Apr 10

/

Alef Dias

Pre-WASDE Monthly Report - 2024 04 10

Back to main blog page

"Comments about the perspectives for USDA's report"

Soybeans: Bearish adjustments on the way

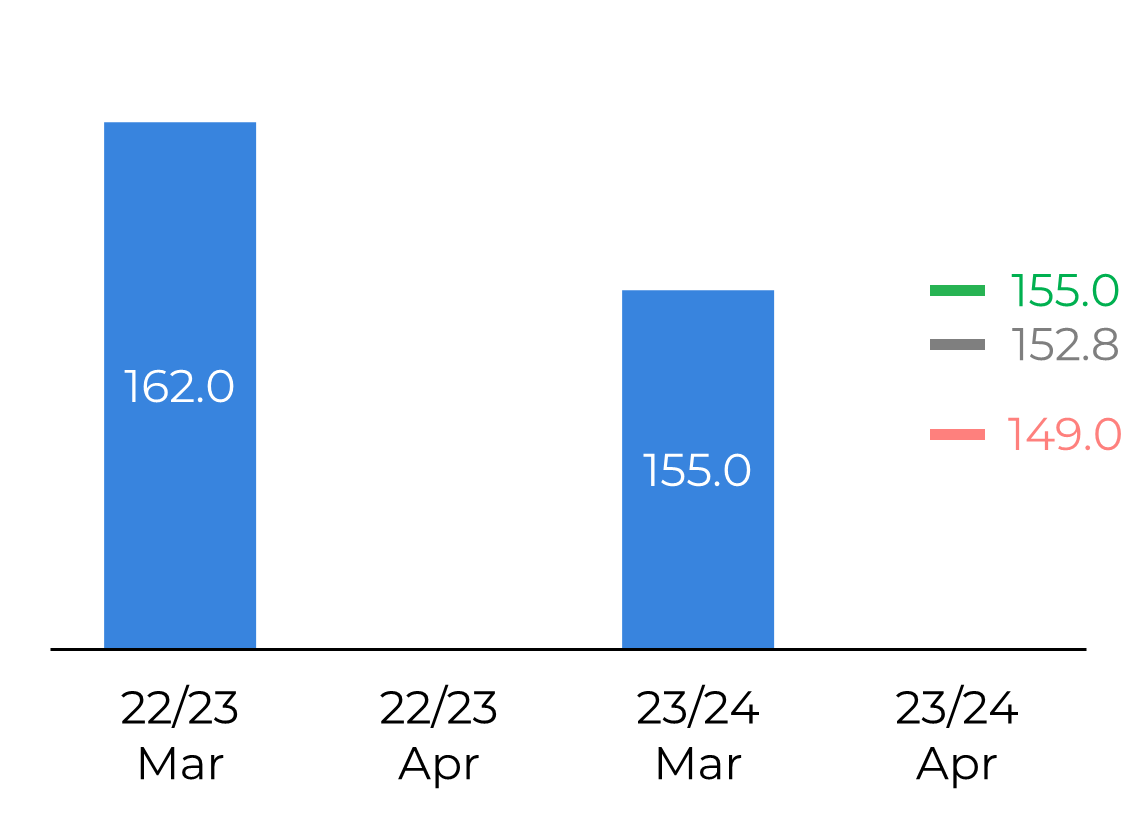

Figure 1: Brazil Soybean – Production (M ton)

Sentiment: Bearish

US Soybean exports during the 2023/24 period have experienced an 18% decline compared to the previous year, falling short of USDA’s predicted pace. Compounding this bearish outlook, latest stock report revealed soybean stocks totaling 1.845B bu as of March 1, exceeding expectations. Market estimates no changes to US’ ending stocks, so there’s room for a bearish surprise here.

US Soybean exports during the 2023/24 period have experienced an 18% decline compared to the previous year, falling short of USDA’s predicted pace. Compounding this bearish outlook, latest stock report revealed soybean stocks totaling 1.845B bu as of March 1, exceeding expectations. Market estimates no changes to US’ ending stocks, so there’s room for a bearish surprise here.

In South America, market anticipates the USDA to revise down its production estimate for Brazil from 155M mt to 152.8M mt. Given the prevalence of lower estimates, it would be reasonable to expect at least this level of reduction from the USDA. Brazil's Conab, on the other hand, forecasts soybean production at 146.9M mt and will provide its own update tomorrow morning – so USDA’s figures may be too far from local figures.

Regarding Argentina, market expects the USDA to maintain its production estimate at 50M mt, which is still double the size of last year's crop affected by drought and below Buenos Aires Exchange’s estimates (of 52.5 mt).

USDA's assessment of global soybean stocks is projected to decrease from 114.3M mt to 114M mt for the 2023/24 period, still marking the highest level in five years if these projections hold true.

Corn: cuts may provide additional bullishness

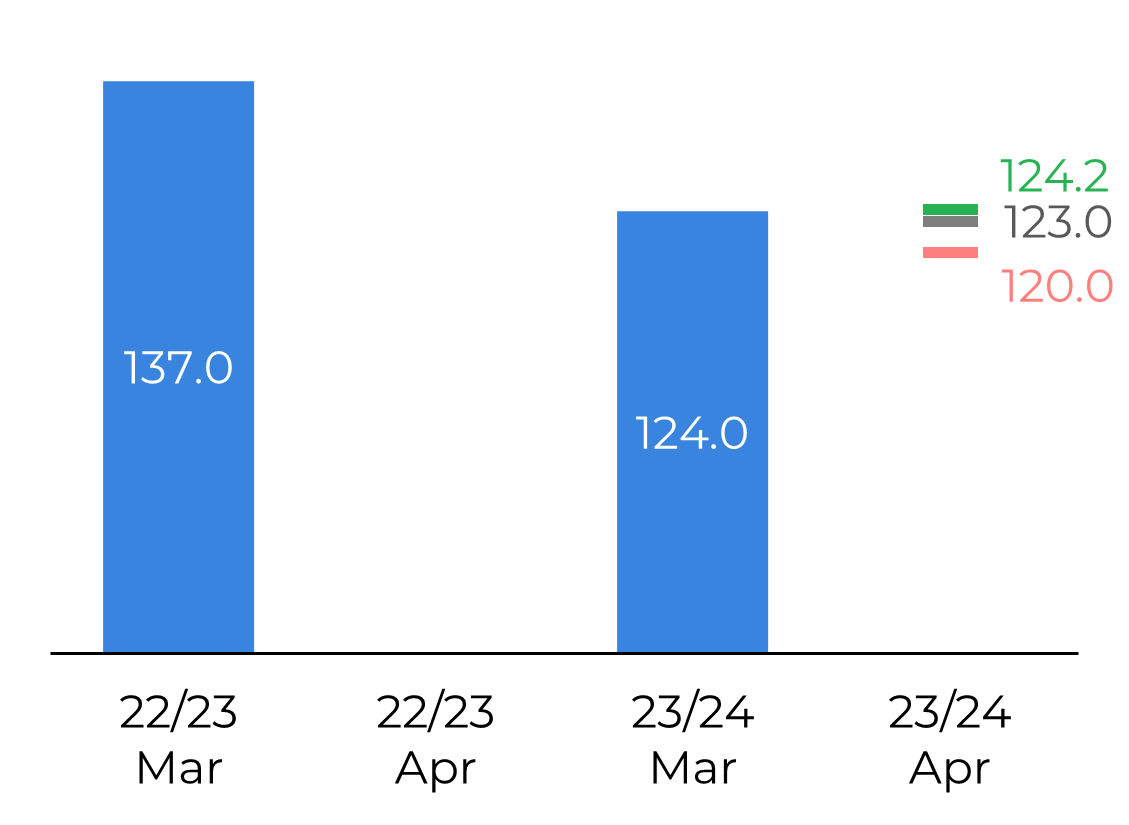

Figure 2: Brazil Corn – Production (M ton)

Sentiment: Bullish

USDA kept its projection of US ending corn stocks at 2.172B bu since February. However, there is a strong possibility that this estimate will be revised downward tomorrow. Corn exports for the 2023-24 period have surged by 33% compared to the previous year, while ethanol production has seen a 4.5% increase over the same period, both exceeding the USDA's initial forecasts.

USDA kept its projection of US ending corn stocks at 2.172B bu since February. However, there is a strong possibility that this estimate will be revised downward tomorrow. Corn exports for the 2023-24 period have surged by 33% compared to the previous year, while ethanol production has seen a 4.5% increase over the same period, both exceeding the USDA's initial forecasts.

Turning to Argentina, the Buenos Aires Grain Exchange has recently downgraded its production estimate to 52M ton, which is below USDA's earlier estimate of 56M mt. Market expects no changes to Argentina's corn production, so a bullish surprise may happen here.

Meanwhile, USDA is anticipated to revise down its forecast for Brazil's corn production from 124M mt to 123M mt – still way above Conab figures (112.8M mt) and most private estimates, so it may have limited impact on prices.

Overall, the USDA's projection for global ending corn stocks in 2023/24 is likely to be adjusted downward from 319.6M mt to 317.0M mt, still marking a five-year high.

Wheat: No major changes expected as market focus on 24/25

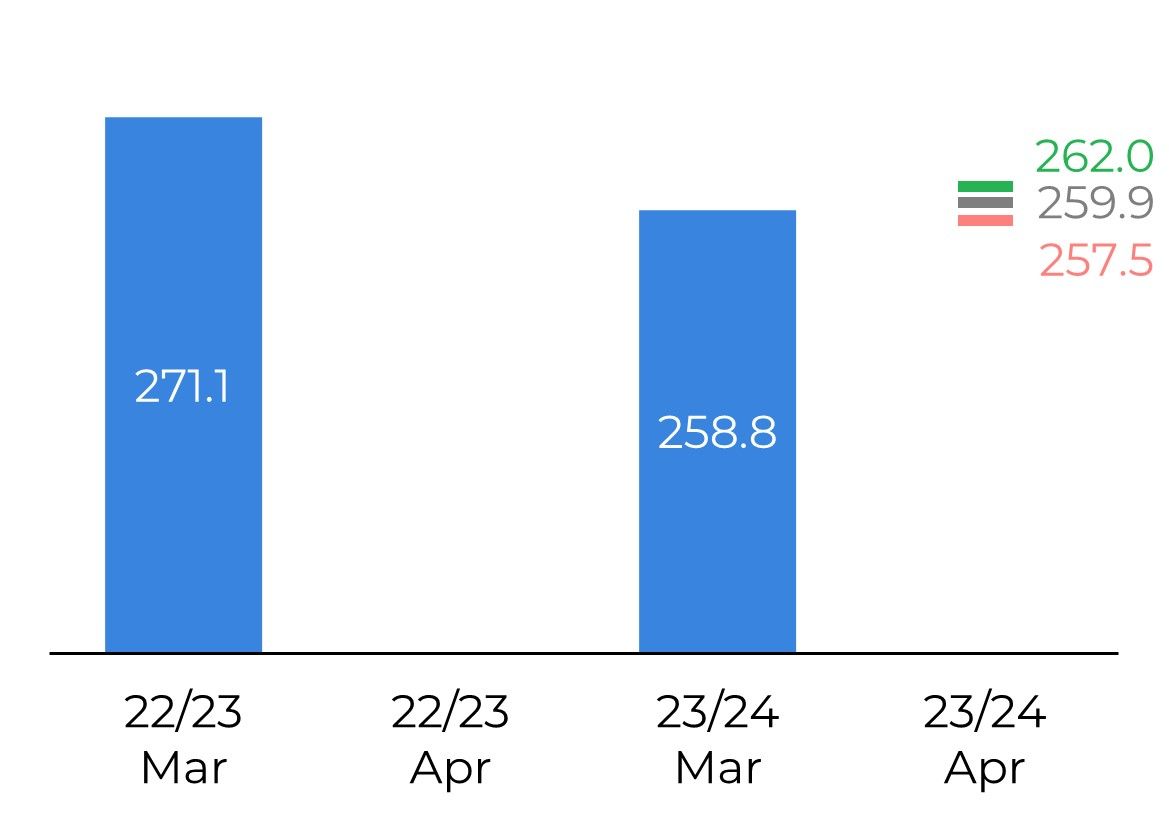

Figure 3: World Wheat - Ending Stocks (M mt)

Sentiment: Neutral

As we enter the final two months of the 2023/24 period, US wheat export sales have nearly met USDA's forecast of 710M bu, already, with shipments expected to come close to that figure by the season's end.

While the USDA may keep its ending stocks estimate unchanged at 673M bu for 2023/24, the report indicating March 1 wheat stocks at 1.087B bu was 34 mb higher than trade expectations, signaling that demand hasn't been as robust as anticipated.

Market expects the USDA to adjust its estimate of U.S. ending stocks upward from 673 to 685M bu, marking the highest level in three years. While traders are currently more focused on assessing prospects for 2024/25 wheat production, the USDA won't provide those estimates until the May WASDE report.

While the USDA may keep its ending stocks estimate unchanged at 673M bu for 2023/24, the report indicating March 1 wheat stocks at 1.087B bu was 34 mb higher than trade expectations, signaling that demand hasn't been as robust as anticipated.

Market expects the USDA to adjust its estimate of U.S. ending stocks upward from 673 to 685M bu, marking the highest level in three years. While traders are currently more focused on assessing prospects for 2024/25 wheat production, the USDA won't provide those estimates until the May WASDE report.

USDA's projection of 258.8M mt for global ending wheat stocks is anticipated to be increased to 260M mt. Even though there’s been weak demand signs, Ukraine exports will likely be increased, leading to lower ending stocks in the country and reducing chances of an upward adjustment.

Charts Legend

WASDE Commentary — Grains

Written by Alef Dias

alef.dias@hedgepointglobal.com

Reviewed by Thais Italiani

thais.italiani@hedgepointglobal.com

alef.dias@hedgepointglobal.com

Reviewed by Thais Italiani

thais.italiani@hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.