Bearish Drivers Dominate Amid Global Supply Strength

"The sugar market remained under pressure last week, with prices falling over 3% to 16.49 c/lb, levels not seen since mid-2021. A key trigger was Petrobras’ gasoline price cut, which lowered ethanol’s price ceiling due to energy parity, weakening its competitiveness against sugar. May exports were slightly above average at 2.25 Mt, with expectations of stronger volumes in June. While China remains selectively active, demand from Algeria, Indonesia, and Bangladesh has declined. In Asia, surplus expectations from India and continued Thai exports are adding to global supply pressure."

Bearish Drivers Dominate Amid Global Supply Strength

- Raw sugar prices dropped over 3% to 16.49 c/lb, driven by bearish sentiment and Petrobras’ gasoline price cut, which lowered ethanol’s price ceiling due to energy parity.

- Ethanol remains less competitive than sugar, especially in São Paulo, limiting any significant shift in the production mix this season as many exporters are already hedged above current sugar prices.

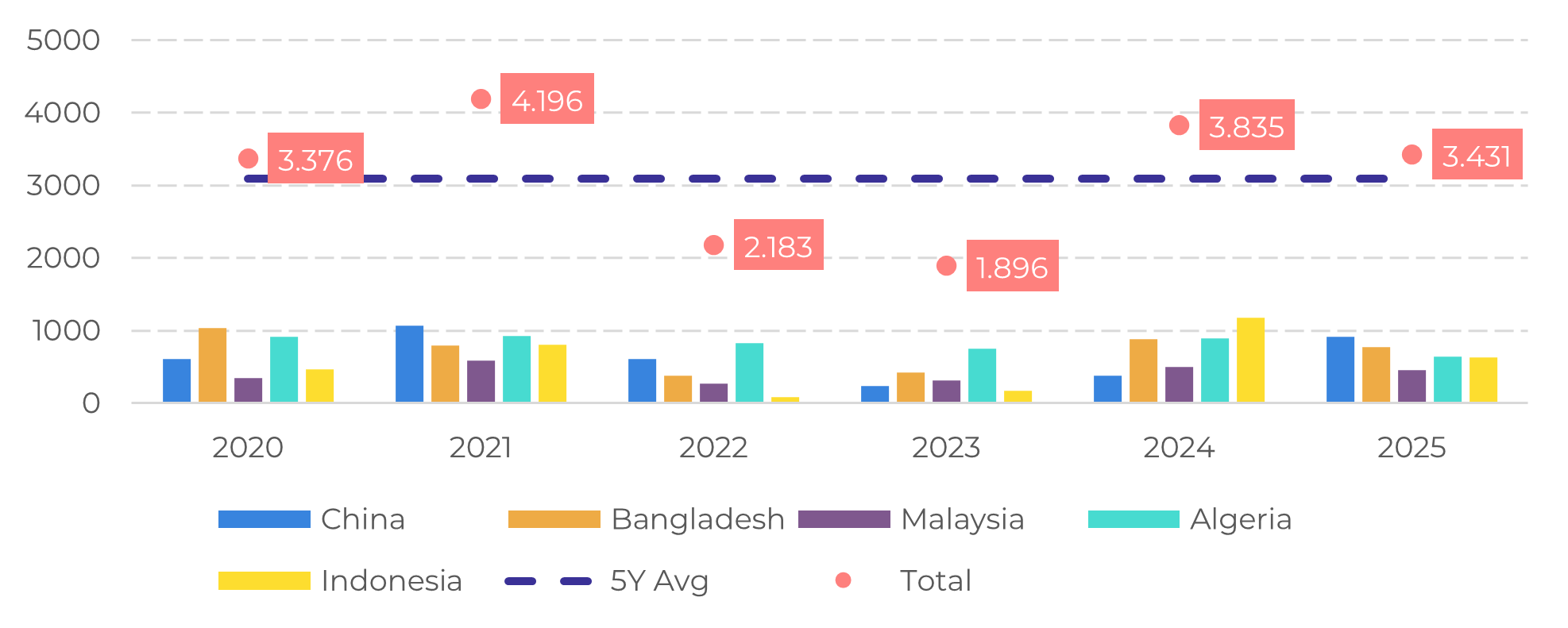

- Brazil exported approximately 2.25 Mt of sugar in May, slightly above average, with expectations of stronger volumes in June boosting short-term supply.

- While China remains selectively active, demand from Algeria, Indonesia, and Bangladesh is down, reflecting weaker global buying interest.

- Surplus expectations from India and continued Thai exports are weighing on prices, though the anticipation of the upcoming UNICA report may offer bullish support.

The sugar market experienced another uneventful week, with little noteworthy news to drive activity, especially on the bullish side. By the end of Friday, raw sugar prices had fallen by more than 3%, settling at 16.49 cents per pound, a level not seen since June 2021, when prices were still rebounding from the impacts of COVID-19 and a broader bearish trend following years of surplus.

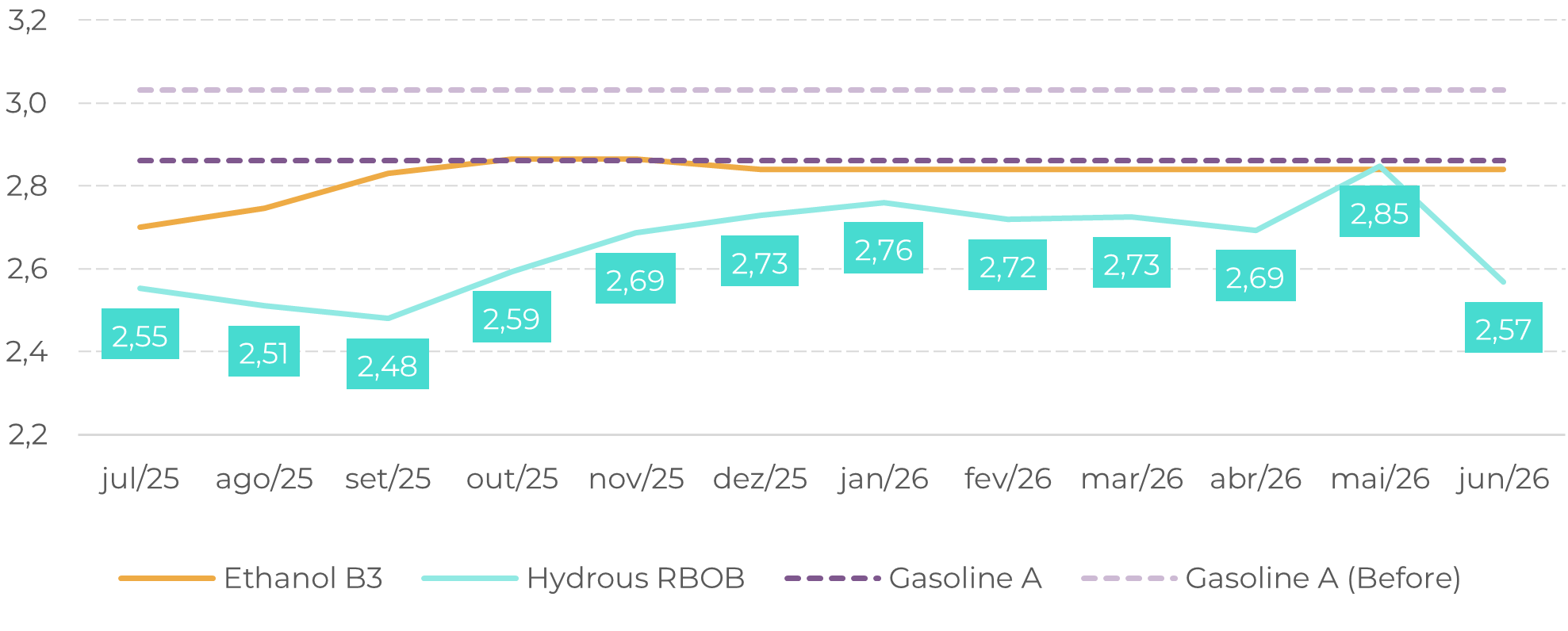

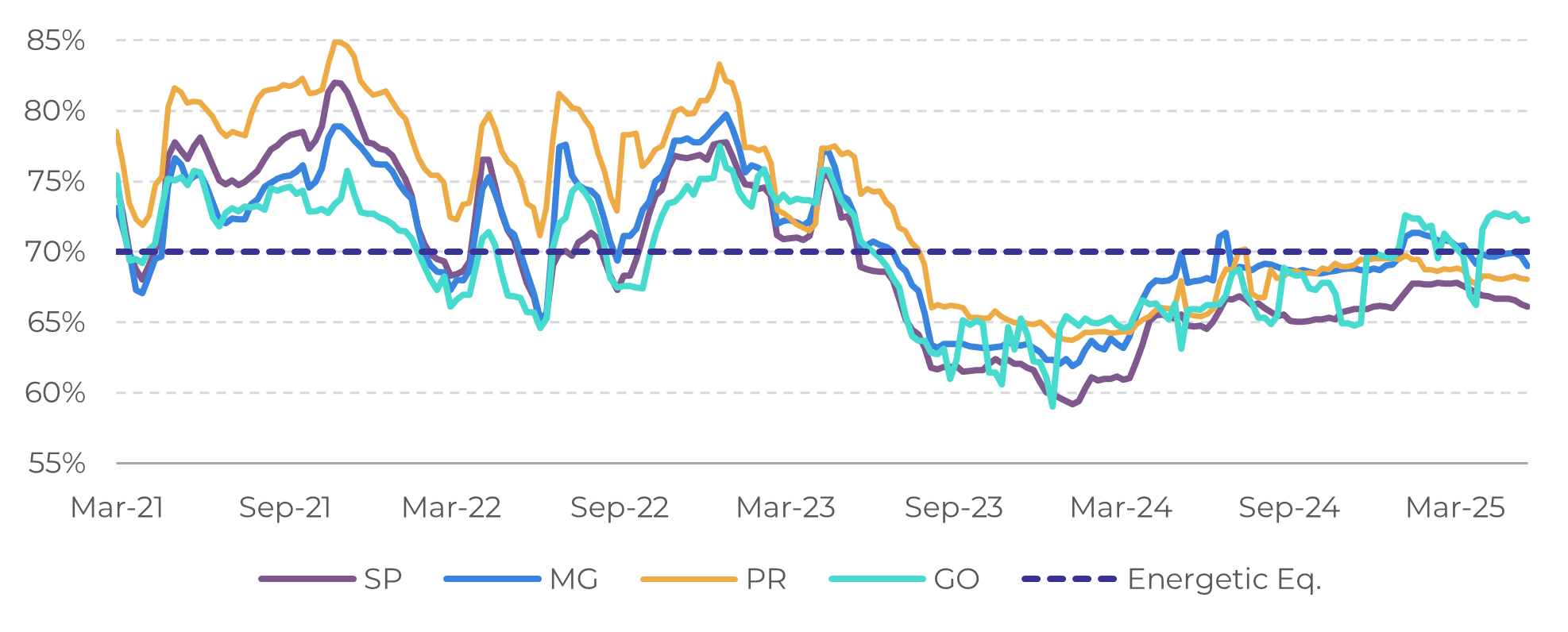

The downward correction began on Monday, June 2, after Petrobras announced a 5.6% reduction in gasoline prices, effective the following day. As a result, the purchase price for distributors in Paulínia, for instance, dropped from slightly over 3 BRL/L to 2.86 BRL/L. This move affects directly the ethanol price expectations. Since the biofuel has about 70% of the energy content of gasoline, its price is closely tied to that of its fossil fuel counterpart. Lower gasoline prices effectively cap the potential upside for ethanol, as reaching the energy-equivalent price threshold more quickly would shift consumer preference back to the now-cheaper gasoline.

Image 1: Gasoline A to the distributor vs Hydrous Ex-mil (BRL/L)

Source: ANP, Bloomberg, Hedgepoint

Image 2: Pump Parity (%)

Source: ANP, Bloomberg, Hedgepoint

Image 3: Brazilian Exports between january and May to Key Countries (‘000t)

Source: SECEX, Hedgepoint

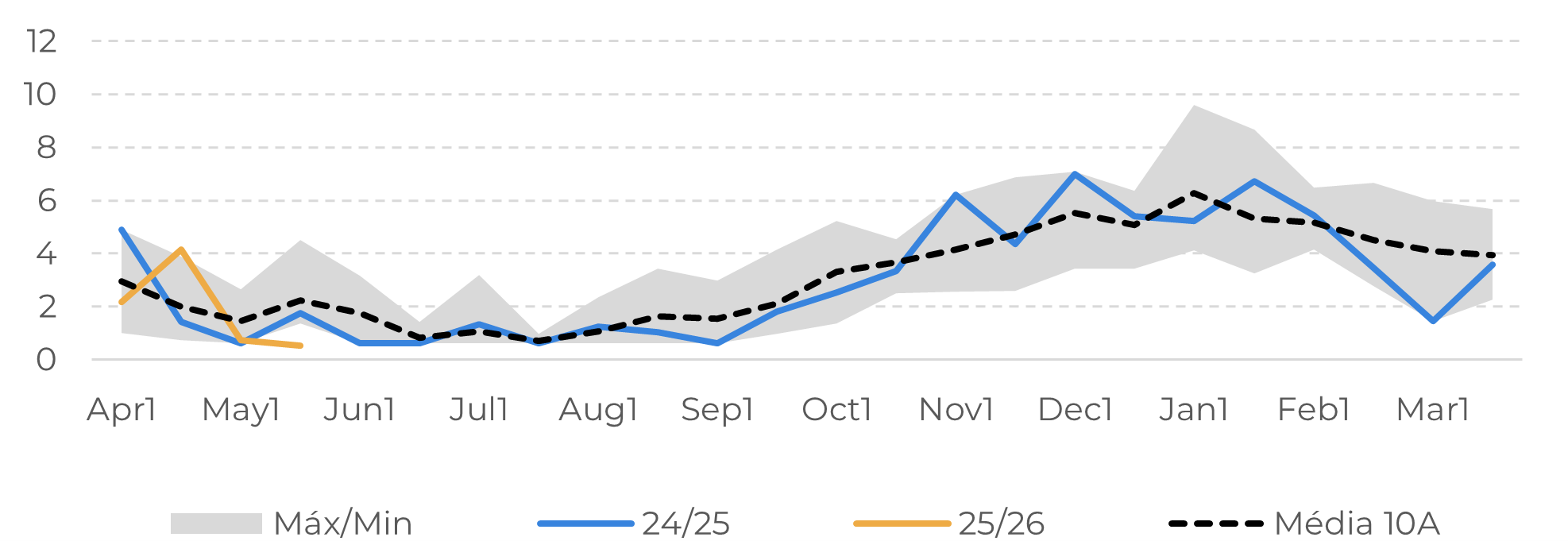

On that note, sugar prices continue to show weakness. Increased availability from the Northern Hemisphere and a lower ethanol parity in Brazil are key drivers behind the prevailing bearish sentiment. However, there may still be room for bullish momentum, particularly with anticipation building around the upcoming UNICA report. The next release is expected to shed light on the pace of the harvest, especially since the number of lost crushing days in May was close to the seasonal average. That said, when it comes to yield performance, more reliable insights are likely to emerge in June.

Image 4: Estimated Lost Days per Fortnight in CS (No. Days)

Source: Bloomberg, Hedgepoint

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

luiz.roque@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

To access this report, you need to be a subscriber.

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.