Oct 2

/

Lívea Coda

Sugar and Ethanol Weekly Report - 2023 10 02

Back to main blog page

"We should remain cautious as to the extent of the bullish trend: October expired and a record volume was delivered. Besides, the weather in India doesn't seem as bad as rumored. "

India’s weather, delivery and macro: what a week!

- From a decent amount delivered, to macro shifts and better short-term rains in India, the sugar market faced some volatility during the past week, with October correcting to 26.02 only to bounce back and expire at 26.27 USc/lb

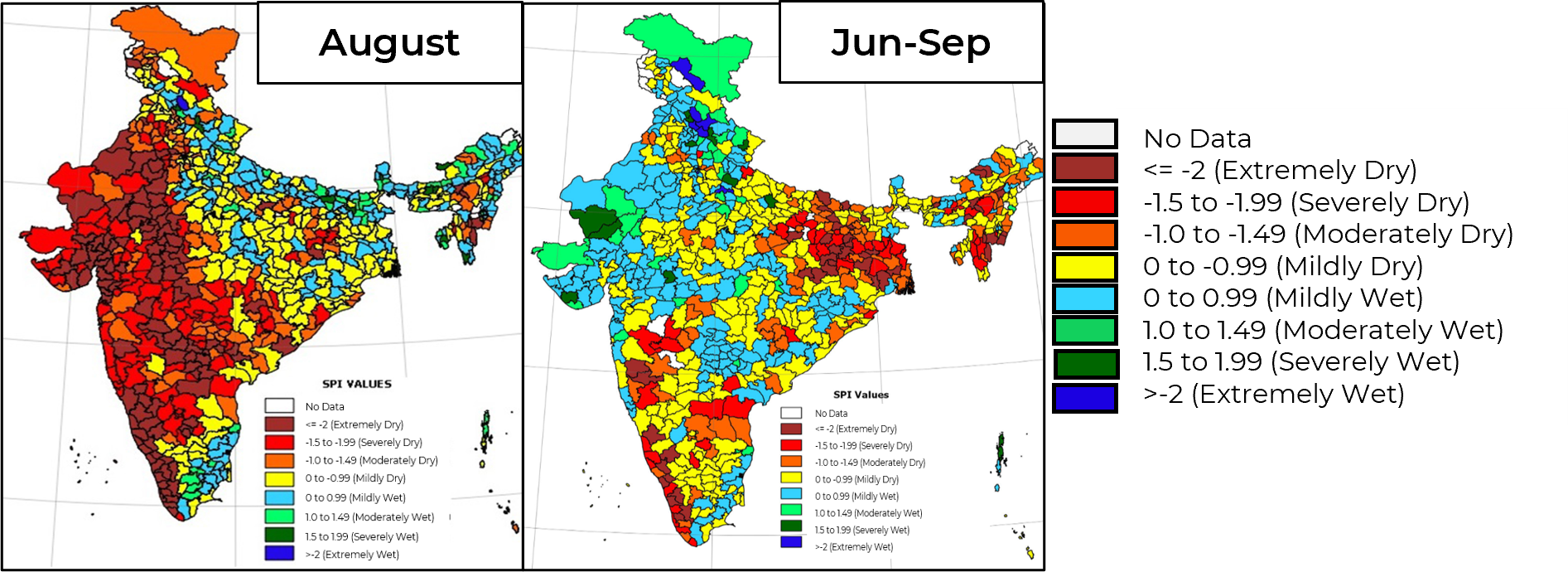

- In this report we aim to discuss India’s weather and why we kept our production unchanged at 31.4Mt. Yes, there were scarce rains and August faced the worst precipitation in 100 years! But looking at the Standardized Precipitation Index (SPI) for India, it’s possible to observe that key producing states such as Uttar Pradesh, Tamil Nadu and Gujarat suffered little throughout the whole cane-developing period (Jun- Sep).

- Although we did not change our production, we changed our base-case trade-flows to no Indian exports, supporting H24 contract.

- As the white’s market is more severely affected by a lower Northern Hemisphere participation, the white premium support should linger.

No changes to fundamentals were seen this past week, the Northern Hemisphere crop is still expected to be lower than average, Brazil's excellent results are no surprise, and the raw’s delivery was as high as it could get: 2.87Mt. The volume delivered on tape was in line with market expectations, as signaled by Brazilian cash premium and open interest, being 242% higher than the 7-year average, 840kt. However, it was interesting to observe that sugar was somewhat resilient to corrections.

The reasons for that were mostly speculative and macro-related. Although the sweetener faced some corrections at the beginning of the week, with US dollar strength given poor economic data releases and a hawkish Fed positioning, as soon as the energy complex bounced back, it found another breath. With the October expiry, March, which is driven mostly by the Northern Hemisphere crop conditions, doesn't seem to have much of a reason to reduce anytime soon.

However, we should remain cautious as to the extent of the bullish trend. In this report we aim to discuss India’s weather and why we kept our production unchanged at 31.4Mt.

Image 1: Standardized Precipitation Index (SPI) for India

Source: India Meteorological Department

Not long ago, in July, the market was betting on normal weather and production higher than 33 Mt for the country. At that time, we argued that it was too soon to tell, especially with El Niño lurking. We estimated 31.4 Mt and haven’t changed our numbers since. We were pessimistic, as some effects from the climate pattern could lead to poor cane development and sucrose loss, thus placing us nearly 2 Mt below market estimates.

El Niño was confirmed, the monsoon got delayed. There were scarce rains during July, and August faced the worst precipitation in 100 years! You might be asking yourself why we didn’t change our view. Well, looking at the Standardized Precipitation Index (SPI) – an important and well accepted index for drought monitoring used by India’s Ministry of Agriculture for defining if a region was affected by drought or not – it is possible to notice that even with a severe August, key producing states such as Uttar Pradesh, Tamil Nadu, and Gujarat suffered little throughout the whole period (June- September). Of course, many districts within Maharashtra and Karnataka were severely affected, but looking at the broader picture, this under 30Mt production is still hard to grasp: India has surprised the market to the upside in the past, more than once!

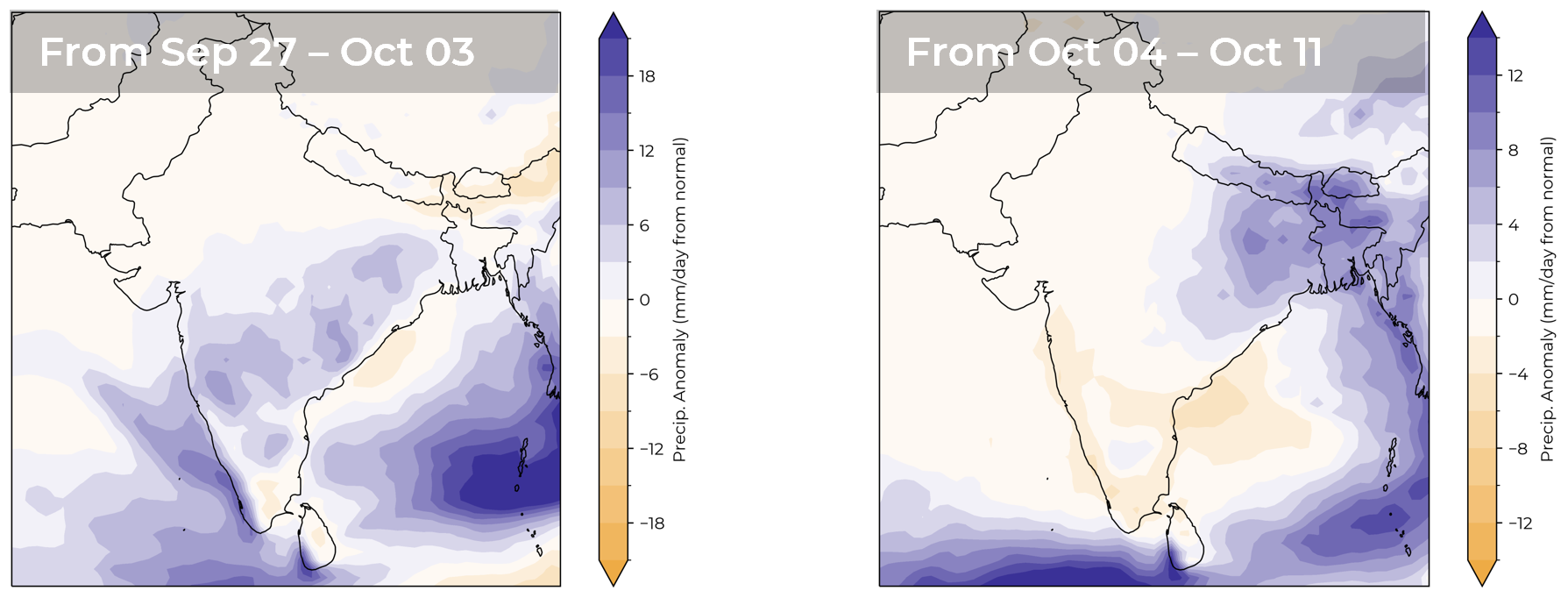

Image 2: Precipitation Anomaly Forecast (mm/day)

Source: NOAA, hEDGEpoint

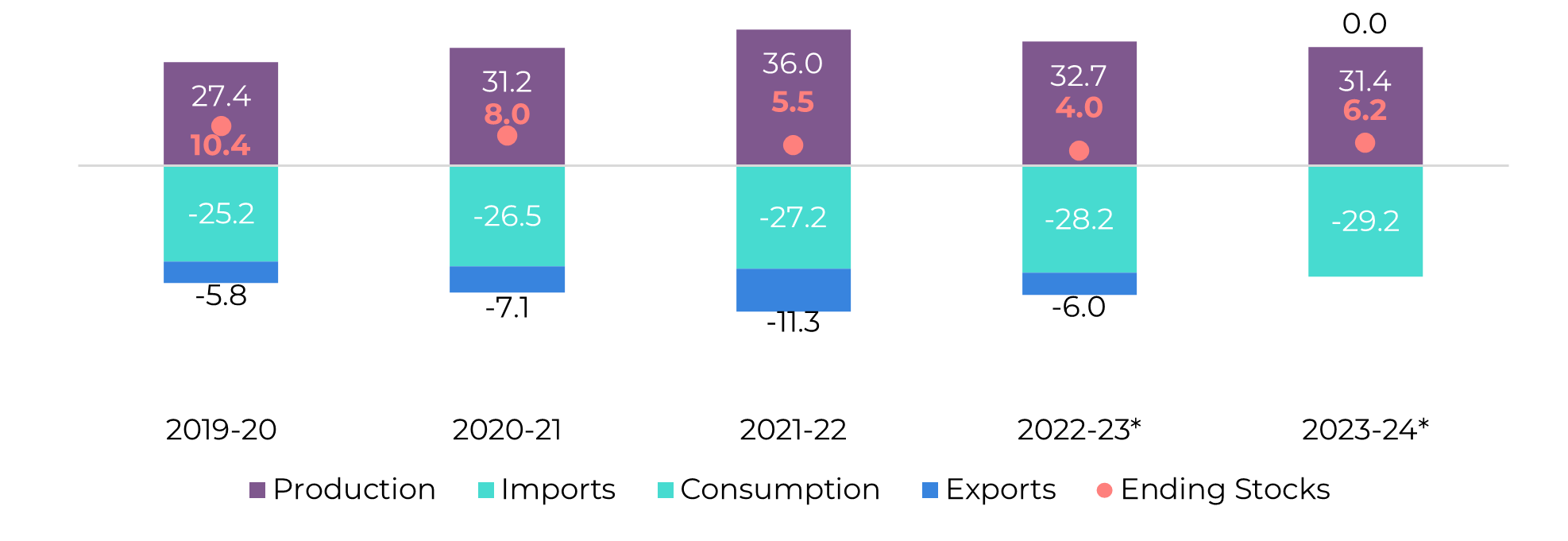

Considering 31.4Mt, India could have some surplus sugar to export, but we do understand – as it was already discussed during our weekly reports – that the decision is highly political. With the ethanol blending program, food security worries amid election year and rising fuel prices, the idea of no exports is indeed likely. India would, in this case, be restocking and a step closer to the usual threshold of 3-month consumption stock.

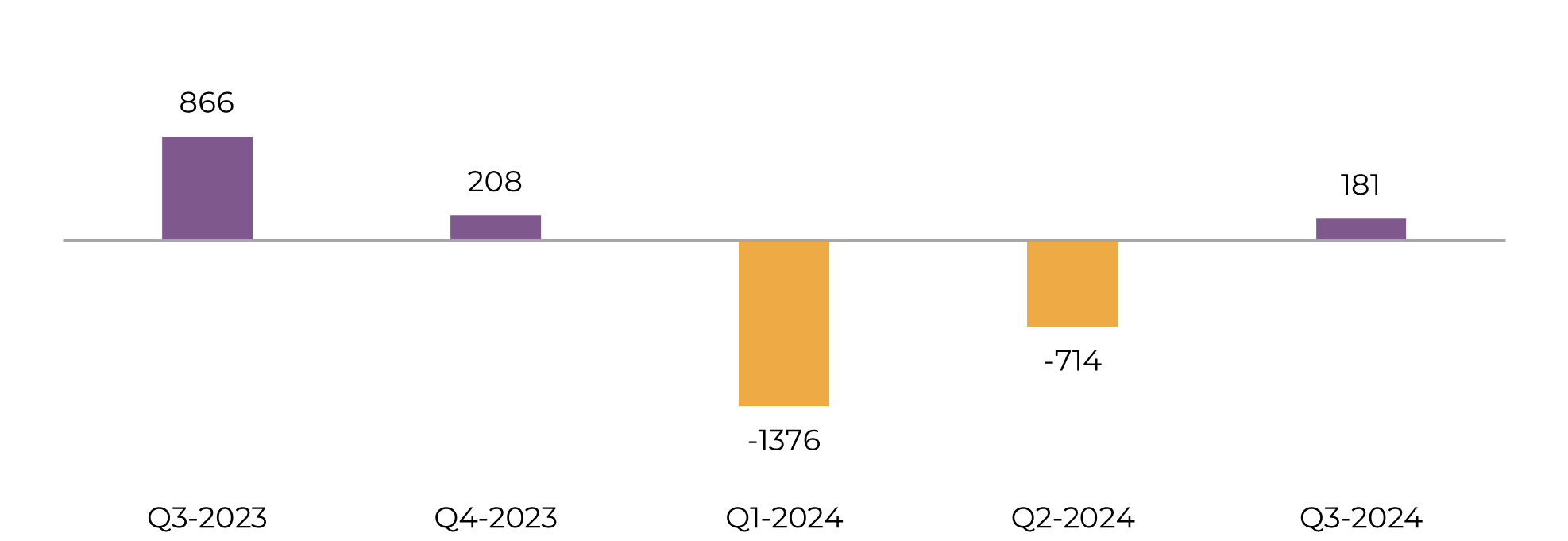

Therefore, while we haven't adjusted our production estimates, we changed our trade flows to incorporate the assumption of no Indian exports as the base case. Brazil’s higher availability partially compensated for the decrease in India’s export estimate (-1.3 Mt), not being enough to prevent a deficit during the first and second quarters of 2024, indicating a bullish trend for H24.

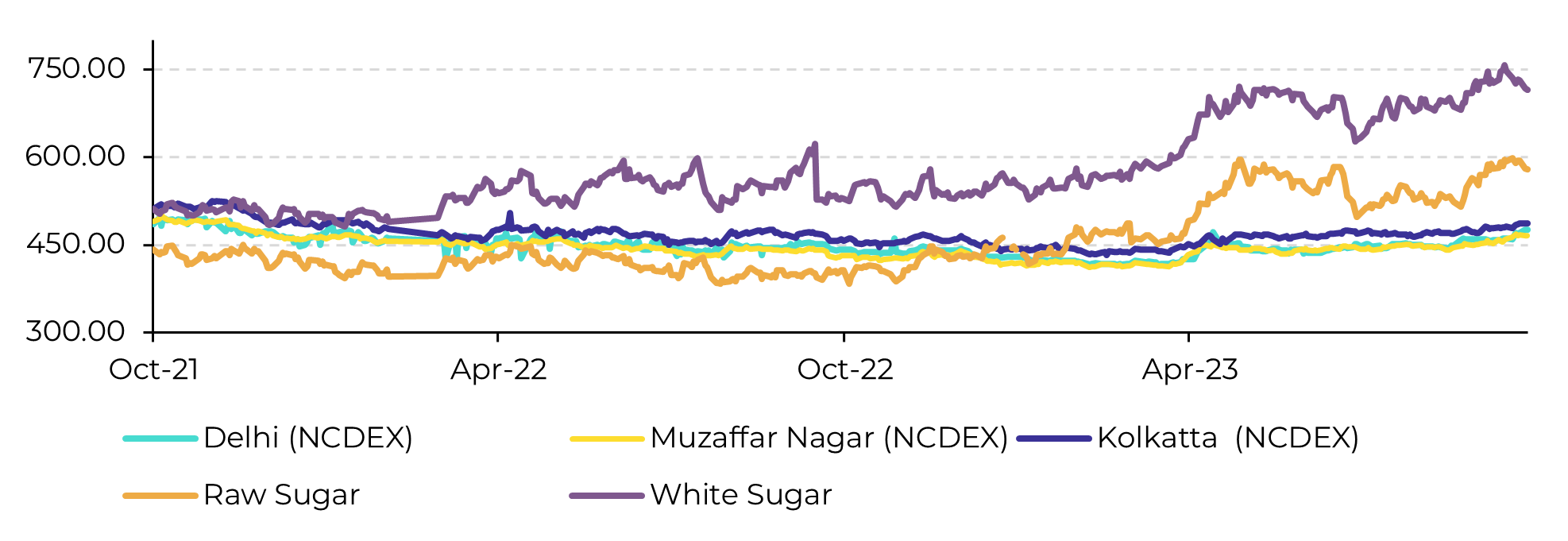

Image 3: Domestic vs International Prices (USD/t)

Source: Bloomberg, hEDGEpoint

Note that other changes were made to our global sugar framework – we’ve revised Thailand and Mexico’s availability down for 23/24, Brazil and Ukraine up, and followed through with the latest USDA report changes on US’s crop conditions, among others – all to be described in future reports.

Image 4: India Sugar Balance (Mt Dec-Nov)

Source: ISMA, AISTA, hEDGEpoint

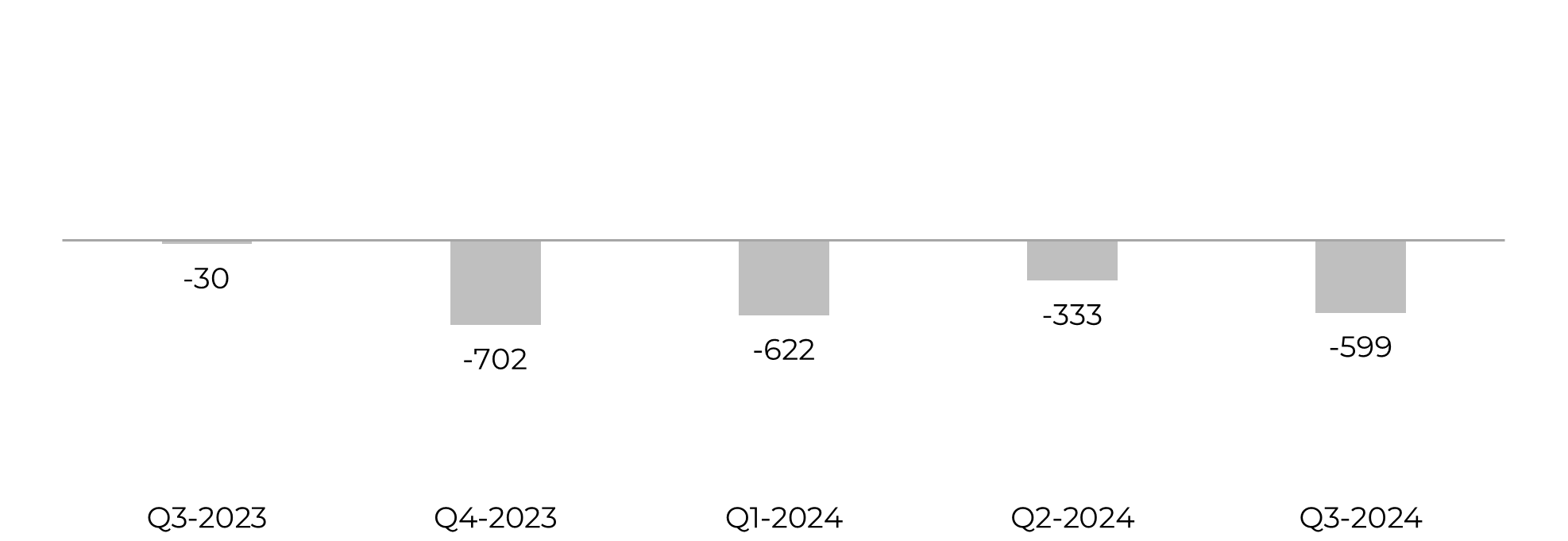

Of course, contrary to raws, Brazil can offer little help to the whites' market, a trend that contributes to the stability of a high white premium and that should linger throughout the last months of the year - and possibly the beginning of the next one.

Image 5: Total trade flow ('000t tq)

Source: hEDGEpoint, Green Pool

Image 6: White sugar trade flow ('000t tq)

Source: hEDGEpoint, Green Pool

In Summary

From a decent amount delivered, to macro shifts and better short-term rains in India, the sugar market faced some volatility during the past week, with October correcting to 26.02 only to bounce back and expire at 26.27 USc/lb.

In this report we discussed India’s weather and why we kept our production unchanged at 31.4Mt. Yes, there were scarce rains during July, and August faced the worst precipitation in 100 years! But looking at the Standardized Precipitation Index (SPI) for India, it’s possible to observe that key producing states such as Uttar Pradesh, Tamil Nadu and Gujarat suffered little throughout the whole cane-developing period (June-September).

Although we did not change our production, for our trade-flows to reflect what’s known to be priced in, we assumed as base case no Indian exports, having still an over 1Mt deficit in Q1-24, meaning a bullish trend for H24.

Although we did not change our production, for our trade-flows to reflect what’s known to be priced in, we assumed as base case no Indian exports, having still an over 1Mt deficit in Q1-24, meaning a bullish trend for H24.

As the white’s market is more severely affected by a lower Northern Hemisphere participation, the white premium support is expected to linger.

Weekly Report — Sugar

Written by Lívea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Reviewed by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.