Oct 9

/

Lívea Coda

Sugar and Ethanol Weekly Report - 2023 10 09

Back to main blog page

"No wonder the market still holds its ground at 26 USc/lb: the two biggest Northern Hemisphere players are way below their average participation inducing a high deficit in Q1/24. However, let's keep in mind that the bullish trend might not be as strong as previously anticipated.."

Sugar market resilience: insights and Thailand’s role

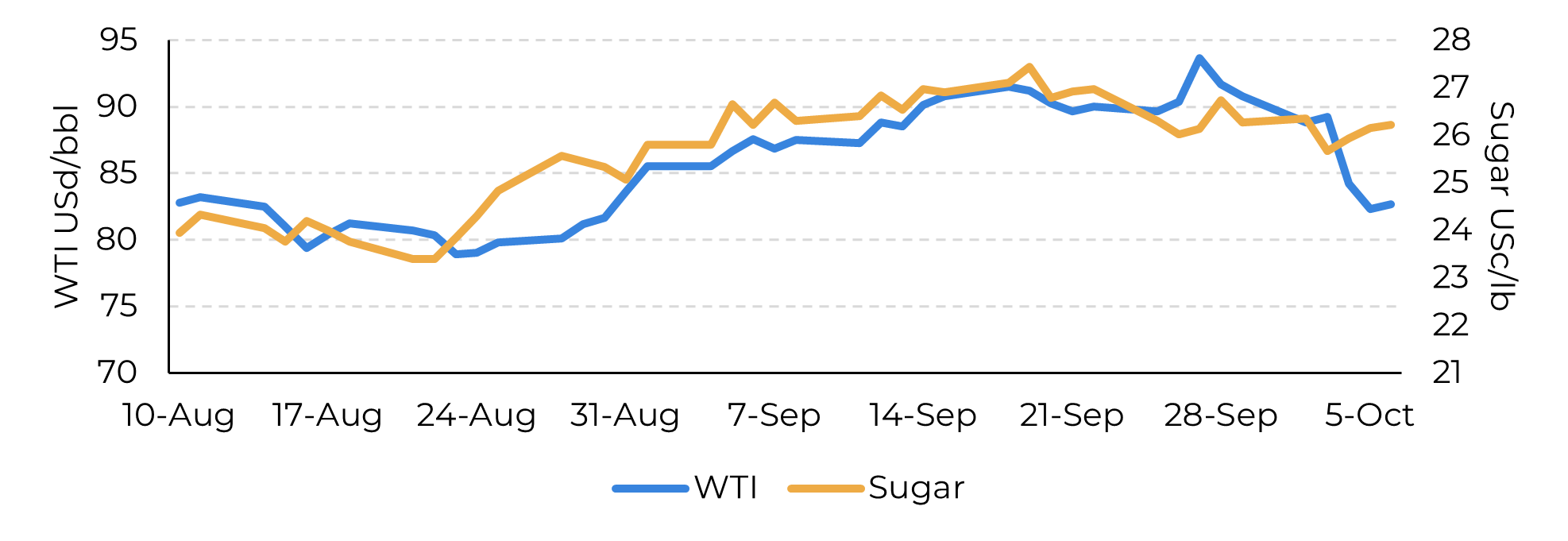

- The sugar market has remained resilient despite bearishness in external markets. Both WTI oil and RBOB gasoline saw significant price declines last week, around 9% each, attributed to reduced gasoline demand per the EIA's report and the potential lifting of Russia's diesel ban.

- Sugar's strength is supported by tight availability in the Northern Hemisphere and recent precipitation in the Center-South, which could disrupt exports.

- Thailand is a major sugar player, typically exporting around 70% of its total production, an average of 7.3Mt. Weather challenges and area competition added a cap to the country’s expected participation on 23/24’s season.

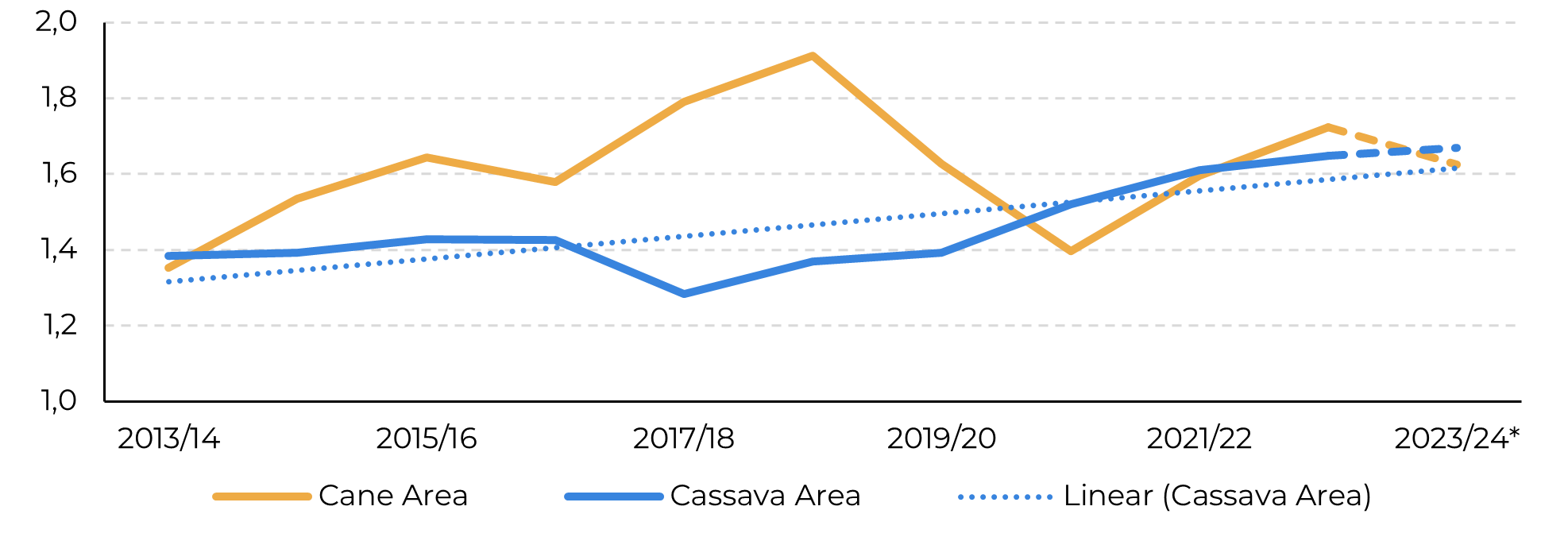

- With over 250 USD/ha difference between cassava and cane’s return, cane area is expected to drop at least 5.6%. Combined with yield reduction caused by lower-than-average precipitation, the country is expected to produce 8.2Mt of sugar, and export close to 5Mt, compared to 7.8Mt expected to this season (22/23 crop year – Dec/Nov).

Sugar has failed to react to external market bearishness. Both main energy benchmarks, WTI oil and RBOB gasoline, registered substantial losses to their prices during last week, reducing about 9% each. This decline was attributed to the EIA's most recent report indicating a decline in gasoline demand and the news suggesting that Russia might soon lift its diesel ban. The sweetener resilience appears to remain supported by tightness in the Northern Hemisphere's availability, and, more recently, precipitation increases in the Center-South, which could partially disrupt sugar export flows. We should keep in mind, however, that OPEC+ has opted to maintain its existing oil output policy, adhering to the commitment made by Saudi Arabia and Russia to extend voluntary supply cuts until the end of the year. This means that the correction to the energy complex might be short-lived, and its reaction could add to sugar fundamentals, providing support to prices.

Image 1: Raw Sugar versus Oil Benchmark

Source: Refinitiv, hEDGEpoint

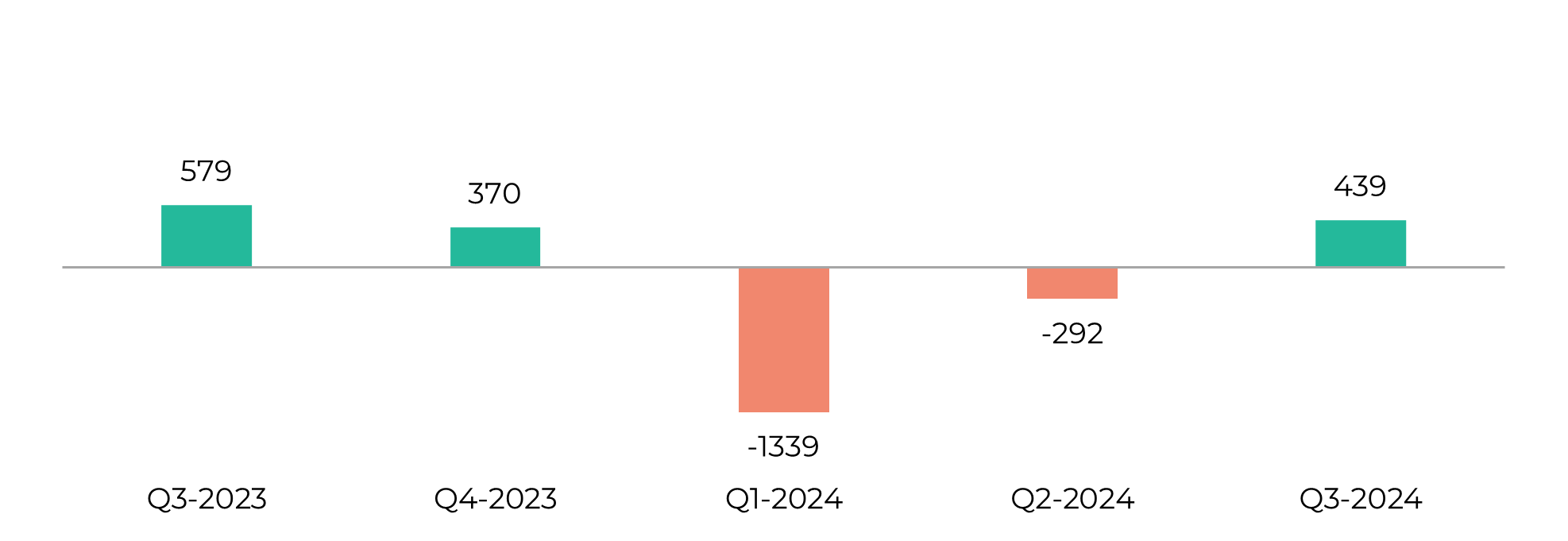

In our previous report, we discussed that fundamentals still point out supportive prices in the short-medium term – while we focus on the March contract, at least. But improvements to the EU, Ukraine, Russia, and Brazil might prevent the previously expected surge in prices, adding a cap to future gains. Note, however, that this doesn’t mean that prices will start correcting anytime soon: there is still a high deficit expected for Q1/24 given India and Thailand’s lower availability.

Speaking of, Thailand is the main theme to this report. Why and how does the country contribute to the elevated sugar price range we’ve been experiencing?

Image 2: Total Sugar Trade Flows (‘000 tq)

Source: hEDGEpoint, Green Pool

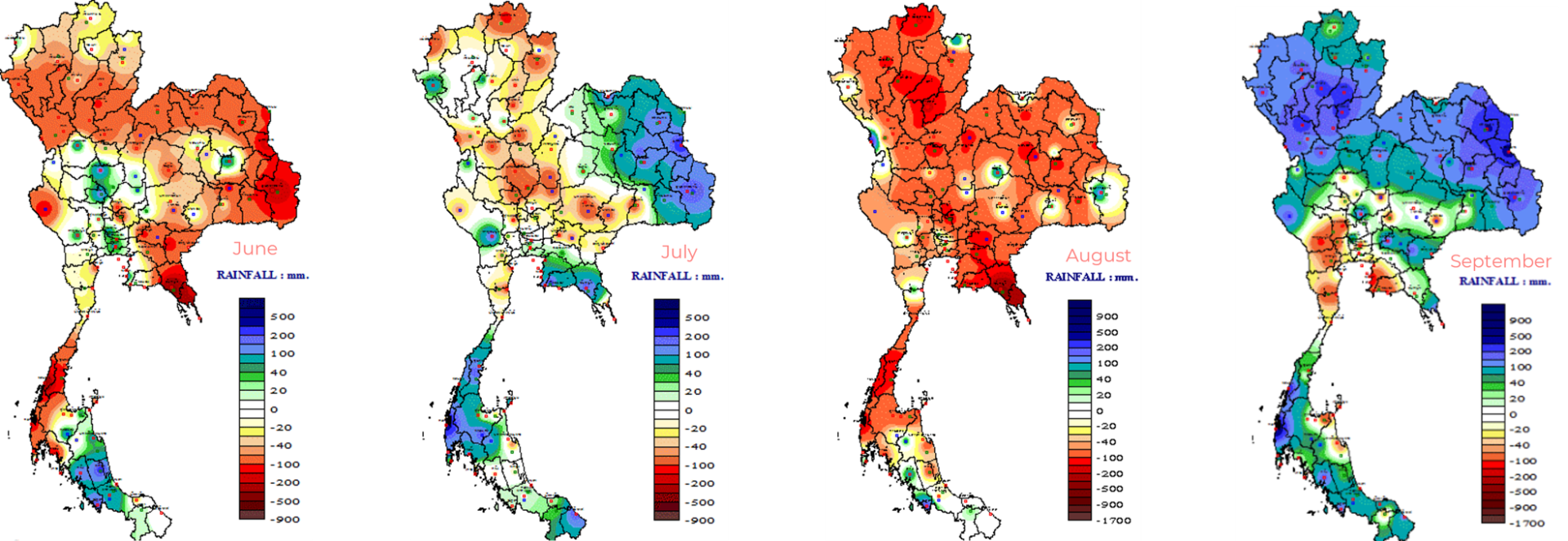

Thailand is an important sugar player as it provides, on average, 7.3Mt of the sweetener to the international market. This means that of the country’s total production, about 70% is usually exported. Nevertheless, Thailand's involvement in global trade flows experiences fluctuations due to weather adversity and competitive factors, introducing another source of volatility to the commodity’s price. This year, for instance, Thailand has faced adverse weather with below-average precipitation throughout cane’s key-development window (June-September). Weather forecast models also point to a dryer-than-normal October, adding further pessimism to the production downside.

Image 3: Monthly Precipitation Anomaly From June (left) until September (right)

Source : Thai Meteorological Department

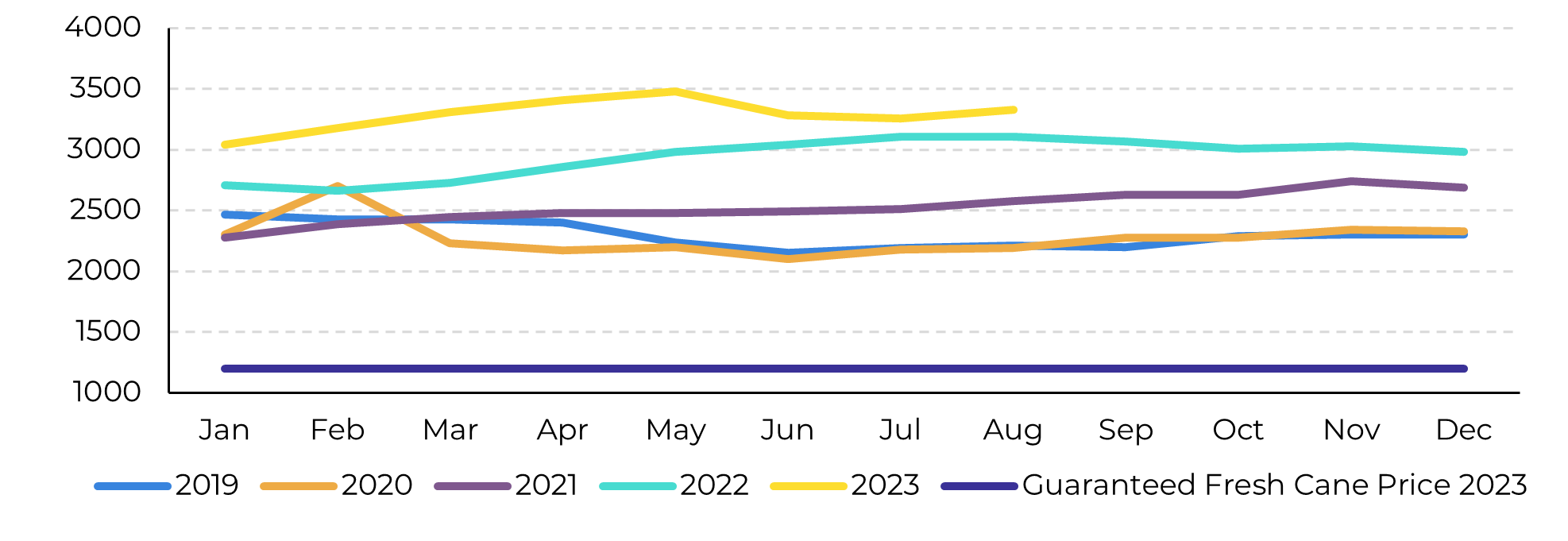

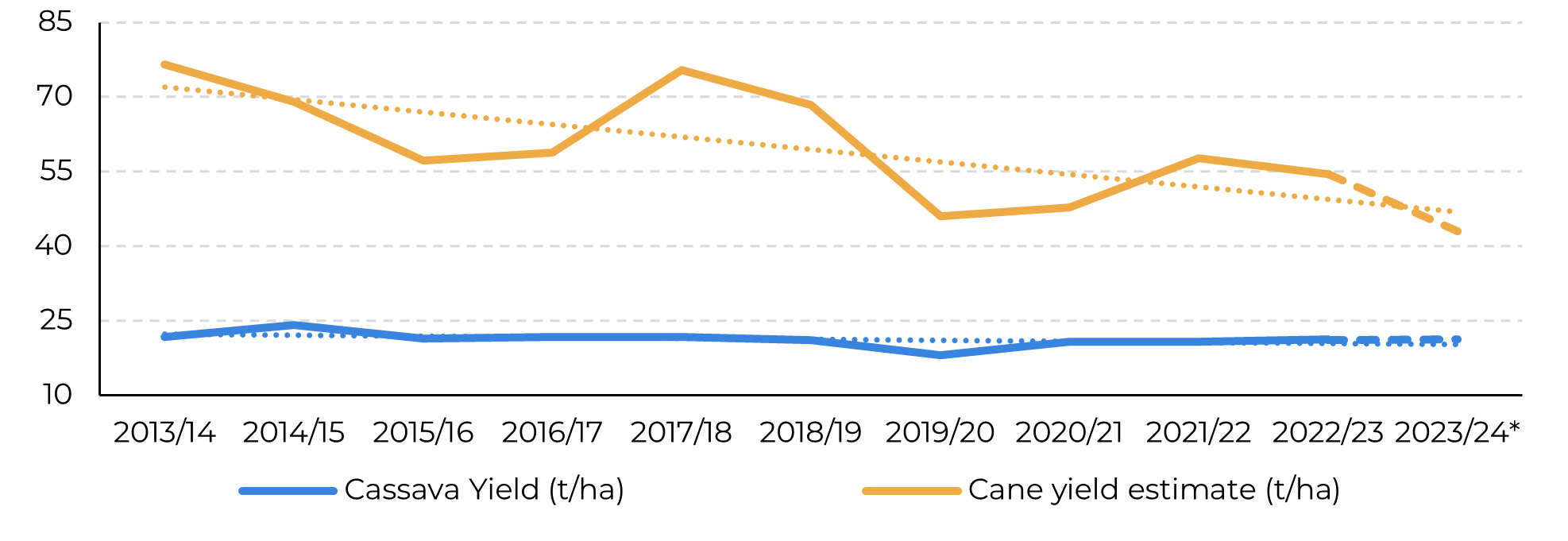

Not only weather, but 23/24 total sugar output is also expected to be severely affected by cane's loss in its competition with cassava. Comparing only the guaranteed fresh cane prices determined by the government in 2023 with cassava’s root price, it seems to be a better deal to plant cassava. This decision becomes even more clear when looking into yields and combining these factors. Cassava yields are lower, yes, however, they are more stable than cane’s.

Image 4: Fresh Cassava Prices vs Fresh Cane Guaranteed (Baht/t)

Source: The Tai Tapioca Trade Association

Thailand’s Office of the Cane and Sugar Board (OCSB) defined the guaranteed fresh cane prices at 1080 Baht/t for 2023. Considering a yield of approximately 54.5t/ha, this means that farmers got a minimum of 1,594.2 USD/ha by producing cane during 22/23. Meanwhile, for cassava, the number is substantially higher, at 1,871.5 USD/ha (considering cassava’s average price during the last 12 months and a 21.23 t/ha yield).

Image 5: Cane Yields vs Cassava (t/ha)

Source: The Tai Tapioca Trade Association, hEDGEpoint

This trend is expected to linger, especially given poor cane development conditions and the tool that it is expected to have on yields. Therefore, besides revising our total cane estimates down from 75Mt to 70Mt, we also remain positive that area should decrease (5.7%). All factored in, production should be lower than the 5-year average by 20%, at 8.2Mt. Although not as small as in 20/21, Thailand’s participation in the global sugar market is far from what it once was, capping exports closer to 5Mt.

Image 6: Area expectation (Mha)

Source: The Tai Tapioca Trade Association, hEDGEpoint

No wonder the market still holds its ground at 26 USc/lb: the two biggest Northern Hemisphere players are way below their average participation inducing a high deficit in Q1/24. However, let's keep in mind that the bullish trend might not be as strong as previously anticipated.

India’s crop doesn’t seem to be as bad as rumoured, as discussed in our previous report, and other countries, such as Germany and Poland, have shown quite some improvement in past weeks – the European Commission even increased its production forecast by 1Mt for the bloc. Of course, the main bearish force still acts on the future contracts, July 24 and October 24, when market starts pricing some optimism regarding Brazil’s 24/25 crop season.

India’s crop doesn’t seem to be as bad as rumoured, as discussed in our previous report, and other countries, such as Germany and Poland, have shown quite some improvement in past weeks – the European Commission even increased its production forecast by 1Mt for the bloc. Of course, the main bearish force still acts on the future contracts, July 24 and October 24, when market starts pricing some optimism regarding Brazil’s 24/25 crop season.

In Summary

Despite a bearish trend in external markets, the sugar market has demonstrated resilience. Sugar's strength is underpinned by constrained supply in the Northern Hemisphere and recent rainfall in the Center-South, which has the potential to disrupt sugar exports.

Thailand plays a substantial role in the sugar industry, typically exporting around 70% of its total production, averaging 7.3 million metric tons. Challenges stemming from weather conditions and competition have limited the country's anticipated participation in the 23/24 season.

Weekly Report — Sugar

Written by Lívea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Reviewed by Pedro Schicchi

pedro.schicchi@hedgepointglobal.com

pedro.schicchi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.