Sep 4

/

Lívea Coda

Sugar and Ethanol Weekly Report - 2023 09 04

Back to main blog page

"The decision to export is political, but the market remains favorable. As inflation in India has exceeded its Central Bank's target, it is natural to expect the government to take action. However, we must remember that sugar is not entirely to blame."

From a market view, India should export

- Although market is scared about the possibility of no Indian exports, we should remain cautious regarding news and rumors: no official decision has been made.

- Of course, higher inflation is an indication that the government might act – as it already has in other markets. However, sugar is not the main reason behind the rise in the food and overall CPI.

- Lack of rain does raise a red flag in terms of availability, but it also helps support the market in a bullish bias. Compared to past crops, India does not have the incentive to import, but market keeps pointing out the need for, at least, reduced participation from the country.

- Despite prices in INR/qtl being extremely high (3,800 INR/qtl), the devaluation of the INR guarantees a lower price in USD, at 460.55 USD/t, below the international market, with raws above 560 USD/t and white above 700 USD/t.

The decision to export is political, but the market remains supportive. In our last report we brought up India’s government key reason for a possible sugar exports ban: an unprecedented rise in its consumer price index (CPI) above their target. As inflation reached 7.4% YoY in July, and their Central Bank target is 4%, with lower and upper tolerance limits of 2% and 6%, respectively, it is natural to expect government to act.

However, it is fair to remember that sugar is not the one to blame. When analysing India’s YoY inflation rates per group, the main drivers of a higher food index were vegetables, with a 37.3% increase, together with spices, which rose 21.63%. Sugar and confectionery, on the other hand, rose by 3.75%. Of course, August monsoon results are not encouraging, and lower production could disturb domestic prices further. Still, much has been said and many rumours have taken a toll on prices – even the possibility of imports are being considered by a few. To try and figure out where the main risks are, and justify our current 1.3Mt export expectation, let’s compare current and past market outlooks.

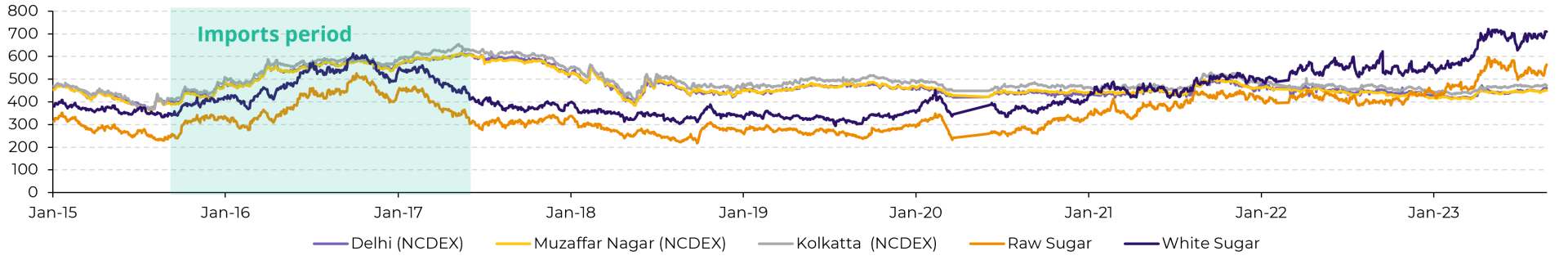

Image 1: Current Prices M Grade (USD/t)

Source: Bloomberg, NCDEX, hEDGEpoint

During the 2015/16 and 16/17 crops, the country not only did not export, but also imported sugar to control domestic prices. From October 2015 to September 2017 the average price for Delhi, Muzaffar Nagar and Kolkatta reached 554 USD/t (3,670 INR/qtl), against the global market average of 374 USD/t for raw sugar and 468 USD /t for white. In this market, it is safe to say that there was plenty of encouragement for imports, and little for exports.

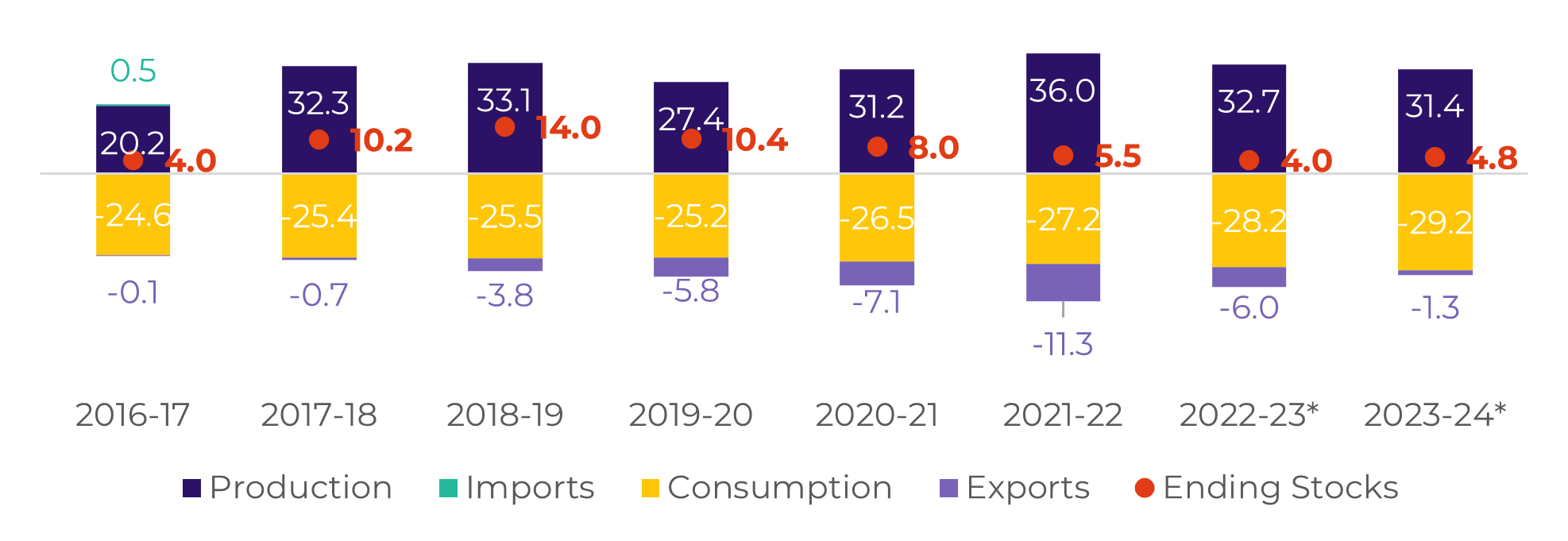

Image : Sugar Balance – India (Mt tq Oct-Sep)

Source: ISMA, AISTA, hEDGEpoint

Using simple math, India should keep exporting sugar. The country could benefit from current market situation and perspective. However, it is not that simple, and fundamentals such as weather, expected production, and stocks play an important role in policy making.

India is the biggest sugar consumer, being responsible for over 28Mt disappearance annually. It is known that the country’s government aims to keep at least 3-months consumption reserve. For 22/23 it would mean 7Mt, while for 23/24, 7.3Mt. So far, with what has been exported (6Mt) during the current season, stocks are at historically low values, at around 4Mt.

India is the biggest sugar consumer, being responsible for over 28Mt disappearance annually. It is known that the country’s government aims to keep at least 3-months consumption reserve. For 22/23 it would mean 7Mt, while for 23/24, 7.3Mt. So far, with what has been exported (6Mt) during the current season, stocks are at historically low values, at around 4Mt.

Even if India doesn’t export in 23/24, stocks won’t reach the “target”. However, given the current international market configuration, we believe that not only are imports off the table, but some exports might as well be allowed once stocks start piling up – it would be hard to prevent millers from taking a little advantage of sugar’s high prices.

It does not mean we are turning a blind eye to lower availability; in fact, we’ve been pledging the 31.4Mt for a while. Although rains were confirmed to be as low as they could have during August, we remain with our production unchanged – there is still some time until the beginning of the crop – and with our 1.3Mt export expectation.

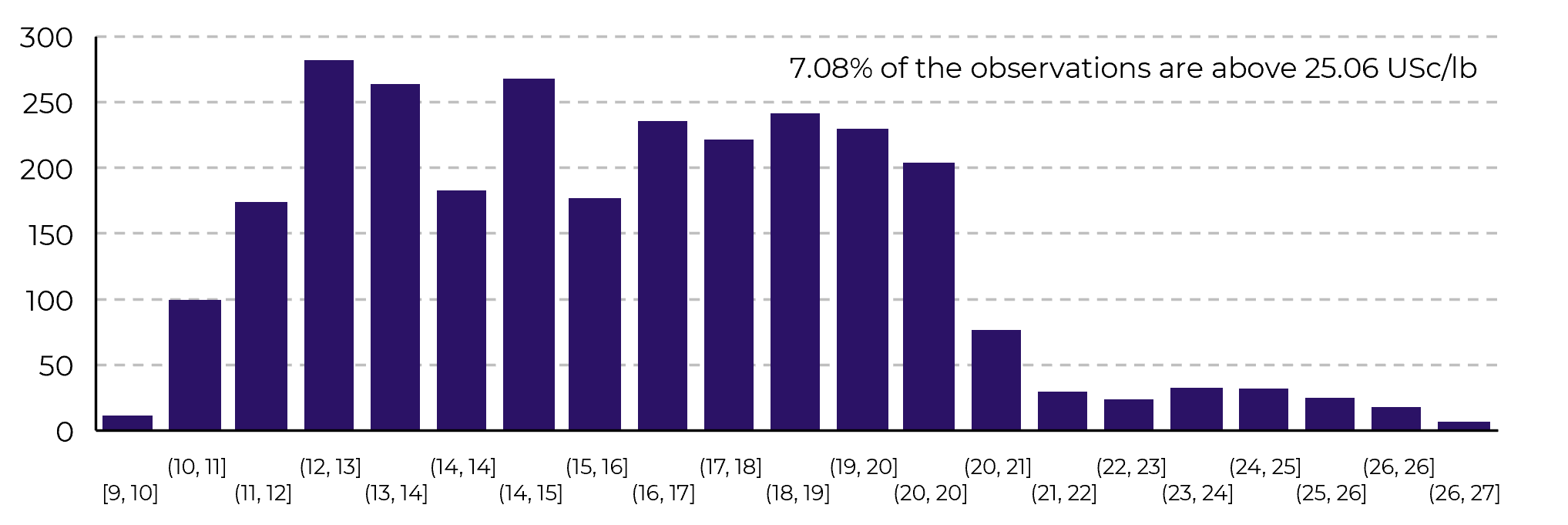

Image 3: Raw Sugar Prices Frequency Analysis (USc/lb)

Source: Refinitiv, hEDGEpoint

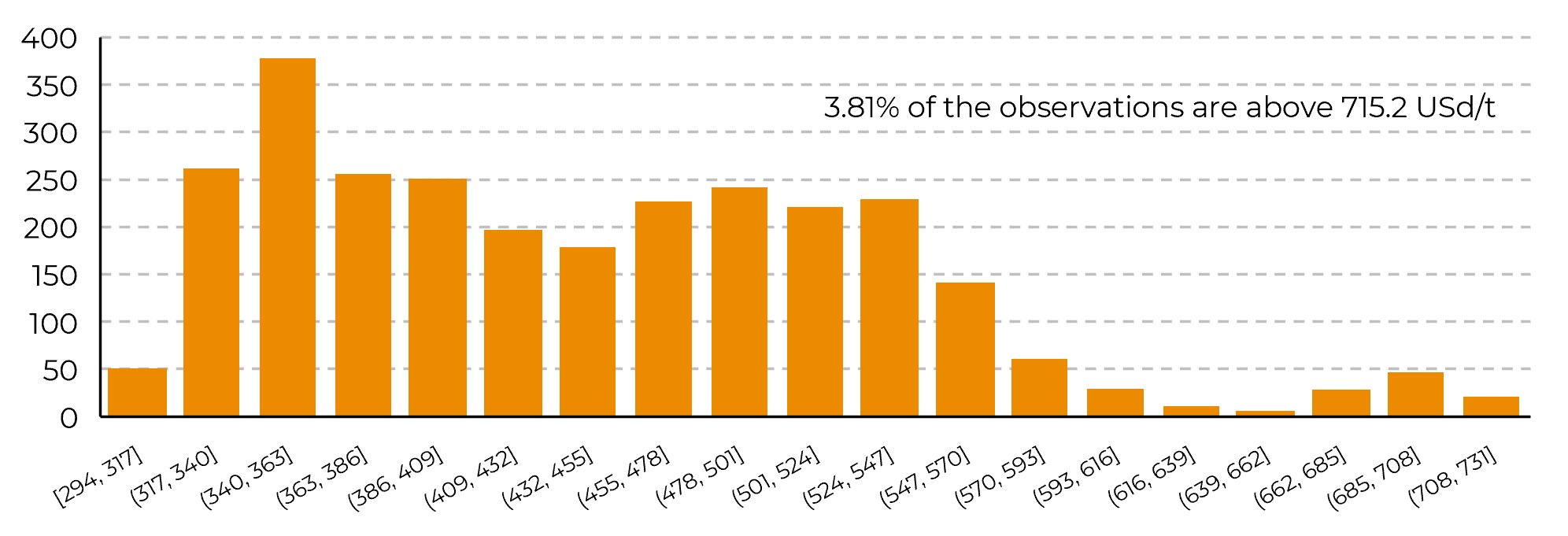

Image 4: White Sugar Prices Frequency Analysis (USd/t)

Source: Refinitiv, hEDGEpoint

In Summary

Although market is scared about the possibility of no Indian exports, we should remain cautious regarding news and rumors: no official decision has been made.

Of course, higher inflation is an indication that the government might act – as it already has in other markets. However, sugar is not the main reason behind the rise in the food and overall CPI.

Lack of rain does raise a red flag in terms of availability, but it also helps support the market in a bullish bias. Compared to past crops, India does not have the incentive to import, but market keeps pointing out the need for, at least, reduced participation from the country.

Weekly Report — Sugar

Written by Lívea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Reviewed by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.