Geopolitical shifts and Market reactions

"The past week saw significant geopolitical events, including Trump's second term as President of the United States, which led to a correction in the dollar index after a softer stance on US trade tariffs. This triggered reactions in emerging currencies, with the Brazilian Real performing well due to foreign capital inflows and Brazil's economic agenda for 2025. Sugar prices, initially bearish, recovered due to technical factors and the strengthening BRL. While Q1 2025 trade flows appear balanced, with potential higher demand due to Ramadan and lower Brazilian availability, the market remains overall bearish for sugar in the long term due to expected oversupply from Brazil’s 25/26 crop development."

Geopolitical shifts and Market reactions

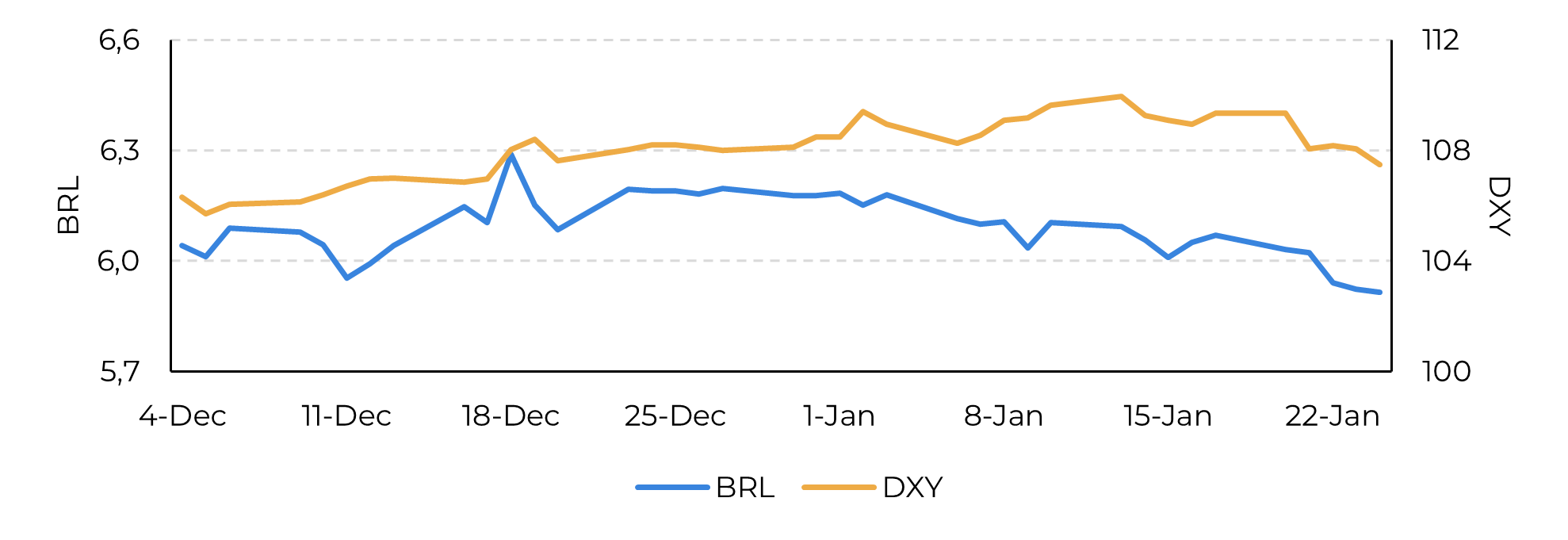

- On January 20, Trump began his second term as President of the United States, adopting a softer stance on US trade tariffs, leading to a correction in the dollar index.

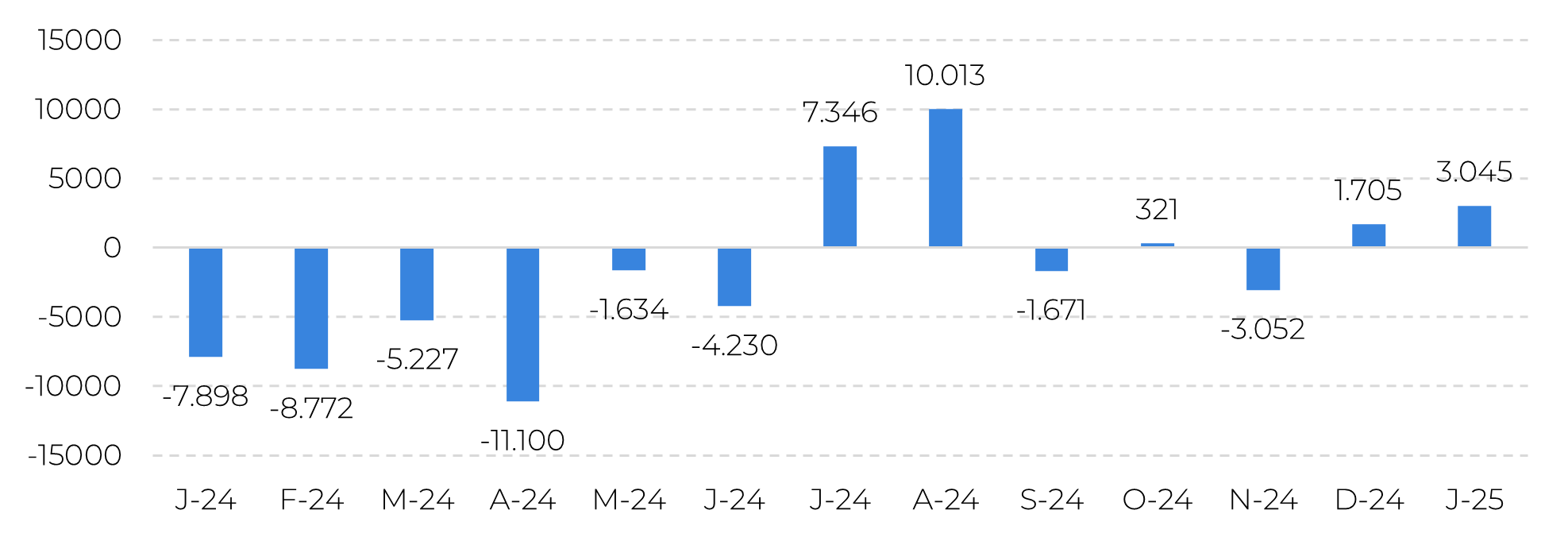

- This movement triggered reactions in several emerging currencies, with the Brazilian Real performing well due to foreign capital inflows and the release of Brazil's economic agenda for 2025.

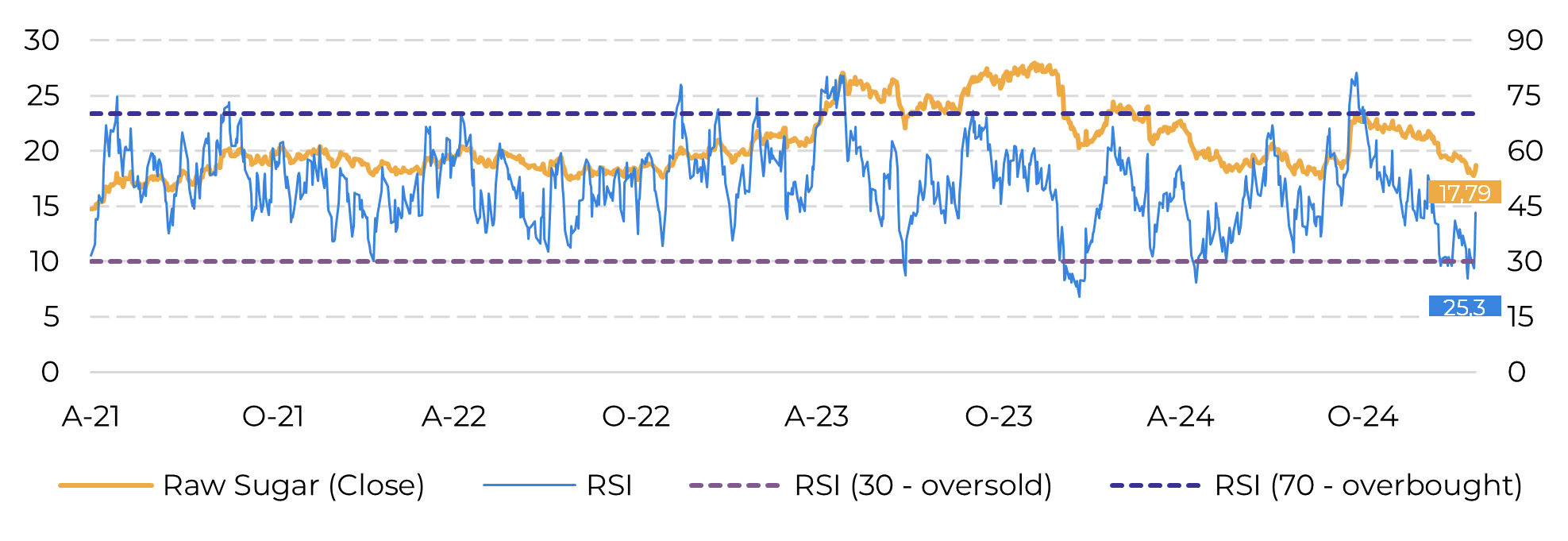

- Sugar prices started the week bearish but recovered due to technical factors and the strengthening BRL. The latter closed at 5.9 by Friday.

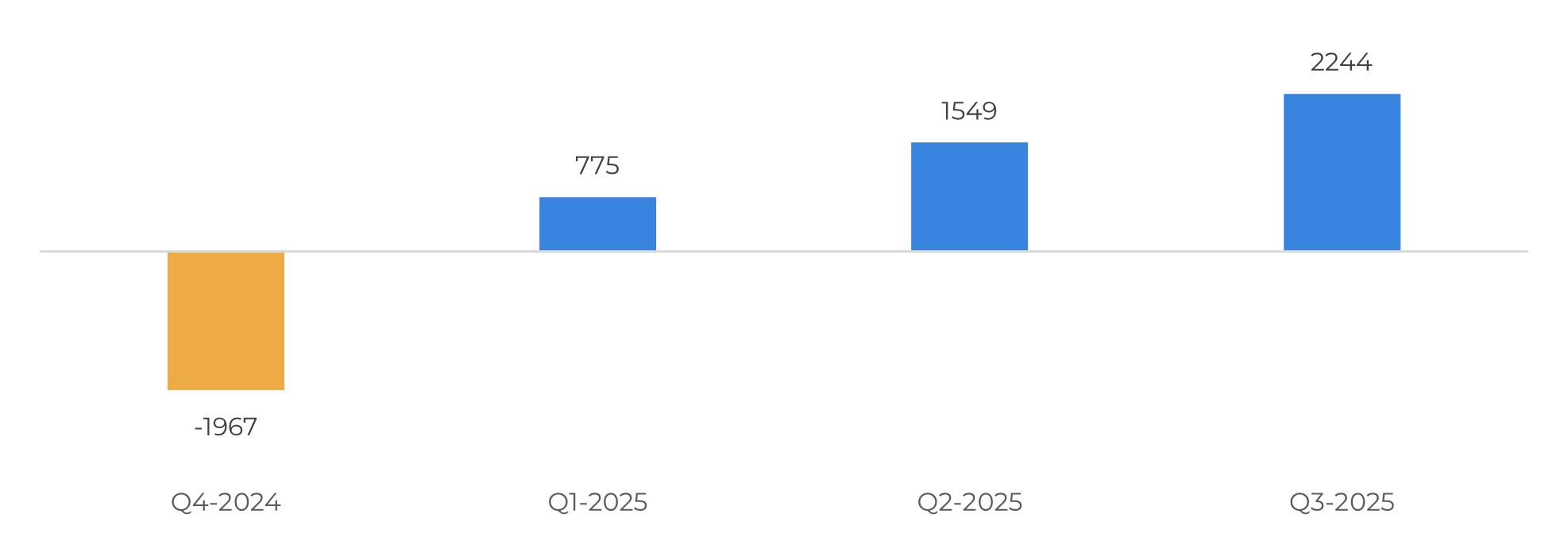

- Q1 2024 trade flows appear balanced, with potential demand strengthening due to Ramadan, which combined with a lower Brazilian availability until the 25/26 season is one of only supports to raw sugar prices.

- Despite some supportive points, the market remains overall bearish for sugar, with long-term oversupply expected due to positive weather during Brazil’s 25/26 crop development.

The past week witnessed a significant geopolitical event. On Monday, January 20, Trump began his second term as President of the United States. The new administration adopted a softer stance on US trade tariffs, which defied market expectations and led to a correction in the dollar index. From over 109, the index corrected by 1.7% by Friday, closing at 107.4.

Image 1: DXY vs BRL

Source: Refinitiv,Hedgepoint

Image 2: Net Foreign Capital Inflows to Brazil (M BRL)

Source: B3; Hedgepoint

Image 3: Relative Strength Index

Source: Refinitiv,Hedgepoint

Looking into fundamentals, the Q1 2025 trade flows appear to be well balanced. Considering the potential demand strengthening in the next few days due to the upcoming Ramadan festivities, and the fact that Chinese import parity is estimated around 16.8 c/lb for non-producing regions, current prices seem fair. Brazil is expected to have lower availability until the beginning of the 25/26 season, which is particularly supportive for raw sugar and should contribute to the 18.5 c/lb level.

Image 4: Total Trade Flows ('000t tq)

Source: Green Pool, Hedgepoint

Going forward, understanding the impacts of possible tariffs on China is essential to grasp how they could affect the Asian country's demand for the sweetener. Today, we estimate that Chinese production will be above average, leading to a more cautious participation in the international market, as import parities have remained closed.

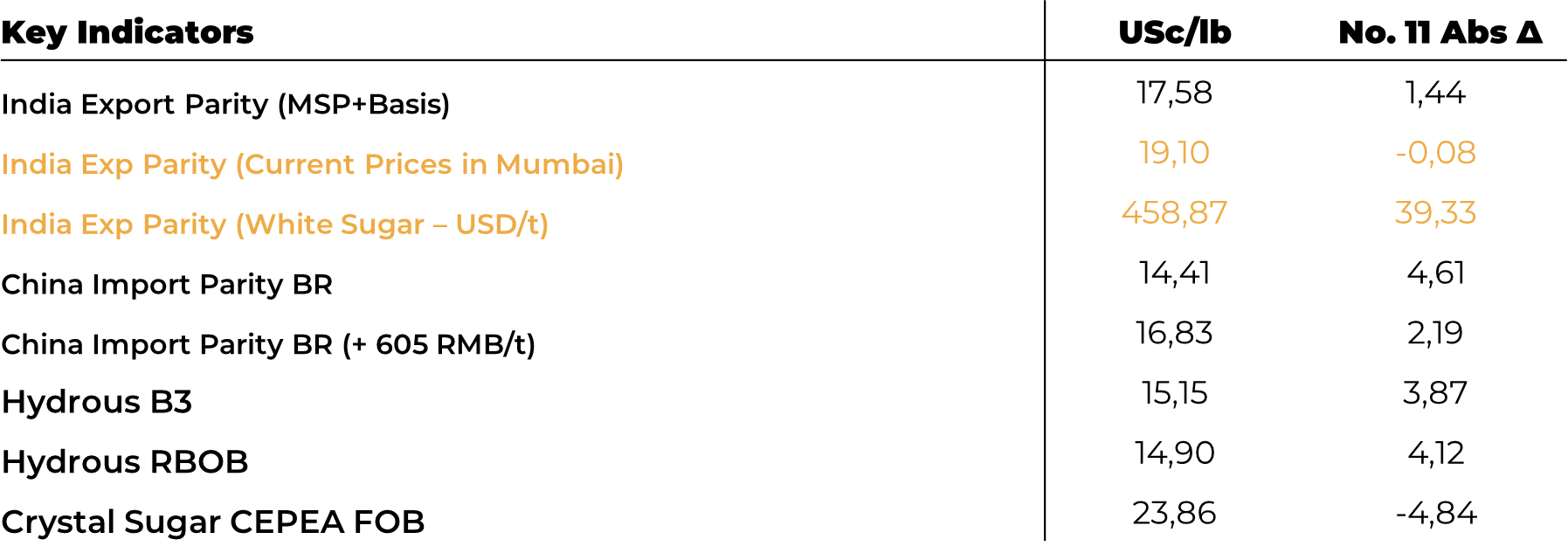

Image 5: Important Sugar Parities (c/lb)

Source: Refinitiv, Bloomberg,Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

luiz.roque@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.