Sep 18

/

Lívea Coda

Sugar and Ethanol Weekly Report - 2023 09 18

Back to main blog page

"We revised our brazilian CS estimate up taking into consideration yields, pace and lost days. With a 624.8Mt sized crop, Brazil will be able to surpass 40Mt sugar production, smoothing part of the international tightness. But, of course, the country is not able to fulfill for the Northern Hemisphere absence alone. "

Brazilian CS's big crop keeps getting bigger

- Market seems to have priced in the higher availability from Center South (CS). The region’s big crop keeps getting bigger and it seems to be a consensus that there is much cane left to be crushed yet this season.

- We revised our numbers up taking into consideration yields, pace and lost days. With a 624.8Mt sized crop, Brazil will be able to surpass 40Mt sugar production, smoothing part of the international tightness.

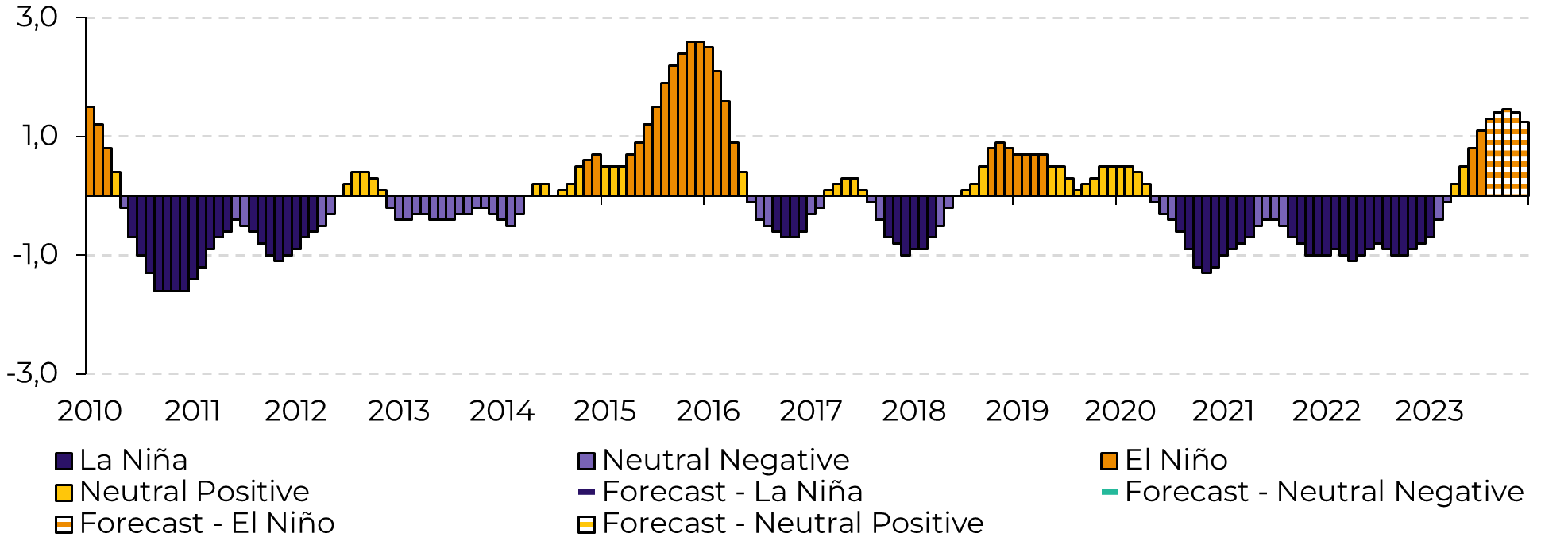

- But, of course, the country is not able to fulfill for the Northern Hemisphere absence alone. Thailand crop worsening and India’s no export possibility keeps supporting the market. The extension of El Niño’s active period also induced market to higher gains during the past week.

- Although we could expect some corrections to October as it approaches its expiry and Brazil keeps trading at a discount, long term fundamentals might offer some players enough incentive to prevent a major drop.

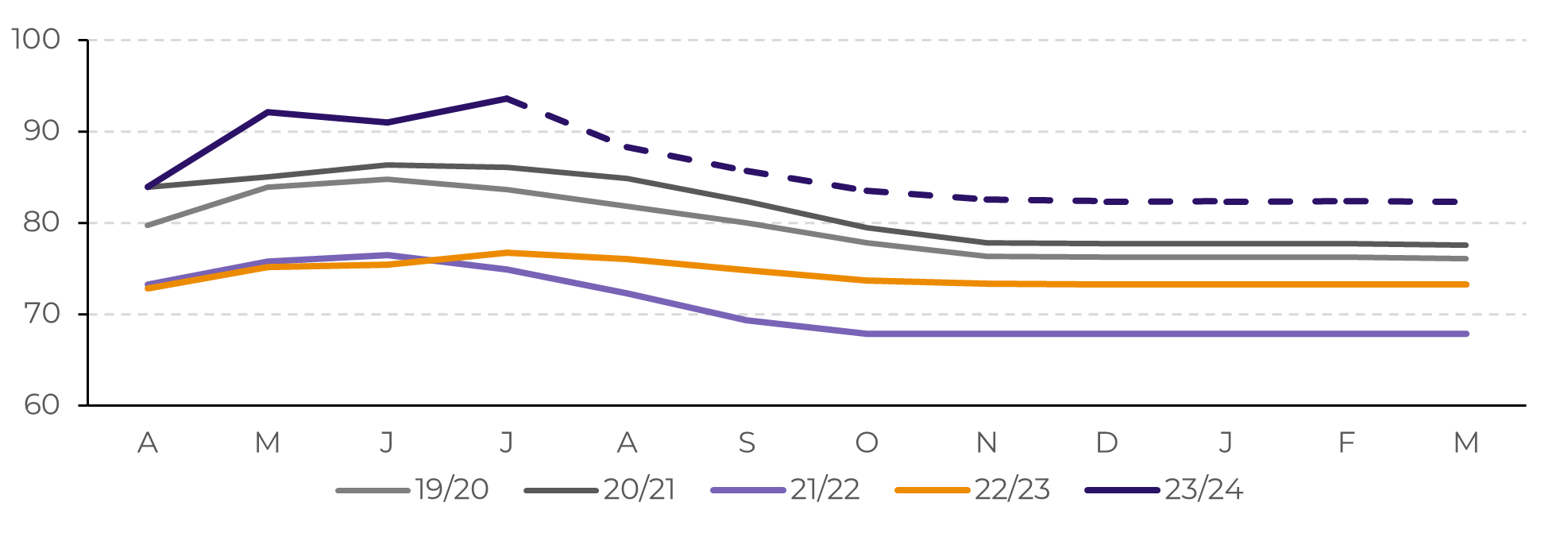

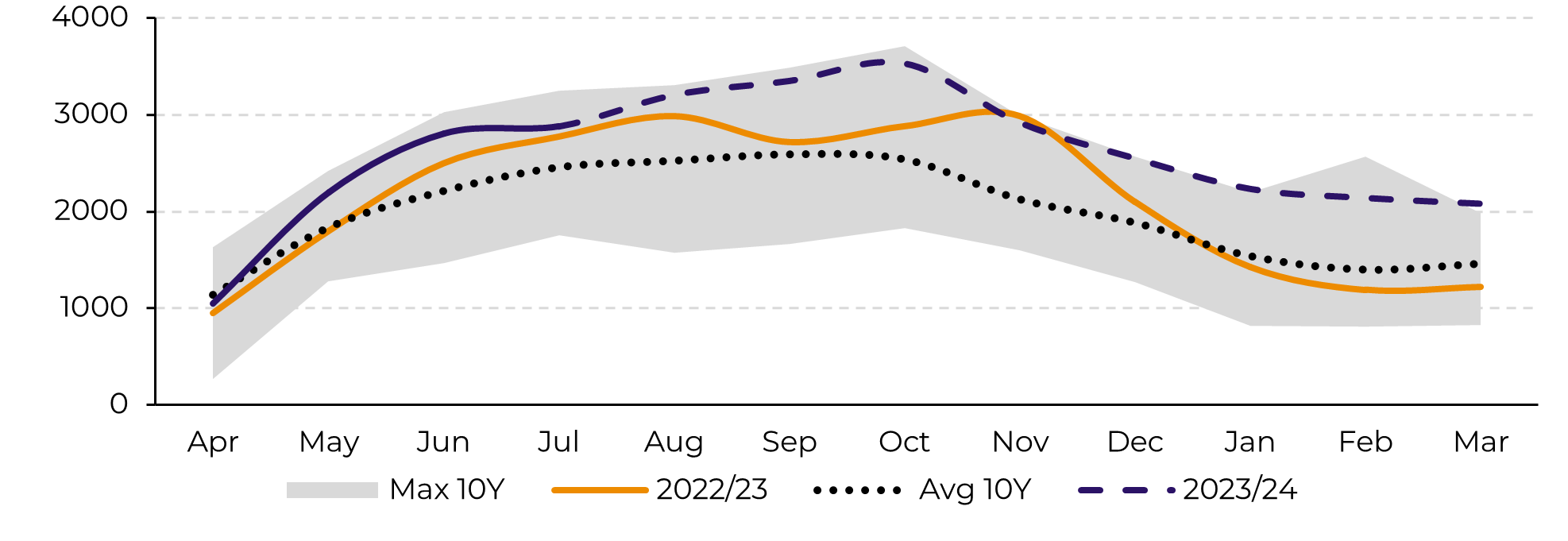

This is no news: Brazilian cane field doesn’t stop surprising on the upside. Cumulative yields have reached 93.6 t/ha after a great July result at 98 t/ha. Unica report also showed a strong result for the latest fortnight – even with some scattered rains. About 46.5Mt was crushed and 3.46Mt of sugar was produced, however, the market failed to correct due to the options expiry and further developments regarding India’s crop. Old news was refreshed as the country’s industry and government stated that Maharashtra production should drop nearly 14% in 23/24.

As noted, TCH showed quite some improvement compared to last season. Younger cane and great weather are the main reasons behind the excellent results and should remain so. Although many weather forecast tools pointed out a wetter-than-usual August, that didn’t turn out to be entirely true – also, September forecast dried out recently. This means that mills will be able to keep the excellent crushing rhythm and that we might have more availability from the region.

Also, during the week, the Brazilian Federal Government introduced the "Fuel of the Future" bill, attempting to attract 250 billion reais in investments. The proposed initiatives include increasing the anhydrous blend in gasoline (up to 30% pending technical feasibility), establishing a sustainable aviation fuel program, and creating regulations for carbon dioxide capture and geological storage activities, all aimed at decarbonizing the transportation sector.

However, despite all last week’s developments, in this report we focus on Center South’s (CS) crop, and why it is going to be bigger than previously anticipated.

As noted, TCH showed quite some improvement compared to last season. Younger cane and great weather are the main reasons behind the excellent results and should remain so. Although many weather forecast tools pointed out a wetter-than-usual August, that didn’t turn out to be entirely true – also, September forecast dried out recently. This means that mills will be able to keep the excellent crushing rhythm and that we might have more availability from the region.

Image 1: Cane Yield (t/ha)

Source: UNICA, hEDGEpoint

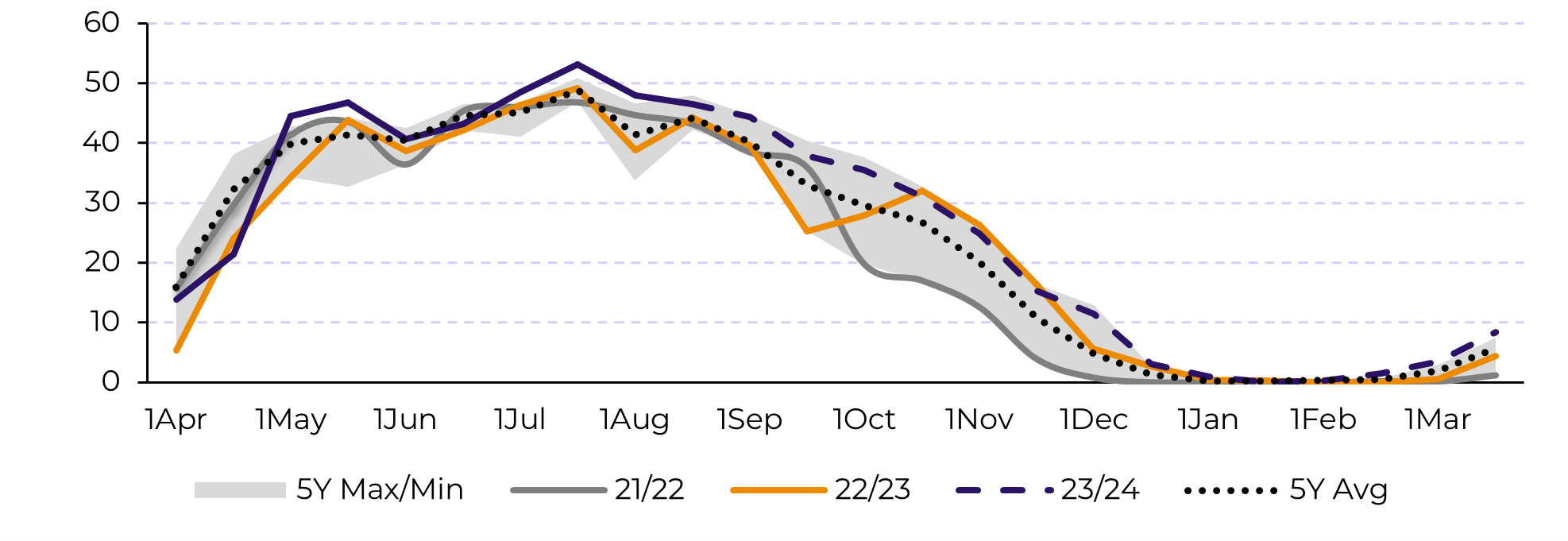

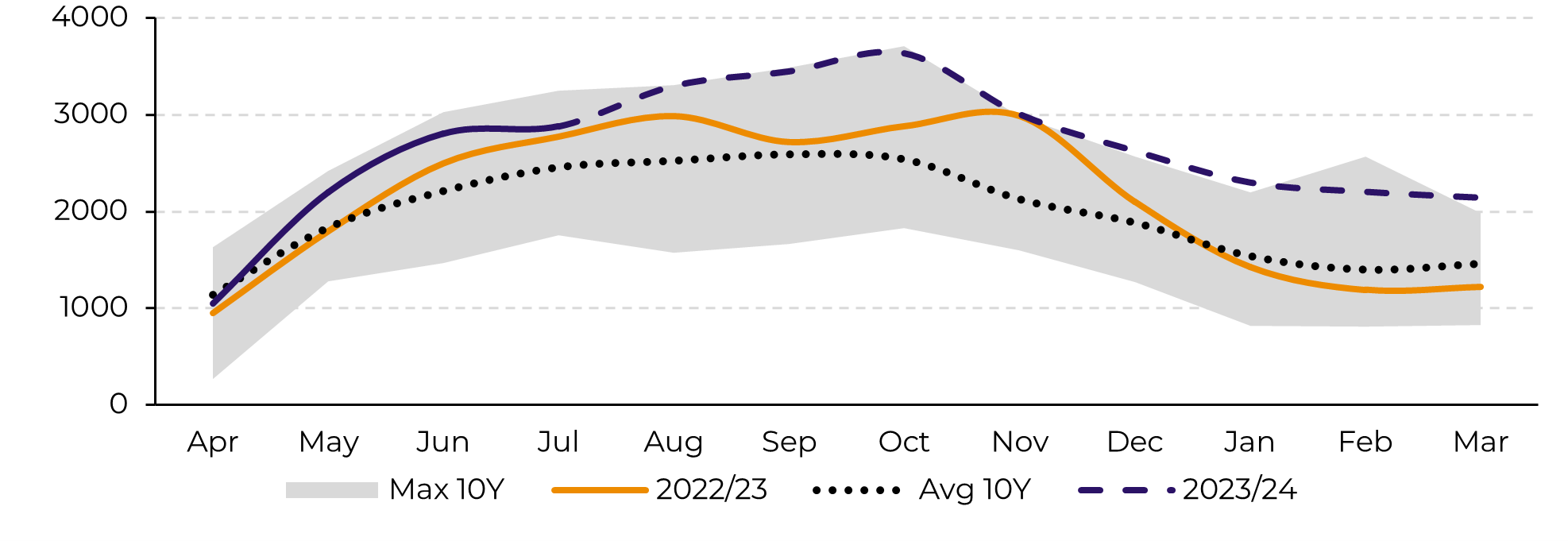

Image 2: CS Crushing Estimate per Fortnight (Mt)

Source: UNICA, hEDGEpoint

The last crop year that faced a strong El Niño was 15/16, no wonder the market is using it as a proxy to estimate the crushing pace. Yet, let's deep dive into the database to understand if it does make sense or not.

First, how much cane does CS usually crush after August? On a 10Y average, CS crushed 34.6% of its total cane from September onwards, meaning that more than 65% was already done by August’s end. During 15/16, a strong El Niño year, the region managed to crush a bit more than average during the rest of the year, reaching 35.2%. Using simple math and considering realized figures so far (406.6Mt crushed), it would be possible to reach 622.2Mt if using the 10Y average, or 627.4Mt if using 15/16 as a proxy.

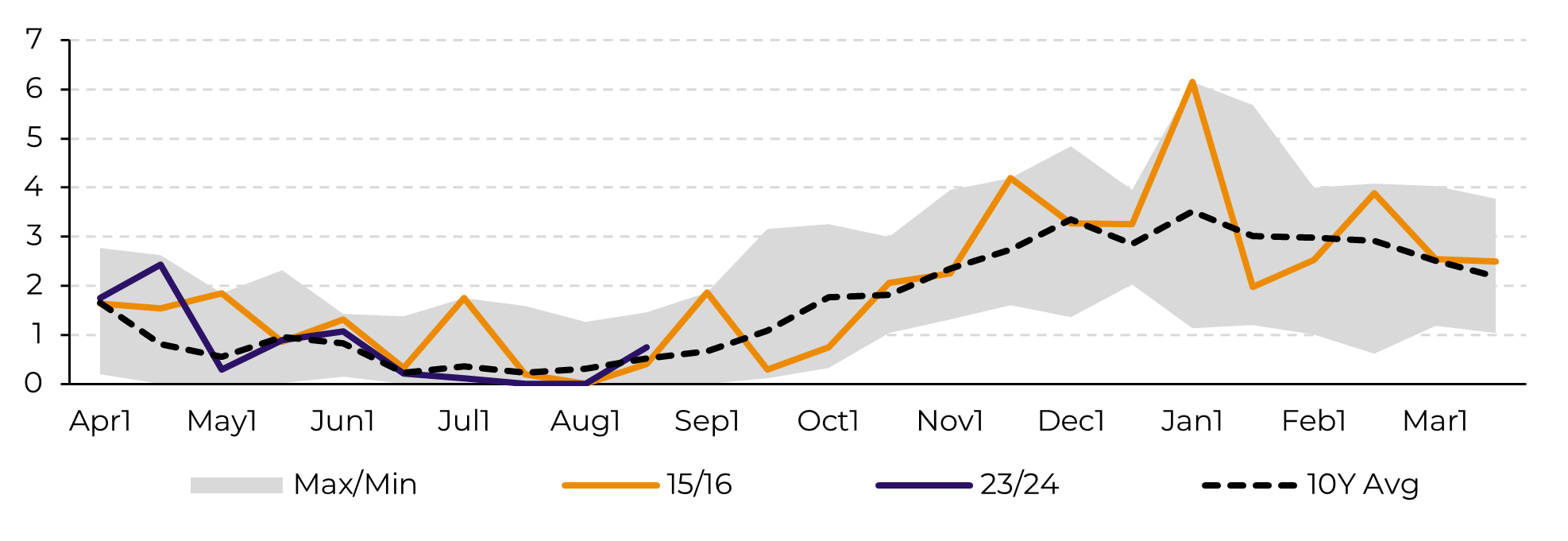

We can consider both estimates as a good range to where the crop is headed. Of course, weather plays a big role in whether the region will be able to achieve that level or not – even though there is enough cane to do so. Therefore, we also analyzed lost days so far and their correlation. To ascertain whether a day was considered lost or not, we established a rainfall threshold of 5mm. We also considered the average between some key regions, such as Ribeirão Preto (SP), São José do Rio Preto (SP), Mineiros (GO), Triângulo Mineiro (MG) and others to estimate CS’s lost days.

We can consider both estimates as a good range to where the crop is headed. Of course, weather plays a big role in whether the region will be able to achieve that level or not – even though there is enough cane to do so. Therefore, we also analyzed lost days so far and their correlation. To ascertain whether a day was considered lost or not, we established a rainfall threshold of 5mm. We also considered the average between some key regions, such as Ribeirão Preto (SP), São José do Rio Preto (SP), Mineiros (GO), Triângulo Mineiro (MG) and others to estimate CS’s lost days.

Image 5: Historical Look to the Oceanic Niño Index and 2023 Forecast - ONI (°C)

Source: NOAA

Looking at the lost days for 23/24 so far, it has shown a 75% correlation to the 10Y average, while only 47% to 15/16. Statistically, it wouldn’t make sense to rely only on 15/16 as a proxy. Therefore, being conservative, we decided to take the average between both, penalizing the lack of correlation between 15/16 and 23/24. In the end, CS cane crushing figures could reach 624.8Mt. This number is also in line with our TCH revision.

Incorporating July’s results, our models show that it is possible to reach a cumulative cane yield of 82.4t/ha by 23/24 end. With a 1.3% increase in area, all evidence points out to a 624.8Mt of cane.

Image 4: Lost Days Estimate per Fortnight (No of days)

Source: Bloomberg, hEDGEpoint

Higher availability also allows for a higher sugar mix, adding 2p.p. to our previous estimate, reaching 48.5%. These changes combined with a 139.7 TRS leads the region to a record sugar production at 40.3Mt. This extra availability (nearly 700kt) will be fully redirected to the international market. This revision also affects 24/25 at first glance. Assuming that there will be some retraction in TCH but positive weather, Brazil could keep supplying up to 40Mt of sugar next season.

Of course, CS alone is not enough to smooth out the Northern Hemisphere’s absence. The possibility of further reductions to Thailand and no exports from India keeps supporting the bulls’ tale for both raws and whites. The U.S. government weather forecasters announced last Thursday that there is over 95% probability that the El Niño conditions will linger throughout the Northern Hemisphere winter, spanning from January to March 2024, giving additional strength to the bullish side and pushing both contracts to their highest levels in months!

Image 5: CS Exports Seasonality Before (‘000t)

Source: UNICA, SECEX, Williams, hEDGEpoint

Image 6: CS Exports Seasonality After (‘000t)

Source: UNICA, SECEX, Williams, hEDGEpoint

In Summary

Market seems to have priced in the higher availability from Center South (CS). The region’s big crop keeps getting bigger and it seems to be a consensus that there is much cane left to be crushed yet this season. We revised our numbers up taking into consideration yields, pace and lost days. With a 624.8Mt sized crop, Brazil will be able to surpass 40Mt sugar production, smoothing part of the international tightness.

But, of course, the country is not able to fulfill for the Northern Hemisphere absence alone. Thailand crop worsening and India’s no export possibility keeps supporting the market. The extension of El Niño’s active period also induced market to higher gains during the past week.

Although we could expect some corrections to October as it approaches its expiry and Brazil keeps trading at a discount, long term fundamentals might offer some players enough incentive to prevent a major drop.

Weekly Report — Sugar

Written by Lívea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Reviewed by Natalia Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.