Pre-WASDE Monthly Report - 2024 06 11

Soybeans: USDA continues being conservative on the crop expectation

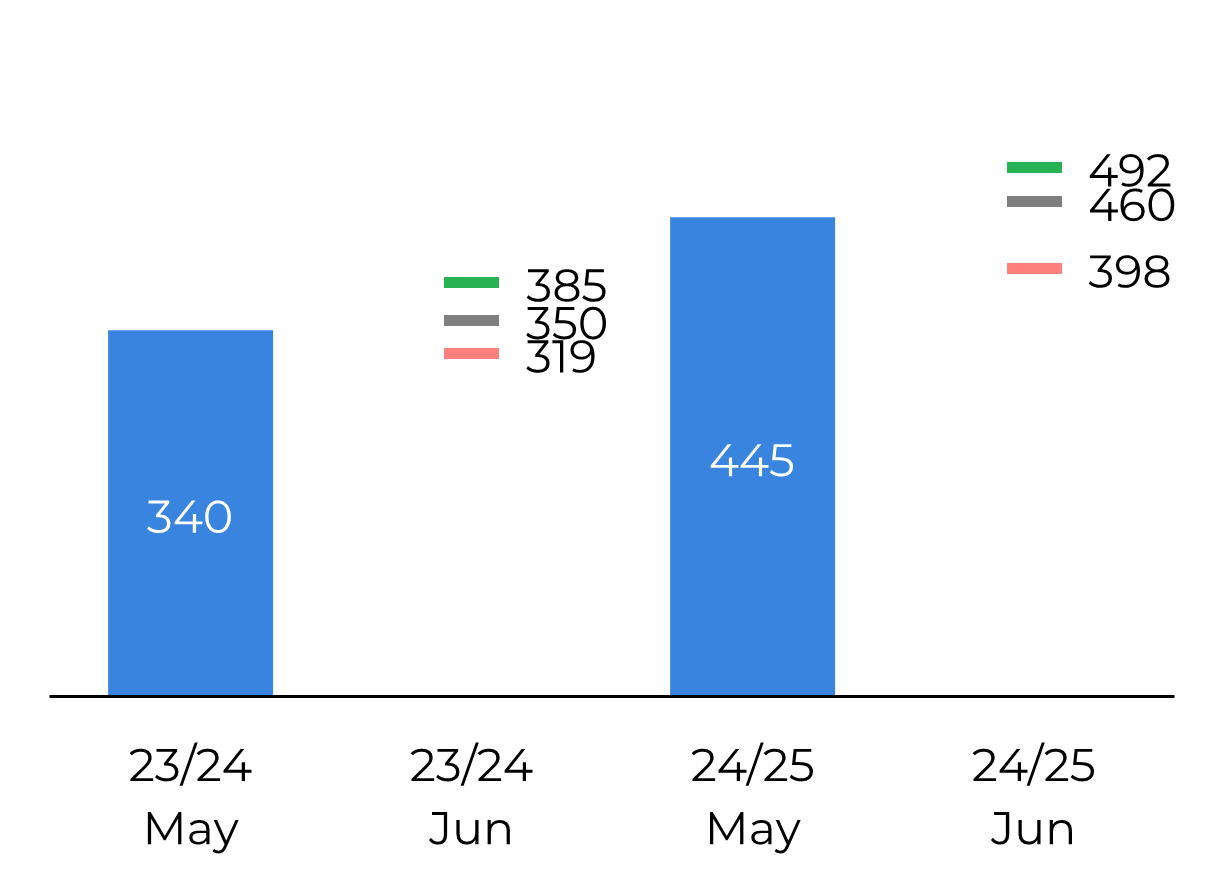

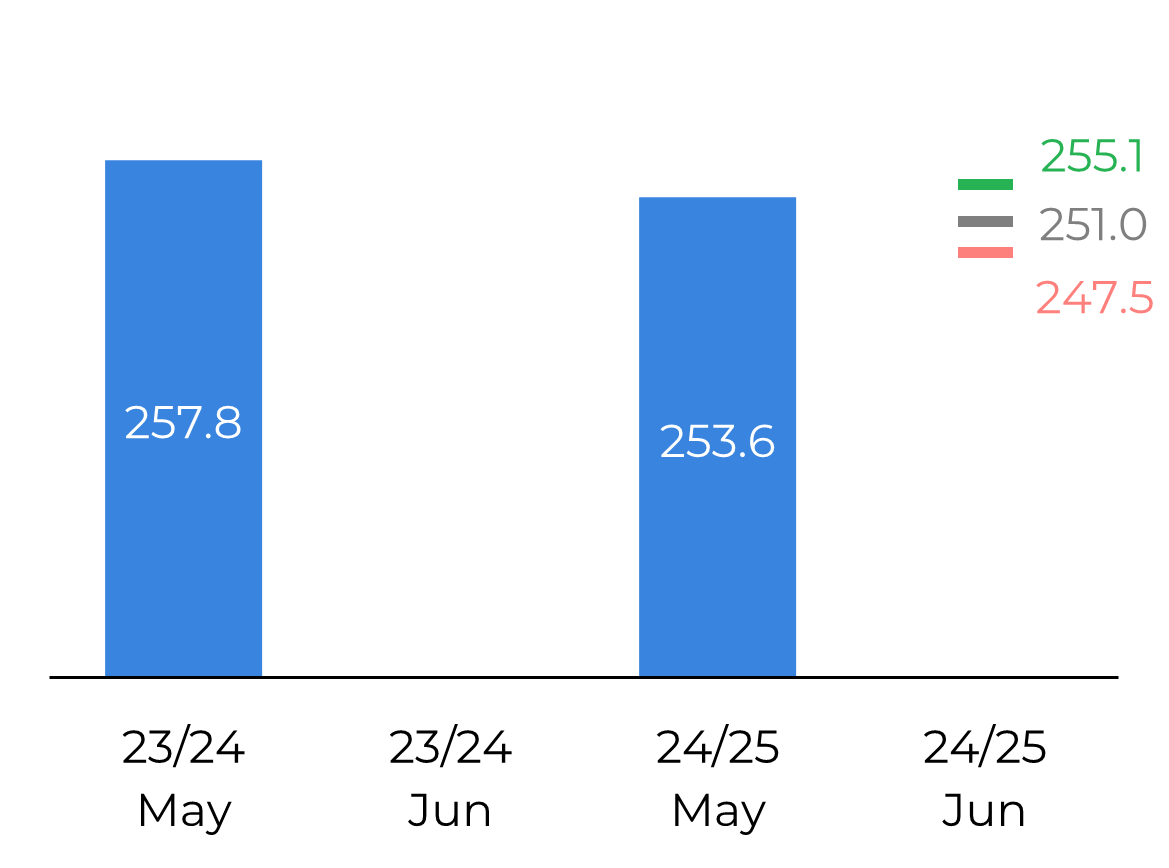

US Soybean Ending Stocks (M mt)

Sentiment: Bearish

June

brings the second WASDE report for 24/25 new crop on next Wednesday, 12 June.

Expectations wise, the market is expecting a production number between 51-49 M mt for Argentina, with a previous WASDE number of 50 M mt which seems comfortable with the last news. On the Brazil side, market’s gap goes between 149-154 M mt with a previous report estimate of 154 M mt which does look a little bit on the high side considering the damage that the challenging weather has done in many parts of Brazil.

Last

news about Brazilian government trying to discount tax credits for certain

industries could bring some fear into the Brazilian farmer, who could

potentially slow his sales and reduce the investment for next crop as this

treat could cut between 4 to 5% of their revenue. Luckly for them, the

Brazilian congress needs to approve this within the next 4 months or leave

everything as it is right now. If this could happen, we should have a bullish

trend on prices that could benefit US as an origin, making their beans more

competitive.

Finally,

ending stocks wise, agents are expecting a range between 319-385 M mt for 23/24 crop and 398-492 M mt for 24/25 crop with current estimates of 340 M mt old crop and 445 M mt new crop.

Considering this scenario, we will find ourselves in a comfortable scenario on

the ending stocks, but we still need to keep an eye on further treats and

changes like the tax credit discussion in Brazil

Corn: Adjustments to SAM crops are not as accurate as local numbers

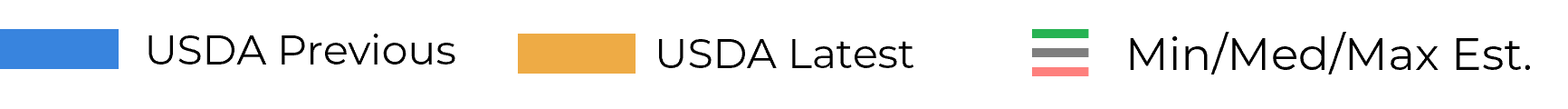

Argentina Corn Production (M mt)

Even though June WASDE report is not a major market mover as market looks forward to more meaningful month’s end reports, it does bring some clarity to some numbers.

On the Brazilian side, the expectations report is expecting around 122 M mt, with a market range between 119-123 M mt. .

Wheat: All eyes on Russia

World Wheat - Ending Stocks (M mt)

After a long winter and spring full of adverse weather challenges, the winter wheat harvest is getting underway across the Northern Hemisphere, and there will be quite a bit for traders to notice in Wednesday's report. Market’s median estimates point to a total US wheat production of 1882M bu in 2024/25, which is expected to result in 779.5M bu of U.S. ending wheat stocks in 2024/25, the highest in four years.

World estimates of wheat production will be more interesting this time around after issues of frost and excess moisture in Europe, coupled with freeze damage in Russia and Ukraine, followed by hot and dry conditions that are still stressing crops around the Black Sea.

WASDE Commentary — Grains

alef.dias@hedgepointglobal.com

Written by Ignacio Espinola

ignacio.espinola@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.