A sluggish start, but a bearish sentiment

"Last week, the sugar market experienced a mix of stability and volatility. While macroeconomic optimism from U.S.–China tariff reductions initially penalized the sweetener, sugar prices were supported early in the week. UNICA’s April data revealed weaker crushing due to weather-related disruptions, briefly lifting prices. However, bearish sentiment returned during Sugar Week, reinforced by Thailand’s B-quota tender and expectations of a surplus year. As the new week begins, attention turns to the upcoming UNICA report for May, which could offer clearer signals on the crop’s trajectory."

A sluggish start, but a bearish sentiment

- Sugar prices dipped on Monday following a stronger dollar and broader commodity corrections after U.S.–China tariff easing.

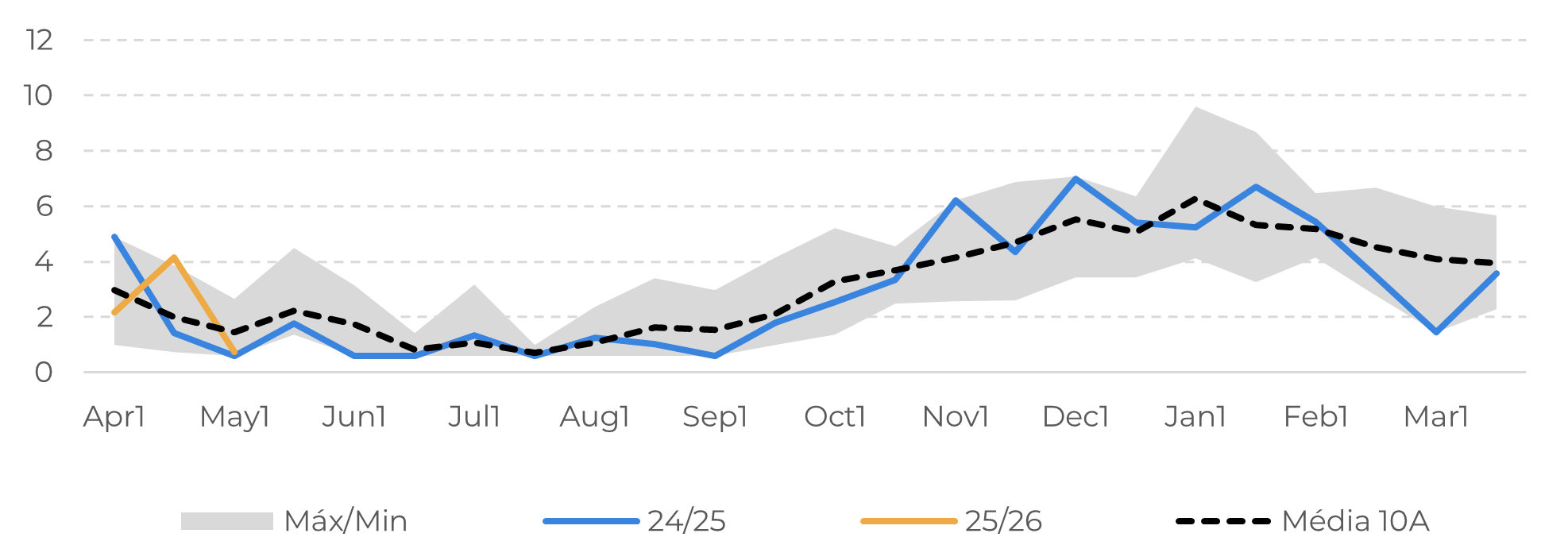

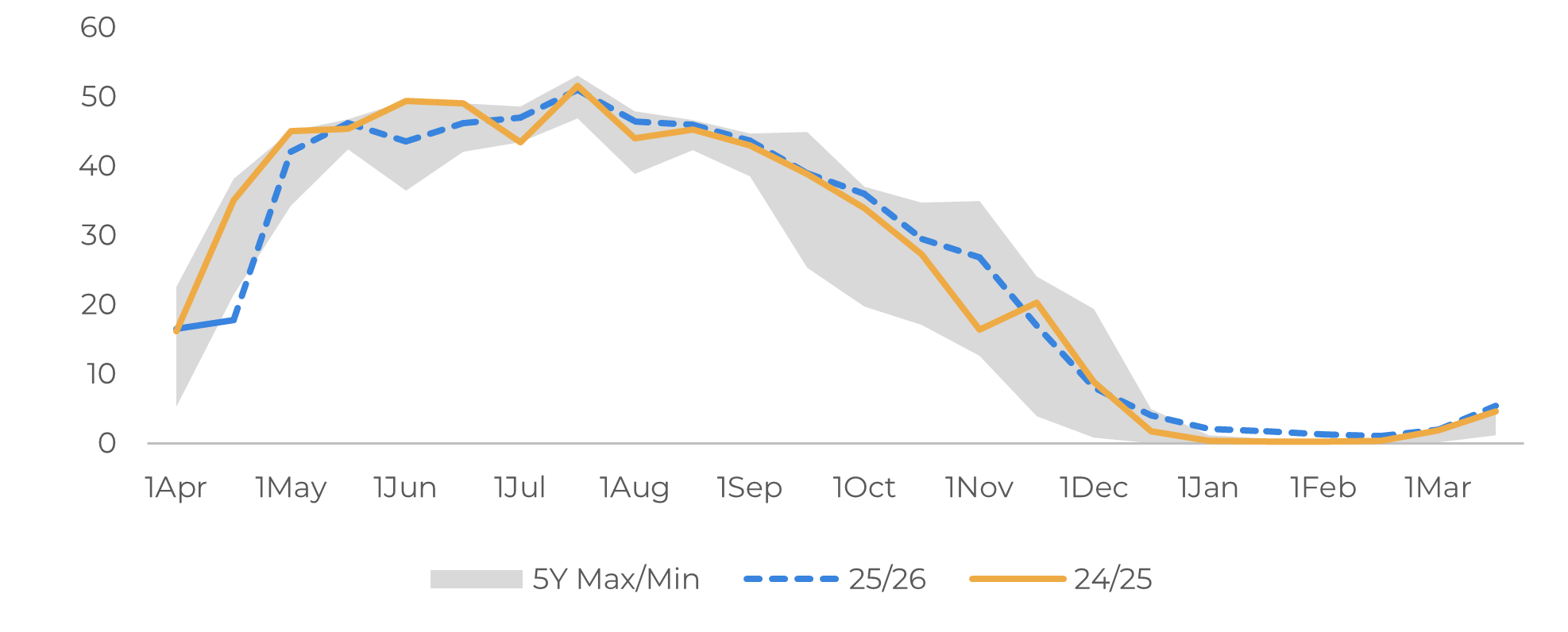

- Center-South’s data showed disrupted cane crushing and poorer yields, pushing raw sugar prices up nearly 3% on Tuesday (13).

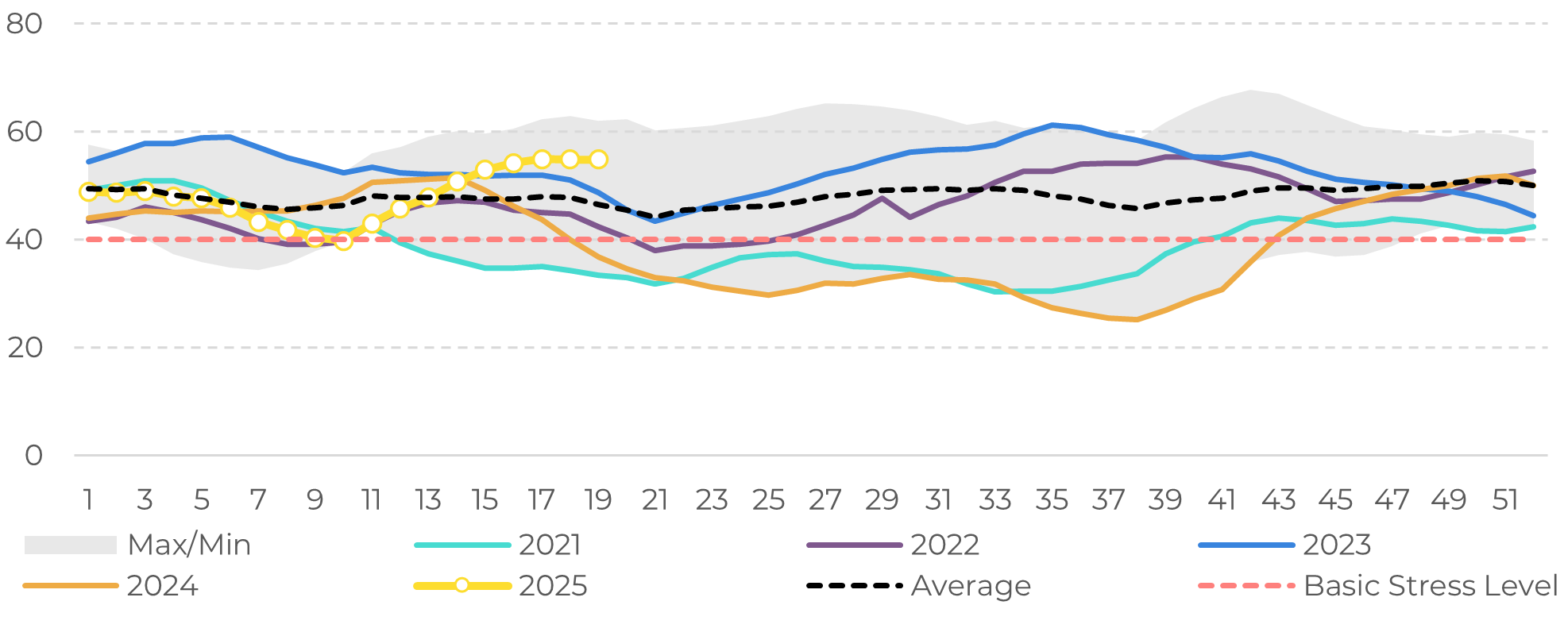

- Despite short-term supply concerns, market consensus leans toward a surplus year in 25/26, pushed by a healthy participation from Center-South, weighing on prices.

- Completion of the 2024/25 Thailand’s B-quota tender could be ambiguous. While its success points to existing demand, Thai producers might have ceased to expect better selling prices.

- The next UNICA report for May’s first half is critical, with early signs pointing to little rain disruptions and a potential better result compared to April’s second fortnight.

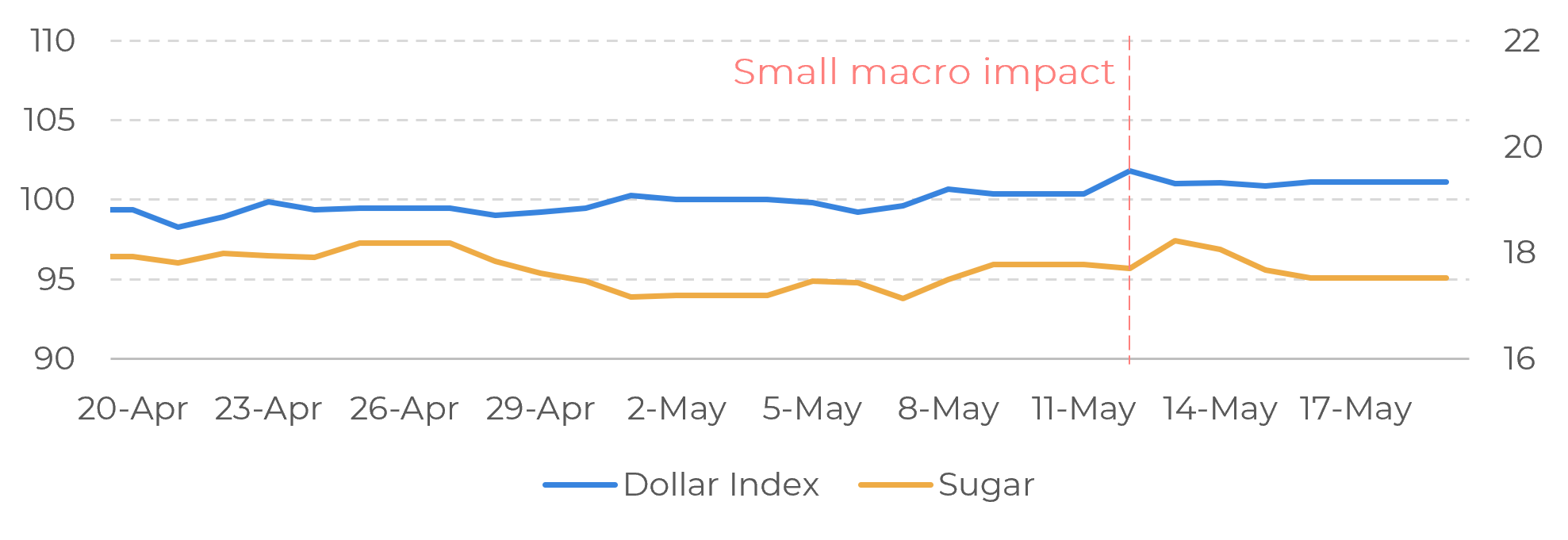

Last week, the market experienced a period of relative stability, largely influenced by trader’s widespread participation in events held in New York. On the macroeconomic front, optimism returned as U.S.-China negotiations over the weekend led to a 90-day tariff reduction agreement. The U.S. committed to lowering tariffs on Chinese imports from 145% to 30%, while China reciprocated by cutting its levies from 125% to 10%. This diplomatic breakthrough strengthened the dollar index, triggering a wave of corrections across commodity markets — and sugar was no exception, giving back some of its previous gains yet on Monday (12).

Image 1: Dollar Index vs Sugar (c/lb)

Source: Refiniv, Hedgepoint

Image 2: Estimated Lost Days of Crushing per Fortnight (No. of Days)

Source: Bloomberg, Hedgepoint

Image 3: Weekly Vegetation Health Index in CS Cane Areas

Source: NOAA, Hedgepoint

Image 4: Expected Cane Crushing Curve (Mt)

Source: UNICA, Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.