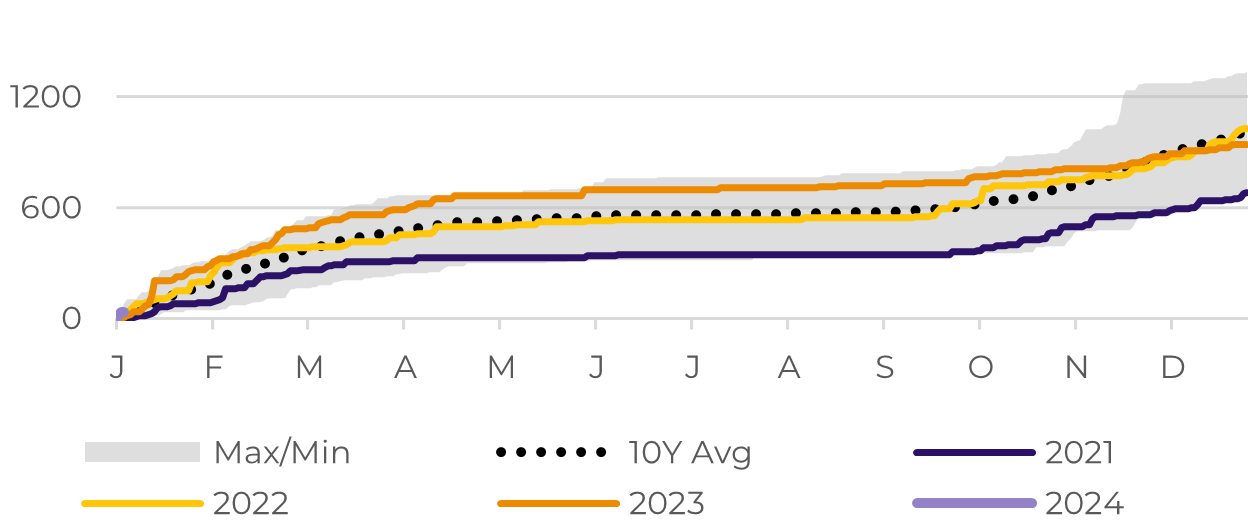

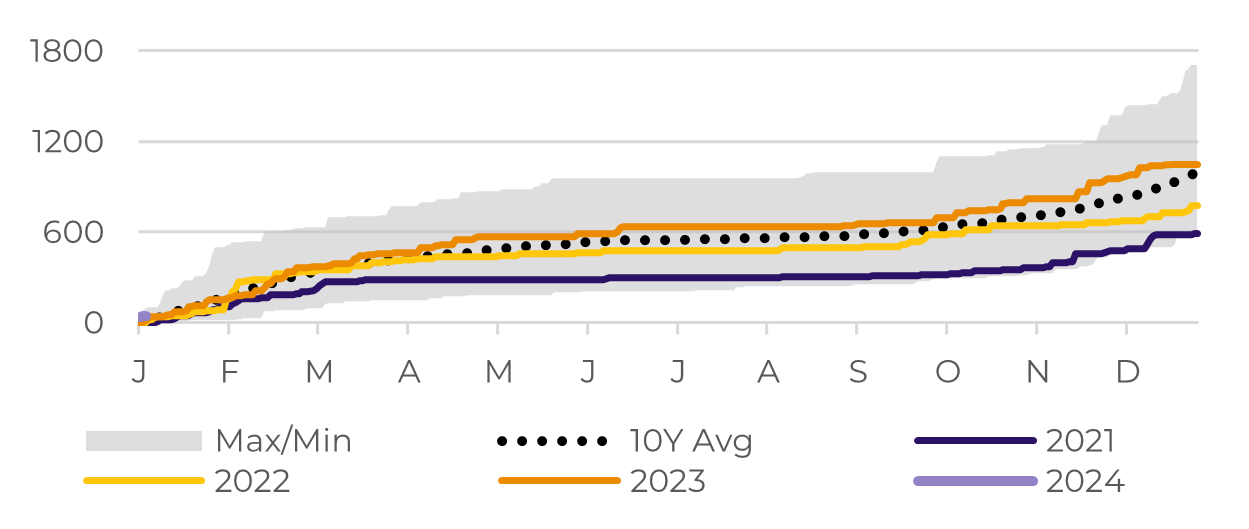

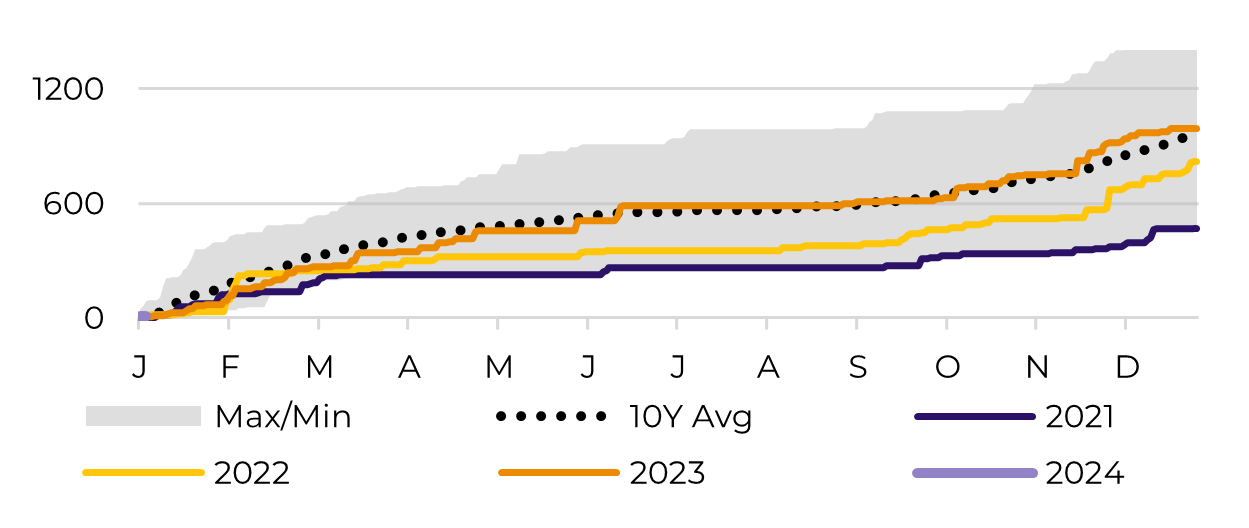

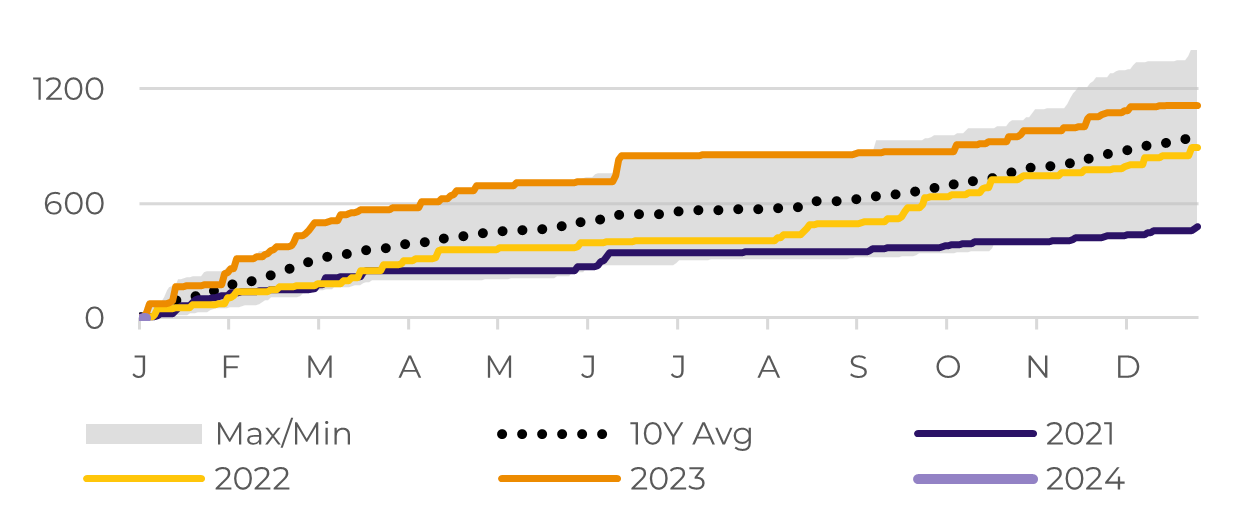

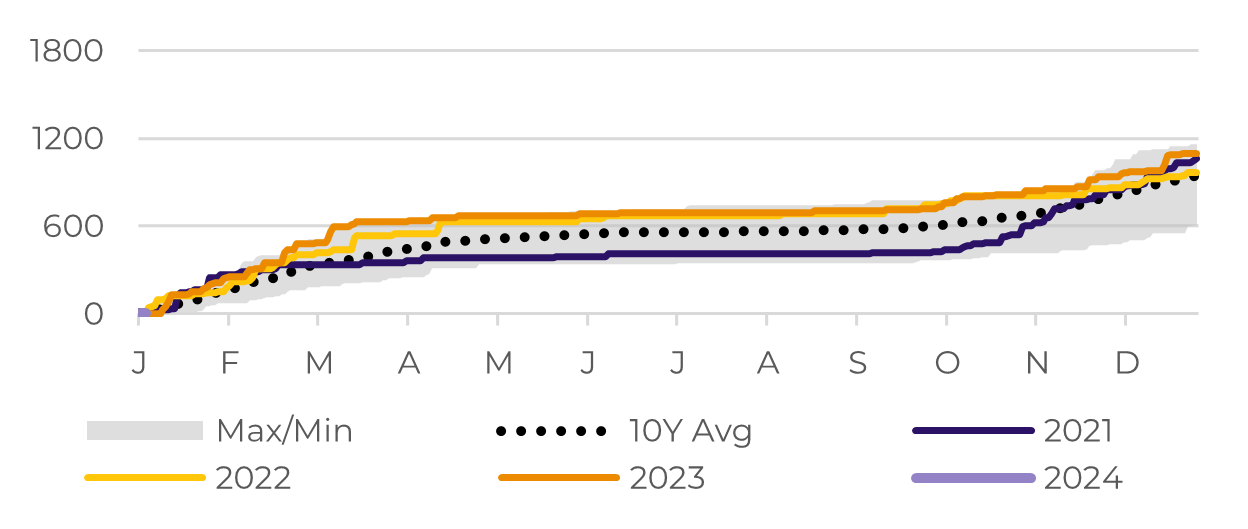

Source: Refinitiv, hEDGEpoint

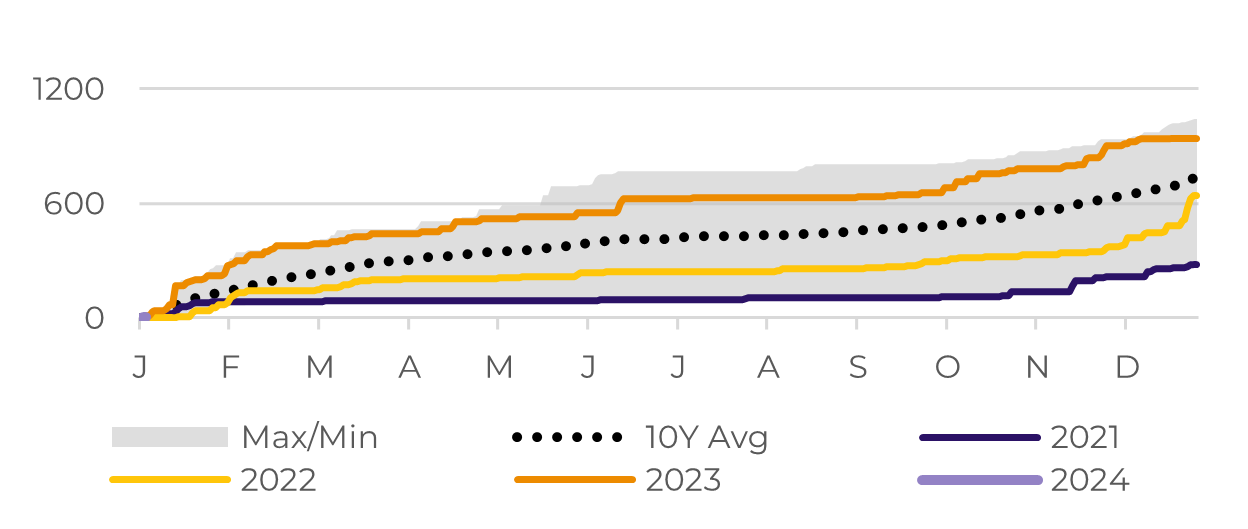

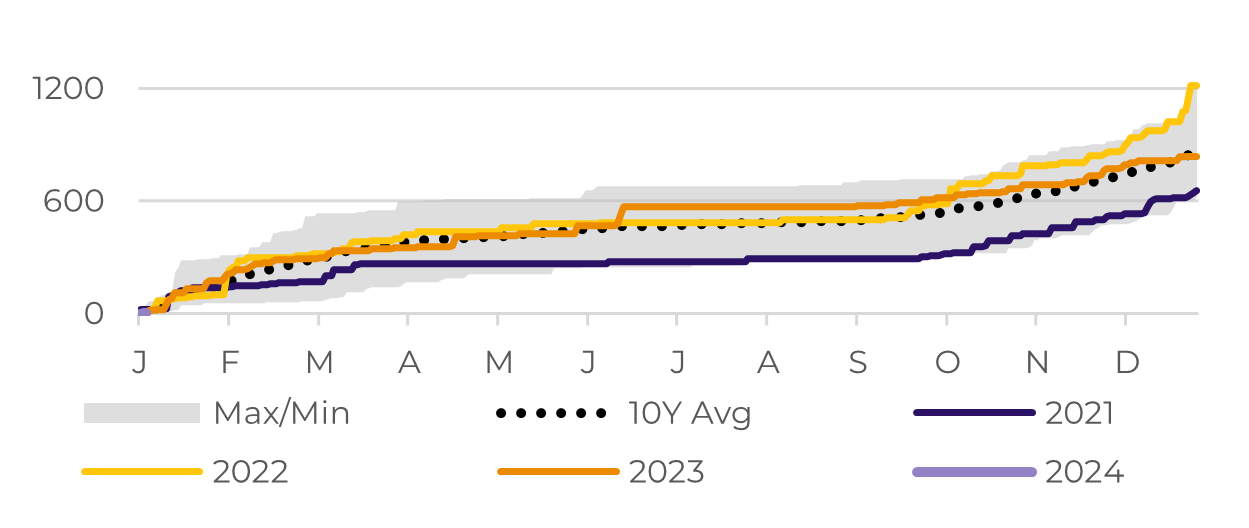

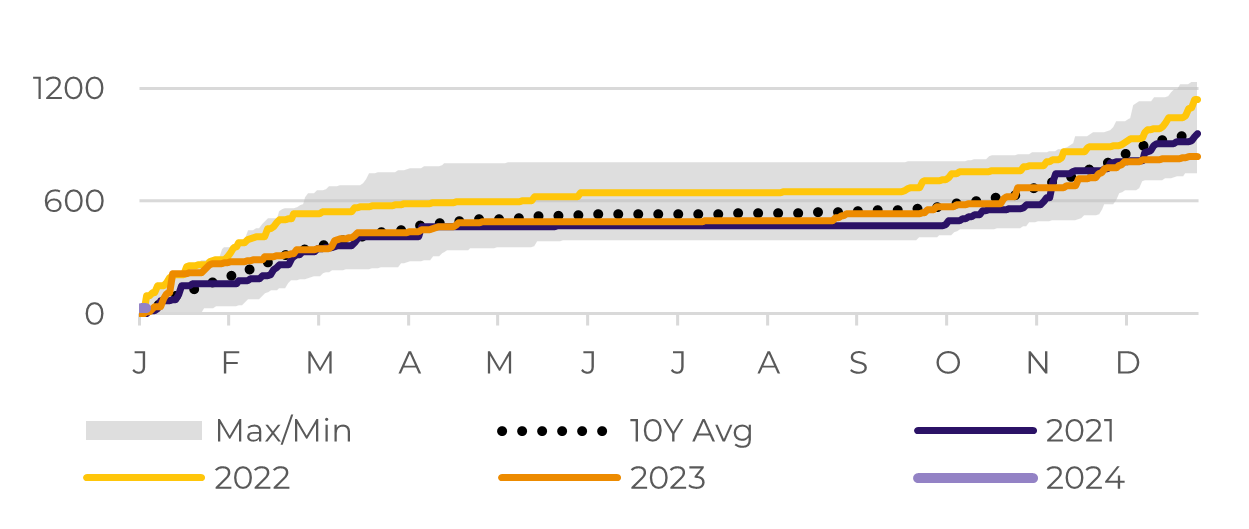

Source: Bloomberg, hEDGEpoint

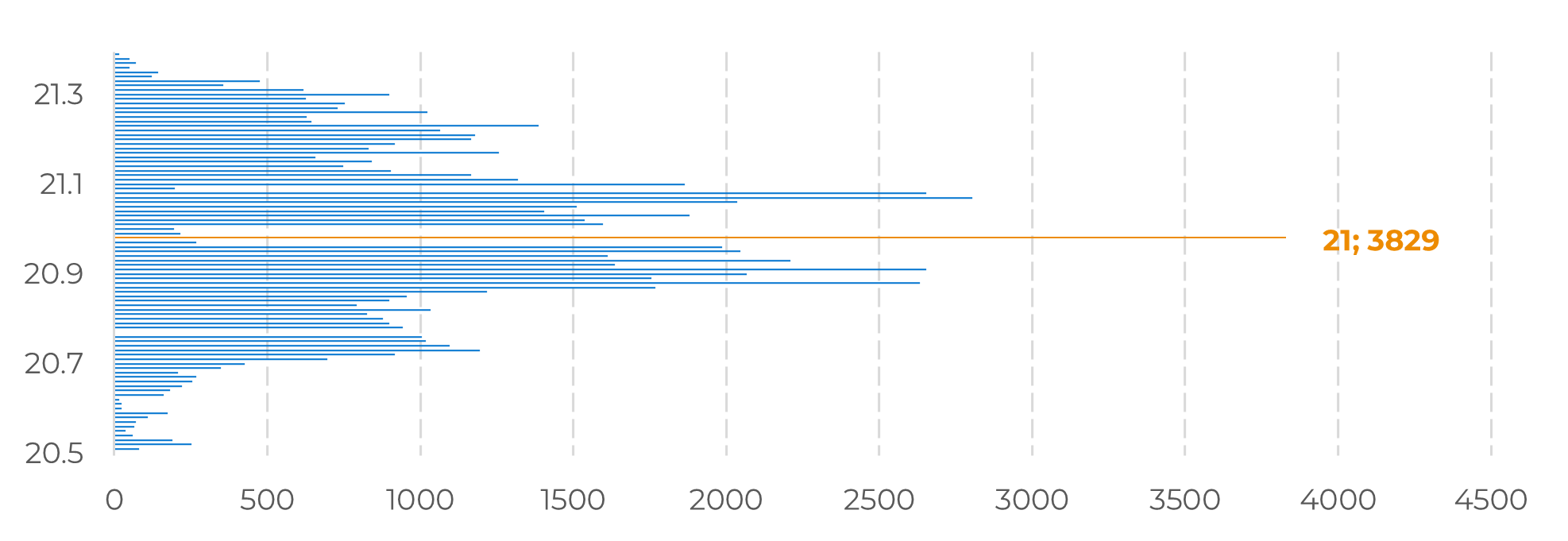

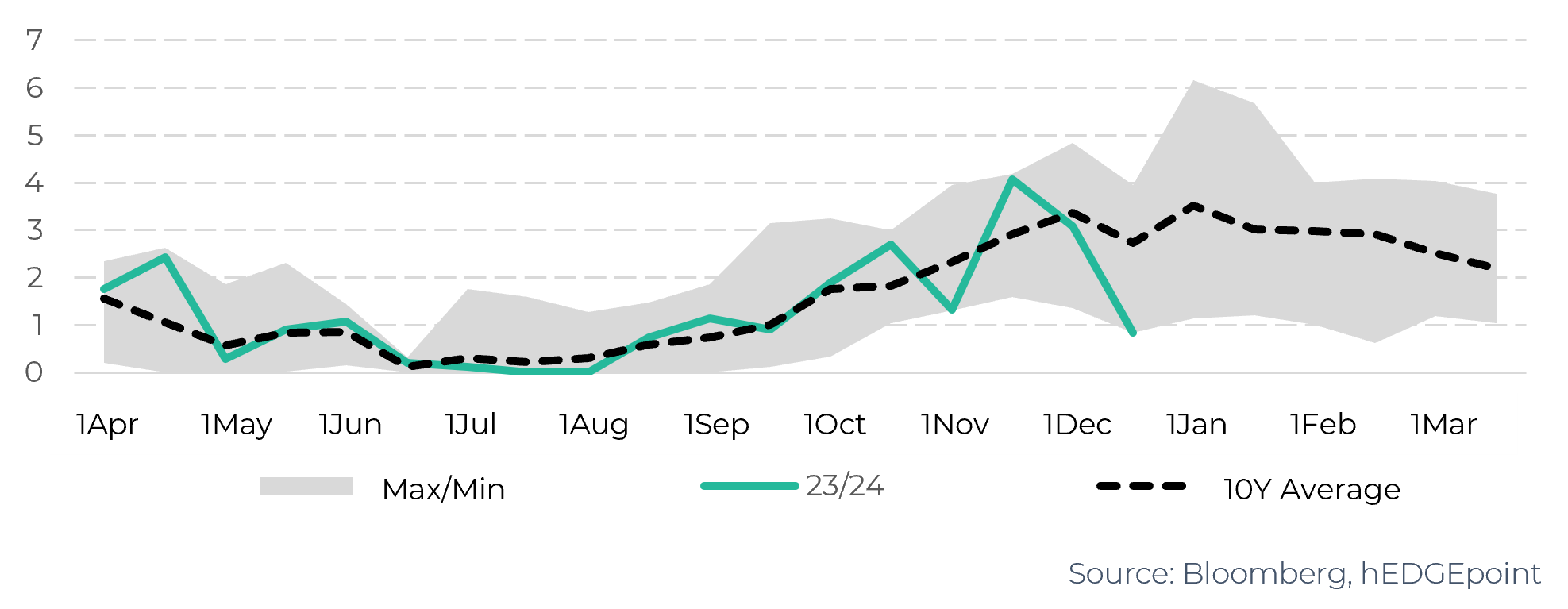

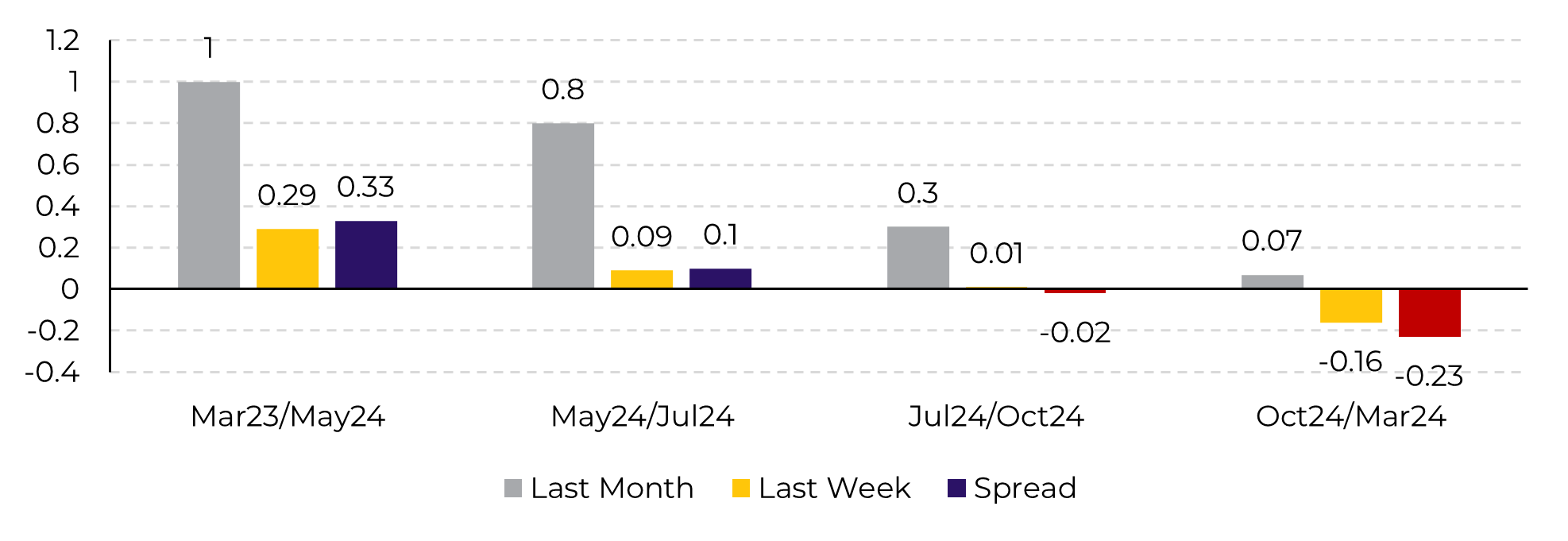

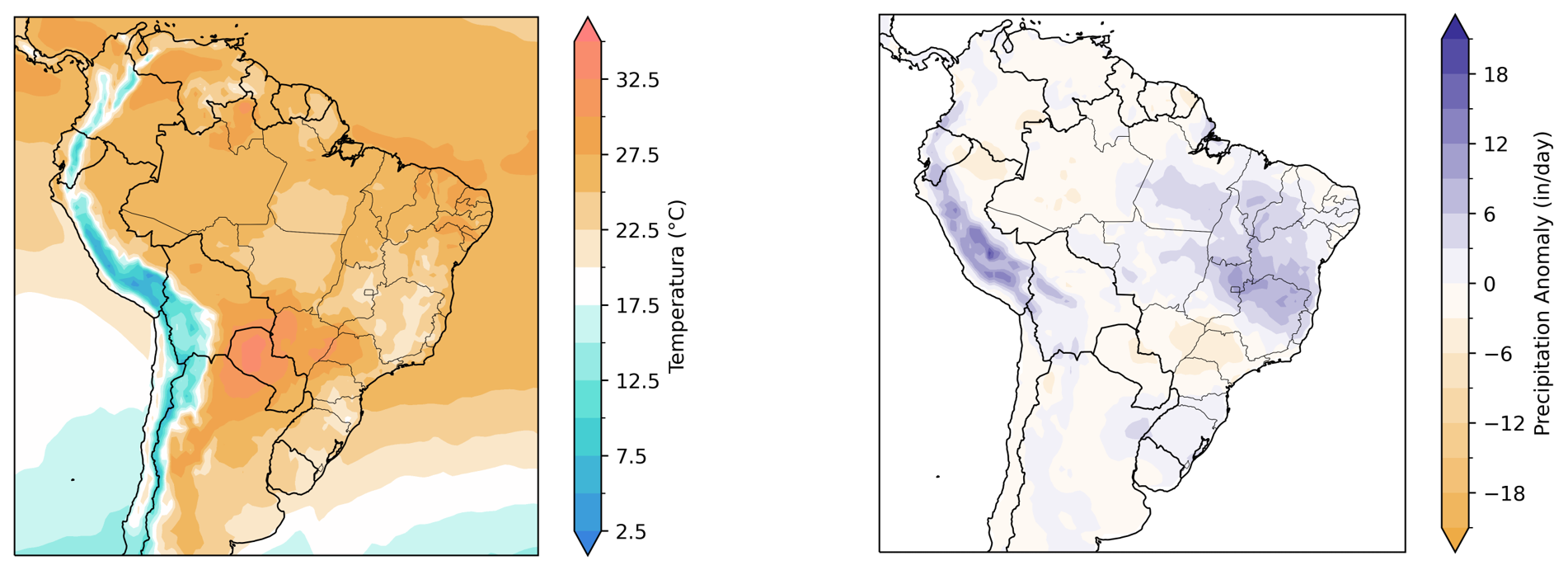

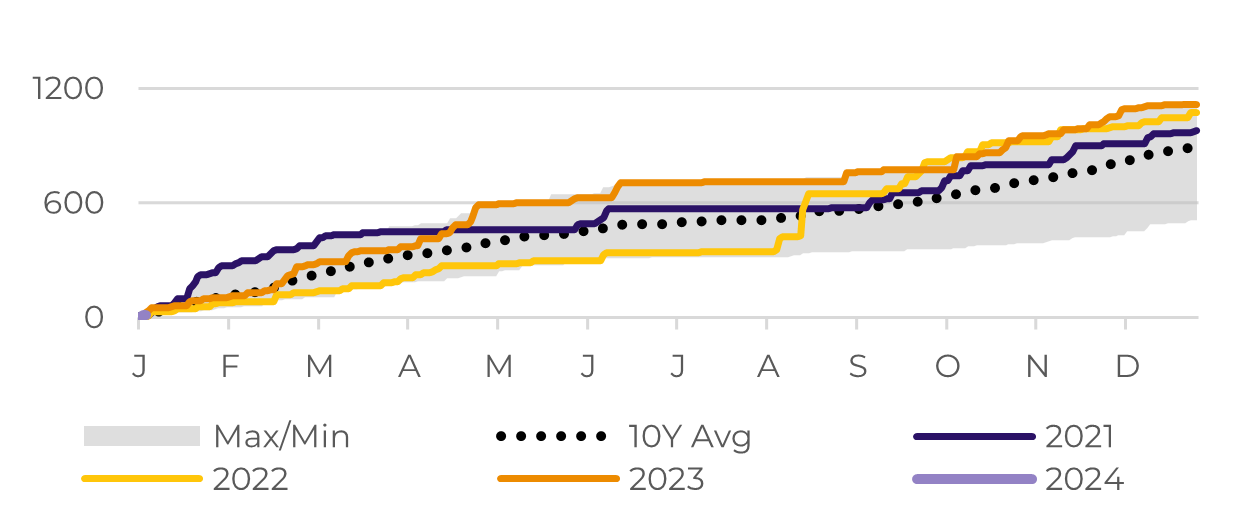

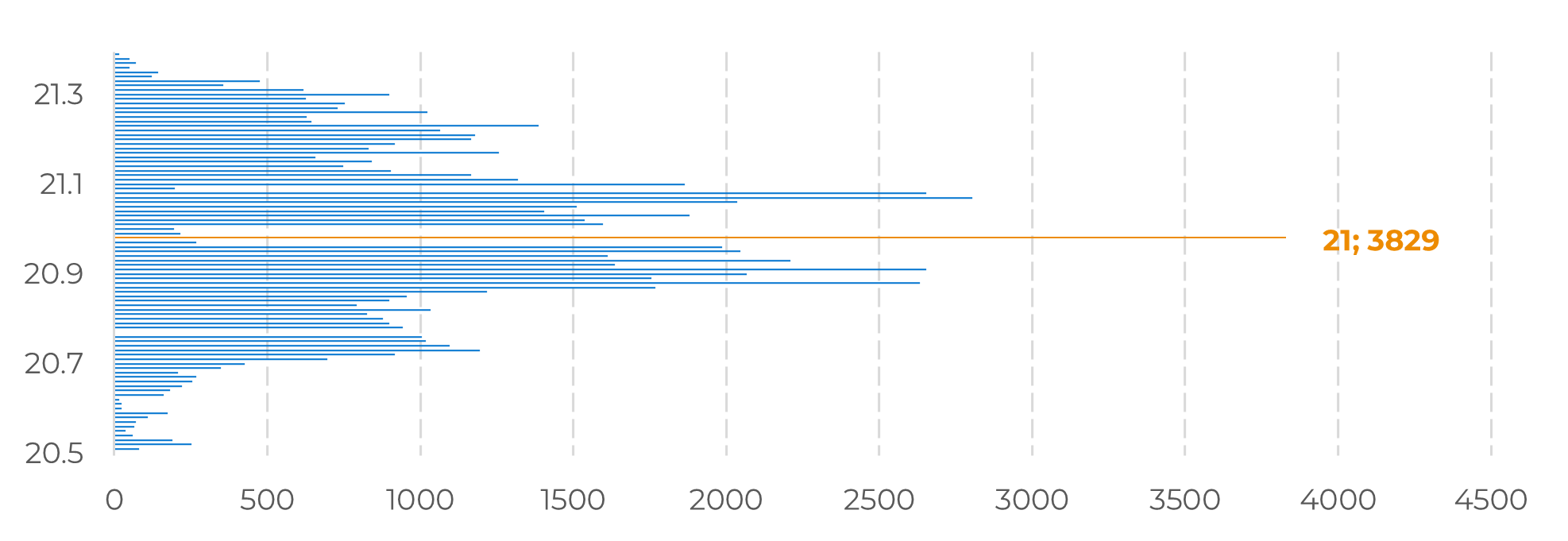

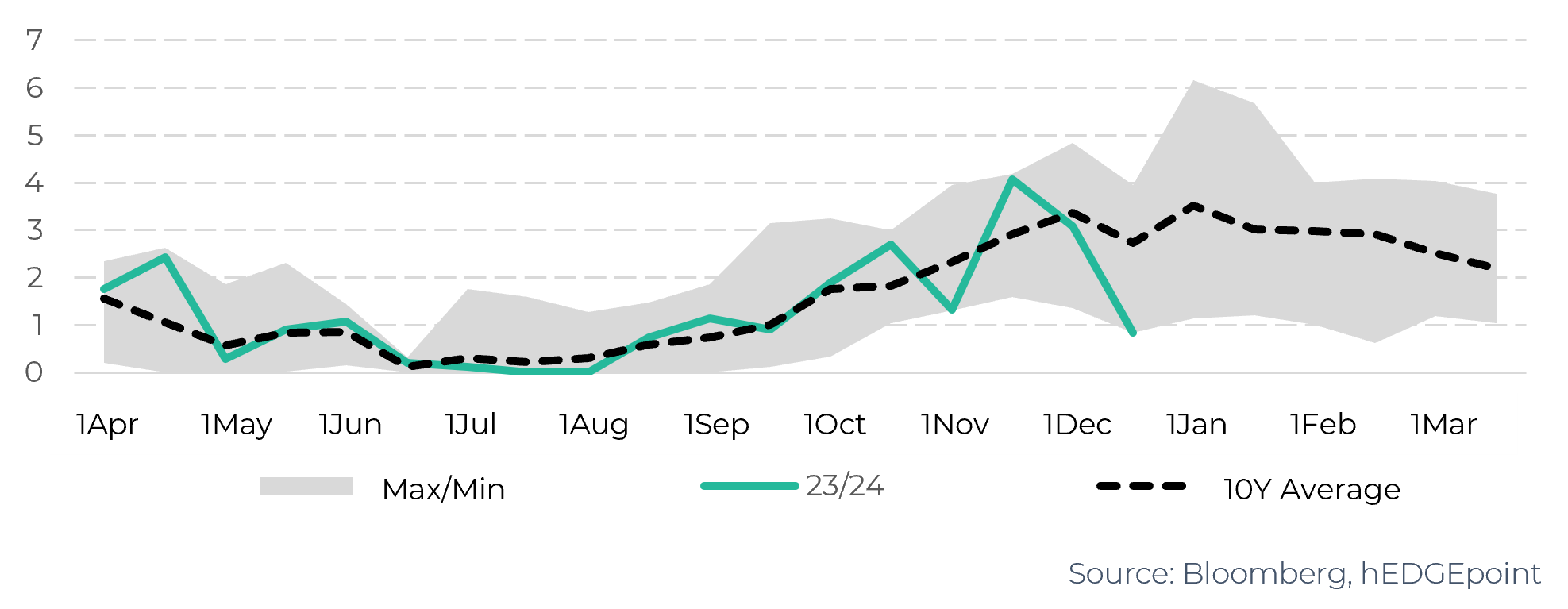

A potential decrease in Brazil's 2024/2025 crop season could lend support to sugar prices, particularly for the July and October 2024 contracts. Despite recent transactions occurring with reduced volume, an examination of monthly spread behavior reveals a flattening of the curve between these months. This suggests that the market continues to value higher availability, but is already monitoring crop conditions – March and May weekly appreciation has been lower than the July and October 2024 contracts. If weather conditions persistently constrain cane development, we might see a shift in the future curve structure.