Sugar and Ethanol Weekly Report - 2023 10 16

Increased volatility amid geopolitical concerns

- Sugar prices have faced higher volatility due to opposing forces in both fundamentals and geopolitics.

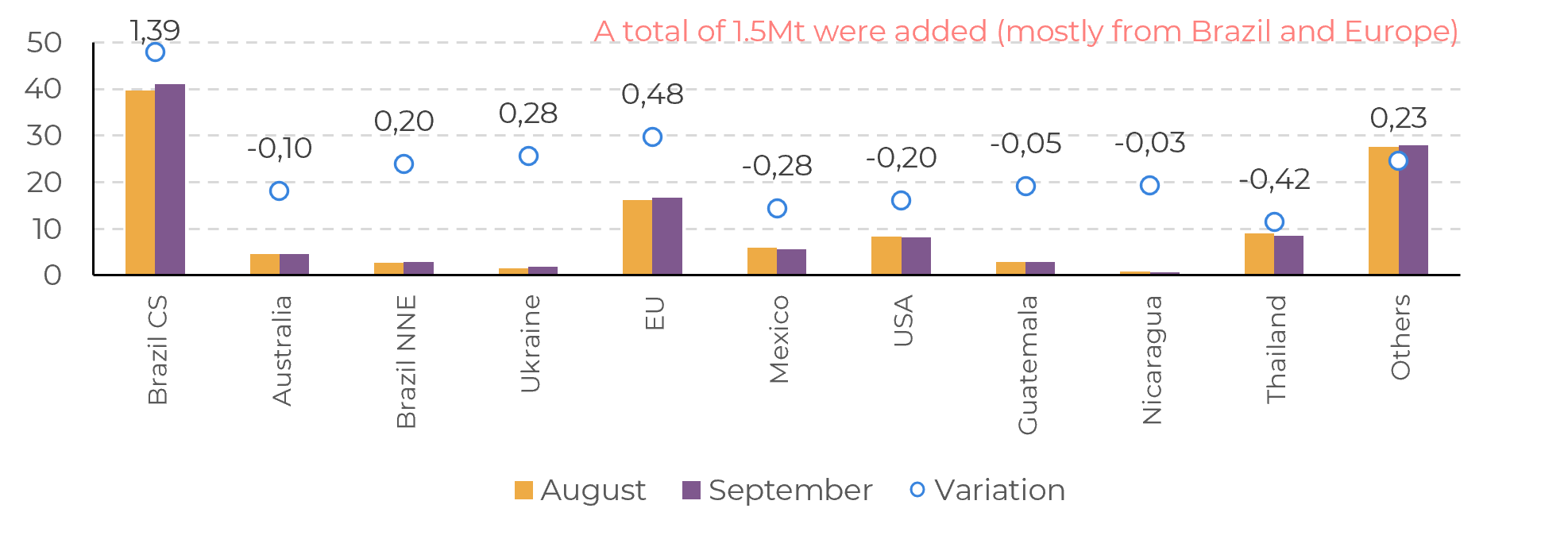

- On fundamentals, while we expect availability tightness during the Brazilian intercrop period, West and East Europe sugar production estimates improved.

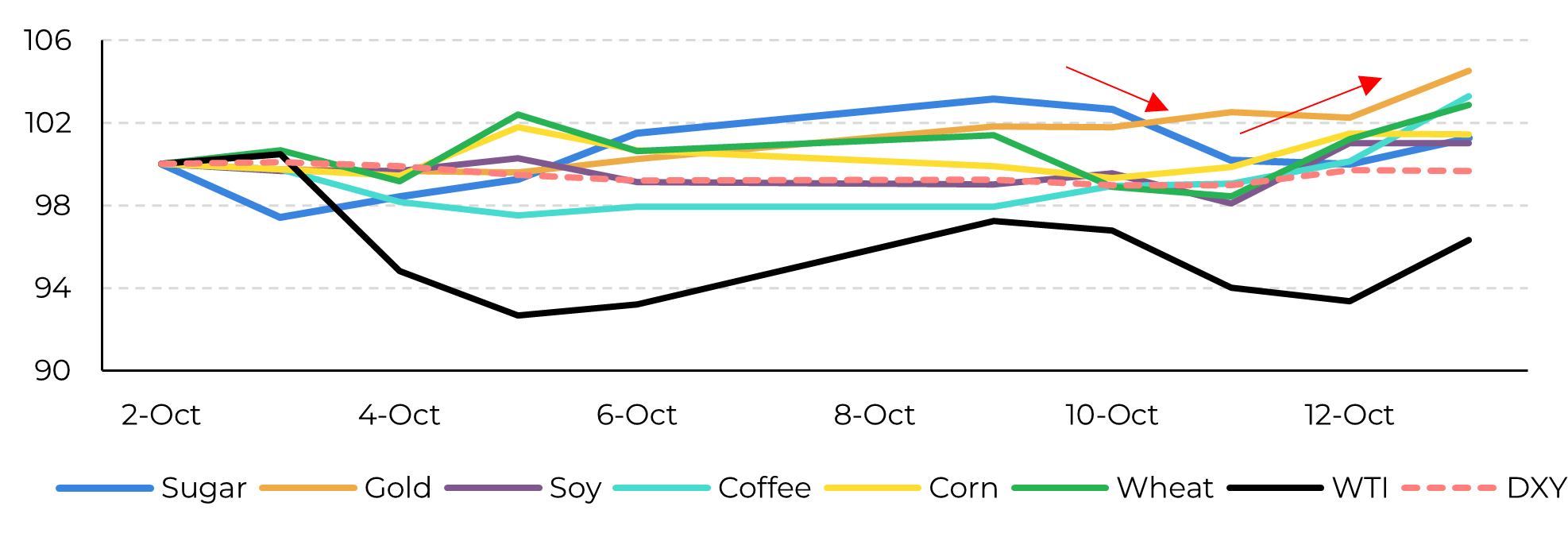

- Ongoing geopolitical tensions, especially concerning oil-producing countries, have intensified market instability and pushed oil prices higher. At the same time, they contributed to a higher risk perception scenario, prompting investors to seek stable assets such as the dollar and gold.

- This volatility is expected to linger. Given the already bullish short to medium-term trend in the sugar market, at least until Brazil's 24/25 crop comes into play, sweetener prices are likely to stay supported.

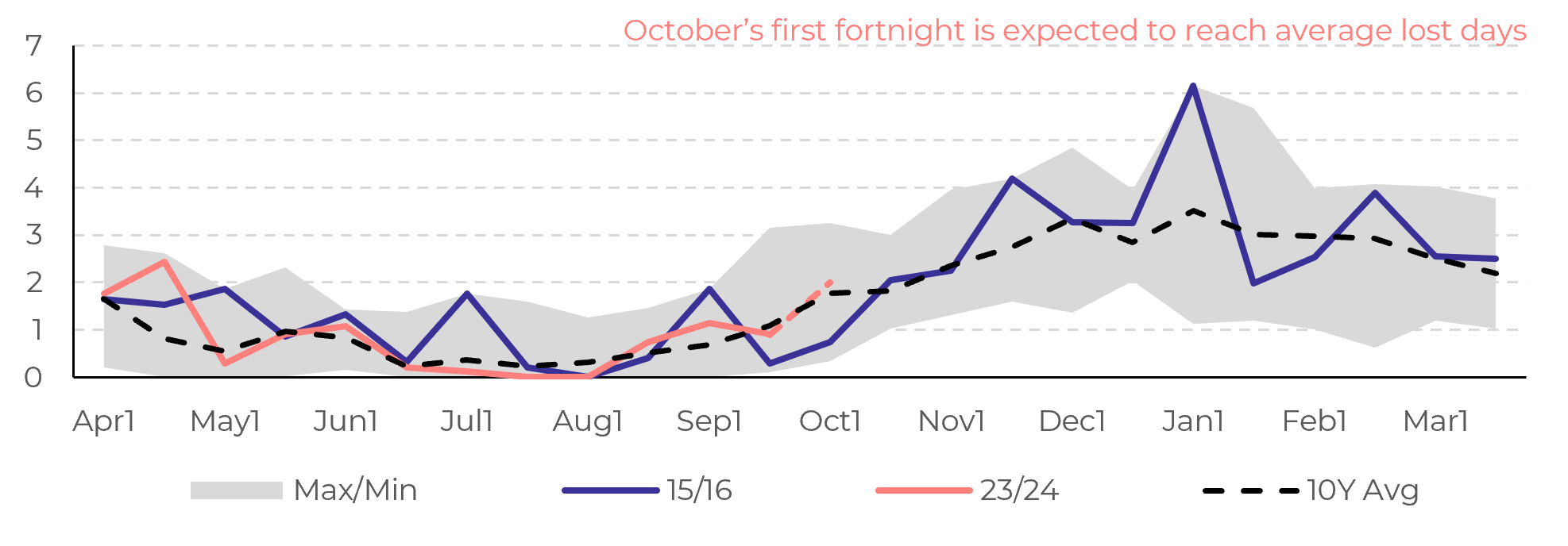

The past week saw a variety of factors impacting sugar prices. From geopolitics to weather, the sweetener surpassed the 27 Usc/lb resistance level only to correct two days later after Unica’s report showed excellent results on Center-South’s crushing. In this report, we aim to discuss price trend possibilities in the coming days.

Image 1: Production estimates for 23/24 (Oct-Sep) variation in Mt tq

Source: hEDGEpoint, Green Pool

Image 2: Lost days estimates for Brazilian Center South per fortnight (nº days)

Source: hEDGEpoint, Green Pool

It is common that in times of geopolitical tensions, investors, especially speculators, look for more stable assets, such as the dollar itself and gold, as a way of financial protection. This movement can trigger significant losses in markets considered to be more volatile, making a correction in funds positioning possible. In this case, due to the importance of the region for the energy complex and maritime transport, sugar can still find support.

Image 3: Risk perception vs bullish oil: price variation index (02 October = 100)

Source: Refinitiv, hEDGEpoint

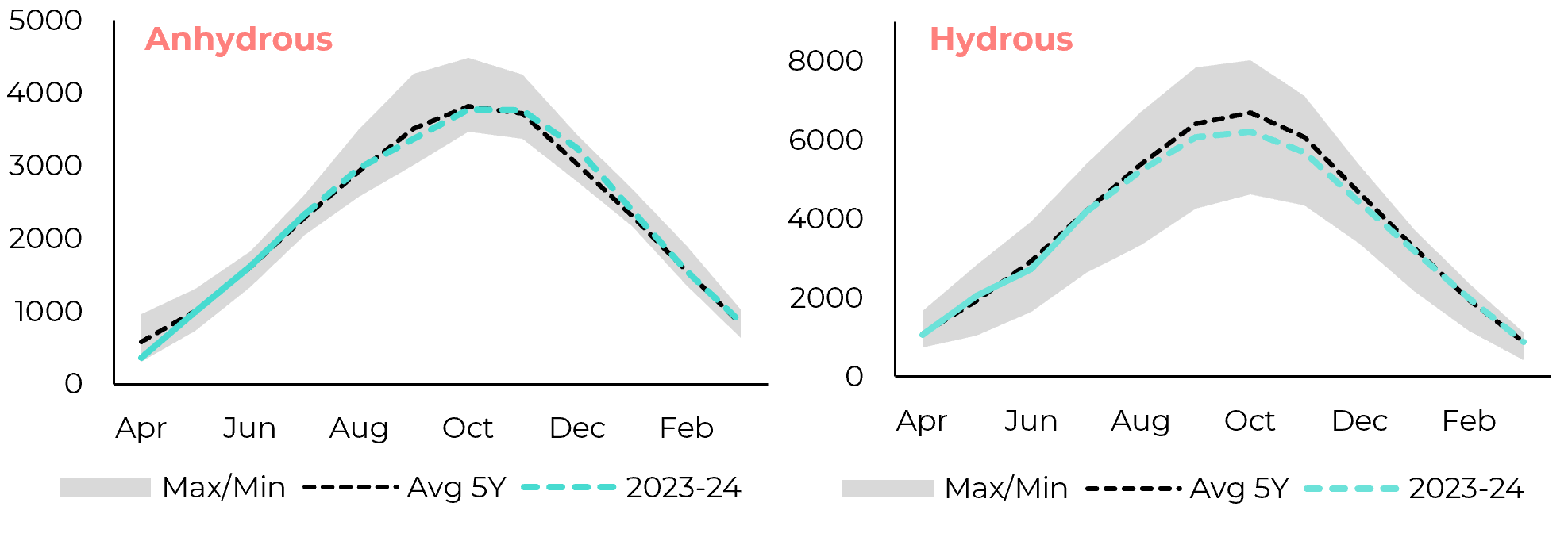

However, there is a cap to the extent of the biofuel’s reaction. We must remember that the high availability of raw materials to be used in biofuel production in Brazil (cane and corn) has prevented any significant reduction in stocks, despite fuel demand increase. In addition, the Brazilian government's commitment to reduced prices at the pump may prevent international volatility from hitting the country’s domestic market abruptly. Therefore, we should not expect a great impact from the ethanol side of the equation, meaning that risk sentiment is battling against oil spillover effect and fundamentals.

Despite the possibility of also affecting ethanol’s price in the Brazilian domestic market – and yes, it should respond to the conflict developments – the international sugar market remains tight in terms of availability, which means that ethanol’s natural response should not induce redirection of raw material to the biofuel in the short and medium term. It would, therefore, support sugar prices further, possibly combining forces with the rainy season start.

Image 4: Brazil – Ethanol stocks with a 5.6% growth in Otto Cycle (‘000 m³)

Source: UNICA, SECEX, MAPA, ANP, hEDGEpoint

Of course, the escalation of the geopolitical tension can shake this whole scenario up. Currently, there is considerable uncertainty about the extent to which oil-producing countries like Iran might become involved and potentially impact global oil supply as the war escalates. This view has pushed oil prices up by nearly 4% last Friday, inducing gains throughout the commodity board, with sugar registering nearly 2% increase. On the other side, the Dolar Index remains quite strong above 106.

This volatility is expected to linger. Regrettably, the emergence of additional geopolitical tensions has further intensified market instability. Given the already bullish short to medium-term trend in the sugar market, at least until Brazil's 24/25 crop comes into play, sweetener prices are likely to stay supported. However, if risk perception escalates significantly, particularly in the absence of positive signs from the US economy data, the market could witness speculative sell-offs.

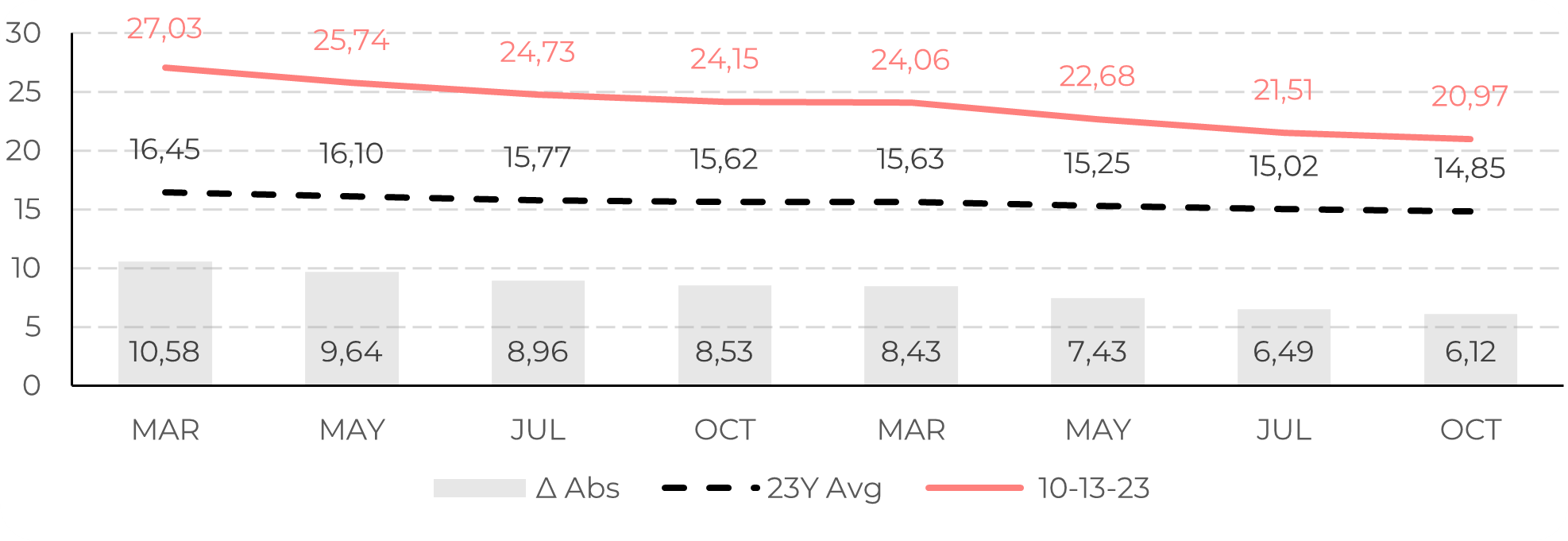

Image 5: Sugar prices remain above the historical average (Usc/lb)

Source: Refinitiv, hEDGEpoint

In Summary

Sugar prices have been highly volatile due to conflicting factors in fundamentals and geopolitics. While there's tightness in its availability during the Brazilian intercrop period, sugar production estimates in West and East Europe have improved. Geopolitical tensions, particularly in oil-producing countries, have increased market instability and raised oil prices. Balancing out these effects, the increase in risk perception might drive investors towards stable assets like the dollar and gold. Therefore, with all to be factored in by the market, volatility is expected to continue. With a bullish trend in the sugar market, prices are likely to remain supported until Brazil's 24/25 crop season

Weekly Report — Sugar

livea.coda@hedgepointglobal.com

pedro.schicchi@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.