Aug 28

/

Alef Dias / Natália Gandolphi

Sugar and Ethanol Weekly Report - 2023 08 28

Back to main blog page

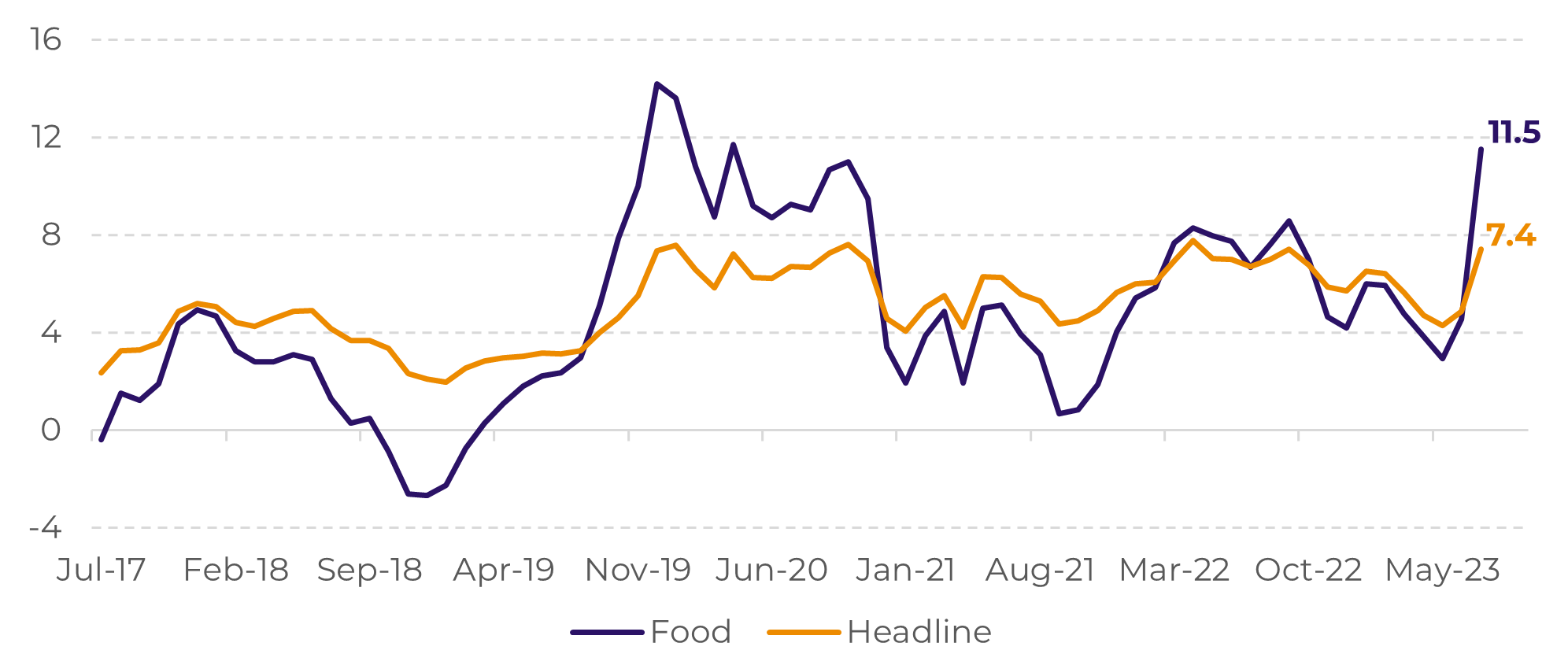

"Weather challenges have a pronounced consequence on India's food inflation, which jumped from 4.7% in the previous month to 11.5%. Sugar was one of the products that saw its domestic price rise in recent months, leading the government to consider restrictions on exports."

Risks of an export ban increase in India

- Over the last few months, India has grappled with numerous weather-related hurdles that have severely impacted various agricultural markets. The most pronounced consequence of these challenges is the significant surge in food inflation, escalating from 4.7% in the preceding month to 10.6%.

- Local sugar prices haven’t escaped this dynamic. Monsoon rainfall in vital cane-producing areas such as Maharashtra and Karnataka, responsible for over half of India's sugar output, fell below average by up to 50%. India's sugar production might decrease by 3.3% to 31.7 million tonnes in 2023/24 according to ISMA.

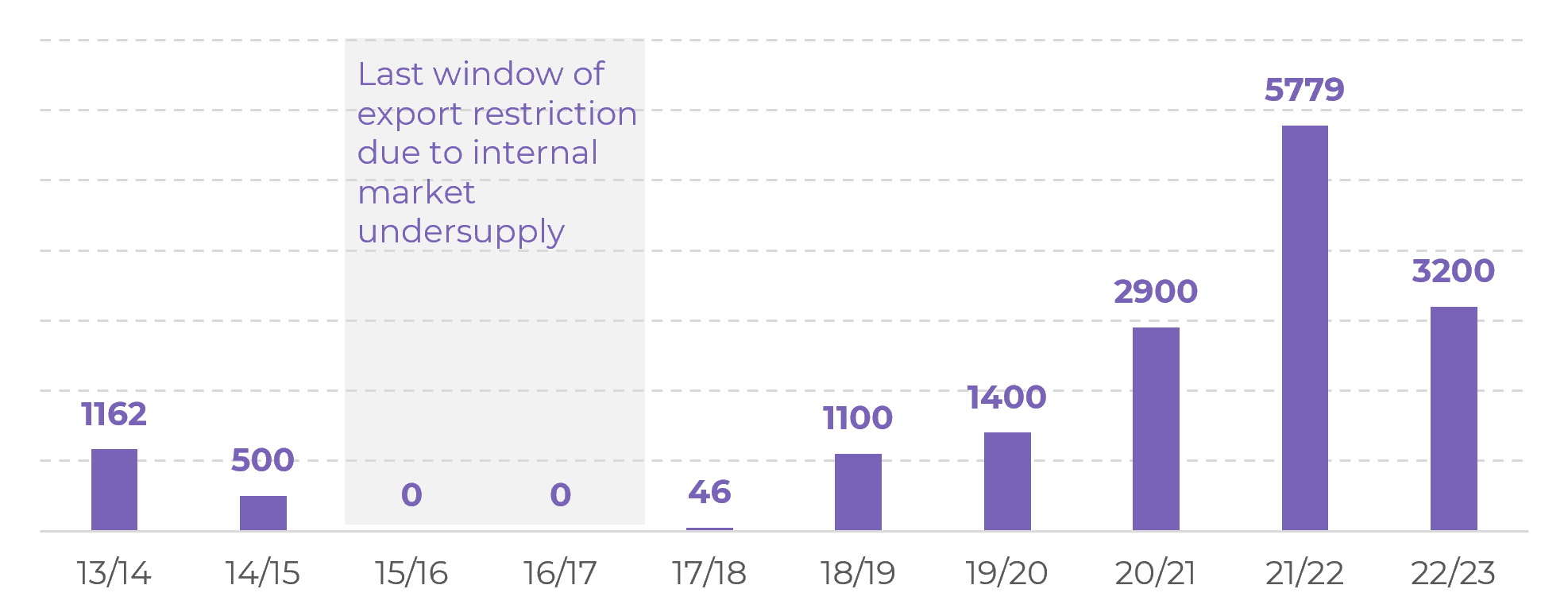

- Consequently, rumors of a ban on India’s sugar exports are increasing. The government aims to ensure adequate sugar availability for consumption, ethanol production, and maintain a 6 million tonne closing stock.

India has been facing a myriad of weather challenges in the past few months which have disrupted agricultural markets, given the country’s standing as producer and exporter. The greatest symptom of these challenges is the food inflation, that climbed to 10.6% from 4.7% the month prior, led especially by a 214% month-on-month jump in vegetable prices, but with consequences to many other products – including sugar.

Consequently, headline inflation also accelerated. India’s CPI jumped to 7.4% year on year from 4.9% in June, a second straight month of gains – breaching the upper end of India’s Reserve Bank 2%-6% target range in July for the first time in five months — and by a wide margin.

Image 1: Headline and Food CPI – India (YoY,%)

Source: Refinitiv

In addition to the high food inflation, weather hasn’t been great for the sugar crop in India so far. With elections coming in 2024, India’s authorities are taking measures to control food inflation – and sugar hasn’t escaped this reality.

India may ban sugar exports for the first time in 7 years

India may ban sugar exports for the first time in 7 years

According to three government insiders, India may prohibit sugar mills from exporting in the upcoming season from October onwards. This will mark the first halt in shipments in seven years, and it is due to diminished cane yields from the insufficient rainfall seen so far.

In response to the reverb created by this announcement, India amended its stance, and will determine its 2023/24 sugar exports based on forthcoming estimates of sugar cane production.

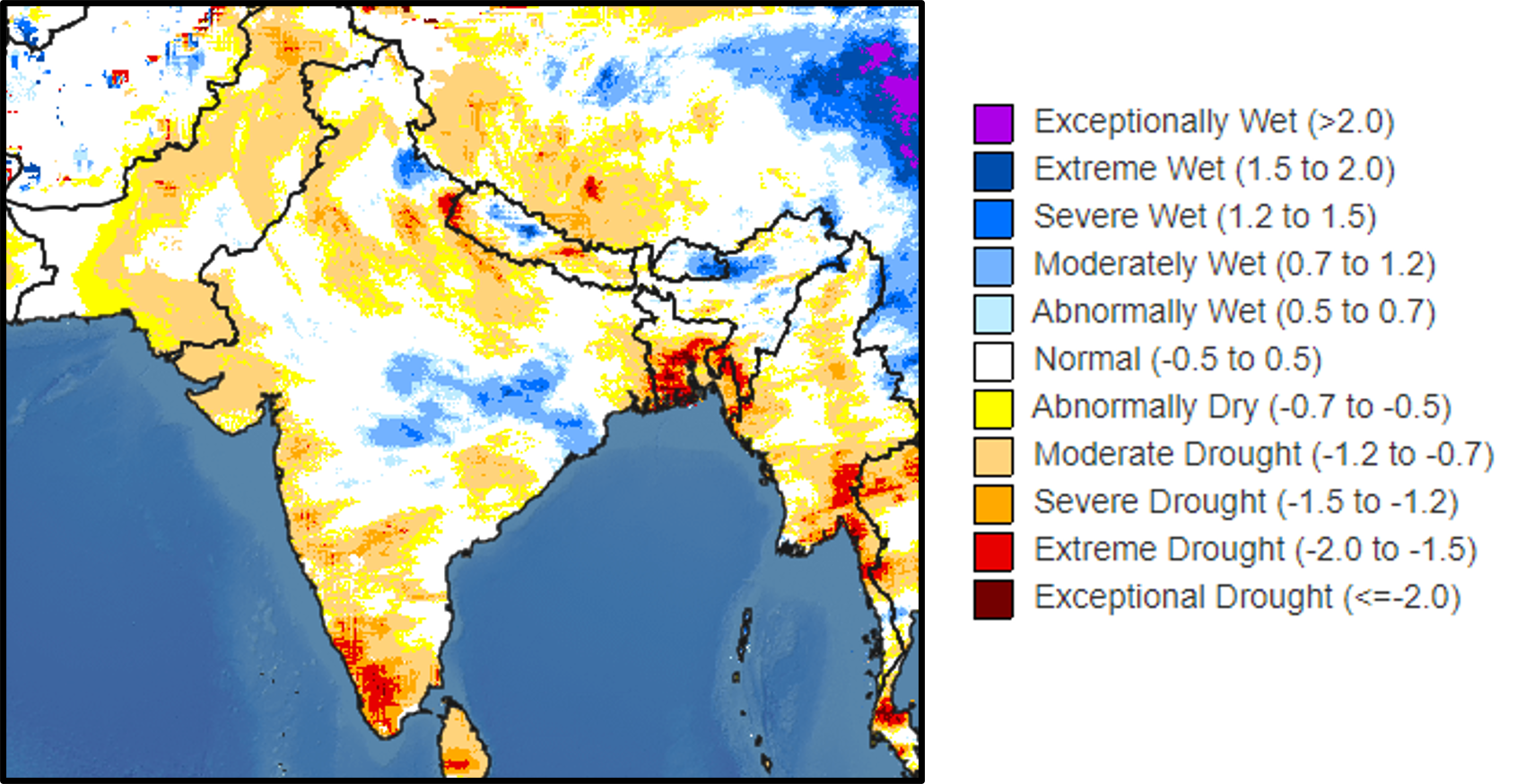

Image 2: NOAA Drought Monitoring Index (Aug 15 to Aug 20)

Source: USDA

The government's focus is on ensuring ample sugar availability for consumption, ethanol production, and maintaining a 6 million tonne closing stock for the season. Last season, India permitted mills to export only 6.1 million tonnes of sugar, a significant reduction from the record 11.1 million tonnes the previous year.

Rainfall during the monsoon season in key cane-producing regions like Maharashtra in the west and Karnataka in the south, responsible for over 50% of India's sugar production, has fallen notably short this year, up to 50% below the average levels.

Stringent measures are being taken to prevent uncontrolled exports and guarantee domestic supply.

Rainfall during the monsoon season in key cane-producing regions like Maharashtra in the west and Karnataka in the south, responsible for over 50% of India's sugar production, has fallen notably short this year, up to 50% below the average levels.

Local sugar prices surged this week to the highest level in 2 years, due to the extreme drought conditions reported in the country.

Image 3: India’s Raw Exports (‘000 MT)

Source: USDA

Image 4: Sugar Prices Mumbai – India (INR/qtl)

Source: Bloomberg

In Summary

India's recent weather challenges have disrupted agricultural markets, leading to significant food inflation of 10.6%. This surge has also pushed headline inflation to 7.4%, breaching the Reserve Bank's target range. Amidst this, sugar crop conditions have been poor due to below-average precipitation in key cane-producing regions.

Concerns about domestic supply may lead India to halt sugar exports for the first time since the 15/16 and 16/17 crops – providing another important bullish fundamental for sugar prices.

Weekly Report — Sugar

Written by Alef Dias

alef.dias@hedgepointglobal.com

alef.dias@hedgepointglobal.com

Written by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Reviewed by Lívea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.