Sep 12

/

Alef Dias and Pedro Schicchi

Post-WASDE Monthly Report - 2023 09 12

Back to main blog page

"The September WASDE leaned towards a bearish outlook for soybeans and corn, but it painted a more bullish picture for wheat. Check below this month’s report highlights"

Soybeans: Neutral / Bearish

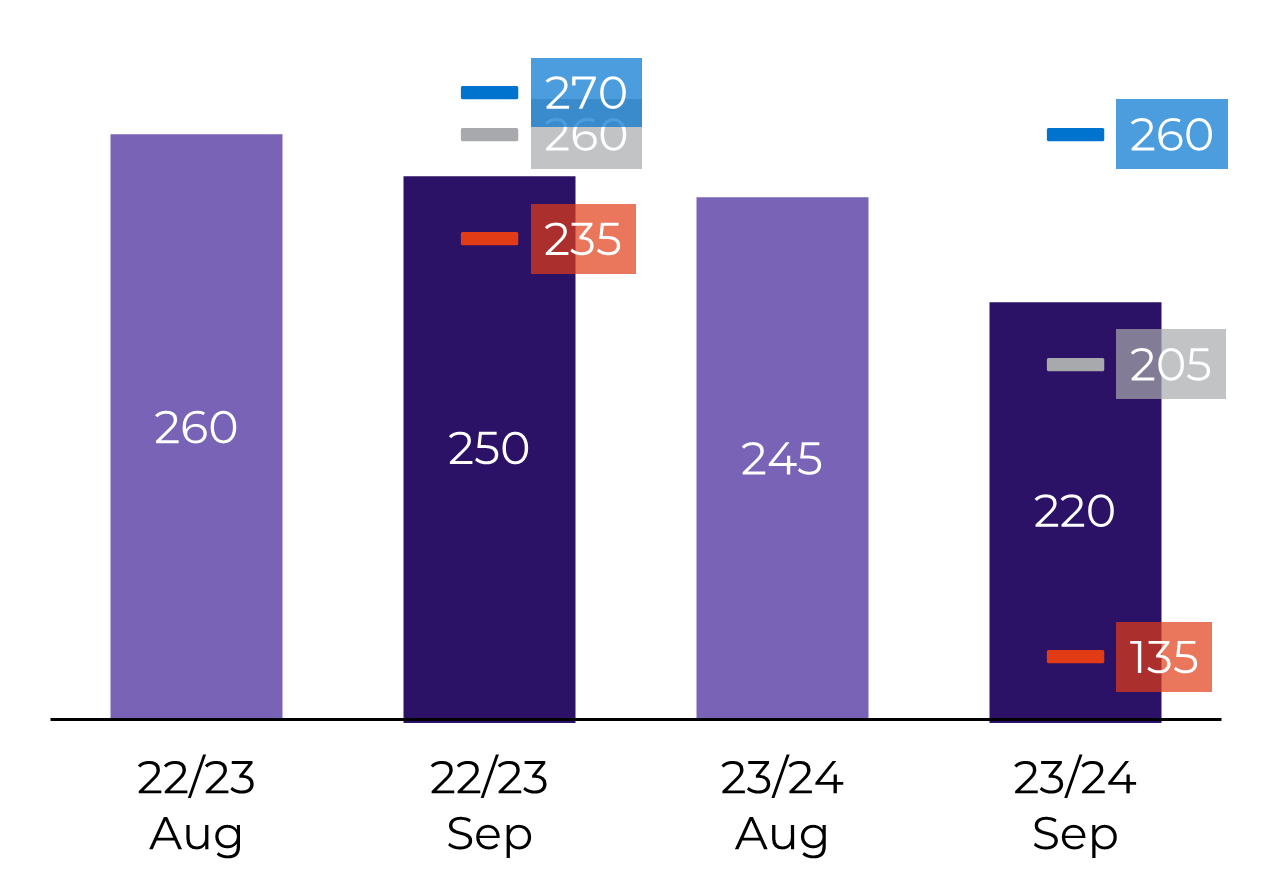

Figure 1: US Soybean - Ending stocks (M bu)

23/24 soybean yields came right at the expected. However, ending stocks ended up above the median estimate. Why?

Although 22/23 carryover stocks were reduced, and the market nailed the yield, higher-than-expected acreage and slight trims to demand led to this outcome.

World ending stocks also came at the upper half of expectations, adding to bearish results.

Still, bullish factors were not completely absent as Chinese imports were increased by 2M and 1M ton in the 22/23 and 23/24 crop, respectively.

Still, bullish factors were not completely absent as Chinese imports were increased by 2M and 1M ton in the 22/23 and 23/24 crop, respectively.

Corn: Bearish

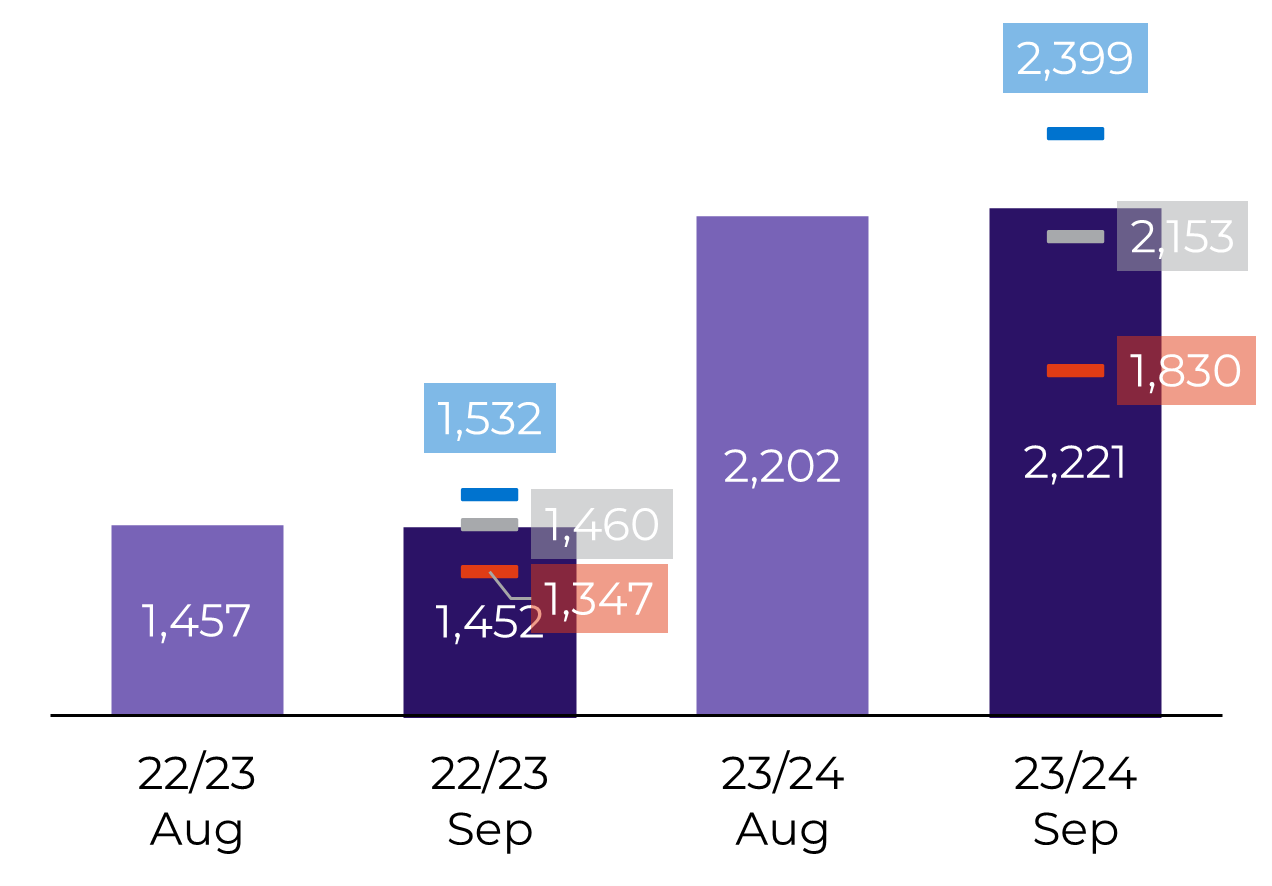

Figure 2: US Corn - Ending stocks (M bu)

Agents also nailed the US yield on corn. However, acreage was also increased, but by a higher amount than on soybean. In turn, it led to US production and ending stocks surpassing the market’s estimates.

Brazil’s 22/23 production was bumped in another 2M ton and Ukraine’s in 0.5M mt, although exports were unchanged in the latter – which is also surprising given the slow export pace seen so far.

Finally, world stocks also came higher than estimates, making for a bearish report on corn, overall.

Wheat: Bullish

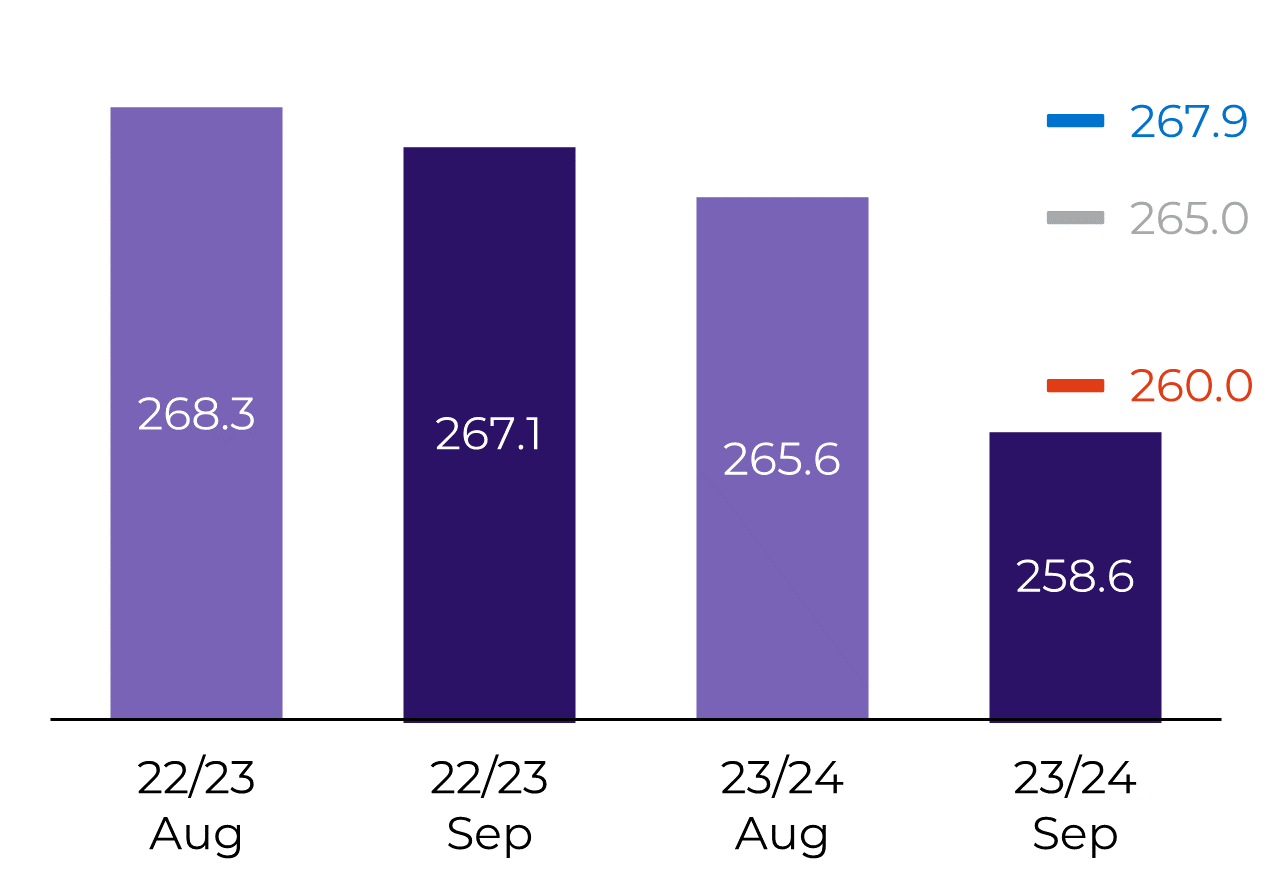

Figure 3: World Wheat - Ending Stocks (M ton)

Once again, the USDA brought bullish figures on wheat, with world ending stocks coming below market’s median estimate.

Argentina, Australia, Canada and the EU were the most relevant cuts, leading to a 7.2M mt trim to global supplies. With the current estimates, this will be the 1st YoY decline in world wheat production since 18/19.

It’s also worth mentioning that Russian production was unchanged – and local consultancies are pointing to a production 7M mt higher than USDA’s current estimate of 85M mt. Nonetheless, Russian exports were raised by 1M mt.

It’s also worth mentioning that Russian production was unchanged – and local consultancies are pointing to a production 7M mt higher than USDA’s current estimate of 85M mt. Nonetheless, Russian exports were raised by 1M mt.

The only relevant increase in production was in Ukraine figures, with an uptick of

WASDE Commentary — Grains

Written by Alef Dias

alef.dias@hedgepointglobal.com

Written by Pedro Schicchi

pedro.schicchi@hedgepointglobal.com

alef.dias@hedgepointglobal.com

Written by Pedro Schicchi

pedro.schicchi@hedgepointglobal.com

Reviewed by Thaís Italiani

thais.italiani@hedgepointglobal.com

thais.italiani@hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.