Different short and long term trends

"The Dubai Conference set a bullish tone last week, with discussions focusing on Southeast Asia, particularly Pakistan, India, and China. The market breached the 20 c/lb resistance level, supported by the strengthening Brazilian real and funds rolling their positions. Revised figures show lower production expectations for Pakistan and India, with potential global balance deficits if India finishes its season early or imposes an export ban."

Different short and long term trends

- The Dubai Conference set a bullish tone, focusing on Southeast Asia, particularly Pakistan, India, and China.

- The market breached the 20 c/lb resistance level, supported by the strengthening Brazilian real and funds rolling their positions.

- Revised figures show lower production expectations for Pakistan and India, with potential global balance deficits if India finishes its season early or imposes an export ban.

- The delayed start of the Brazilian 25/26 crop could maintain support, but prices are expected to enter a bearish trend as Brazil recovers its supply capacity.

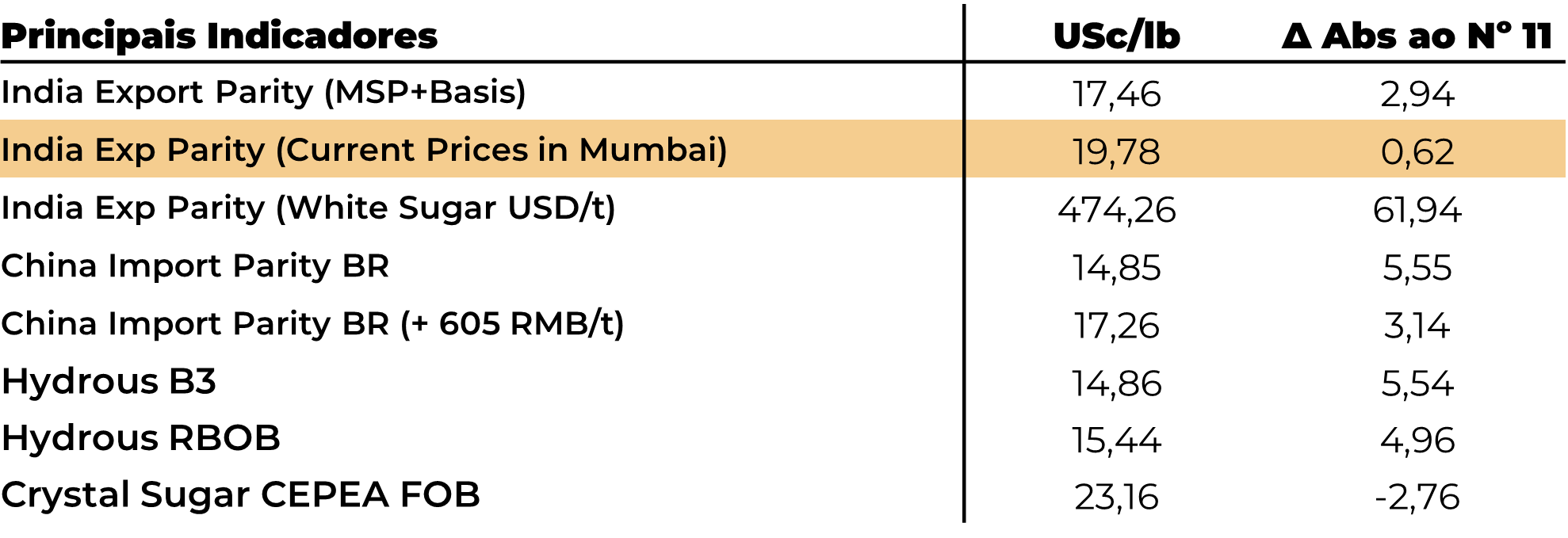

- Key points to monitor include Indian export parity, Brazilian weather, and the Northern Hemisphere's crop development.

The Dubai Conference set a bullish tone over the past week, with numerous discussions focusing on the outcomes in Southeast Asia and particular concerns about Pakistan, India, and China. As a result, the market responded by breaching the 20 c/lb resistance level. Meanwhile, the Brazilian real continued its strengthening path, and funds started rolling their positions at the verge of March’s delivery, further contributing to this short-term bullish trend.

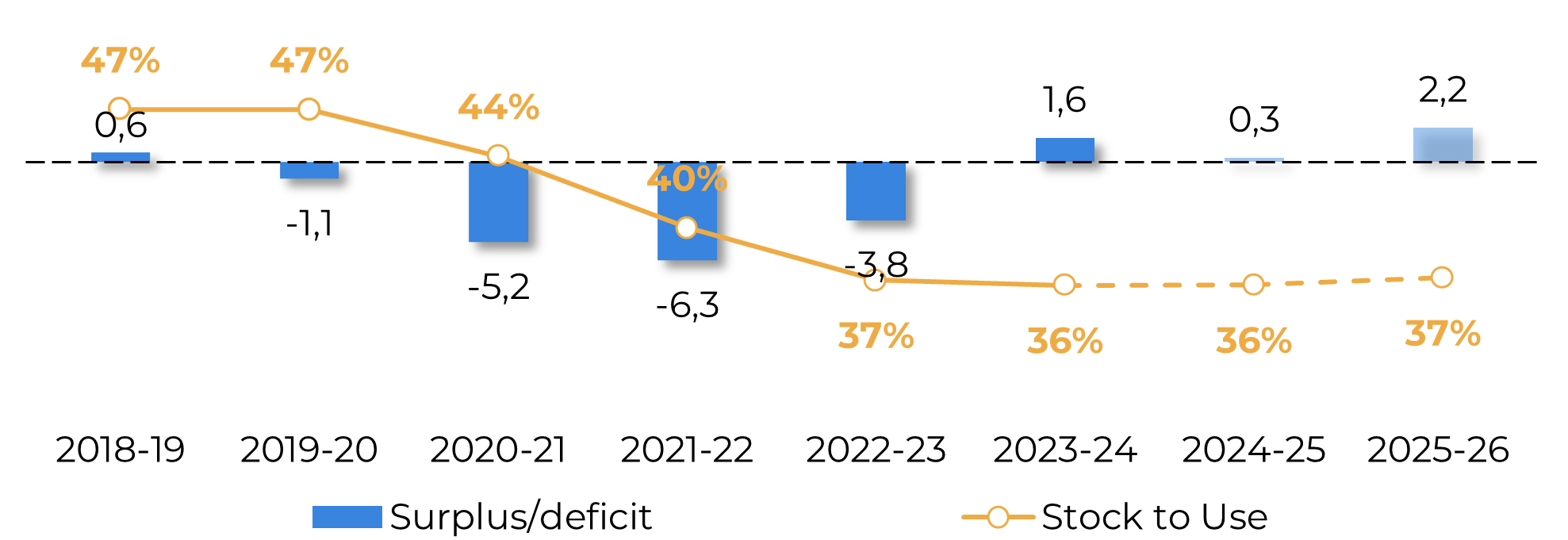

We have revised some of our numbers according to recent discussions. For instance, Pakistan is expected to have lower production, around 6.5Mt or less. We also downgraded our figures for India, particularly in terms of ethanol diversion expectations, reducing them from over 5Mt to 3.5Mt. In terms of sugar, we remain optimistic with a projection of 30Mt. However, if India finishes their season earlier, we could face a more intense global balance deficit. Instead of a marginal surplus, it could switch to around a 3Mt deficit. Nonetheless, trade flows usually set the price trend – and that looks a lot more bearish in the long term.

Image 1: Global Sugar Balance vs Stock to Use Rati (Mt/%)

Source: Green Pool, Hedgepoint

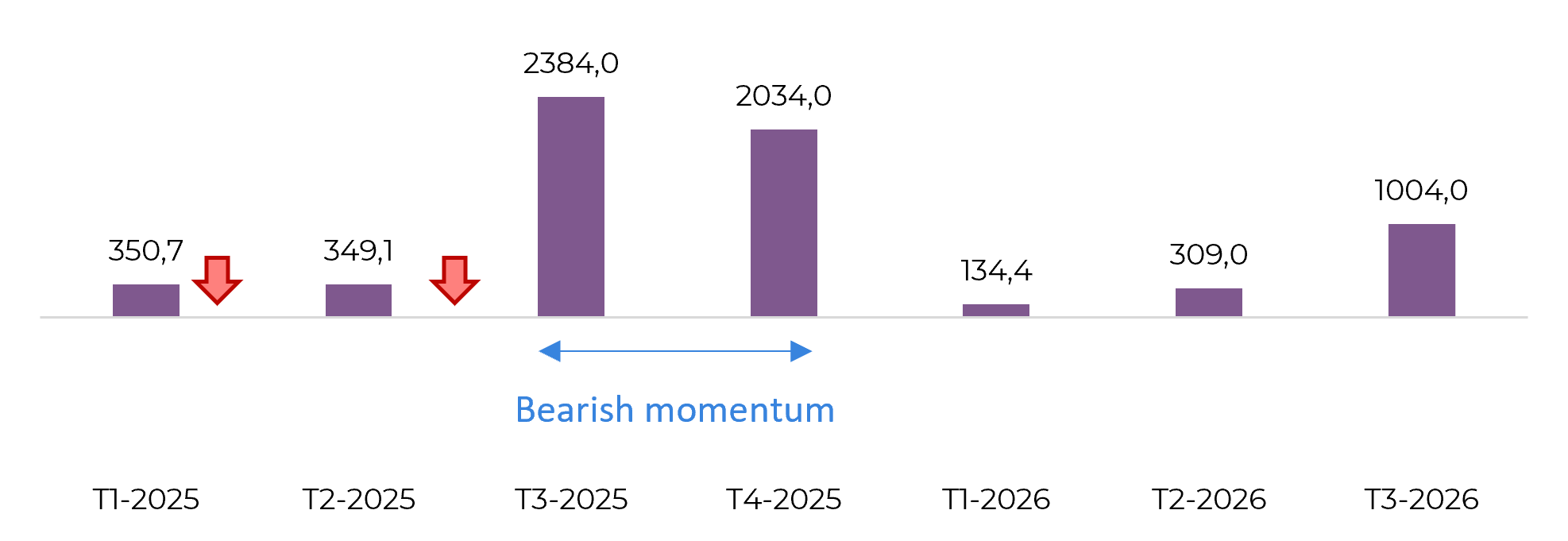

Image 2: Total trade flow ('000t tq)

Source: Green Pool, Hedgepoint

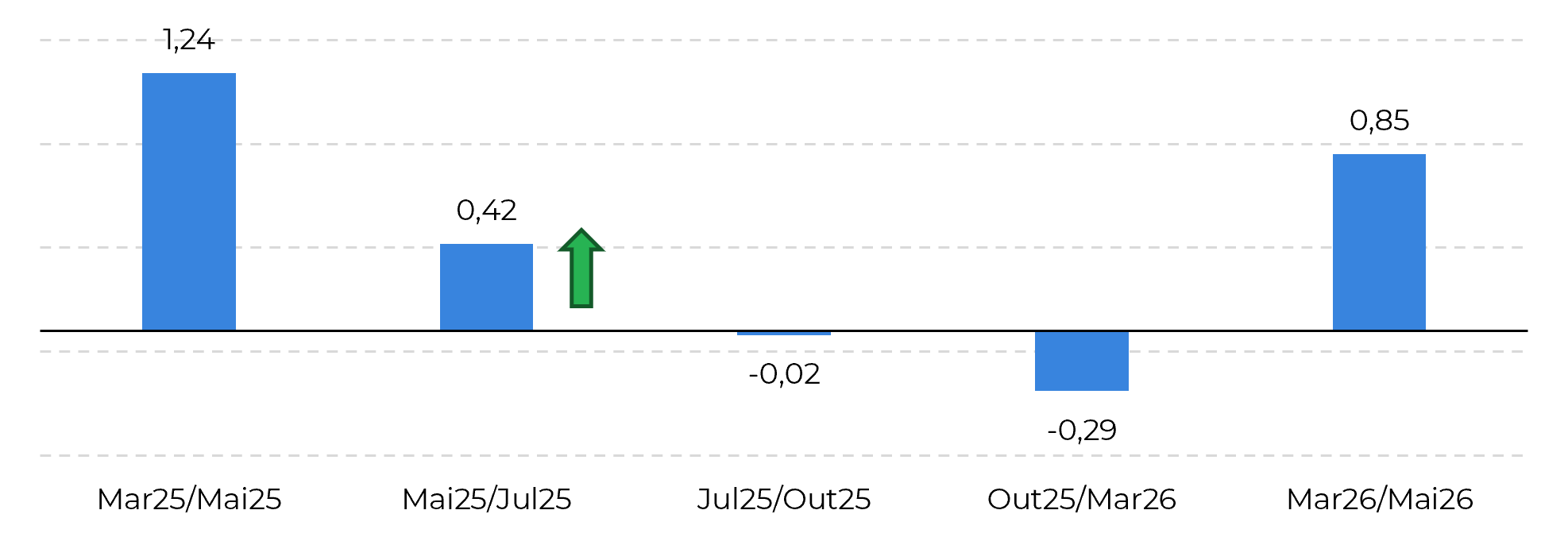

When should this switch start happening? It's hard to pinpoint, but it wouldn't be surprising to see a bullish trend affecting K/N spreads after the H/K expiry. The new availability from Brazil is likely to impact the June and October contracts more intensely.

Image 3: Current Spread Structure

Source: Refinitiv, Hedgepoint

In the long term: the Brazilian export pace and the development of the Northern Hemisphere's 25/26 crop will be crucial. If, by June, Brazilian availability flows as expected and the Northern Hemisphere continues its recovery track, the bearish trend could gain further strength.

Image 4: Key Market Parities

Source: Refinitiv; Bloomberg; Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.