Monetary Moves and Sweet News

"Last week saw significant monetary policy decisions, with the U.S. Federal Reserve keeping interest rates unchanged and Brazil's COPOM raising the Selic rate by 100 basis points to 13.25%. These moves contributed to the BRL's appreciation and supported sugar prices, which also benefited from reduced sugar availability in Brazil, Chinese buying rumors, and Bangladesh's tender for sugar imports. However, trade flows are expected to be more comfortable going forward, suggesting limited upside for sugar prices."

Monetary Moves and Sweet News

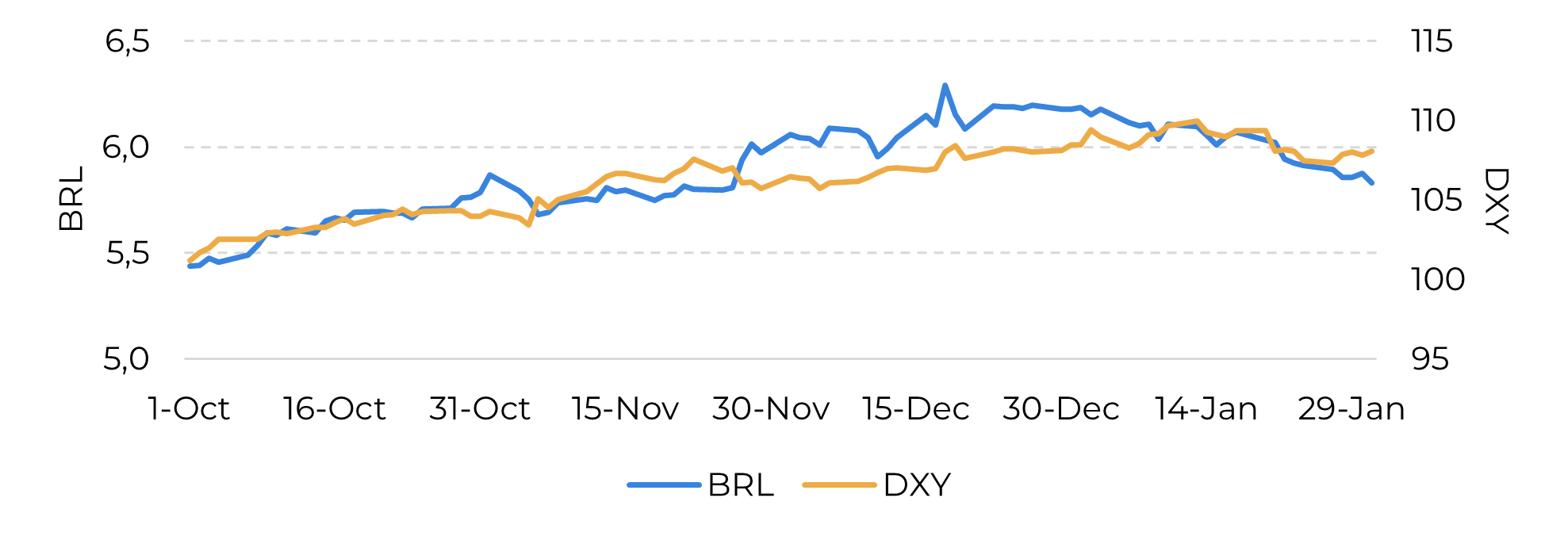

- The U.S. Federal Reserve kept interest rates unchanged, leading to stock market declines, but Fed Chair Powell's speech helped contain dollar-selling pressure.

- Brazil's COPOM raised the Selic rate by 100 basis points to 13.25% and indicated another hike in March, revising its inflation forecast upward.

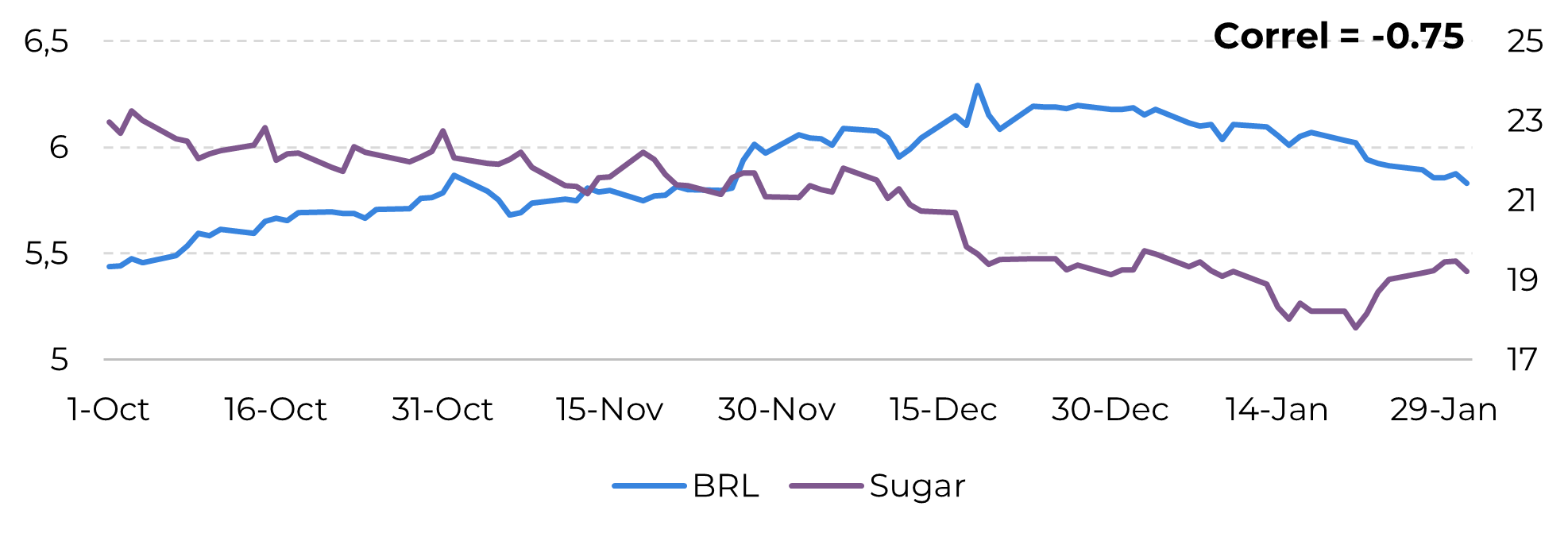

- These policy moves contributed to the BRL's appreciation and supported sugar prices, with Brazilian producers possibly becoming more hesitant to sell.

- Reduced sugar availability in Brazil, Chinese buying rumors, and Bangladesh's tender for sugar imports also supported sugar prices.

- Trade flows are expected to be more comfortable going forward, suggesting limited upside for sugar prices.

Starting with a macro-overview, last week was marked by significant monetary policy decisions. In the U.S., the Federal Reserve (Fed) opted to keep interest rates unchanged after three consecutive cuts. Markets reacted negatively, leading to stock declines. However, Fed Chair Powell’s speech helped contain dollar-selling pressure, as he signaled that rate hikes were unlikely in 2025 despite persistent inflation concerns.

Meanwhile, in Brazil, The Monetary Policy Committee (COPOM) raised the Selic rate by 100 basis points to 13.25% and indicated another hike of the same magnitude in March. This came as the central bank revised its inflation forecast upward from 4.5% to 5.2%, well above the 3% target for the current year.

Image 1: BRL strengthened over the dollar

Source: Refinitiv,Hedgepoint

Image 2: The Brazilian currency has been negativelly correlated to sugar prices

Source: Refinitiv, Hedgepoint

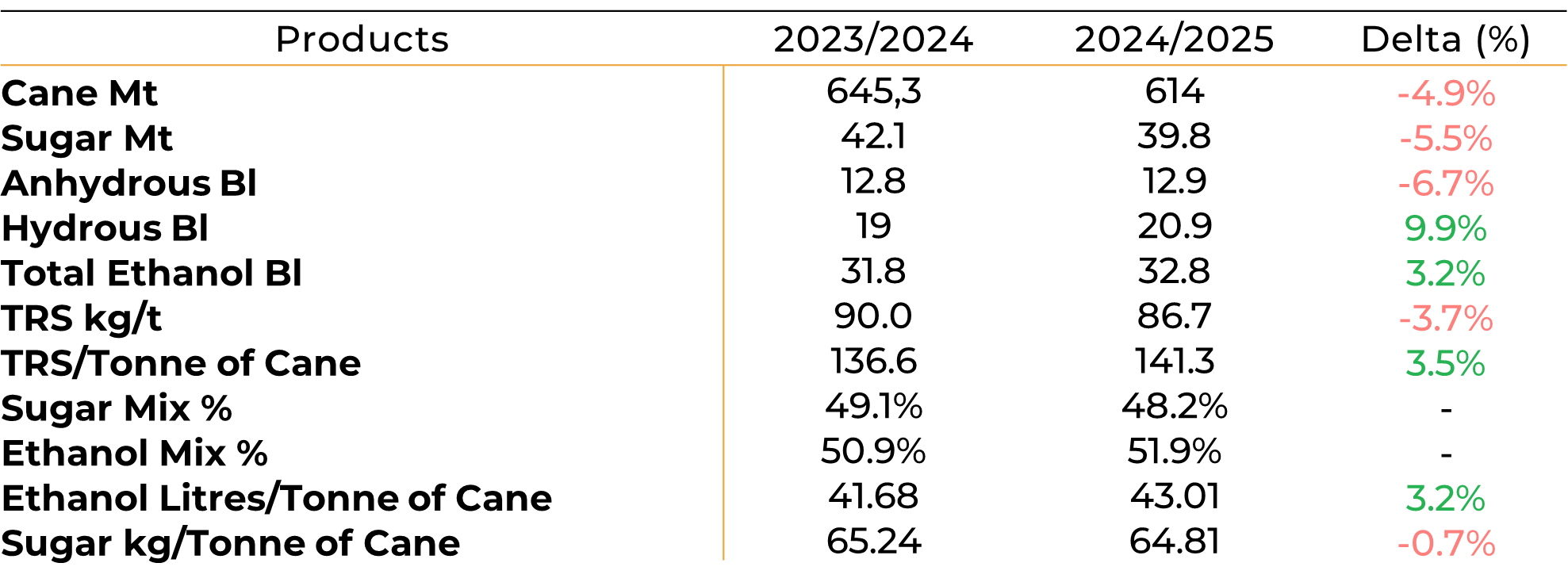

Image 3: Center-South - Cumulative Results until January 15

Source: Unica

Regarding supply, besides concerns about Brazil, India’s sugar sales are reportedly slow. The country’s export parity is estimated to be marginally open for raws, which could further support prices as millers might seek higher prices before selling. Although the white parity is fairly open, rumors indicate some resistance in sales by Indian millers, who are currently asking for a premium that buyers may not be eager to comply with.

Image 4: Key Market Parities

Source: Refinitiv; Bloomberg; Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.