Jul 11

/

Alef Dias and Ignacio Espinola

Pre-WASDE Monthly Report - 2024 07 11

Back to main blog page

"Comments about the perspectives for USDA's report"

Soybeans: Big stocks could incentivize a stock building policy

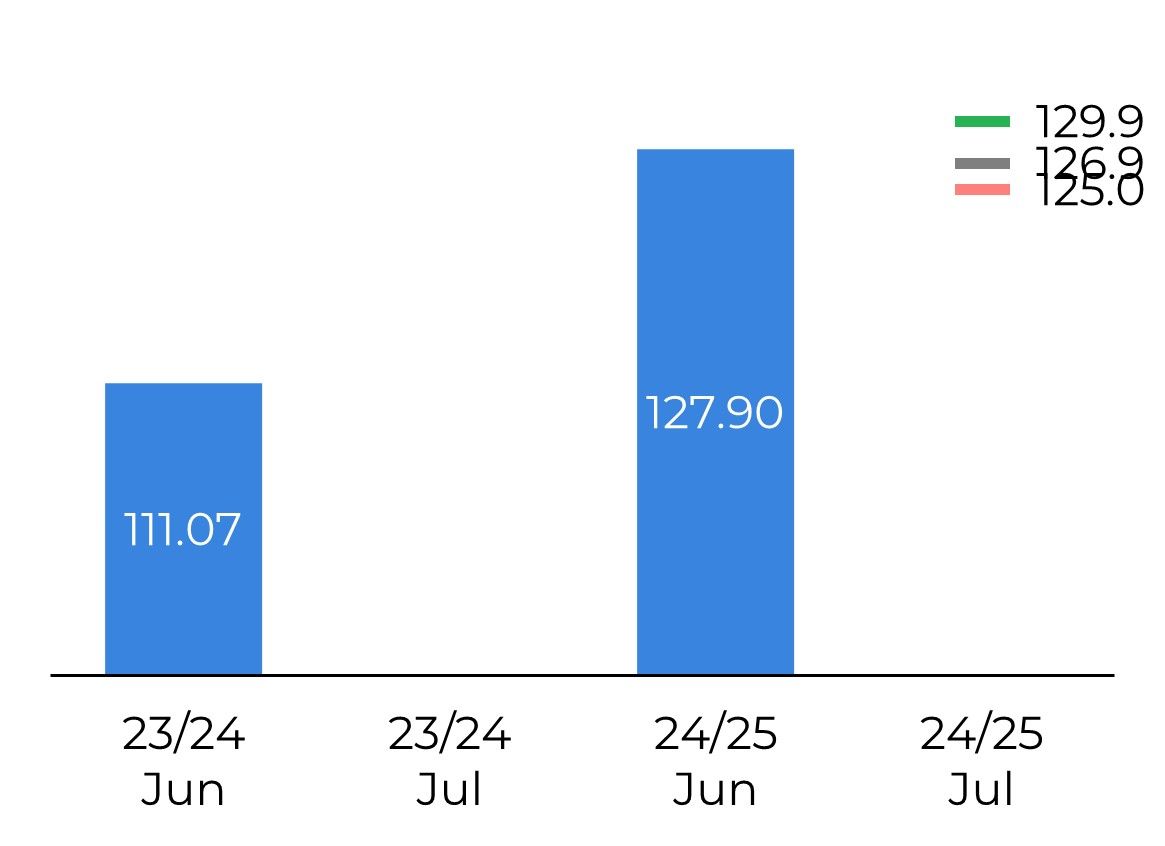

World Ending Stocks (M mt)

Fonte: USDA, Bloomberg, Hedgepoint

Sentiment: Bearish

Expectations wise, the market is looking forward to a production number between 51-49 for Argentina, with a previous WASDE number of 50 which seems comfortable with the last news and it’s the same number than the last update.

On the Brazilian side, market’s expectations go between 155-149 with a previous report estimate of 153 M mt, which is 1 M mt less than previous update. Finally, on the US side, WASDE printed 121.1 M mt while for this report the average estimations are at 120.6 M mt with a range of 120.7-118 M mt. Ending stocks wise, we expect a number at around 9.5 Mmt for 23/24 and 12 Mmt for 24/25. This numbers, and current prices, could continue incentivizing China, who has been very active in the beans and corn market with a build stocks policy.

Finally, ending stocks wise, there’s a lot of expectation on the final world number, with last report at 128.5 M mt, and a range of 130-120 M mt. We should see a number close to 120 M mt, in line with the average estimations of the market.

Corn: Waiting for a SAM adjustment

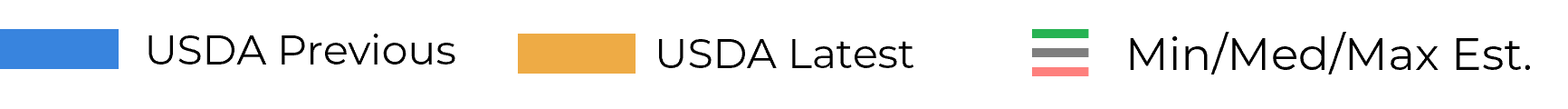

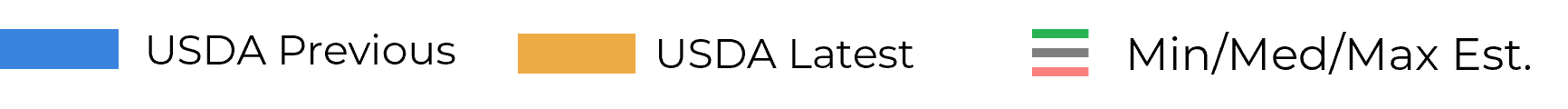

Argentina Corn Production (M mt)

Fonte: USDA, Bloomberg, Hedgepoint

Sentiment: Bearish

For corn, the previous report was giving an estimation of 53MMt for Argentina while the latest local reports are showing numbers closer to 46-47 M mt due to the Chicharrita disease.

For corn, the previous report was giving an estimation of 53MMt for Argentina while the latest local reports are showing numbers closer to 46-47 M mt due to the Chicharrita disease.

This decrease on the Argentina production could be offseted by an increase on the US crop, where the estimate of the market is an increase from 377,4 M mt into 383 M mt. So far, the USDA has not updated the Argentine crop and if that continues, we will still have an imbalance in the global SnD.

On the Brazilian side, the report is expecting around 122 M mt, with a market range between 125.6-120 M mt, unchanged from previous numbers but far away from CONAB’s 115.9 Mmt.

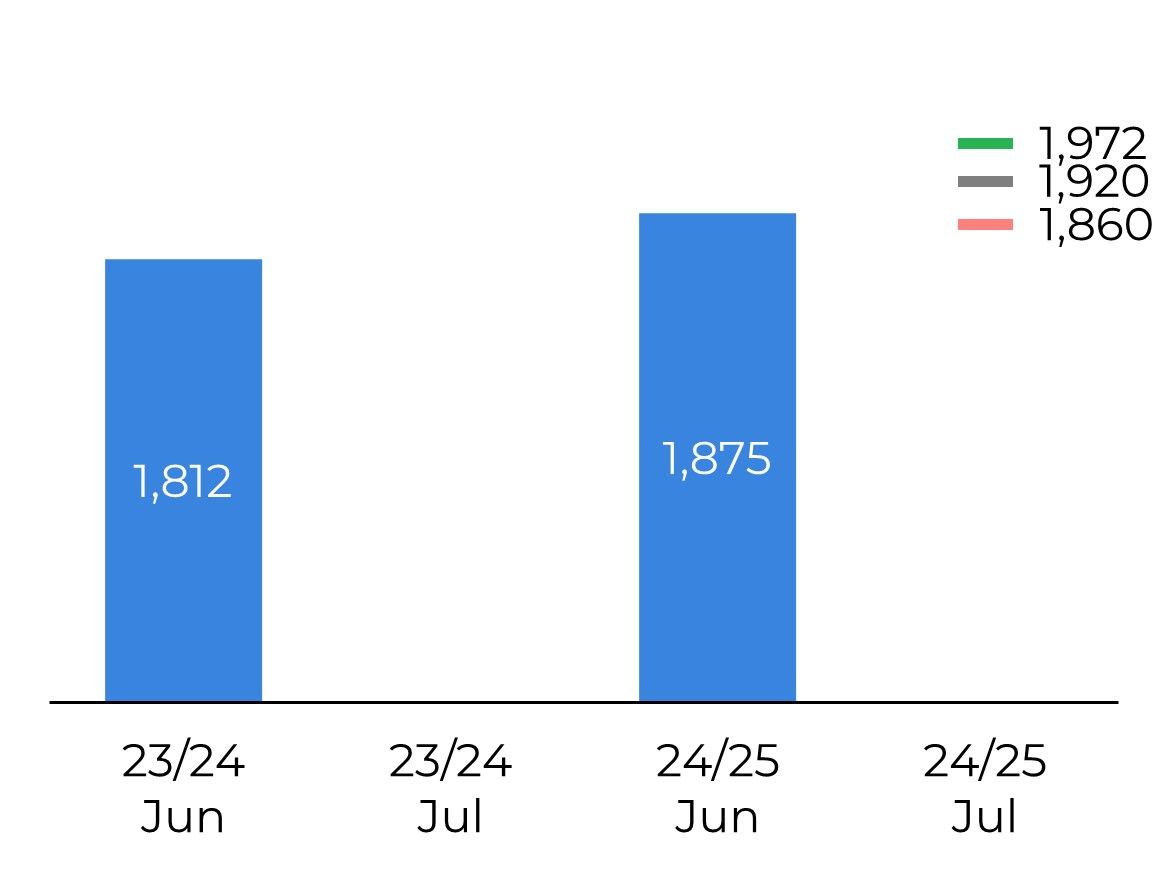

Wheat: Expectations of a bearish report

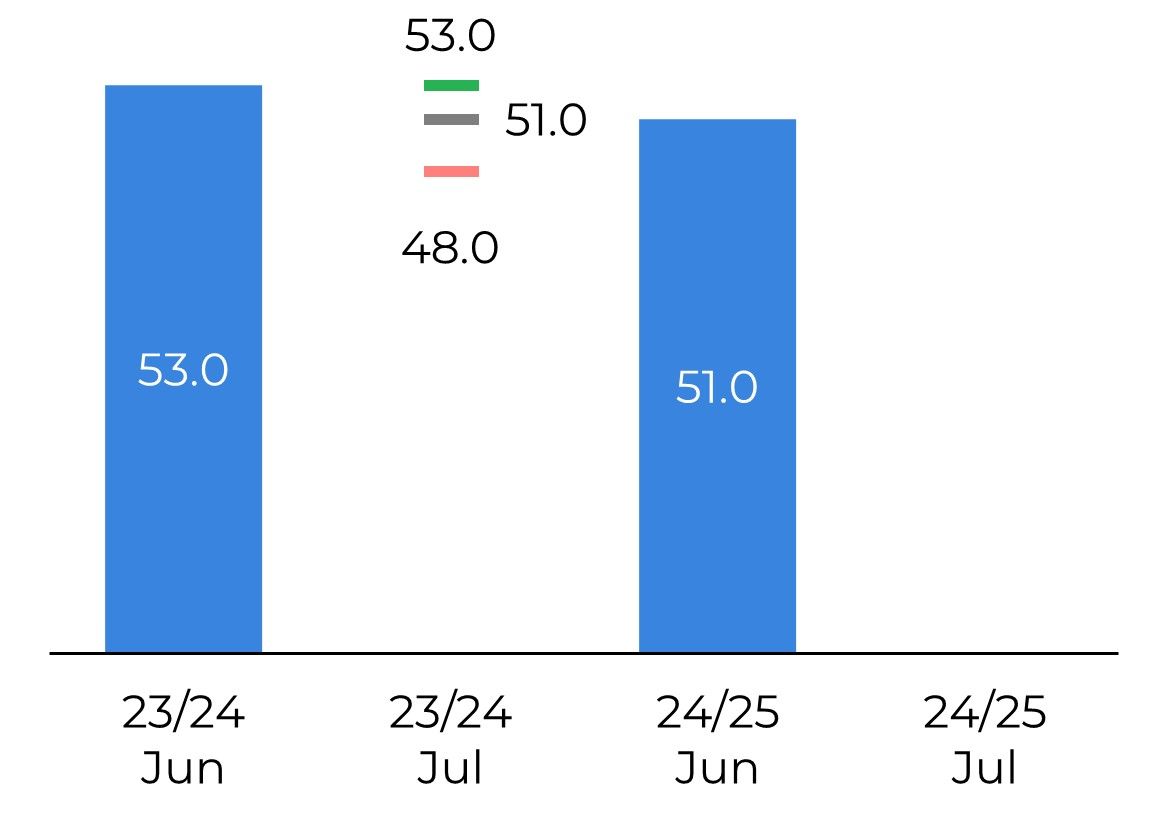

US Wheat - Production (M bu)

Fonte: USDA, Bloomberg, Hedgepoint

Sentiment: Bearish

In general terms, the July WASDE should bring more bearish figures for wheat. US wheat production in 2024/25 is expected to total 1920M bu, 45M bu higher than the 1875M bu projected in the June WASDE report. Production in the new crop year is expected to be 5.6% higher than the 1812M bu forecast for 2023/24 in the June WASDE report. This increase is mainly due to the accelerated winter wheat harvest and the excellent condition of the spring crop.

In general terms, the July WASDE should bring more bearish figures for wheat. US wheat production in 2024/25 is expected to total 1920M bu, 45M bu higher than the 1875M bu projected in the June WASDE report. Production in the new crop year is expected to be 5.6% higher than the 1812M bu forecast for 2023/24 in the June WASDE report. This increase is mainly due to the accelerated winter wheat harvest and the excellent condition of the spring crop.

In the global scenario, ending stocks in 2024/25 are expected to total 252M mt, a slight reduction from the 252.3M mt projected in the June WASDE, according to the median of market expectations. Analysts expect ending stocks for the 2023/24 crop year to total 260M mt, down 440k mt from June's WASDE. The market will focus on Russia's production projections, after the first results since the start of the country's harvest pointed to higher-than-expected yields. Private estimates, according to a Fastmarkets survey, are between 82-86M mt, up from the 77.5-81.5M mt estimated just a month earlier, after the main growing areas suffered frosts and dry weather in May.

The USDA lowered its estimate to 83M mt in the June WASDE, down from 88M mt projected in the May edition of the report. On the other hand, the USDA may further reduce its EU production estimate due to prolonged wet weather in France, the bloc's largest wheat producer, which resulted in fewer growing days and reduced yield potential. On July 9, the French Ministry of Agriculture released its initial wheat production estimate, which predicted a 15.4% drop in production to 29.7M mt.

WASDE Commentary — Grains

Written by Alef Dias

alef.dias@hedgepointglobal.com

Written by Ignacio Espinola

ignacio.espinola@hedgepointglobal.com

alef.dias@hedgepointglobal.com

Written by Ignacio Espinola

ignacio.espinola@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Global Markets LLC and its affiliates (“HPGM”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint Commodities LLC (“HPC”), a wholly owned entity of HPGM, is an Introducing Broker and a registered member of the National Futures Association. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and outside advisors before entering in any transaction that are introduced by the firm. HPGM and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. In case of questions not resolved by the first instance of customer contact (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ombudsman@hedgepointglobal.com) or 0800-878- 8408/ouvidoria@hedgepointglobal.com (only for customers in Brazil).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.