 million tons, but as mentioned, it is possible to see positive adjustments in the coming weeks given the high productivity expected for Mato Grosso.

Regarding corn, it's still too early to define the production potential of the “second crop”, and we need to keep an eye on the planting works to understand what the final area will be. We believe that, if the weather helps, planting should accelerate from the second half of February onwards, and there is still a window for sowing the entire estimated area in the central part of the country, if the weather doesn't get in the way.

Accumulated Precipitation Forecast - 1 to 8 days and 8 to 15 days (mm)

Source: Wxmaps

Precipitation – Days 1-14 (mm/day)

Source: Source: NOAA, Hedgepoint

Temperature Anomaly – Days 1-14 (°C from normal)

Source: NOAA, Hedgepoint

Brazil Soybean Harvest

Source: Safras, Conab

Brazil Soybean Harvest

Source: Safras, Conab

Brazil Winter Corn Planting

Source: Safras, Conab

Brazil Winter Corn Planting

Source: Safras, Conab

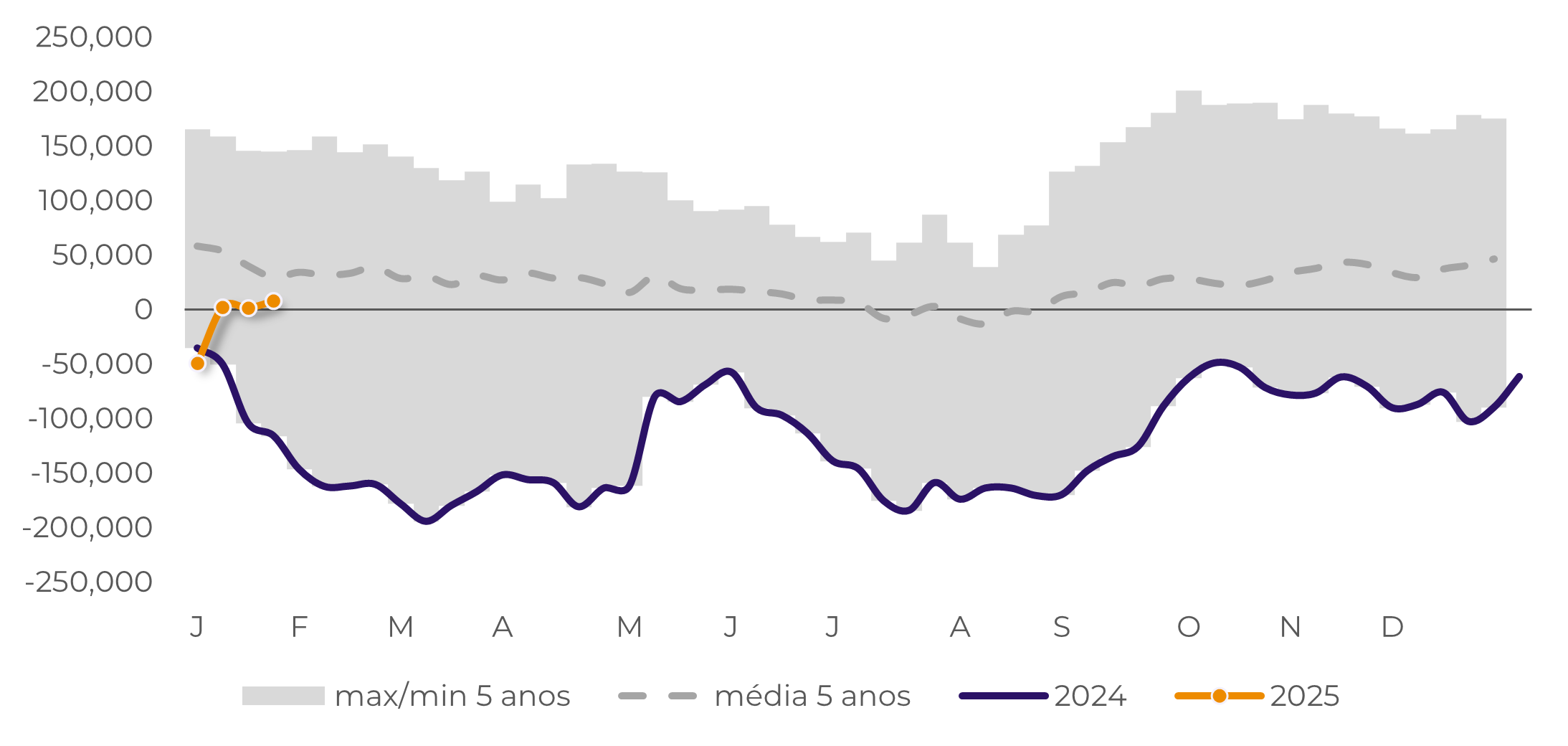

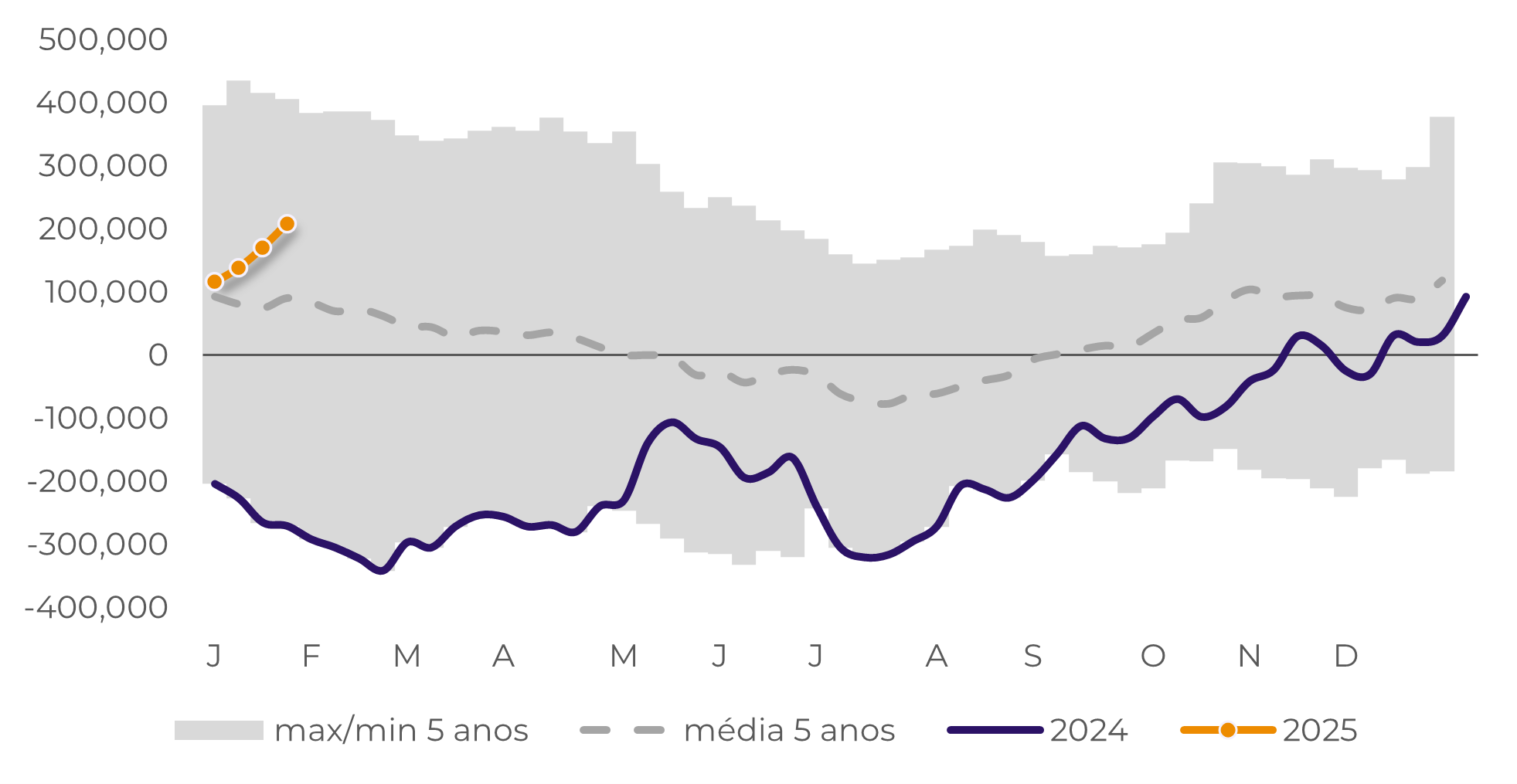

Funds Activity

Over the last three weeks, the funds have maintained a close-to-zero position on beans, reflecting their neutral bias mostly due to the current weather situation in Brazil and Argentina. These are levels that the market hasn’t seen since November 2023.

On the corn side, they have been increasing their long up to the current 208k contracts long which is the biggest long position since February 2023. The market has a clear bearish view on corn that is being reflected in their current position.

Finally, with the market paying a lot of attention to Argentina, who had a draught issue until this week where they are having some very needed rains. On the Brazilian side, especially on the south, the weather premium will also play a key role in the next coming weeks. Regarding Trump, he has been threatening with tariffs and then postponing them so the impact of his decisions, or at least his threats, are a big question mark for the traders and the market

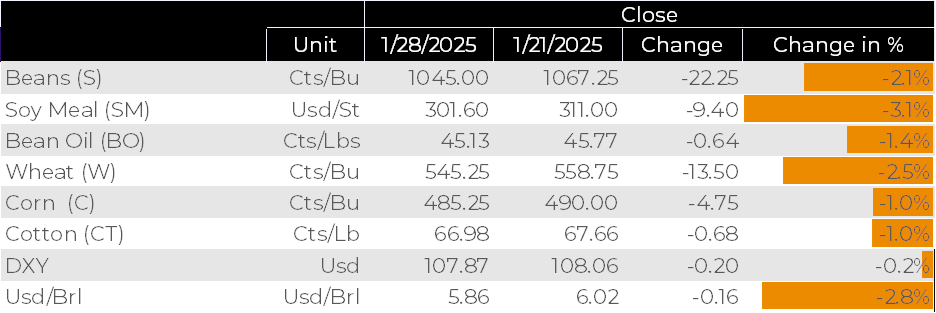

Price Movement Week Over Week

Source: Reuters

Non-Commercials Net Position (Spec) – Soybean

Source: CFTC

Non-Commercials Net Position (Spec) – Corn

Source: CFTC

Market Intelligence - Grains & Oilseeds

Ignacio.Espinola@hedgepointglobal.com

Luiz.Roque@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.