Bearish Now, Bullish Later? Weather and Supply Dynamics

- Strong trading activity occurred as the market digested Dubai Sugar Conference signals, with a still‑bearish 25/26 outlook but downside limited by Brazil mix and India’s export uncertainty.

- El Niño could tighten 26/27 availability and support longer‑term bullish sentiment, depending on event strength and 25/26 carry‑over stocks.

- ENSO‑related risks weigh on Northern Hemisphere origins: India, Thailand, and Central America face potential yield losses under El Niño after mixed performance in recent seasons.

- Brazil’s ENSO exposure is seasonal, with limited impact on 25/26 but possible effects on 26/27 crushing pace, yet cane output remains projected near 630 Mt.

- Brazil’s strong availability could mute price recoveries unless lower values spur a shift toward fuel demand, absorbing part of the surplus.

Bearish Now, Bullish Later? Weather and Supply Dynamics

The week ending on February 6 was marked by heightened activity, with strong trading volumes as the market continued to digest the discussions from Dubai Sugar Conference. Although the broader outlook for the season (25/26 Oct-Sep) remains bearish, uncertainties surrounding the Center-South Brazil production mix and India’s true willingness to export may have helped limit further downside. As we move toward the March expiry, some volatility is expected. Still, as highlighted in our previous report, once the new Center-South crop begins to materialize, prices are likely to trend lower before any potential recovery. While that recovery still lacks clear fundamental support, there is a silver lining for bullish traders.

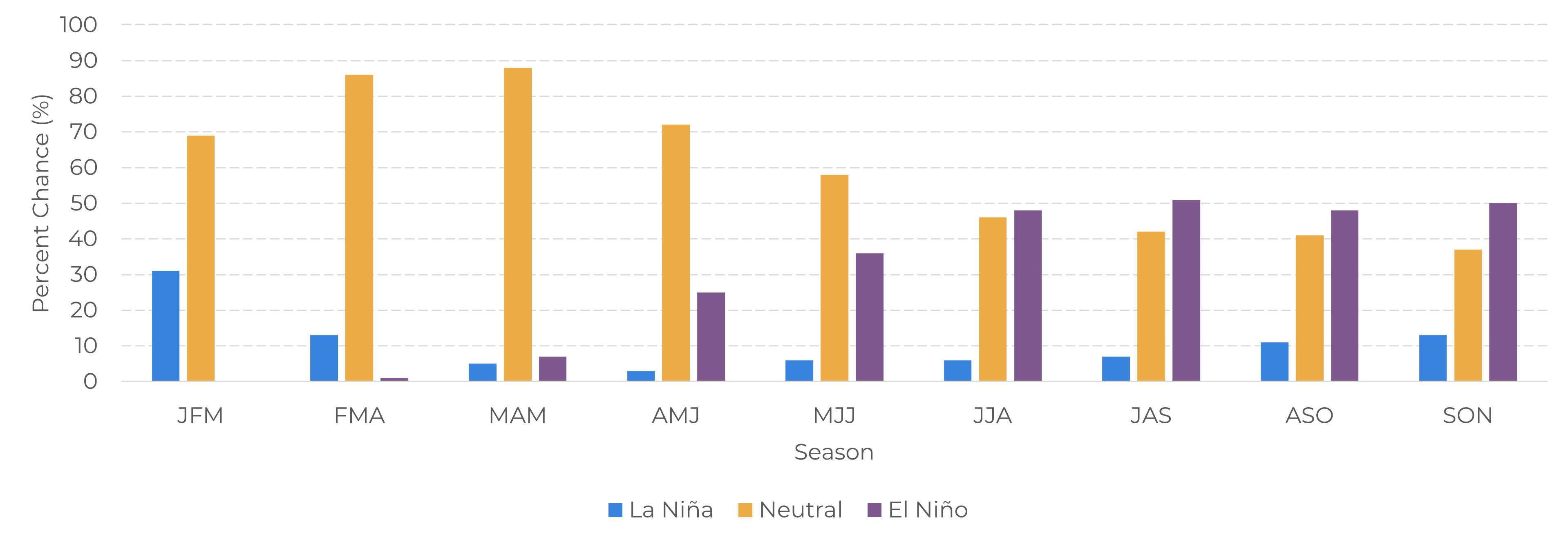

The potential development of an El Niño could impact global availability in the 26/27 Oct–Sep cycle, fostering a longer term bullish outlook, which could affect 2027 contracts. It is important to note, however, that the strength of this trend will depend both on the magnitude of the phenomenon and on the volume of surplus carried over from 25/26.

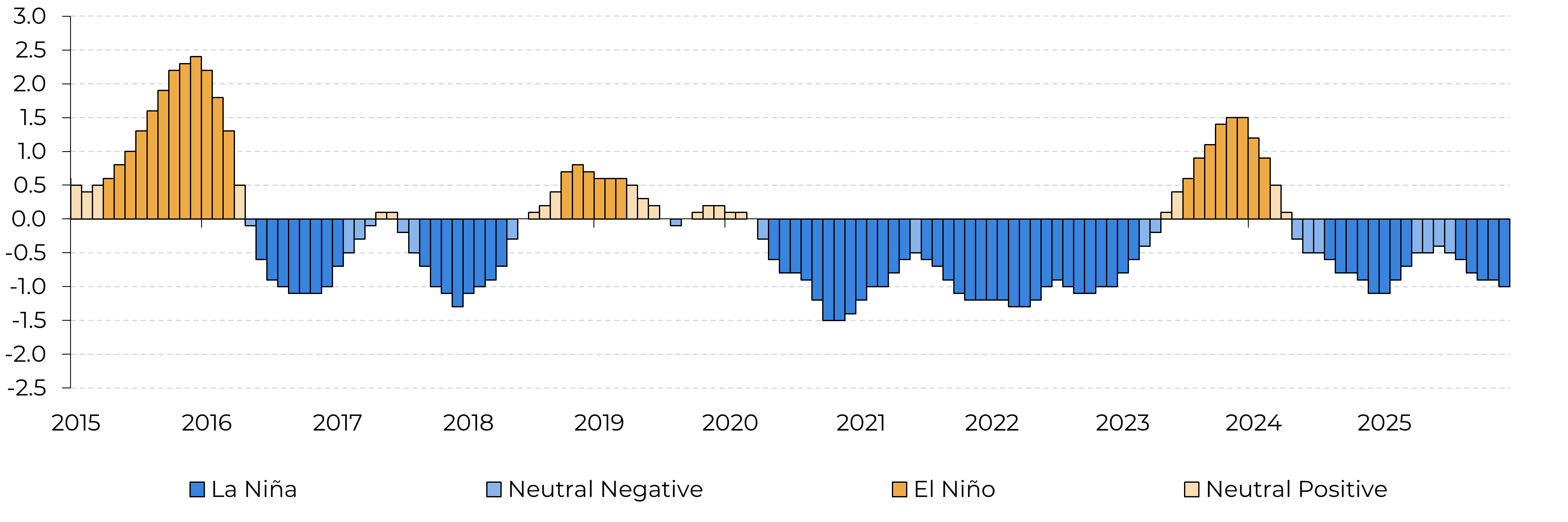

Historical ENSO Pattern Behaviour (Niño 3.4 index)

Source: NOAA, Hedgepoint

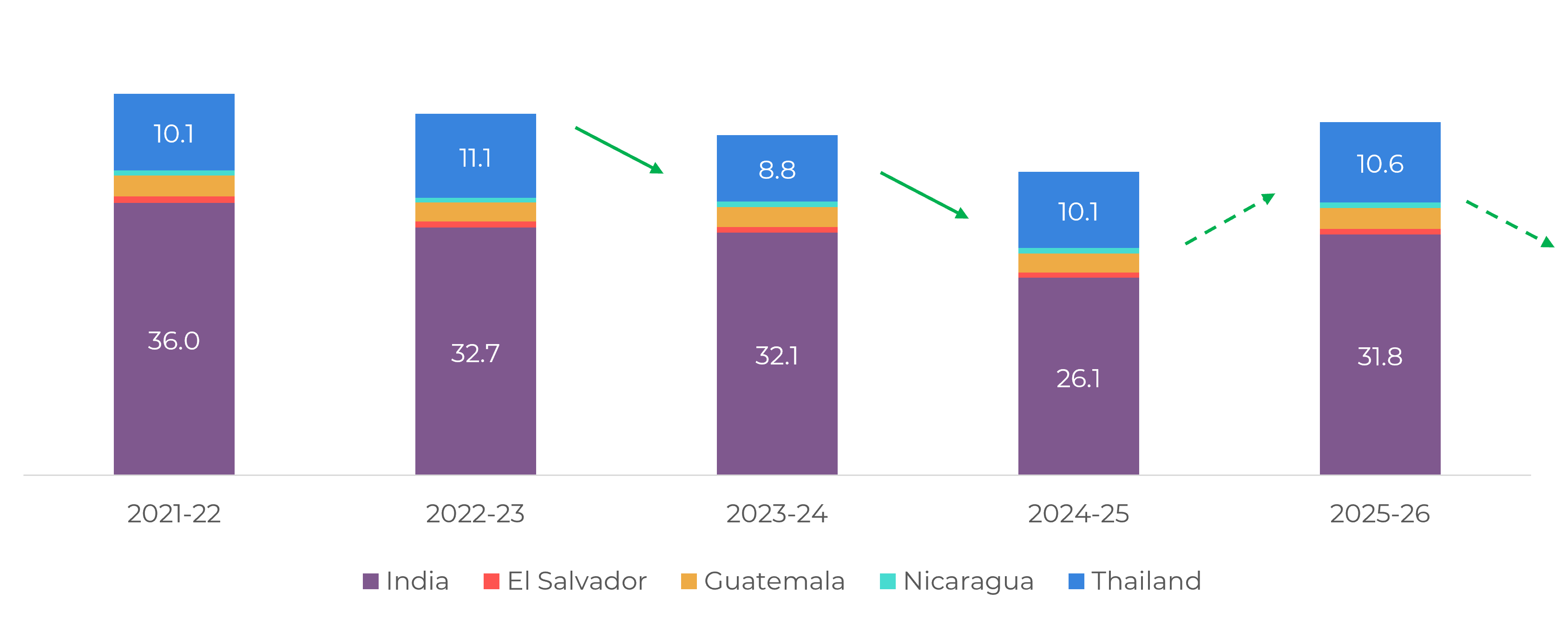

Considering the Northern Hemisphere, ENSO strongly influences India’s climate through the summer Southwest Monsoon (June–September). If an El Niño is confirmed, it typically weakens monsoon circulation, suppressing convection over the Indian Ocean and resulting in below average rainfall, higher temperatures, and increased drought risk. During the development and harvest of the 23/24 season, when El Niño was active, India’s total production fell by 7%, and sugar output was sustained only through reduced ethanol diversion and a modest expansion in harvested area.

The following year’s results were also affected by an already penalized cane, combined with a reduction in planted area, ultimately leading to the country’s lowest net sugar production in more than seven years, at 26.1 Mt. As conditions shifted to a La Niña pattern, under which monsoon rains generally increase, the 25/26 harvest found support for its sugarcane development.

Signs of recovery are already visible, with market estimates placing 25/26 sugar net production near 32 Mt. However, current indications of an emerging El Niño suggest renewed weather related risks for 26/27 availability.

This trend is true not only for India, but other Norther Hemisphere countries. Thailand, for example, is strongly affected by ENSO during its summer season (May–October), when the Southwest Monsoon prevails. Under El Niño, rainfall is typically suppressed, often delaying monsoon onset and heightening drought risk; under La Niña, rainfall generally increases, extending the monsoon season. Therefore, the formation of an El Niño for 26/27 could leave Thailand’s cane development exposed to below ideal rainfall, further reducing export availability — especially considering that the Thai Sugar Board is already projecting lower production due to disease pressure and land use constraints.

Central America’s summer (May–October) is also highly sensitive to ENSO dynamics. During El Niño years, suppressed convection over the eastern Pacific intensifies the midsummer drought, which can penalize cane development throughout the crucial April–November window. If this pattern is confirmed, the 26/27 cycle could face notable stress. Moreover, should El Niño conditions persist into the region’s winter months (November–March), when the phenomenon typically peaks, drier and warmer weather could prevail along the Pacific side, affecting key cane growing areas in Guatemala, El Salvador, Costa Rica, and Nicaragua, further constraining regional output.

Key Northern Hemisphere Producers Affected by ENSO

Source: Hedgepoint

ENSO % Chance Forecast

Source: NOAA, Hedgepoint

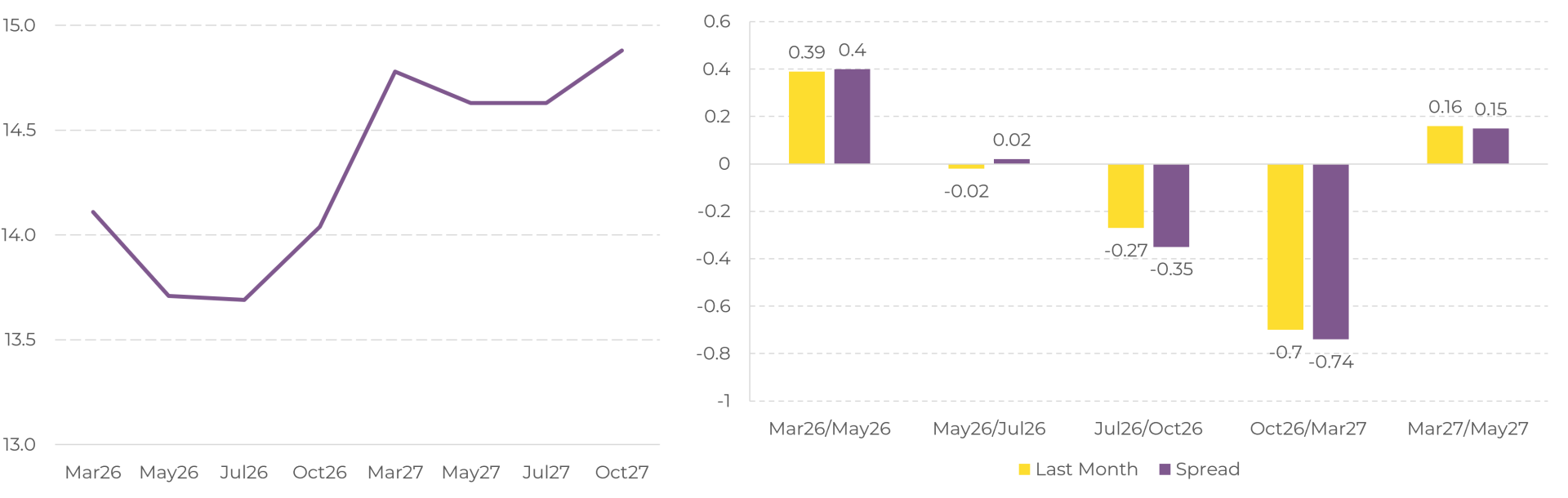

Sugar Future Curve (left) and Spreads (right) | c/lb

Source: LSEG, Hedgepoint

Summary

ENSO dynamics introduce significant regional risks: El Niño threatens cane development across India, Thailand, and Central America in 26/27, while Brazil’s seasonal exposure is less disruptive and keeps the 630 Mt cane outlook intact. Although El Niño could support a longer term bullish view by tightening future availability, strong Brazilian supply still cap near term recovery, unless lower prices trigger demand shifts at the pump that help the ethanol market to absorb part of the sugar surplus.

Weekly Report — Sugar

Reviewed by Laleska Moda

laleska.moda@hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products.

To access this report, you need to be a subscriber.

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.