Sugar market stalls amid policy uncertainty and bearish fundamentals

"Sugar prices stayed flat last week, with weak fundamentals and selling pressure capping gains. Oil’s rise from Middle East tensions had limited impact on sugar, as Petrobras’ pricing policy restricts ethanol’s upside. The sugar/hydrous parity hit a two-year low, but mills are locked into a high sugar mix for 2025/26. The delayed E30 rollout now expected in July softens ethanol demand, reinforcing a bearish outlook for both markets. With geopolitical risks and policy uncertainty, funds remain cautious, awaiting stronger signals before shifting positions."

Sugar market stalls amid policy uncertainty and bearish fundamentals

- Raw sugar prices remained flat, with weak fundamentals and selling pressure limiting any upward movement.

- Geopolitical tensions boosted oil futures, but Petrobras’ pricing policy muted ethanol’s response, weakening sugar’s support. There needs to be an actual cost pass-through to induce a stronger response.

- Despite sugar/hydrous parity hitting a two-year low, the sweetener remains in advantage. Additionally, mills are locked into a high sugar mix for the 2025/26 season, limiting flexibility.

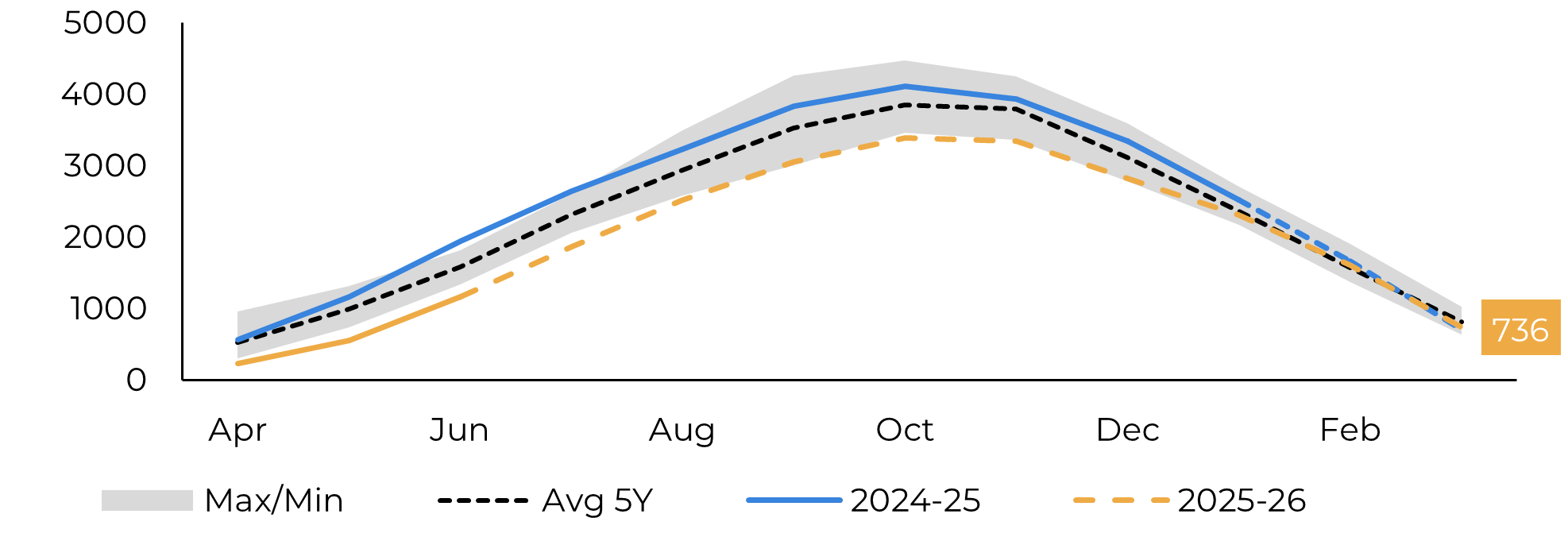

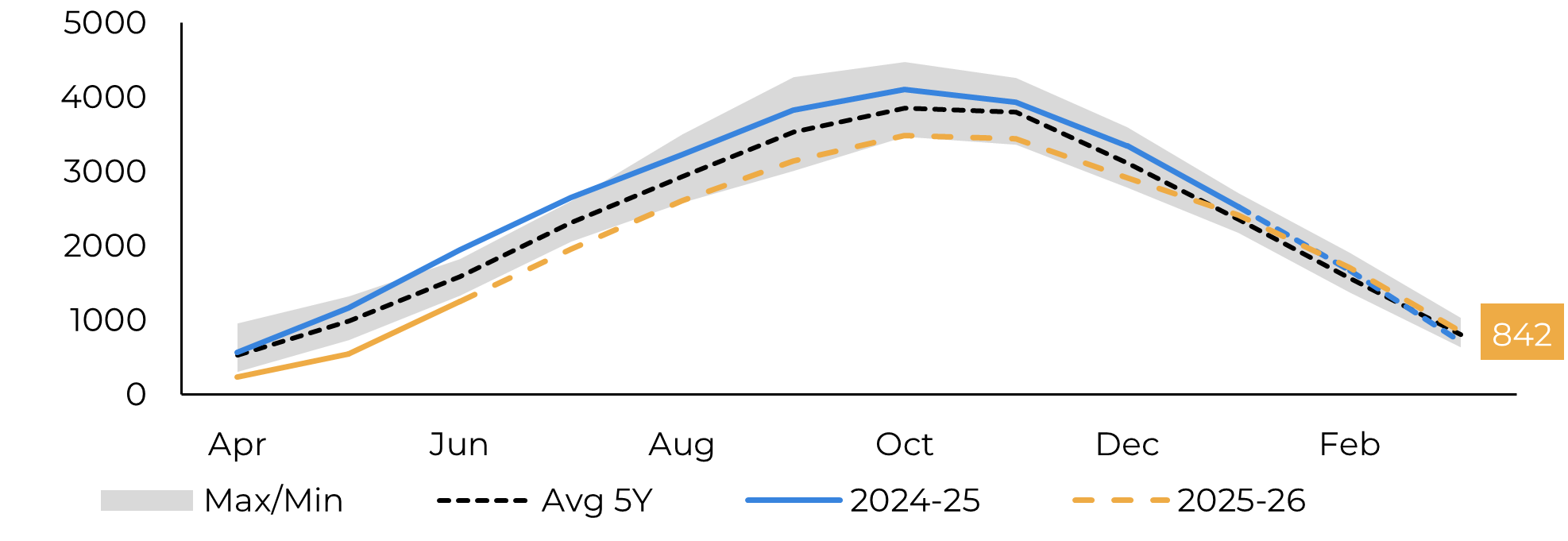

- The ethanol blend transition from E27 to E30 was pushed to July, compared to our initial expectations, easing some of the pressure on ethanol stocks.

- With policy uncertainty and geopolitical risks, funds remain hesitant to adjust sugar exposure.

Sugar had another quiet week, with prices moving sideways and no big changes in the market’s fundamentals, which still point to a bearish outlook. Prices have been failing to sustain any gain as each rally attempt is met with selling pressure, ending the week at 16.1 c/lb on June 20, a weekly variation of -0.2%. The market awaits more relevant news, suffering from weakening spreads and no strong signs of demand as the July contract approaches expiry. Even though oil prices rose during the same week (+3%), given the entry of the US in the Israel-Hammas-Iran conflict, it wasn’t enough to lift the market.

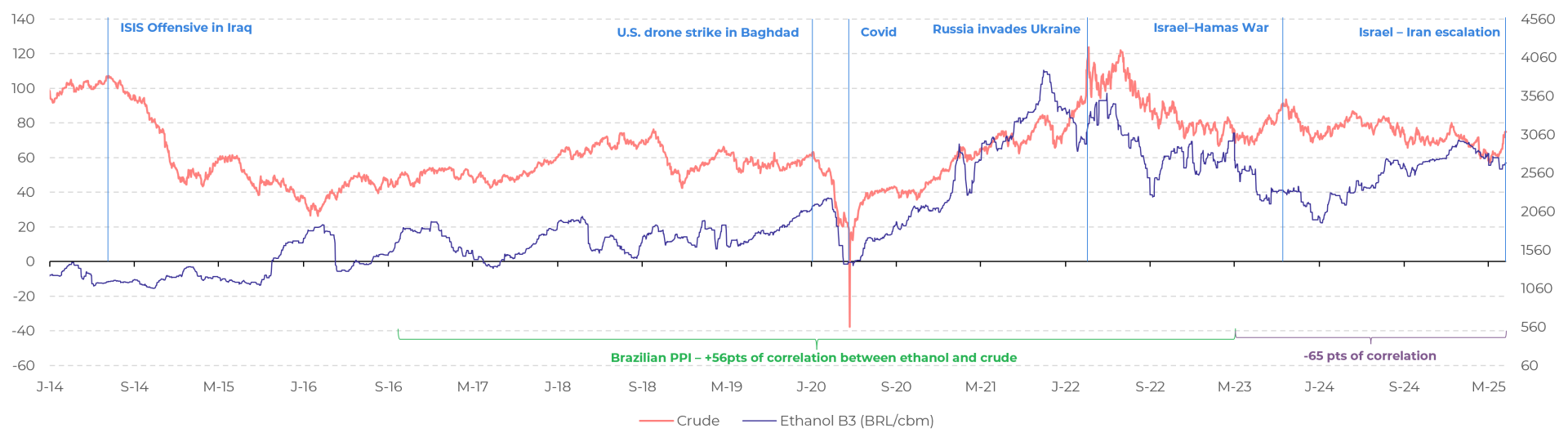

Although the sugar/hydrous parity has dropped to its lowest level in over two years, a move that could be seen as somehow supportive for sugar, there are two key factors to keep in mind. First, the market’s reaction was mostly based on expectations, when it comes to the ethanol side of the equation. Under Petrobras’ new pricing policy, any rise in international energy prices doesn’t automatically translate to higher domestic fuel prices. Political decisions play a big role, which means gasoline prices at the pump could limit how much ethanol prices can rise. During the PPI era, when domestic fuel prices closely tracked international markets, the correlation between crude oil and hydrous ethanol (B3) was +56 points. Since the policy ended in May 2023, that correlation has reversed to –65 points, highlighting a significant decoupling—excluding currency effects in this analysis.

Image 1: Major oil-related headlines versus crude (USD/bbl - left) and hydrous (BRL/cbm - right) correlation

Source: LSEG, Hedgepoint

Image 2: Anhydrous stocks (‘000 m³) – Base Case

Source: UNICA, MAPA, SECEX, ANP

Image 3: Anhydrous stocks (‘000 m³) – One month delay

Source: UNICA, MAPA, SECEX, ANP

In Summary

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products. Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions. Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately. Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only). Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets. “HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.