Challenges and opportunities for sugar prices

"Prices are currently influenced by China’s import arbitrage and ethanol parity. While demand has been slower, especially from China, other countries like Bangladesh, Malaysia, and Algeria have increased their demand for Brazilian sugar since October 2024 – meaning that maybe the supply side, or even macro, have weighted more on the current price level. Macroeconomic relief and rumors of a smaller harvest in the Center-South of Brazil are the main factors for short-term price-recovery."

Challenges and opportunities for sugar prices

- Positive outlook for Center-South’s 25/26 crop and resumed vessel nominations contribute to the current bearish trend.

- International market's reliance on Brazil adds to price volatility; any downturn in Brazil’s availability could trigger a rapid price recovery.

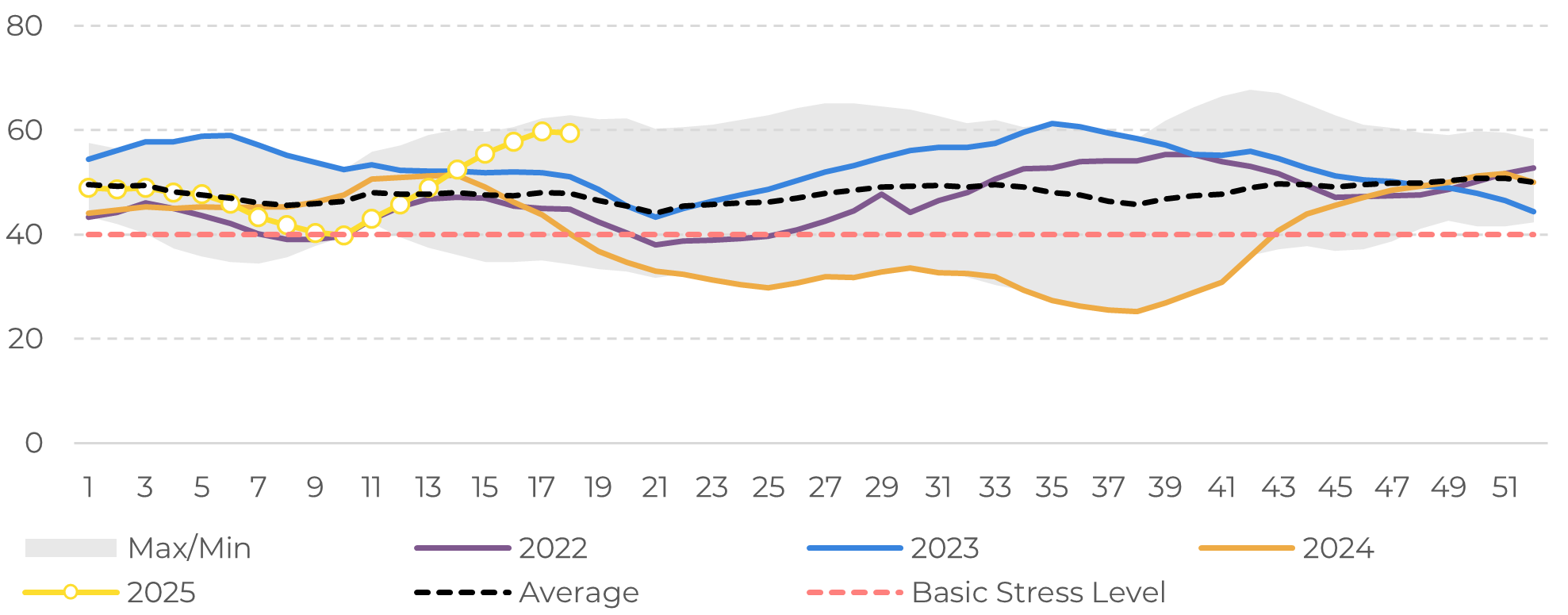

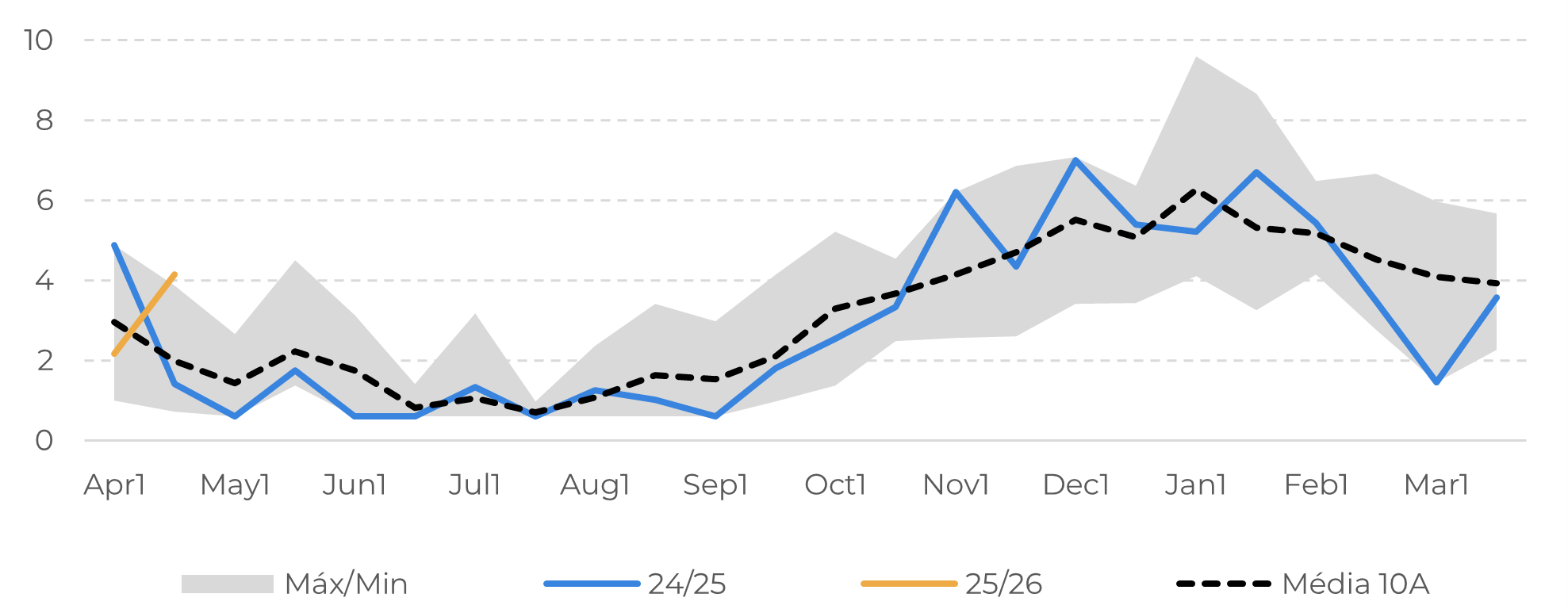

- April rains benefited mid-to-end-of-season cane yields in Center-South, but lost days in late April may impact crushing figures, potentially aiding July’s prices in the coming days.

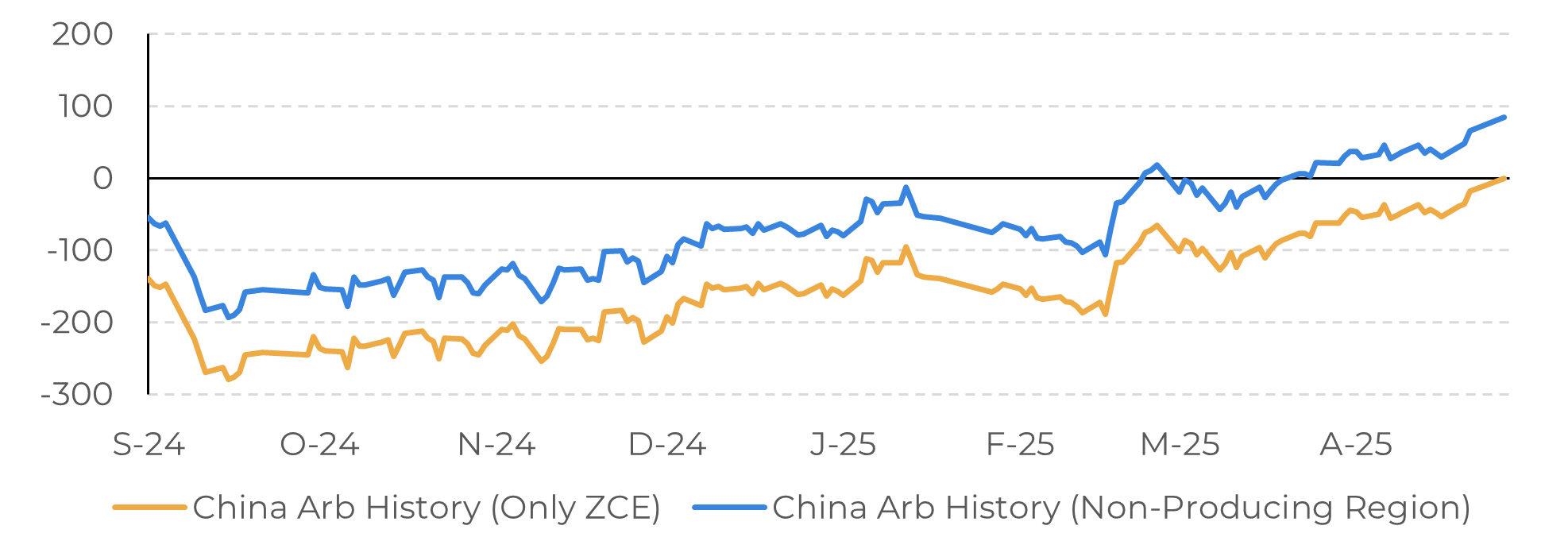

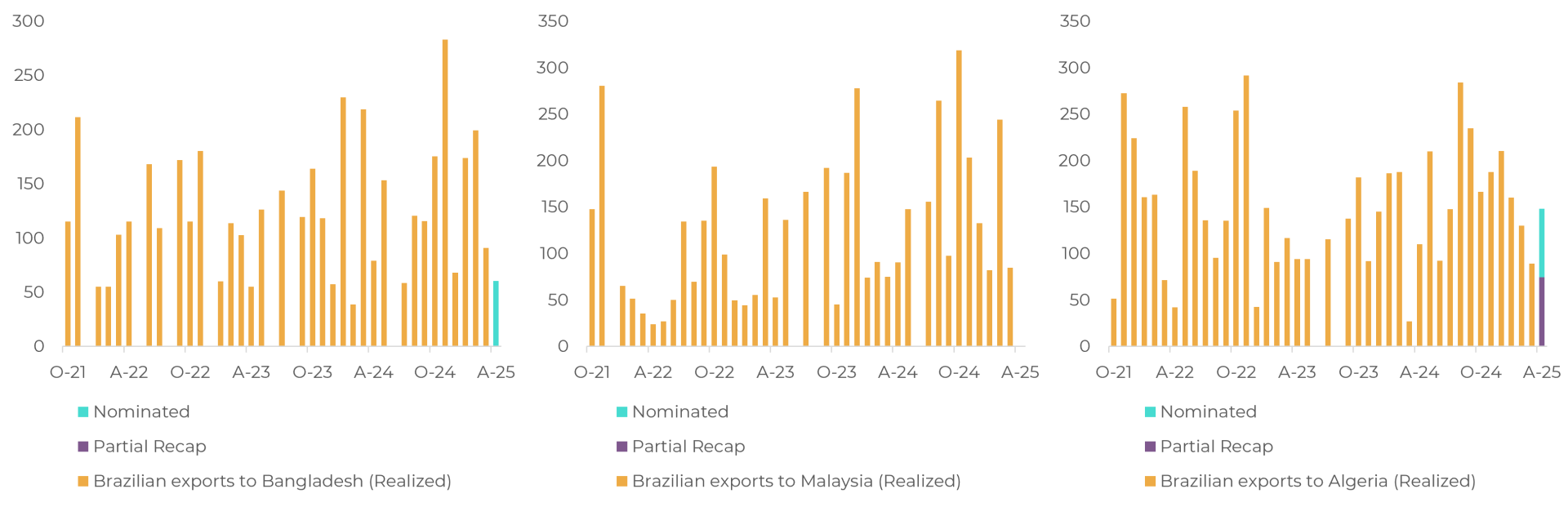

- Prices are influenced by China’s import arbitrage and ethanol parity. Demand from China has slowed, but Bangladesh, Malaysia, and Algeria have increased their demand for Brazilian sugar since October 2024.

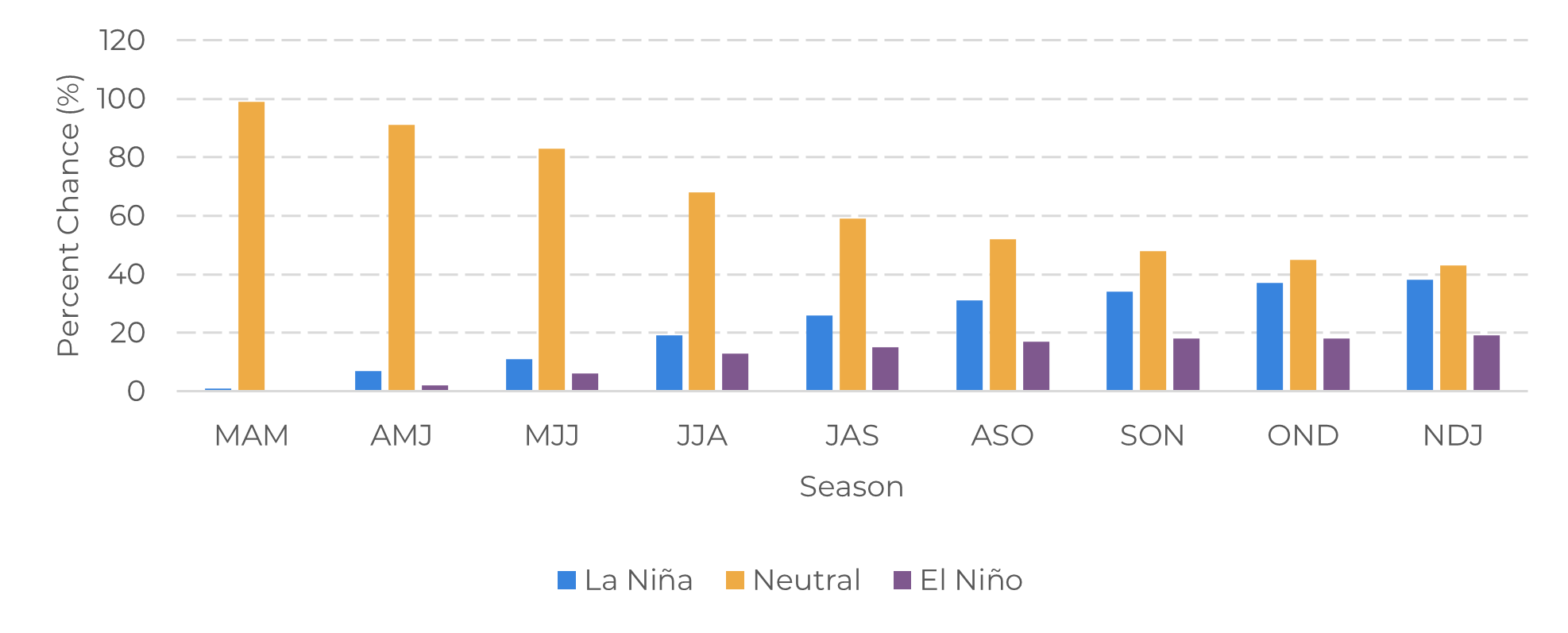

- Future prices will depend on weather conditions in Center-South, Europe, and India, besides the potential impact of a late La Niña on Mexico and Thailand.

Since the May expiry, the raw sugar July contract has encountered resistance in its recovery, reaching values as low as 16.97 cents per pound, a level not seen in the past four years. The higher-than-expected Brazilian deliveries in March and May are likely the primary factors behind this resistance, coupled with a shier purchasing behavior coming from the main importer, China. Additionally, the positive outlook for the CS 25/26 prospects contributes to a bearish trend, especially as the country resumes its vessel nomination pace, after a restricted April. As highlighted in other analysis, the increasing dependence of the international market on Brazil's availability adds to price volatility: any discrepancies between expected and actual figures can lead to more intense price fluctuations than what it usually meant in the past.

Image 1: Weekly Vegetation Health Index – Center-South

Source: NOAA, Hedgepoint

Image 2: Estimated Lost Days per Fortnight – No. Of Days

Source: Bloomberg, Hedgepoint

- China Import Arbitrage: The arbitrage is currently open for non-producing regions and was briefly open for producing regions, remaining close to this support level. The country is expected to import at least another 2 million tons during 24/25, so it would not be surprising to see buying rumors emerging from the region. In fact, it would be unusual if no movement is observed. This could indicate that Chinese importers are waiting for even better prices – if possible. However, weather conditions have not been favorable for the country’s 25/26 crop development. Although the 24/25 crop is expected to exceed 11 million tonnes, a recent record, China might face a precarious situation if Guangxi yields deteriorate in the coming year.

- Ethanol Parity: While sugar continues to pay a premium over ethanol and mix changes are viewed with skepticism, key supports that were higher than the biofuel level have been tested. This may place a cap on the rise of the sugar mix during the season, supporting our 51% estimate – especially if demand for fuel is higher than anticipated. This trend is worth monitoring.

Image 3: China Import Arbitrage Estimate (USD/t)

Source: Bloomberg, Refinitiv, Hedgepoint

Image 4: Brazilian Exports and Nominations to Bangladesh (left), Malaysia (center) and Algeria (right) until April 30 (‘000t)

Source: Williams, Hedgepoint

Image 5: Official NOAA CPC ENSO Probabilities (April 2025)

Source: NOAA, Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

To access this report, you need to be a subscriber.

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.