The Northern Hemisphere adds to price resistance

"Sugar fundamentals have remained steady, with Brazil’s Center-South region showing signs of healthy output despite a slow start to the 25/26 season and lower early yields due to early-development conditions. Market sentiment remains muted, as sugar prices lack support from fresh news and are instead influenced by macroeconomic factors."

The Northern Hemisphere adds to price resistance

- Sugar prices remain subdued due to a lack of fresh fundamentals, with recent movements driven more by macroeconomic factors than supply-demand shifts.

- Despite a slow start to the 25/26 season, Brazil’s Center-South is still expected to be a healthy one, with currently lower yields attributed to adverse early-development conditions.

- A favorable crop outlook in the Northern Hemisphere is shifting attention away from Brazil and may further delay any price recovery.

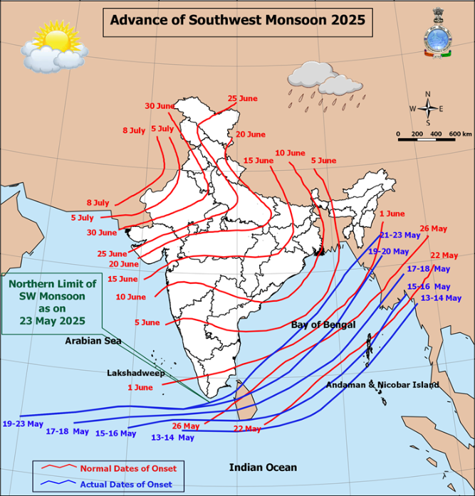

- Indian production is expected to fall sharply in 24/25 due to reduced acreage and poor weather, but a recovery is likely in 25/26 if monsoon conditions remain supportive.

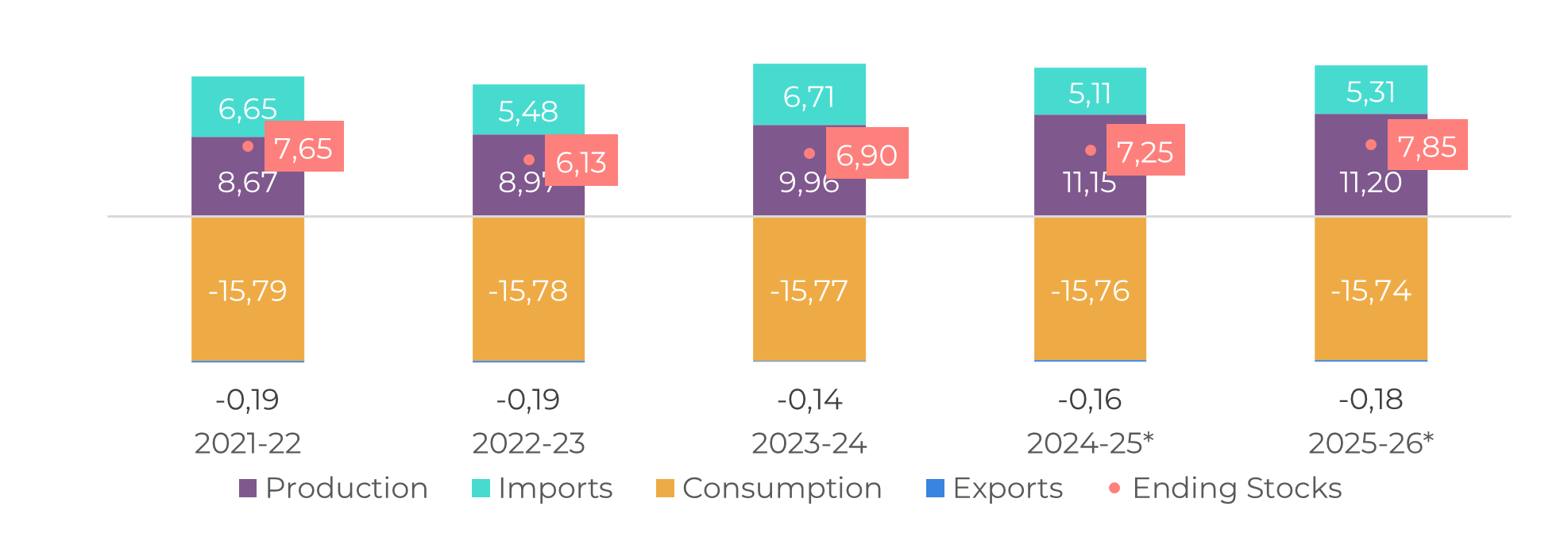

- Thailand’s outlook is cautiously optimistic, while China continues to support domestic production and selectively imports only at attractive price levels.

Sugar fundamentals have remained relatively stable in recent weeks. Although the Brazilian Center-South region experienced a slow start to the 25/26 season, indicators such as the Vegetation Health Index suggest another year of healthy output. While current yield figures are reported to be below last year’s levels, it’s important to consider that the 24/25 crop first results included a significant volume of leftover cane from the exceptionally strong 23/24 harvest. Additionally, the cane currently being harvested is from fields that were most affected by adverse conditions in 2024, making lower-yields expected.

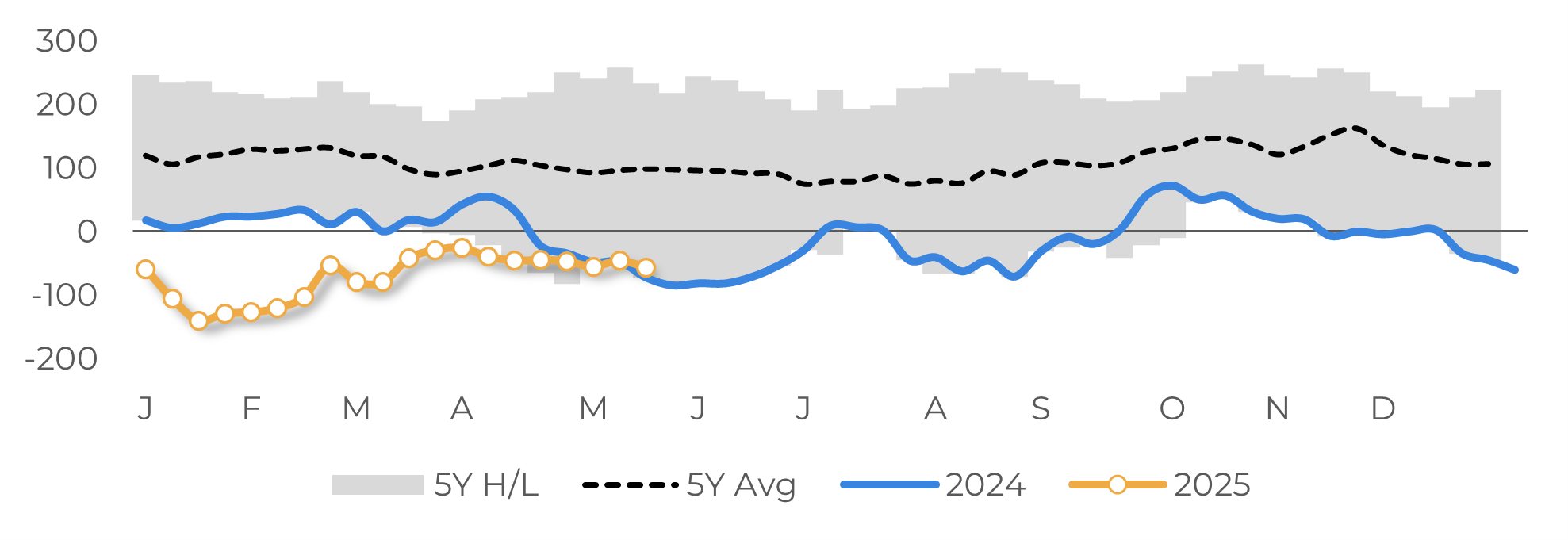

While the Market waits for further developments in the biggest exporter, sugar prices have failed to react in the lack of supporting news . Funds have maintained short and stable positions, and recent price movements have been largely influenced by macroeconomic factors. For example, the spike observed last Wednesday was driven by a dollar index correction, rather than any new sugar-specific developments.

Image 1: Raw Sugar Net Speculative Positioning (‘000 lots)

Source: CFTC, Hedgepoint

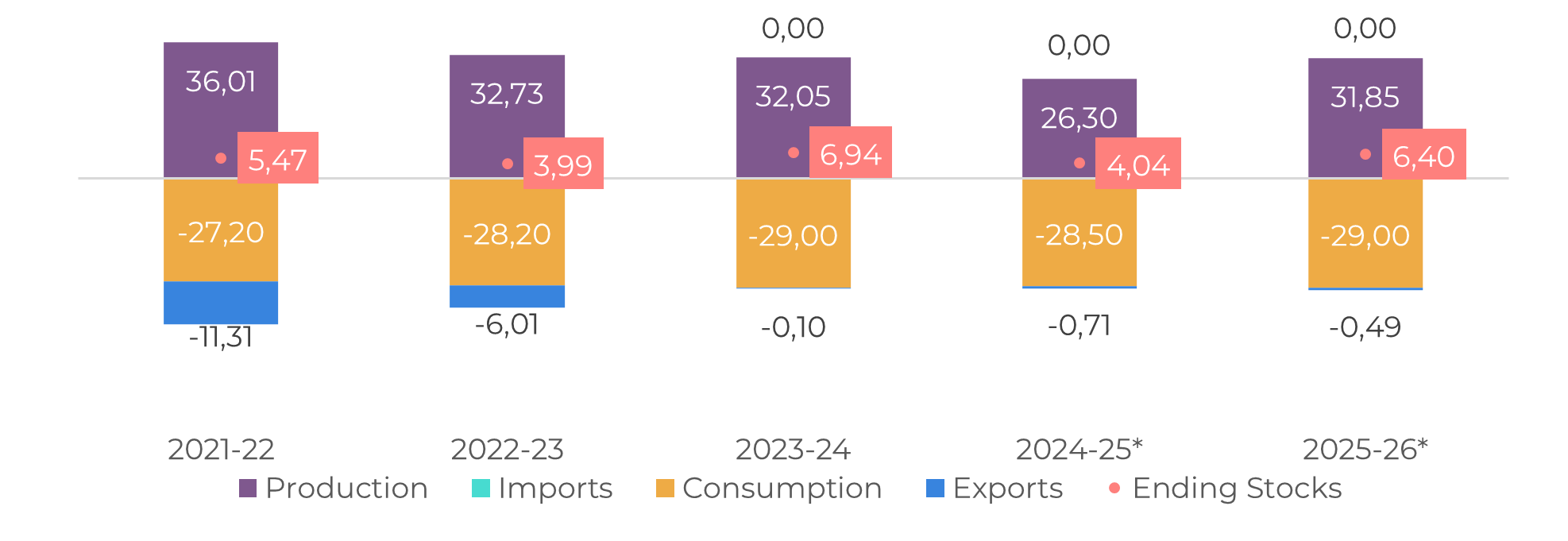

Regarding India, the Indian Sugar Mills Association (ISMA) recently projected sugar production for the 24/25 season at 26.1–26.2 million tons, marking a sharp decline from the previous season. This drop is primarily attributed to reduced acreage and adverse weather conditions in key producing states like Maharashtra and Karnataka and has already been heavily discussed. On the demand side, contrary to the typical annual growth trend, domestic consumption is expected to contract this season. This shift has already begun to influence domestic sugar prices and has contributed to higher-than-expected closing stock estimates, given the supply poor results.

Image 2: Sugar Balance - India (Mt Oct-Sep)

Source: ISMA, AISTA, ChiniMandi, NFCSF, Hedgepoint

Image 3: Advance of the South-West Monsoon in India

Source: India Meteorological Department

Image 4: Sugar Balance - China (Mt Oct-Sep)

Source: GSMN, CSA, YNTW, Refinitiv, Greenpool, Hedgepoint. Obs: stocks also account for bonded warehouses volume.

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.