Sugar steadiness: waiting for demand to react

"The commodity market has been volatile due to the US-China trade war, but sugar has remained relatively unaffected, with price effects being indirect, such as through the dollar index. Central America's larger-than-expected participation in the March contract delivery eased short-term supply concerns, with the May contract failing to recover to March’s level. China’s sugar production increased significantly, while India’s exports faces challenges due to closed export parity. The Center-South region of Brazil had lower rainfall, but soil moisture improved, leading to a better outlook for the cane’s development compared to the previous season."

Sugar steadiness: waiting for demand to react

- Sugar prices are indirectly affected by the US-China trade war, responding more to its own fundamentals as it not significant traded by the involved countries.

- Central America’s higher-than-expected participation in the March delivery eased short-term supply concerns, restraining May contract prices.

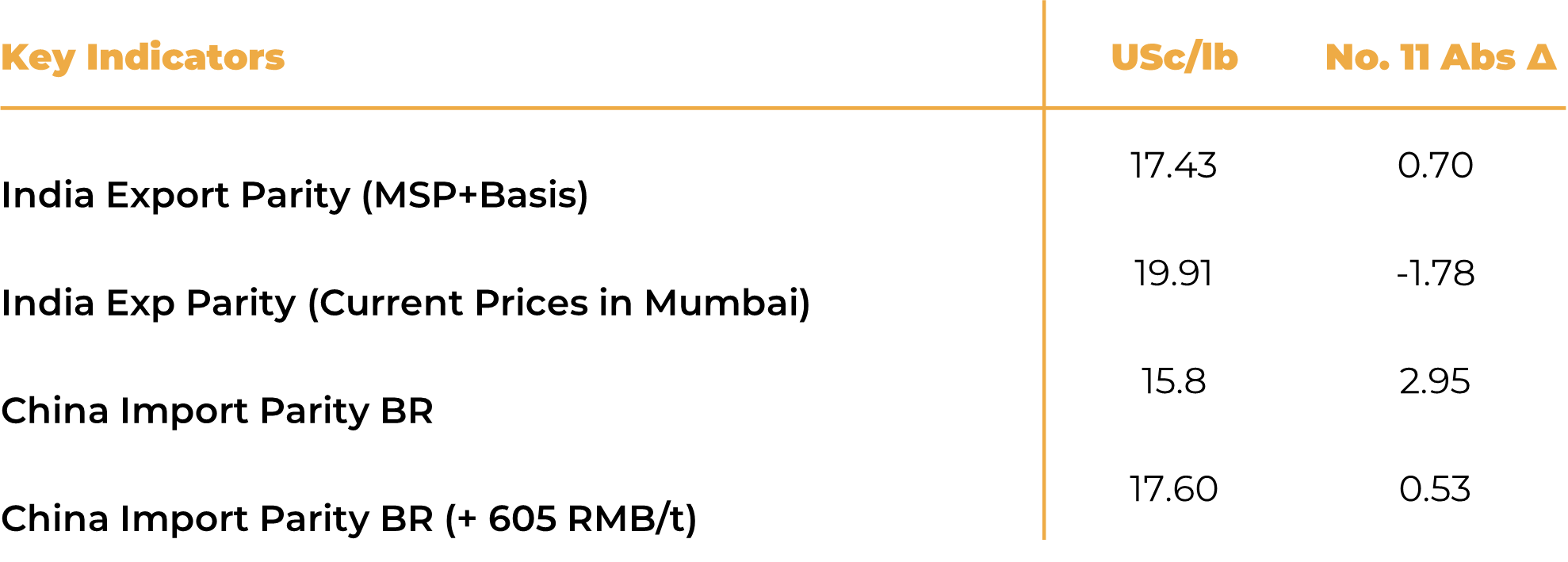

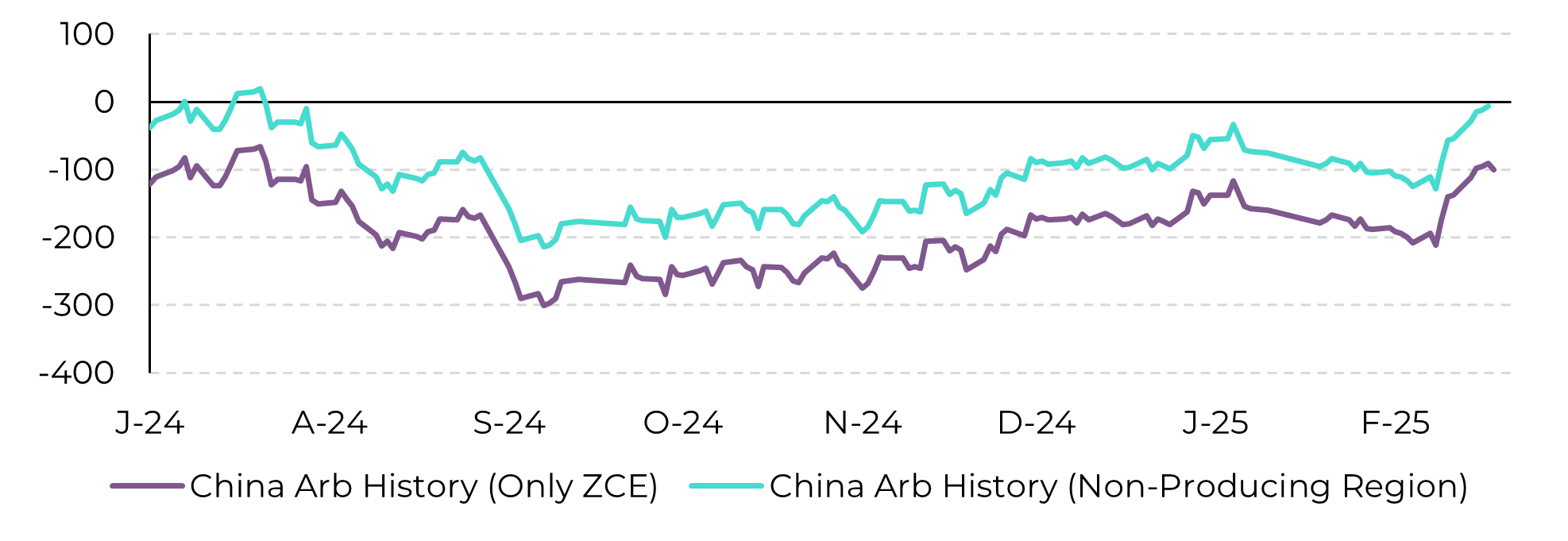

- China’s sugar production increased to 9.7 million tons so far, with lower imports expected.

- India exported 250kt of sugar, but new sales could suffer due to the closed export parity.

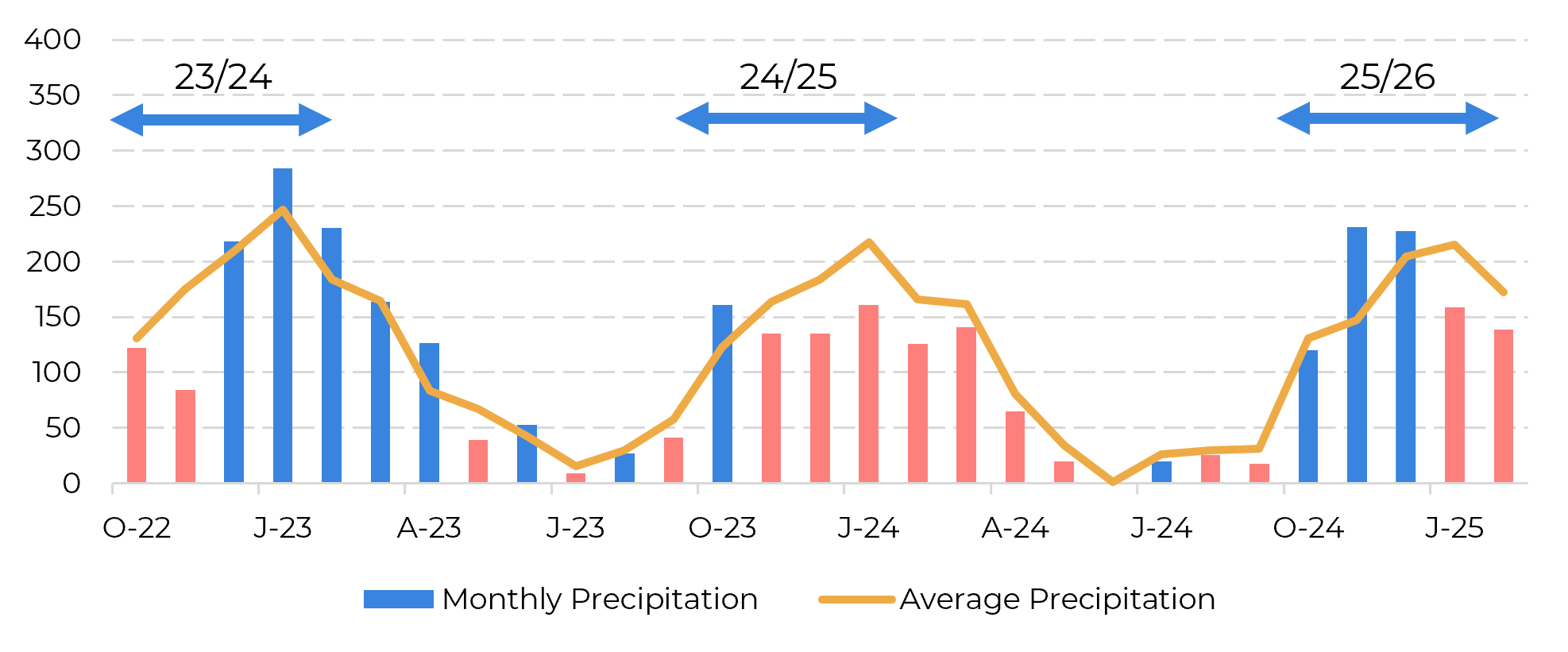

- Brazil's Center-South region had lower rainfall, but soil moisture improved compared to the same period in 2024, leading to a better outlook.

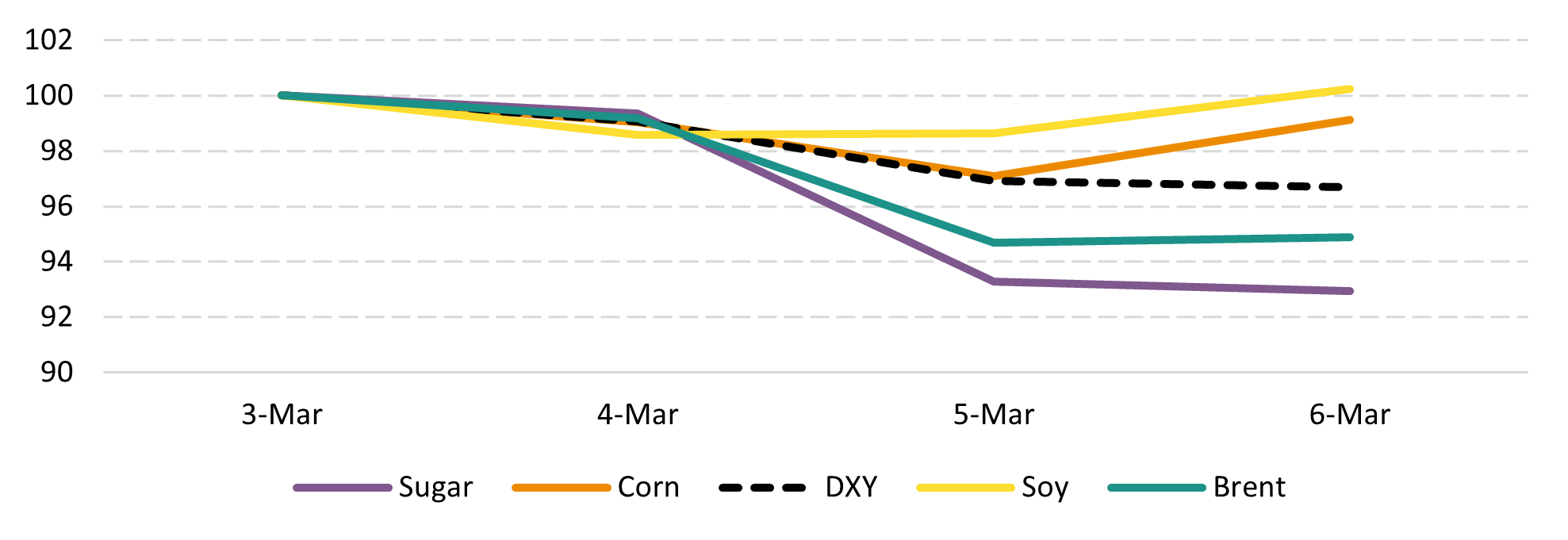

The commodity market has had a volatile week, largely due to the ongoing US and Chinese trade war, with China announcing its retaliatory tariffs. However, it's worth noting that sugar has remained relatively unaffected compared to the grains complex. It's widely known that sugar isn't a significant, or even traded, commodity between the two conflicting countries. Consequently, any price effects it experiences during these discussions are likely to be indirect, such as through the dollar index. In the end, most of the sweetener’s price adjustments have been attributed to the robust March contract delivery.

Image 1: Commodities prices variation index (Mar 03=100)

Source: Refinitiv, Hedgepoint

Image 2: Sugar Market Indicators

Source: Bloomberg, Refinitiv, Hedgepoint

Image 3: Chinese Historical Arbitrage (USD/t)

Source: Bloomberg, Refinitiv, Hedgepoint

Image 4: Precipitation versus crop development window (mm)

Source: Unica, Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

To access this report, you need to be a subscriber.

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.