Aug 14

/

Lívea Coda

Sugar and Ethanol Weekly Report - 2023 08 14

Back to main blog page

"Concentrated rains, low stocks, and elections: Indian export quotas have never been so uncertain. Especially after ISMA reduced its harvest estimate to 31.6Mt, the market once again considered between none and 2.5Mt of exports to the country."

What if India is out of the table?

- Prices fail to react to Brazilian CS expressive positive results during the week as market went back to discussing the possibility of no exports from India. Especially after ISMA adjusted their crop estimate down to 31.6Mt and the concentrated rains in some states, the Southeastern country’s availability hit the spotlight.

- While it fueled concerns about a possible sugar shortage in Q1 and Q2 2024, it is not yet a consensus. We need to keep monitoring rains and India’s domestic prices as the decision is highly political: stocks are pressured.

- In the short term, however, it is important to state that there is a bearish force as Brazilian CS pace is strong and there are rains predicted to happen in India. This might encourage some selling, especially with physical demand keen to wait and pushing cash discounts further.

- Another trend worth assessing is China import’s behaviour. The country has reduced its import pace in the face of such a closed arbitrage.

Last week started with sugar showing some strength and recovering to close to 24 c/lb. News such as the rice exports ban in India due to high domestic prices sounds worrisome for the sugar market, as the latter’s prices have also increased sharply due to lower stocks. Therefore, although the week was marked by Unica’s report bringing a strong fortnight result and a market consensus that Brazil will have more cane, uneven monsoon rains in the Southeast country keep adding to the bull side of the story.

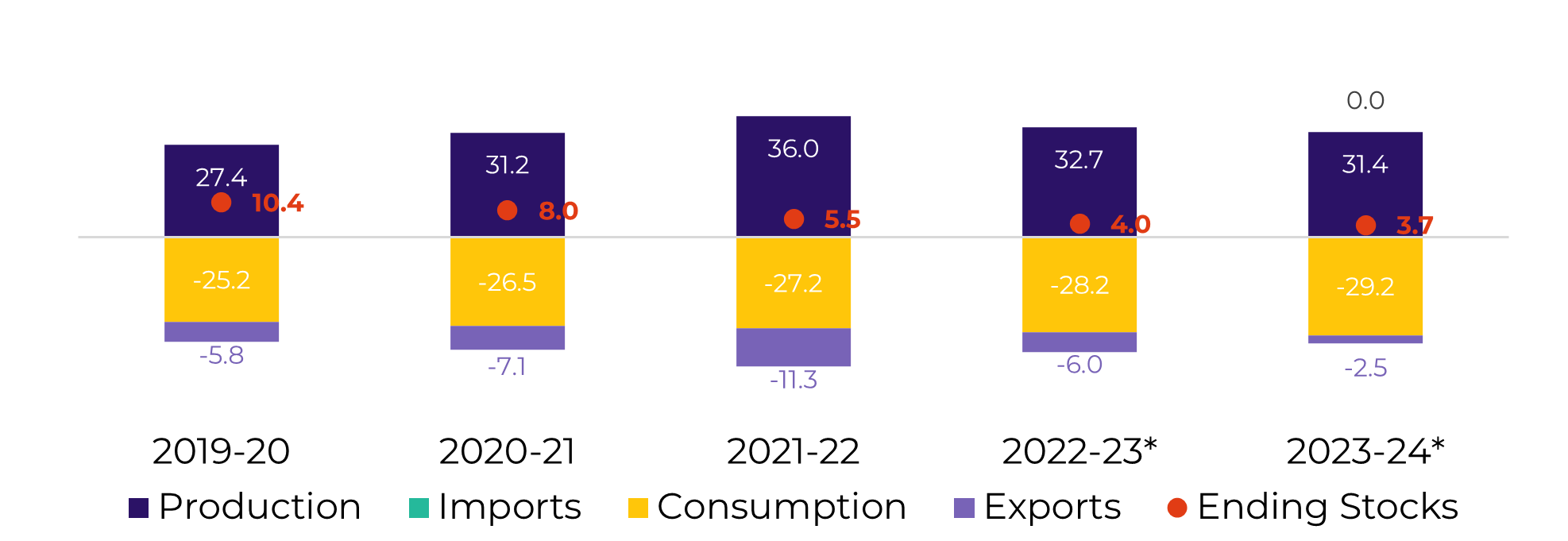

Image 1: India Sugar Balance (‘000t)

Source: ISMA, AISTA, Green Pool, hEDGEpoint

Last week we discussed how trade flows changed given our latest Brazilian crop update, this week, we aim to show what could be the effects of no exports coming out of India during 23/24. Note that our base case suffered some changes from the last report as we updated many other countries, such as Mexico, China, and Thailand.

As base case we consider an optimistic view of India. With our unchanged estimates of 31.4Mt sugar production for 23/24, keeping stocks stable, the country would be able to export up to 2.5Mt. However, we believe that the government would wait for stocks to start building up before allowing any quota, meaning that anyone relying on it would have to wait until the end of Q1/Q2-24 to start seeing higher volumes of sugar available from the country.

As base case we consider an optimistic view of India. With our unchanged estimates of 31.4Mt sugar production for 23/24, keeping stocks stable, the country would be able to export up to 2.5Mt. However, we believe that the government would wait for stocks to start building up before allowing any quota, meaning that anyone relying on it would have to wait until the end of Q1/Q2-24 to start seeing higher volumes of sugar available from the country.

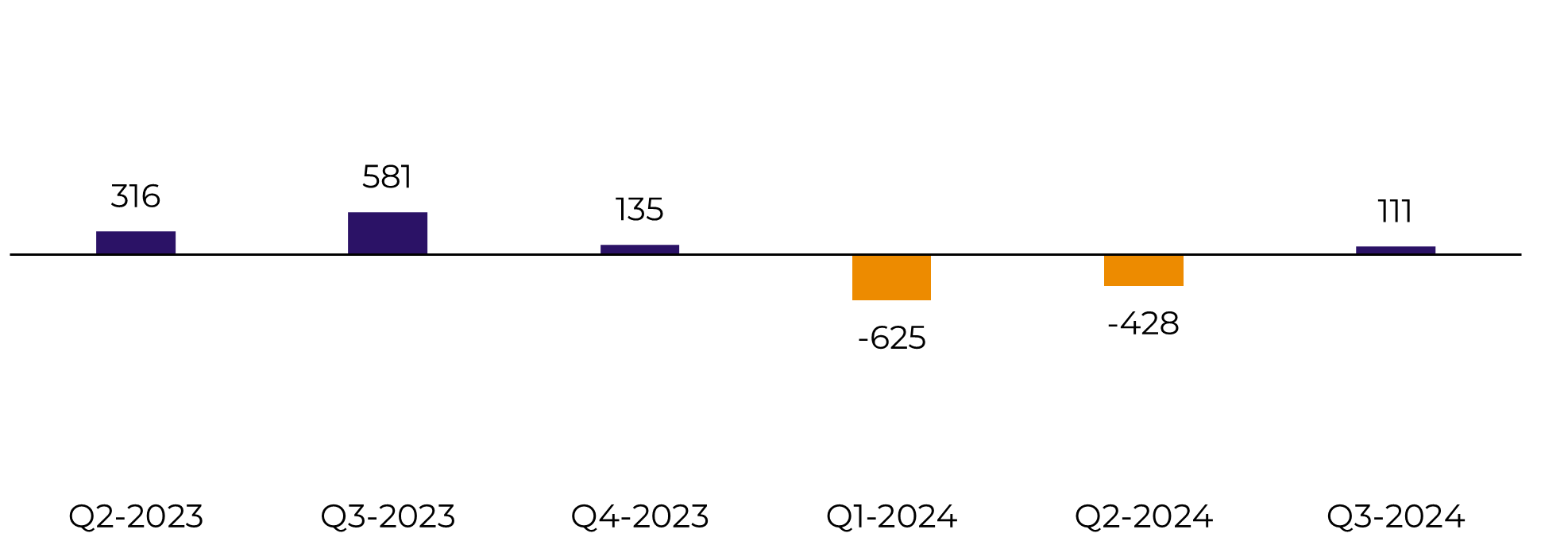

Image 2: Base Case – Total Trade Flows (‘000t tq)

Source: hEDGEpoint, Green Pool

The idea that India might not export at all is the main bullish resource. Even though our base case considers some deficits in Q1-24 and Q2-24, they are not expressive but are enough to keep the V23/H24 spread negative. If India doesn’t export at all, the deficit might become an issue even considering two expressive CS crops in a row.

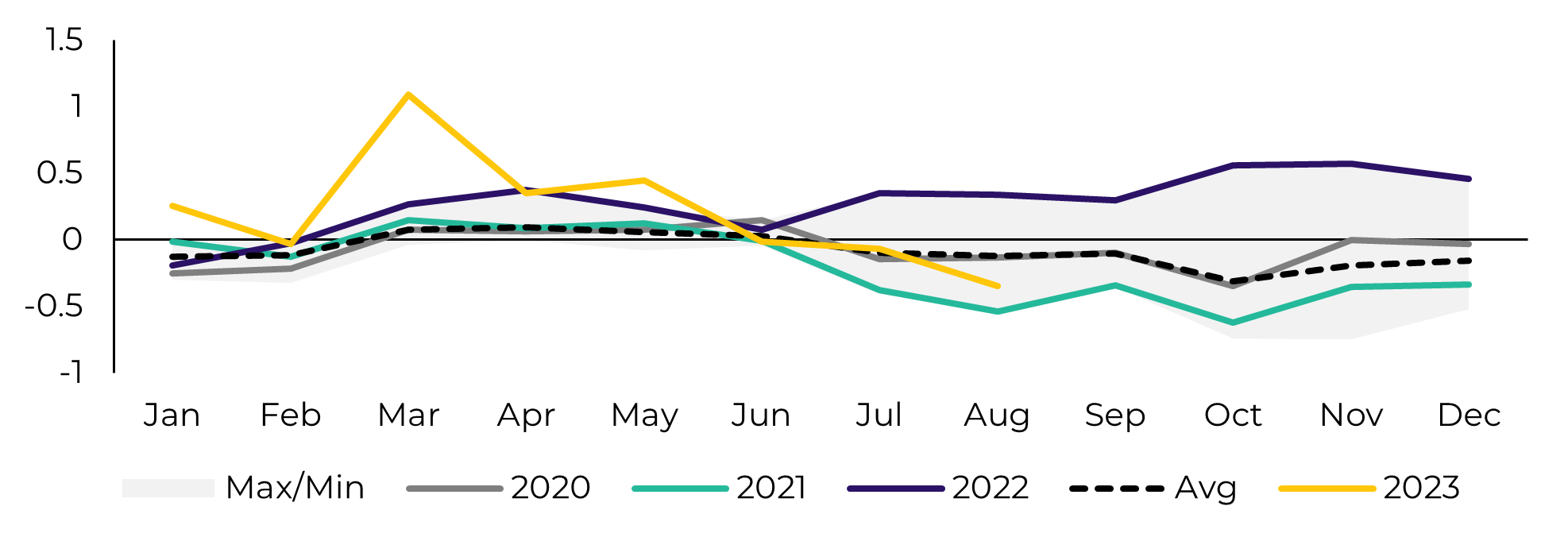

The first quarters of 2024 would be extremely bullish for sugar prices. The lack of Indian exports would combine with Thailand’s crop break and lead to over 1Mt deficit in both Q1 and Q2-24. However, we must be cautious as there is still time for Indian cane to develop. We should keep on monitoring the rains and expect to have a better idea of the crop by September’s end. Also, it is an election year, so any export decision is possible to be a political one.

Image 3: No India Exports – Total Trade Flows (‘000t tq)

Source: hEDGEpoint, Green Pool

As there is still much to unravel, this scenario doesn’t seem to be priced in. The H24/K24 spread is still highly strong and, in the case of two major consecutive deficits, we would expect a smoother behaviour. Current spread structure, therefore, has a higher match to our base case, but in order to anticipate market shifts we need to understand the main risks, and India’s government seems to have all the cards on its hands.

In the short term, however, it is important to state that there is a bearish force as Brazilian CS pace is strong and there are rains predicted to happen in India. This might encourage some selling, especially with physical demand keen to wait and pushing cash discounts further.

In the short term, however, it is important to state that there is a bearish force as Brazilian CS pace is strong and there are rains predicted to happen in India. This might encourage some selling, especially with physical demand keen to wait and pushing cash discounts further.

Image 4: Sugar Cash Premium (Santos FOB – c/lb)

Source: Refinitiv, hEDGEpoint

In Summary

Prices fail to react to Brazilian CS expressive positive results during the week as market went back to discussing the possibility of no exports from India. Especially after ISMA released their new crop estimate down to 31.6Mt and the concentrated rains in some states, the Southeastern country’s availability hit the spotlight.

While it fueled concerns about a possible sugar shortage in Q1 and Q2 2024, it is not yet a consensus. We need to keep monitoring rains and India’s domestic prices as the decision is highly political: stocks are pressured.

Also, another trend worth accessing is China’s imports behaviour. The country has reduced its import pace in the face of such a closed arbitrage. With a marginal production recovery, it might be able to keep its presence in world trade flows reduced compared to previous years.

Weekly Report — Sugar

Written by Lívea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Reviewed by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.