Jul 12

/

Alef Dias and Ignacio Espinola

Post-WASDE Monthly Report - 2024 07 12

Back to main blog page

"Comments about the results of USDA's report"

Soybeans: USDA confirms small correction on US Ending Stocks

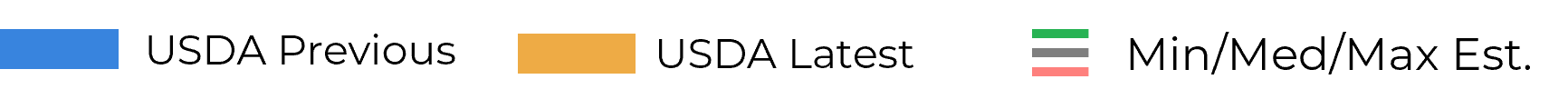

Figure 1: US Soybeans - Ending Stock (M bu)

Following last month report trend, the 24/25 supply and demand balance for soybeans came with almost no adjustments.

On South America, the USDA seems comfortable with a Brazil production of 153 M mt for current crop and 169 M mt for 24/25 crop, both numbers unchanged. On the Argentina side, the report adjusted the current crop into -0.5 M mt, leaving a final number at 49.5. M mt and adjusting also the final stocks.

For US, the agency brought a small cut to production and ending stocks mostly due to the lower planted area – that was expected after the June acreage report.

Finally, in China, the major change for the Asian Giant came from the imports, with an expectation of +3 M mt, leaving a final number at 108 M mt, in line with the last purchases they have done from Brazil over the last weeks. (Almost +3 M mt more vs historical average).

You can check the most important numbers from the report here.

Corn: US Corn production comes in line with market expectations

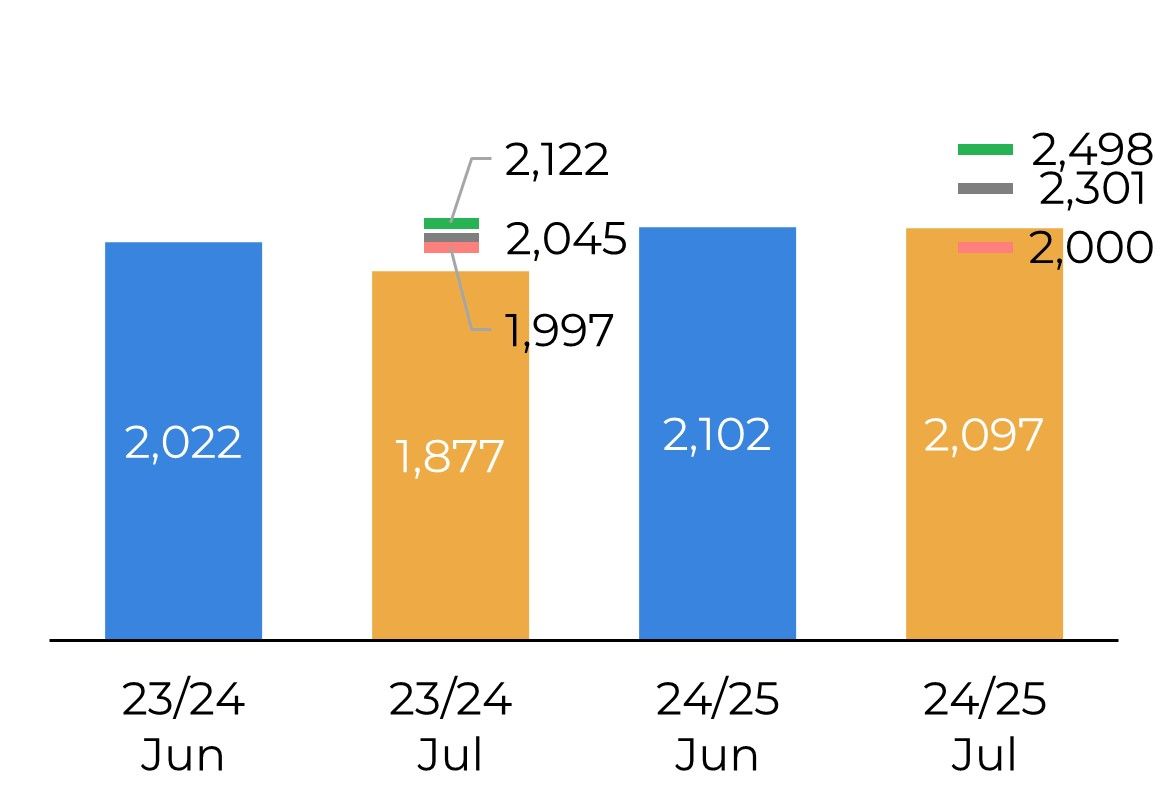

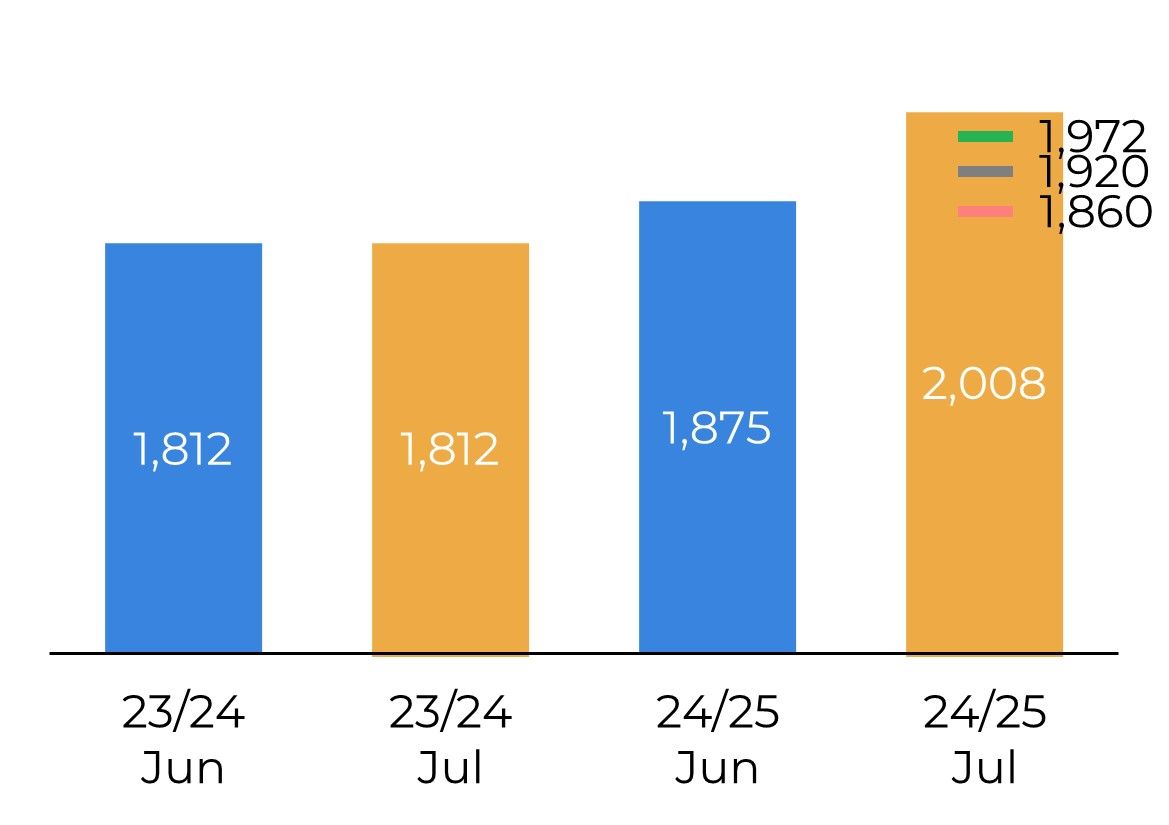

Figure 2: US Corn - Ending Stock (M bu)

On the US side, there was an increase for 24/25 production number of 260M bu, leaving a final number at 15100M bu, very close to market’s median estimate of 15079M bu. Conversely, higher exports for both current and next crop led to tigher-than-expected ending stocks, curbing the bearishness with the higher production.

We were expecting a certain adjustment over the production numbers in the South American side but this did not happen this time. The report printed a 52 M mt production for Argentina, 1 M mt less than the previous report, a very optimistic production number considering that some analysts are talking about a 46 Mmt crop. On the Brazilian side, the report remained unchanged, printing 122 M mt. As a reference, CONAB’s number is 116 M mt.

We will have to wait for the next report to see if the USDA finally cuts the production numbers from South America, adjusting the actual misbalance on the global SnD.

You can check the most important numbers from the report here.

Wheat: Bearish numbers all across the board

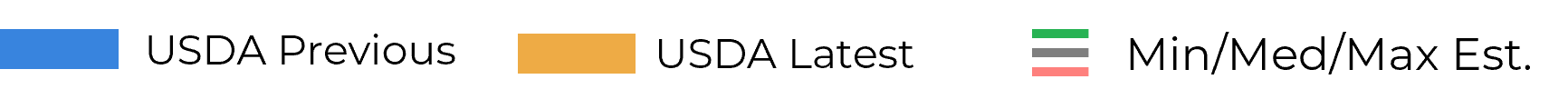

Figure 3: US Wheat - Production (M bu)

In the US, production of all wheat classes were raised due to the accelerated winter harvest progress and great crop conditions for the spring crop. The first 2024 survey-based production forecasts for other spring wheat and Durum indicated an increase from last year for both classes. That lead to higher yields and harvested area despite the cut to planted area - in line with June’s acreage report.

Beginning stocks were also raised due to the higher figures seen in the last NASS Grain Stocks. Still, the production and ending stocks adjustments were much larger than market analysts were expecting, leading to a very bearish session for Chicago Wheat.

World ending stocks also came above market’s maximum expectations, with the production increases in the US (+3.6M mt), Pakistan (+1.4M mt) and Canada (+1M mt) being the largest contributors to the upward adjustment of 5M mt to global ending stocks, that now sit at 257.2M mt for the 24/25 season. Pakistan’s production forecast was raised to a record 31.4M mt, based on government estimates indicating a large yield. Canada’s production was increased to 35M mt on improved moisture conditions in the Prairie Provinces.

WASDE Commentary — Grains

Written by Ignacio Espinola

ignacio.espinola@hedgepointglobal.com

ignacio.espinola@hedgepointglobal.com

Disclaimer

Este documento foi preparado pela Hedgepoint Global Markets LLC e suas afiliadas (“HPGM”) exclusivamente com fins informativos e instrucionais, não tendo o propósito de estabelecer obrigações ou compromissos à terceiros, nem a intenção de promover uma oferta, ou solicitação de oferta de compra ou venda de quaisquer valores mobiliários, futuros, opções, moedas e swap ou produtos de investimento. A Hedgepoint Commodities LLC (“HPC”), uma entidade de propriedade integral do HPGM, é uma Introducing Broker e um membro registrado do National Futures Association. A negociação de futuros, opções, moedas e swap envolve riscos significativos de perdas e pode não ser adequado para todos os investidores. Performance anterior não é necessariamente indicativo de resultados no futuro. Os clientes da Hedgepoint devem confiar em seu próprio julgamento independente e em consultores externos antes de entrar em qualquer transação que seja introduzida pela empresa. A HPGM e seus associados expressamente não se responsabiliza por qualquer uso das informações contidas neste documento que resulte direta ou indiretamente em danos ou prejuízos de qualquer tipo. Em caso de questionamentos não resolvidos por nossa equipe de atendimento ao cliente (client.services@hedgepointglobal.com), contate nosso canal de ombudsman interno (ombudsman@hedgepointglobal.com) ou 0800-878 8408/ouvidoria@hedgepointglobal.com (somente para clientes no Brasil)

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.