Tariffs and ethanol trade flow

"Ethanol trade between the US and Brazil is heavily influenced by the cost of logistics and arbitrage in the North and Northeast regions, with tariffs of 2.5% and 18% applied by the US and Brazil, respectively. If Brazil were to stop exporting to the US, the impact on the Brazilian domestic market would be minimal, with the main downward trend in the sector being related to the greater availability of raw materials and timid growth in demand for energy."

Tariffs and ethanol trade flow

- Ethanol trade between the US and Brazil is heavily influenced by arbitrage, with the price differential in the North and Northeast of Brazil potentially favoring either exports or imports of biofuel, due to the lack of significant ethanol production in the region and the weight of logistics.

- Currently, the US applies a 2.5% tariff on Brazilian ethanol, while Brazil imposes an 18% tariff on American ethanol. Discussions on "reciprocal" tariffs are complicated by US protectionism in relation to other agricultural commodities, such as sugar.

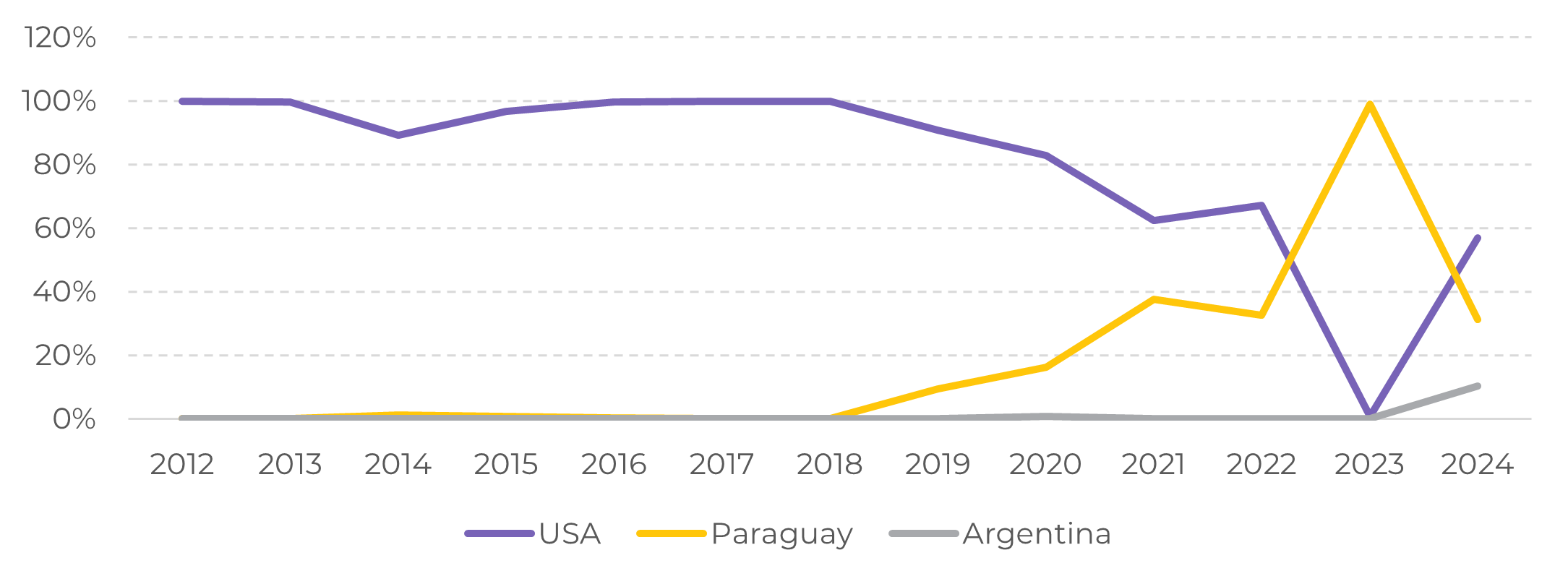

- In 2024, Brazil exported around 1.9 billion liters of ethanol, of which only 313 million liters went to the US. At the same time, Brazil imported 110 million liters from the US, resulting in a positive balance for Brazil between exports and imports.

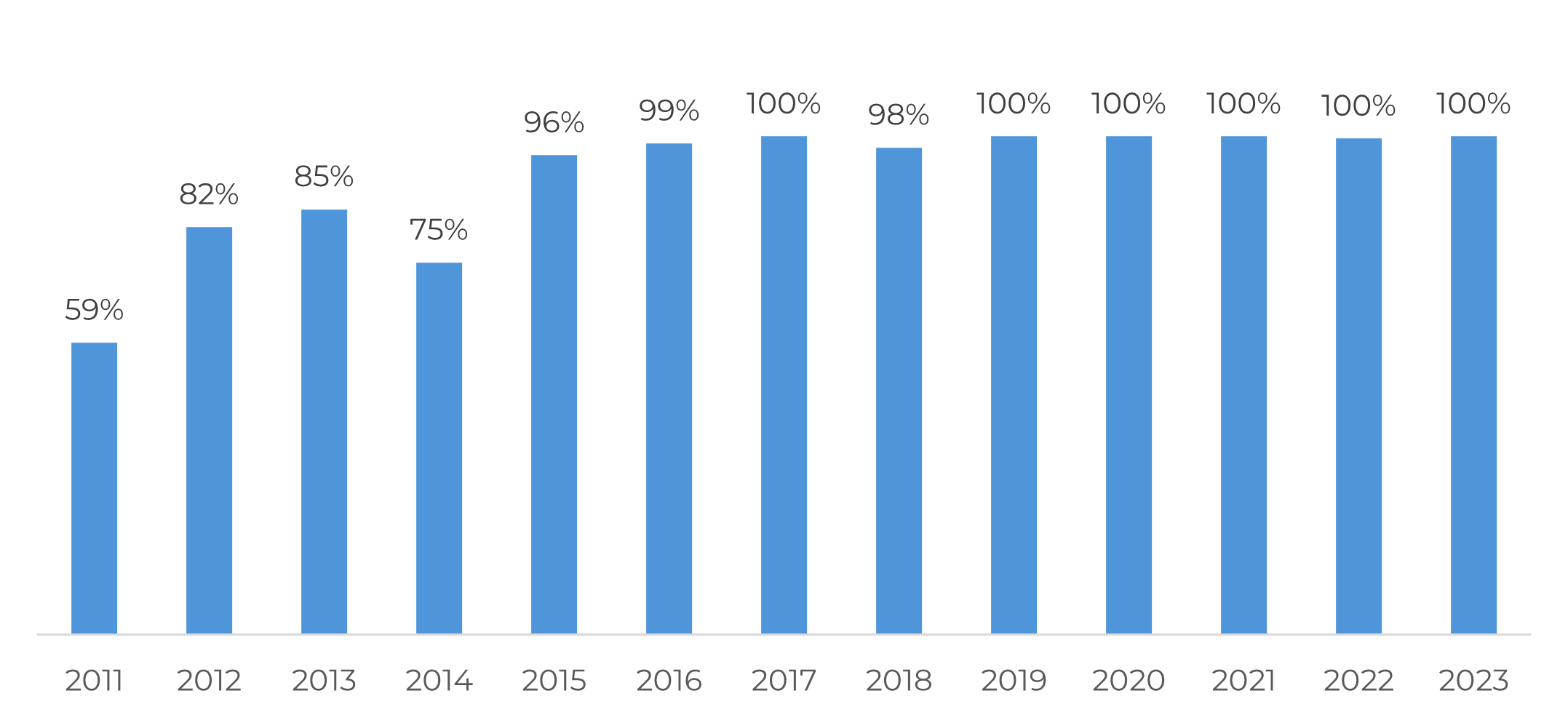

- The US has a significant dependence on imports of Brazilian ethanol, with an average of 380 million liters per year over the last five years. The US imports more ethanol from Brazil than exports.

- If Brazil stops exporting to the US, the impact on the Brazilian domestic market would be minimal, with less than 1% more production being injected. The main bearish trend for the Brazilian biofuel market is related to the greater availability of raw materials, timid growth in demand for energy and the absence of expected stock problems.

The ethanol trade between the US and Brazil is strongly linked to arbitrage. Depending on the corn harvest in the US and, above all, the sugar cane crop in Brazil, the price differential in the Northeast can favor either the export or import of biofuel. As this region does not have significant ethanol production, logistics end up being a decisive factor in the process.

Currently, the US applies a 2.5% tariff on Brazilian ethanol, while Brazil imposes an 18% tariff on American ethanol. Although the adoption of "reciprocal" tariffs is being discussed, it is important to remember that the US adopts a very protectionist stance towards other agricultural commodities, especially sugar. The country not only imports sugar from Brazil through quotas but also applies an 80% tax on any volume outside the import quota. For this reason, Brazil's sugar-energy sector and the federal government have taken a stand against Trump's proposal.

In addition to international political discussions, it is important to note that changes in trade flows between countries seem to penalize the US more than Brazil.

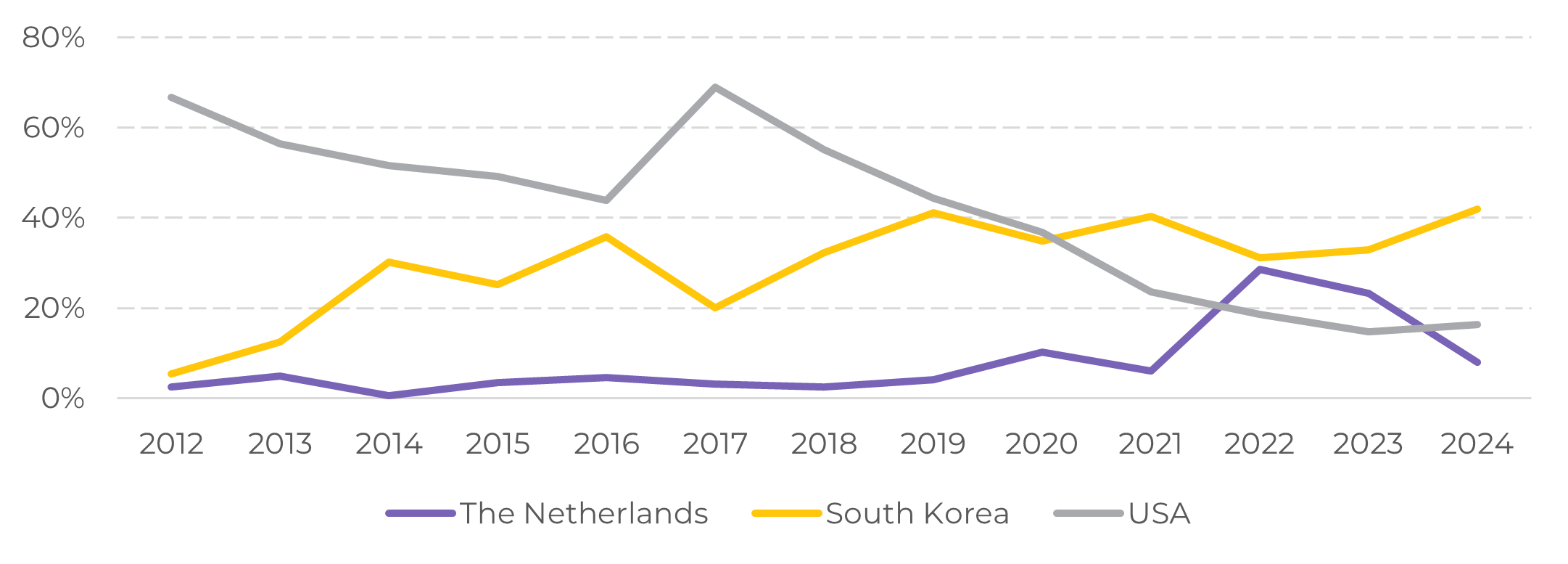

Let's take the year 2024 as an example. During that year, the Center-South of Brazil produced around 34.6 billion liters of ethanol, and considering an estimated 2 billion liters produced in the North/Northeast, the total came to 36.6 billion liters. Of this, approximately 5.4% was exported, or around 1.9 billion liters. According to SECEX data, the USA received only 313 million liters - just 1% of the total produced and 16.3% of what was exported. Although the US is the second largest trading partner for biofuels, the country's share of Brazilian exports has been declining, falling below 20% in the last three years and losing ground to countries like South Korea and the Netherlands.

Image 1: Share of Brazil's total ethanol exports (%)

Source: SECEX, Hedgepoint

Image 2: Share of Brazil's total ethanol imports (%)

Source: SECEX, Hedgepoint

Image 3: Brazil's Share of American Fuel Ethanol Imports

Source: Source: EIA, Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

carolina.franca@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.