US tariffs impacts on sugar are mostly indirect

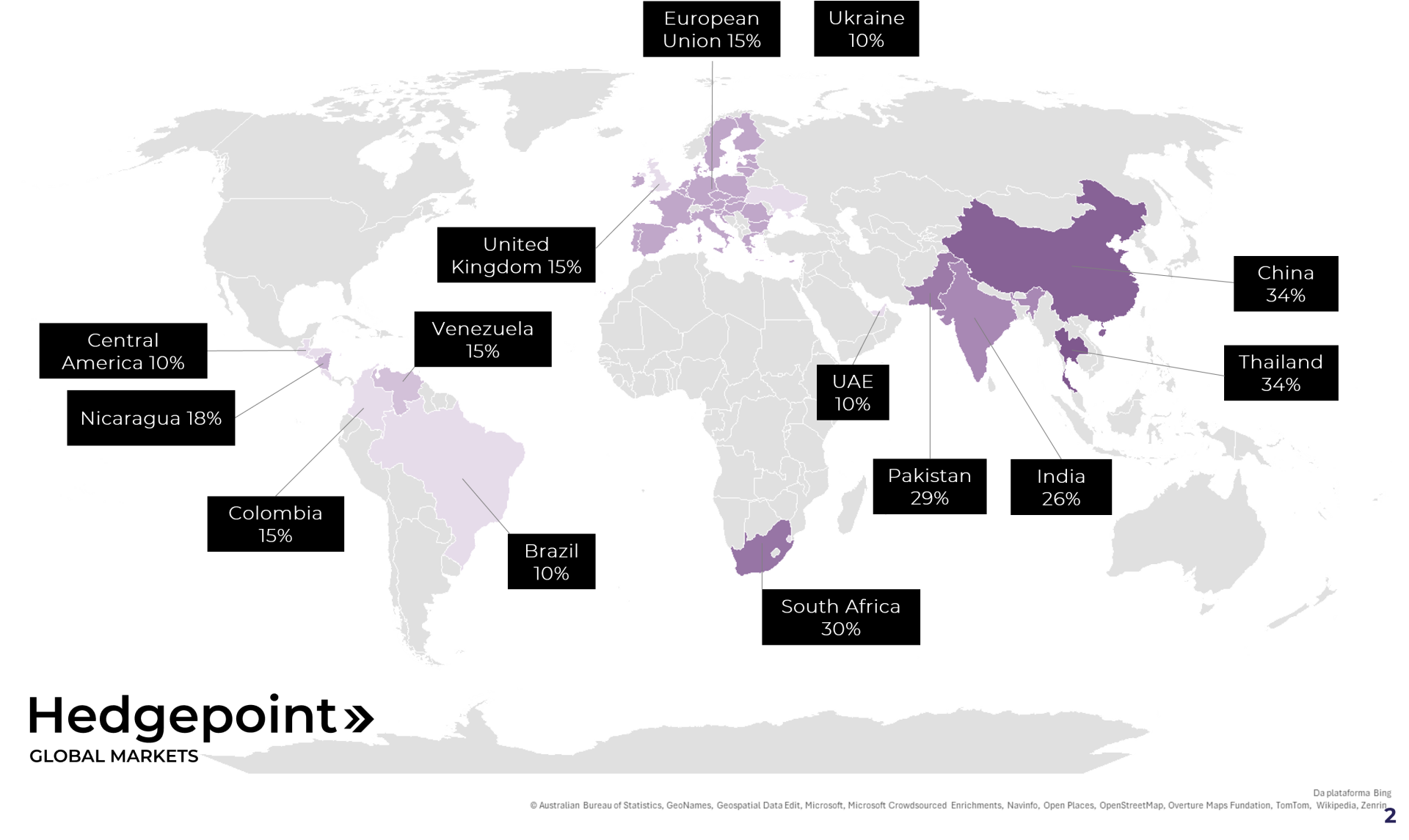

"Last week was marked by the anticipation and aftermath of Trump's "Liberation Day." Market expectations regarding the US tariff announcement disrupted the support sugar prices received from India’s poor March. The new tariffs had minimal impact on sugar trade flow, with Canada and Mexico exempt and TRQ quotas expected to start paying new duties – although the latter remains rather uncertain as the program was not explicitly mentioned. Concerns about a potential US recession and higher inflation are pressuring the dollar, boosting other currencies' purchasing power. "

US tariffs impacts on sugar are indirect

- Last week was dominated by the anticipation and aftermath of Trump's "Liberation Day"

- Market expectations regarding the US tariff announcement disrupted the support sugar found on poor March crushing figures from India, leading to higher volatility, and causing sugar prices to drop nearly 2.5% by Thursday.

- By the end of Friday, sugar closed at 18.84c/lb, with a strong support level coming from Chinese import arbitrage.

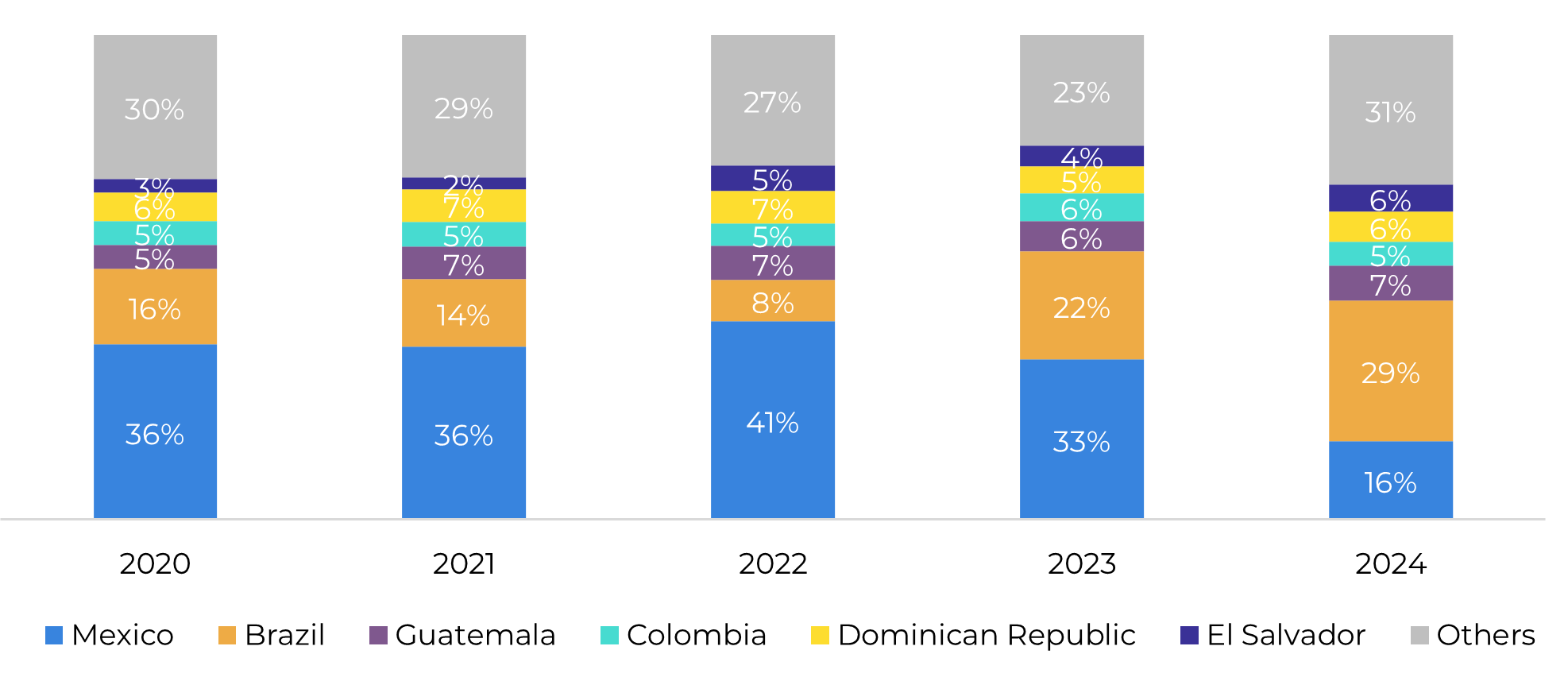

- The new tariffs had minimal impact on sugar trade flow, with Canada and Mexico exempt and TRQ quotas expected to start paying new duties, boosting Mexico's advantage.

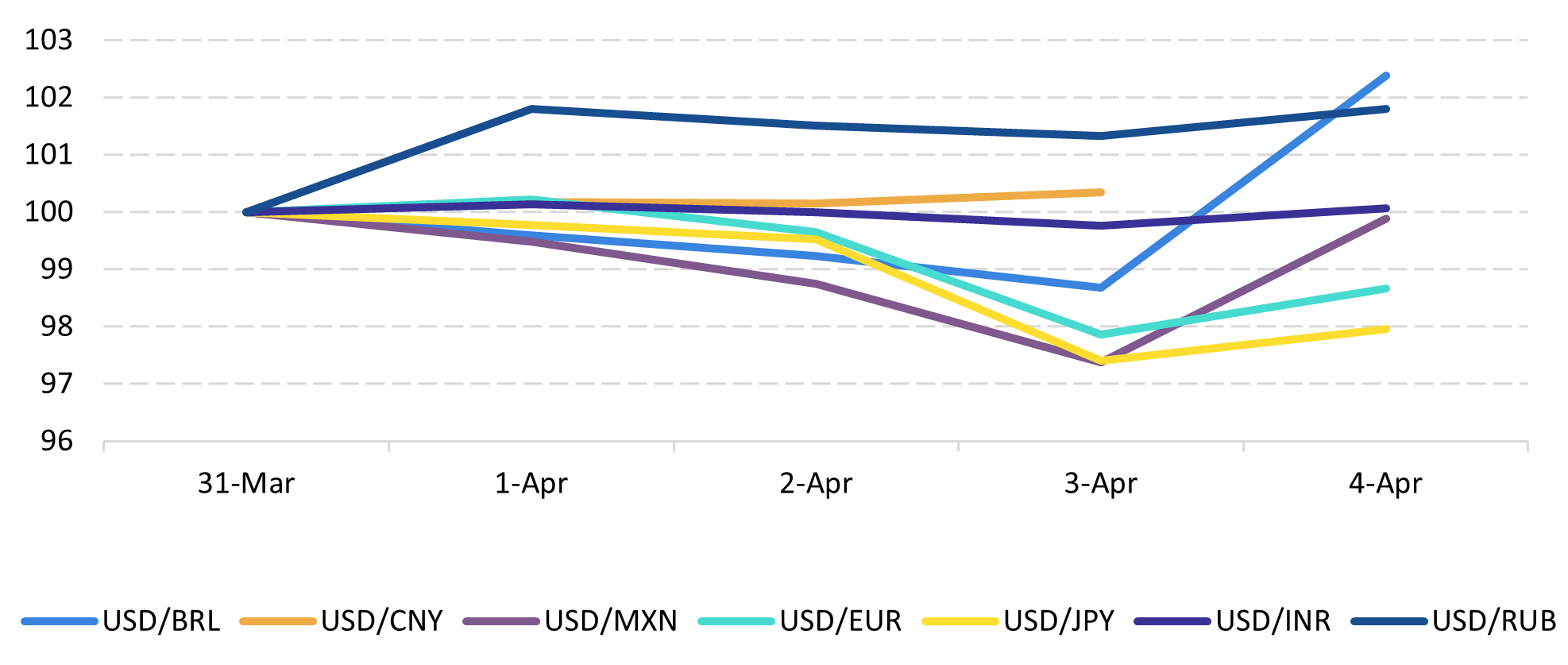

- Concerns about a potential US recession and higher inflation are pressuring the dollar, boosting other currencies' purchasing power, while the new Brazilian crop is approaching, promising to ease short-term availability pressure and limit price increases.

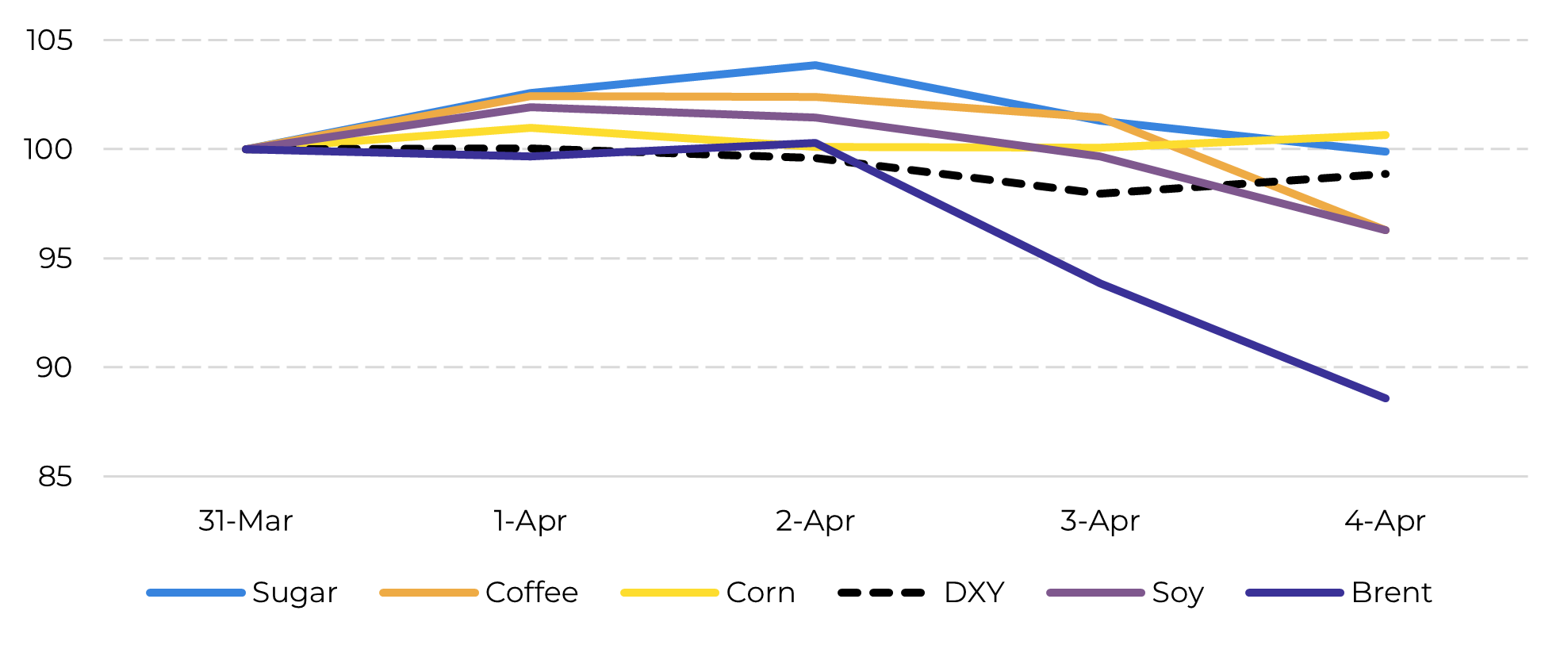

Last week was all about the anticipation and aftermath of Trump's "Liberation Day“. Traders were cautious, and we saw a modest recovery in sugar prices on Tuesday after India's sluggish March crushing results. However, this support was disrupted by market expectations regarding the US tariff announcement, leading to greater volatility in the markets that were still open on Wednesday, such as the energy and currency markets, and impacting sugar prices on Thursday.

By the end of Thursday, crude oil had dropped over 7%, accompanied by a downward trend in the US dollar and global equities. The BRL and other currencies appreciated compared to the dollar index, while sugar took a significant hit, dropping nearly 2.5% during the session. By the end of Friday, sugar closed at 18.84c/lb. It's important to note that sugar has a strong support level due to Chinese import arbitrage. As prices approached 18.7 c/lb, there might have been some import arbitrage opening in non-producing regions, aiding sugar not to fall further.

Image 1: Commodities Weekly Variation Index ( Mar 31 = 100)

Source: Refinitiv, Hedgepoint

Image 2: Usually Mexico Acconts for Most of US imports

Source: U.S. Department of Commerce

Image 3: Currencies Weekly Variation Index ( Mar 31 = 100)

Source: Refinitiv, Hedgepoint

Image 4: US: New Tarrifs – Sugar Market

Source: Refinitiv, Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.