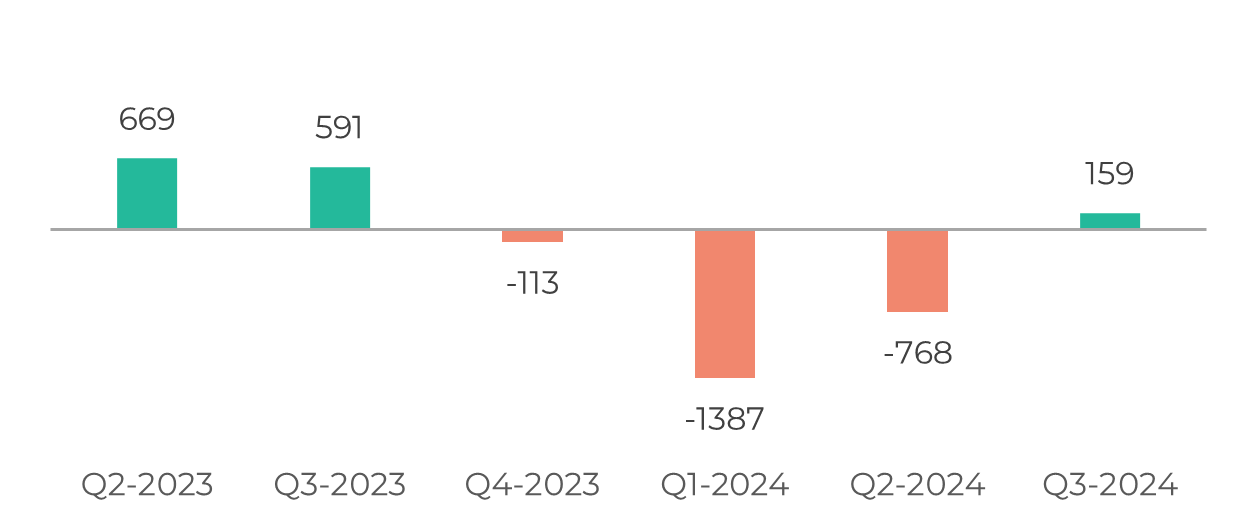

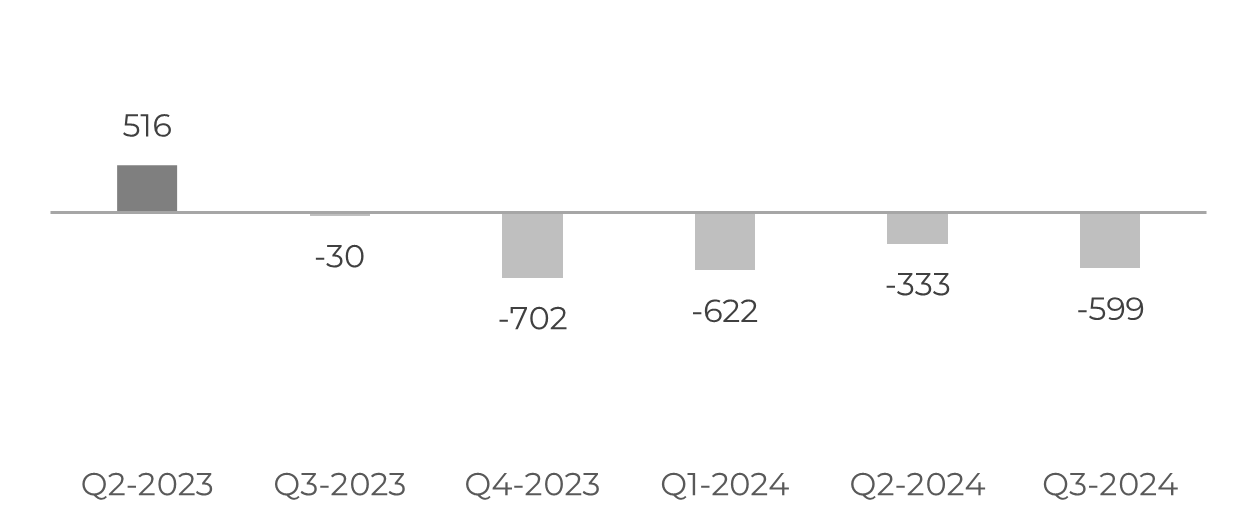

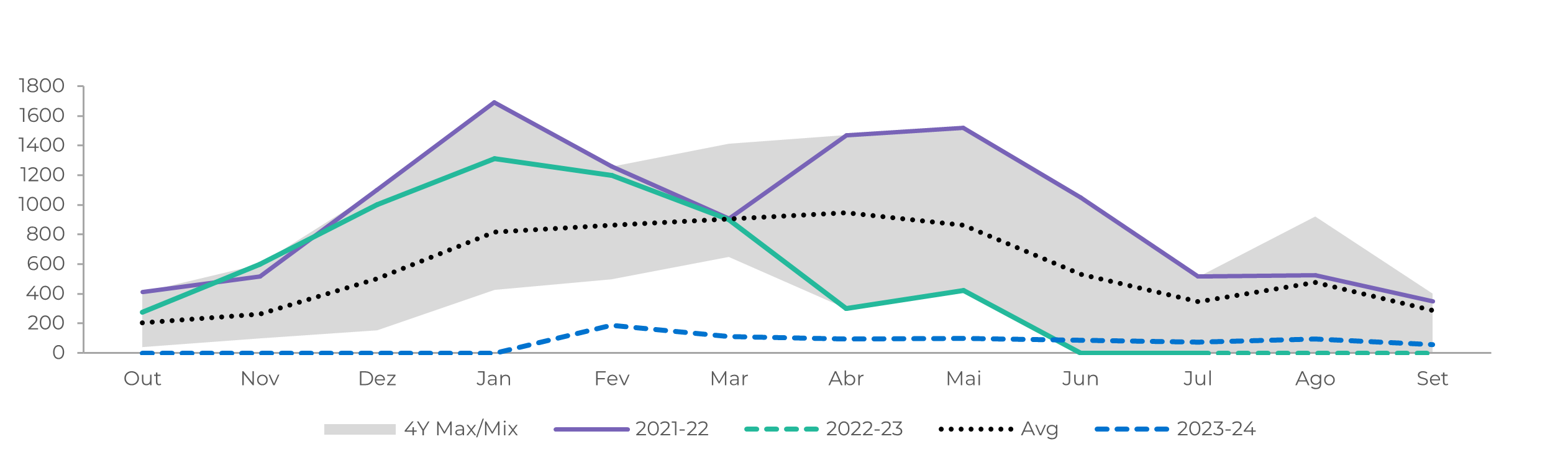

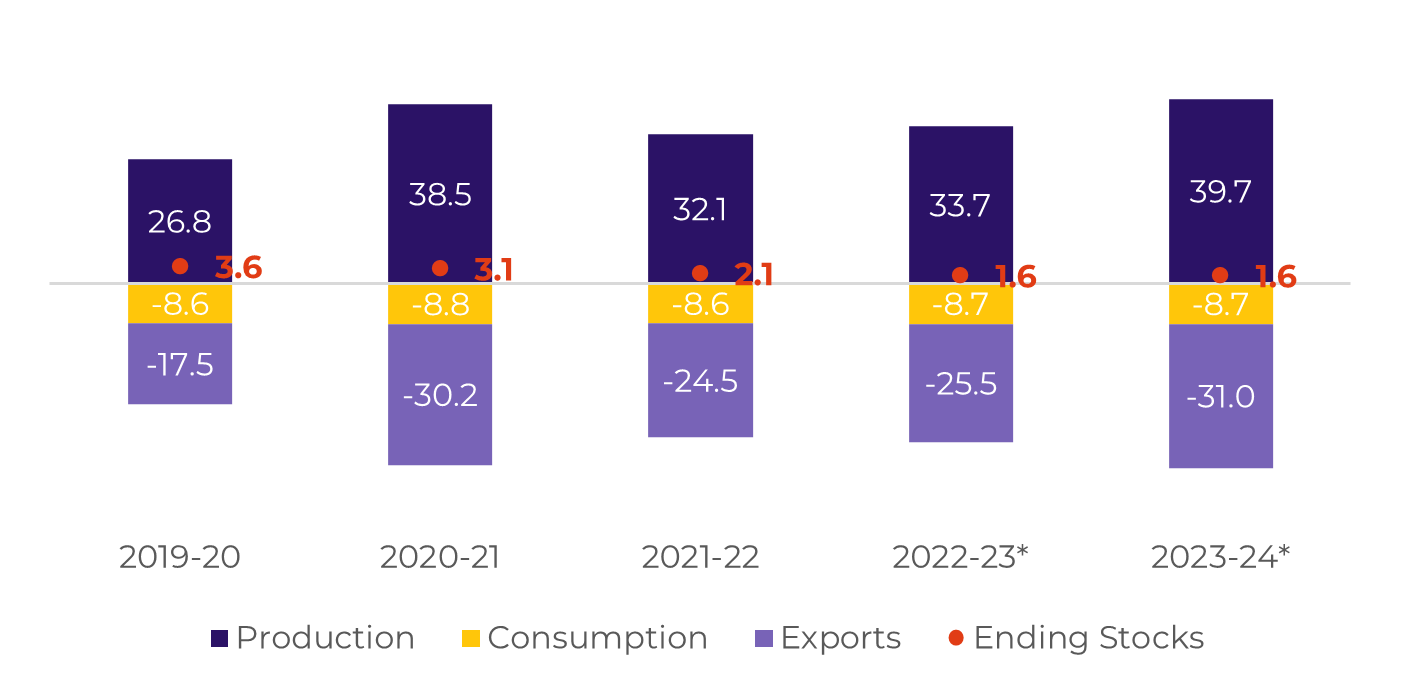

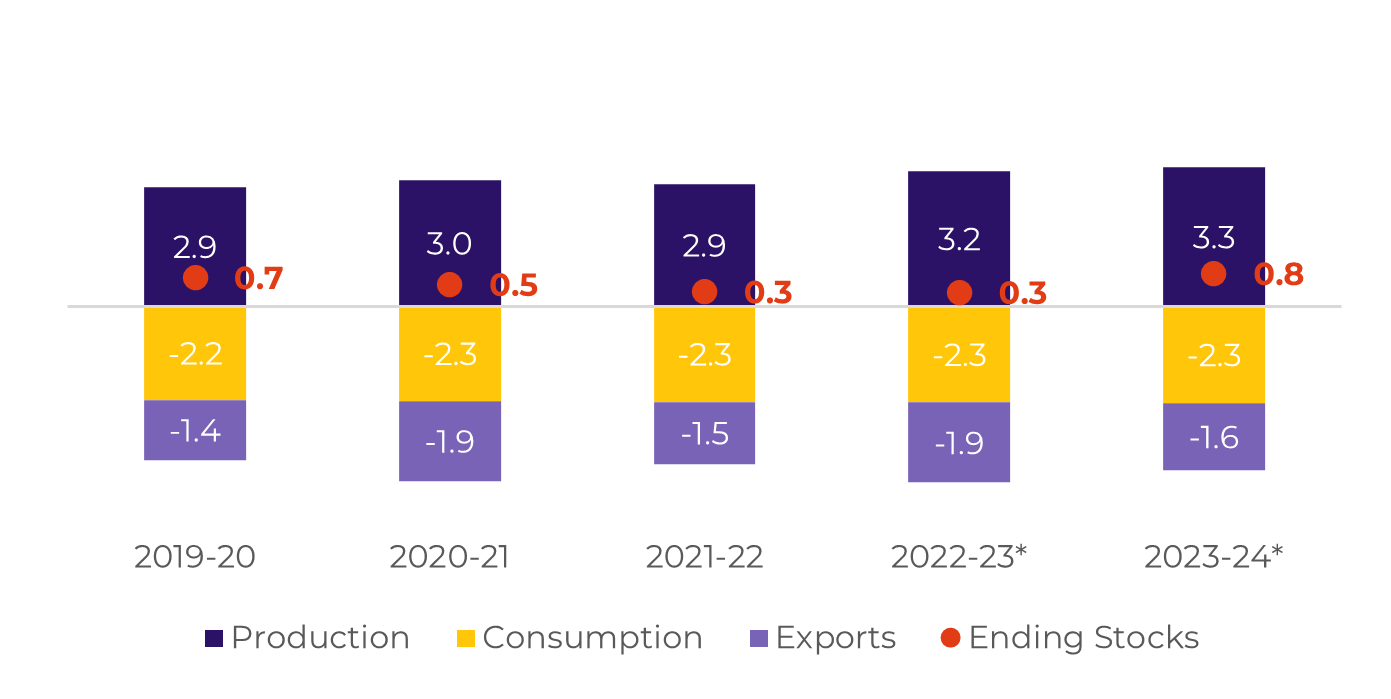

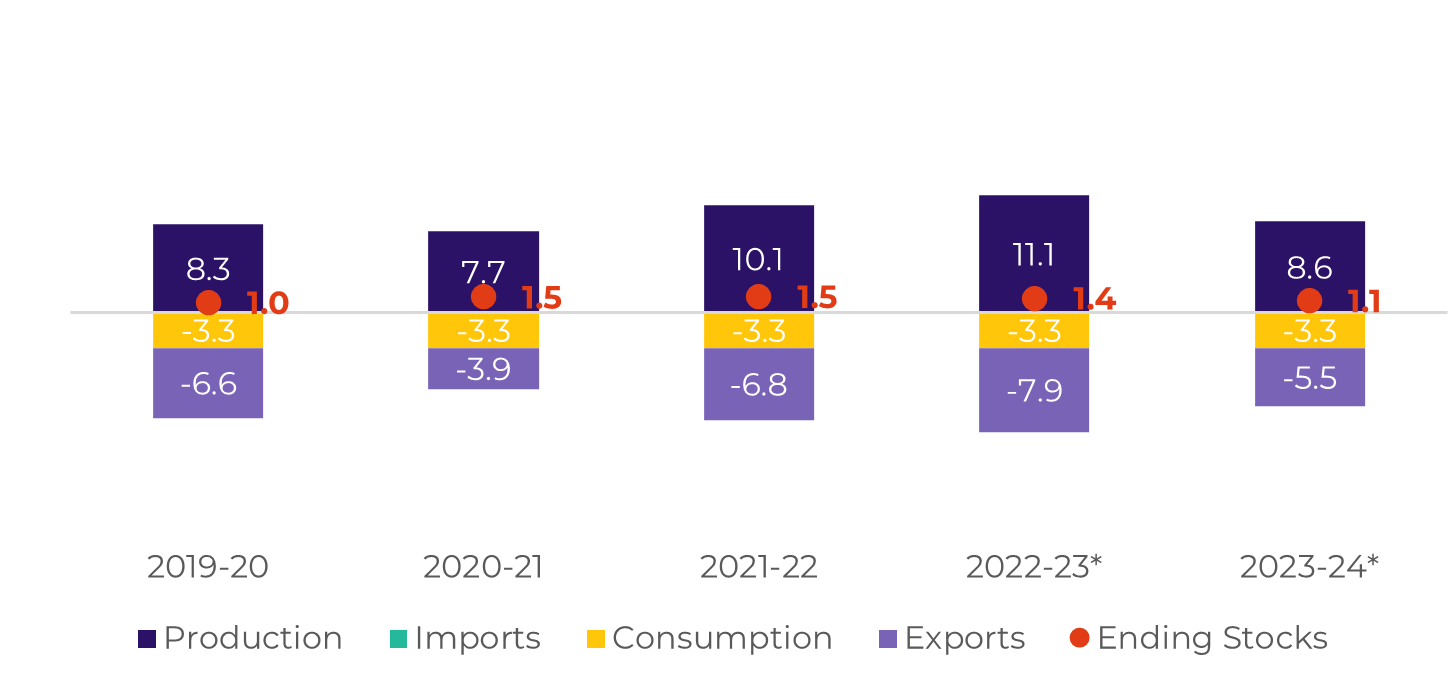

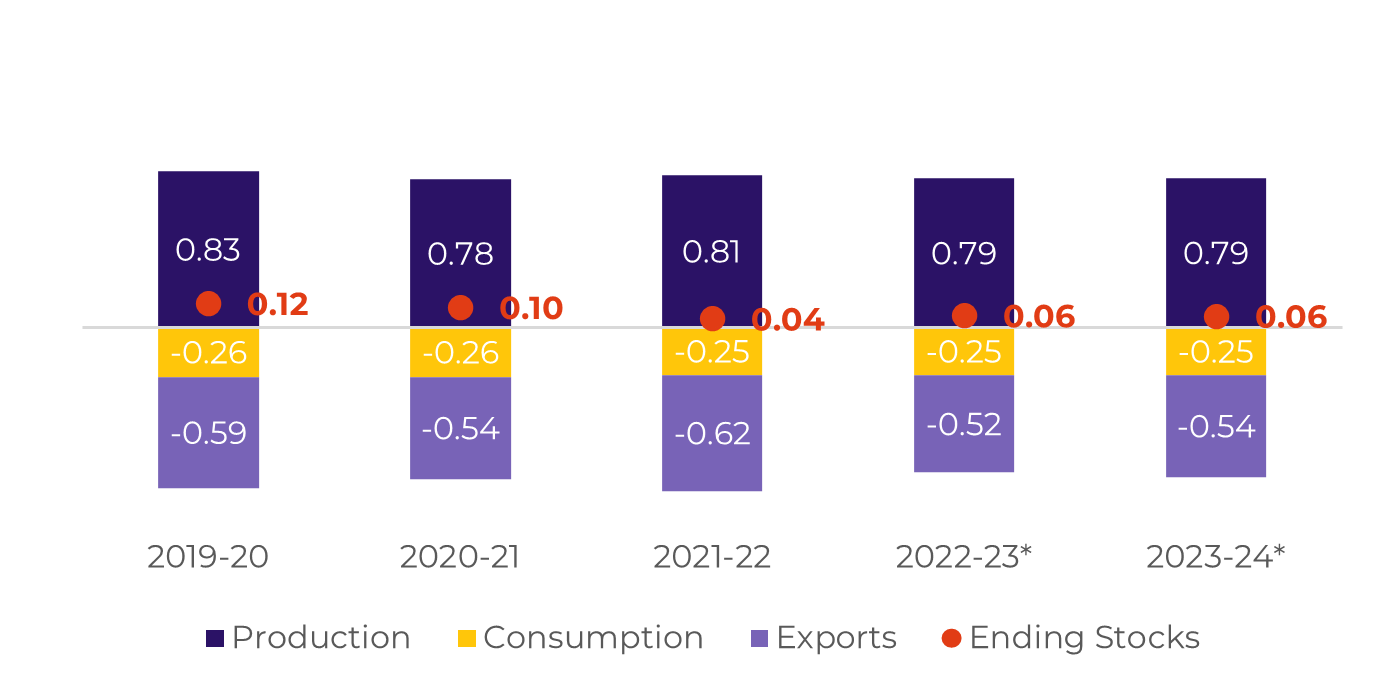

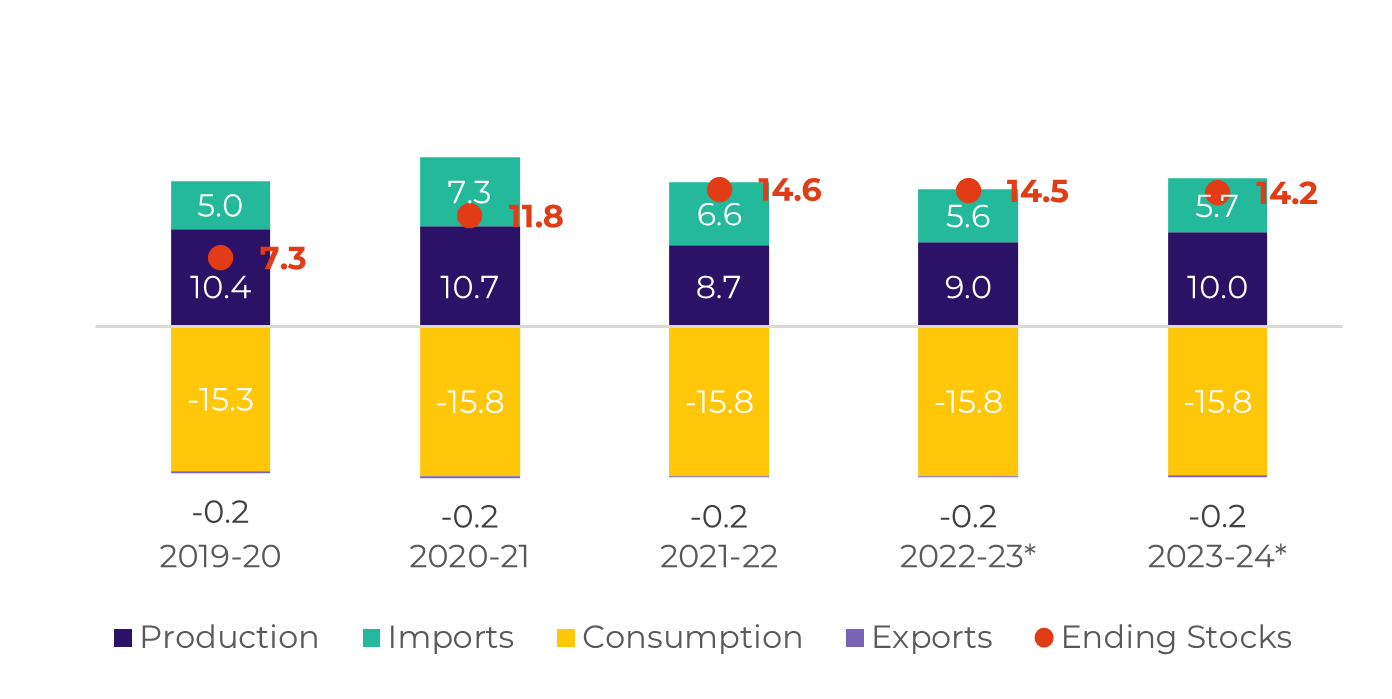

Our revision to the Brazilian Center-South total volume contributed positively to trade flow availability, at least until the end of 2023. Confirmations of other countries' production and exports reduced the Q3 surplus, especially India's fulfilling all of its approved quota yet in Q2.

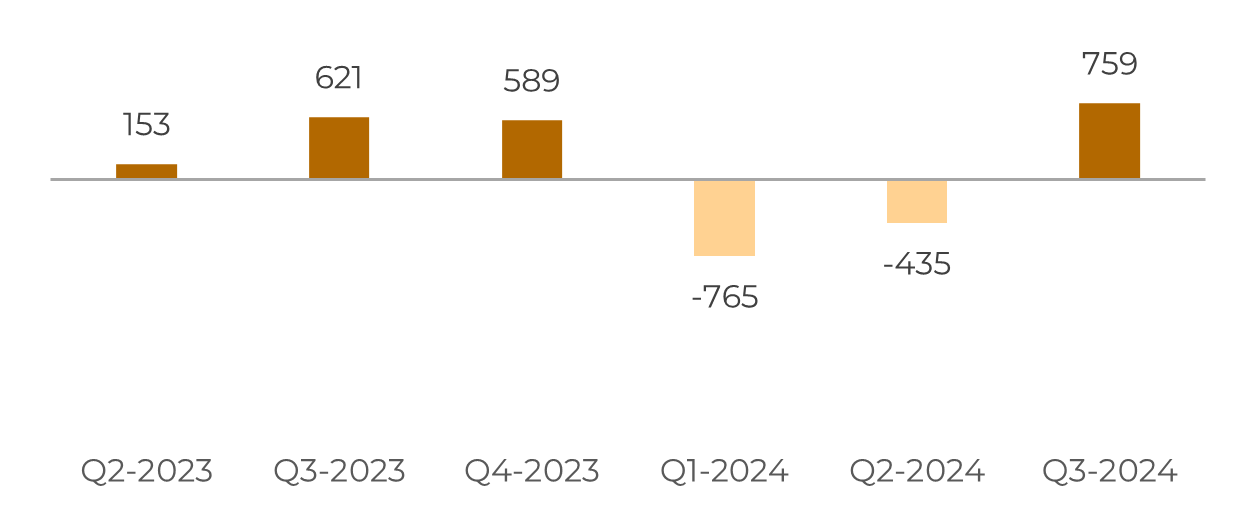

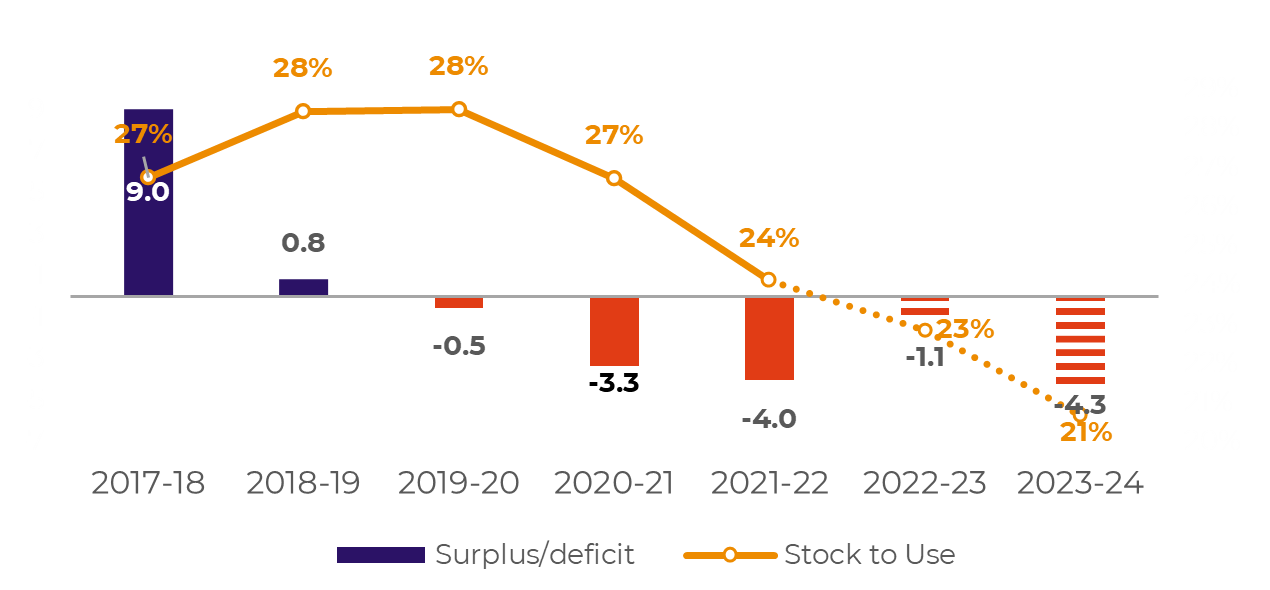

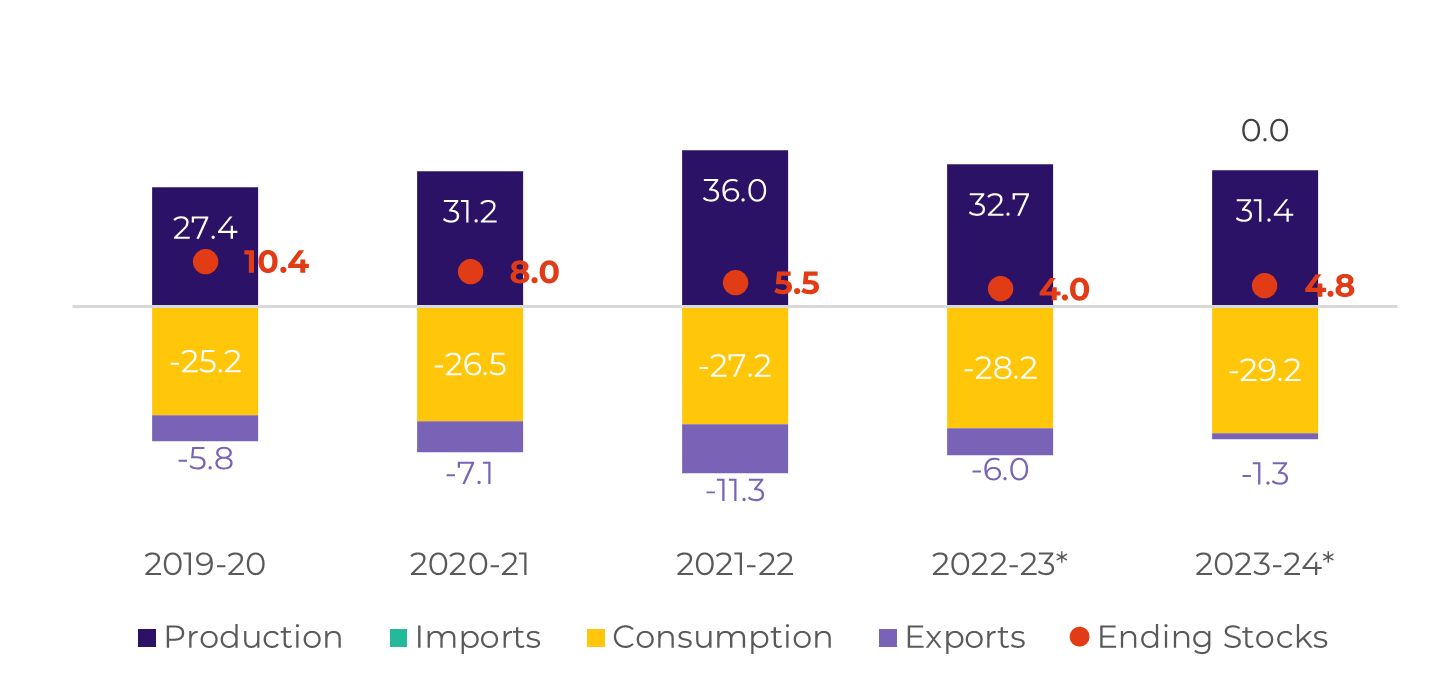

For the next year, 2024, the first and second quarters are still penalized by lower participation from the Northern Hemisphere. India has faced the worst August monsoon in many years, contributing to further availability disruptions, leading the market back to the null to 2.5Mt exports discussion.

We revised our India's exports to 1.3Mt, starting later in the season due to possible delays in quotas allowances - lowering our Q1 and Q2 2024 trade flows further. Therefore, sugar remains facing a short-term bearishness coming from Brazilian CS higher availability, however, prices have found some extra support in 2024 tightness, breaching the 25c/lb resistance level.