Oct 23

/

Lívea Coda

Sugar and Ethanol Weekly Report - 2023 10 23

Back to main blog page

"On the fundamentals side, it's safe to say that little has changed. Brazil is entering its rainy season and, naturally, it may cause some stress when loading and sailing sugar out. But, besides Brazil, India, and Thailand, it is important to discuss another region that has added to the bull’s tale: North and Central America."

A little of North and Central America

- Raw sugar contracts remained supported, with factors like rains in the Center-South and India's export ban extension contributing to last week’s gains. However, the sweetener faced some correction on Friday, not long after the Brazilian government announced reductions to domestic gasoline prices, a piece of bearish news for ethanol.

- El Niño disrupted rainfall in Mexico, affecting sugarcane growth, particularly in Jalisco and San Luis Potosi, leading to short availability expectations and price support.

- Louisiana is set to experience a significant drop (18%) in sugar cane availability due to drought, impacting the US sugar market, although Florida and other beet-producing states were less affected.

- Central American countries, including Guatemala and El Salvador, faced dry conditions, impacting sugar production levels forecasts and limiting optimism due to low soil moisture.

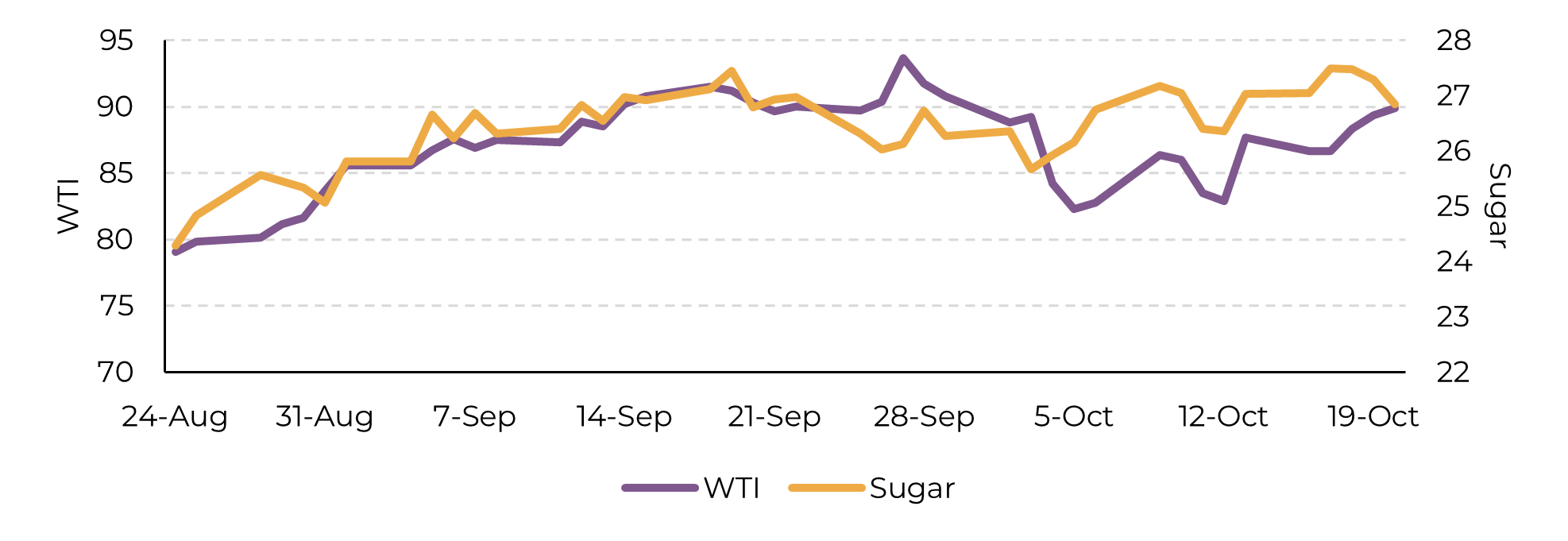

Raw sugar contracts remained supported throughout last week, news such as rains in Center-South and India’s government extending the export ban until further notice added to the oil prices strength and helped sugar to remain close to 27 USc/lb, although there was a correction on its last trading session. The Middle East conflict prolongation alarmed the market, raising concerns that the war could escalate into a broader regional crisis. Given the proximity of several oil-exporting nations to Israel and Palestine, there is a risk of disruptions in oil global supplies. This view backs up energy complex strength, which reflects directly on the commodity board, counterbalancing the increased risk perception and giving funds another reason besides the deficit perspective to remain long.

Image 1: WTI (USd/bbl) versus Sugar (USc/lb)

Source: Refinitiv, hEDGEpoint

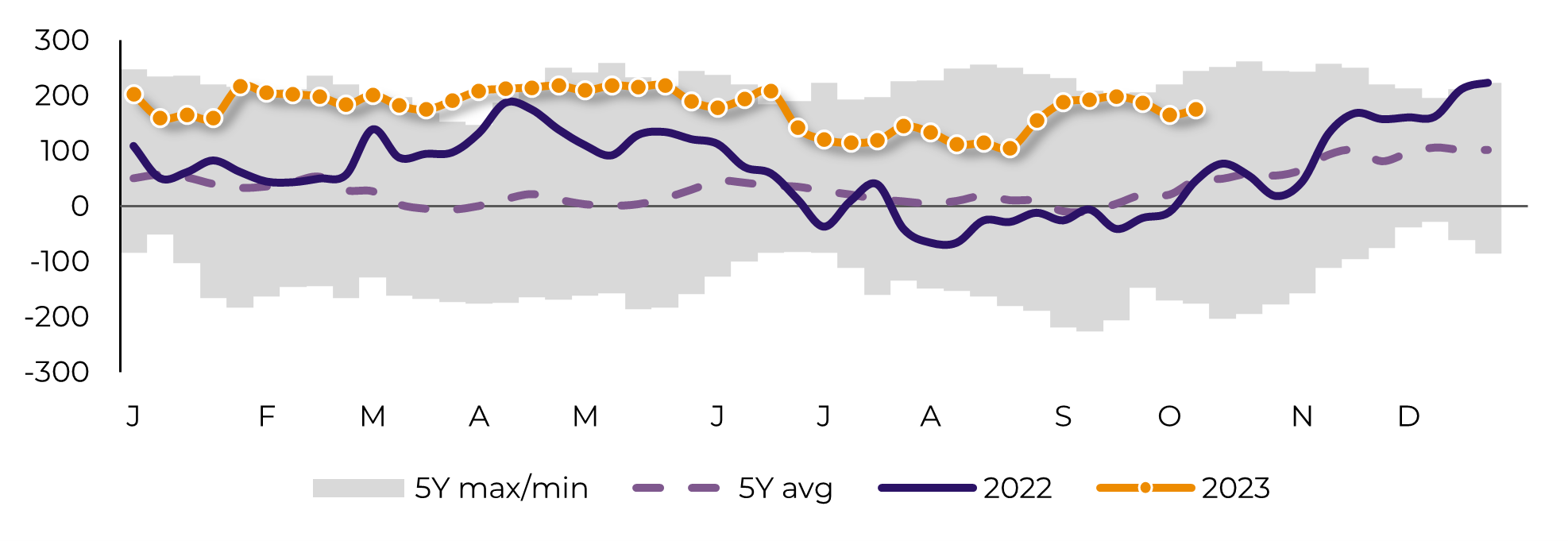

Image 2: Speculative Positioning (‘000 lots)

Source: CFTC

On the fundamentals side, it's safe to say that little has changed. Brazil is entering its rainy season and, naturally, it may cause some stress when loading and sailing sugar out. The Brazilian government, on the other hand, reduced gasoline prices further, making it even harder for the international volatility to reach domestic market. But, besides Brazil, India, and Thailand, it is important to discuss another region that has added to the bull’s tale: North and Central America.

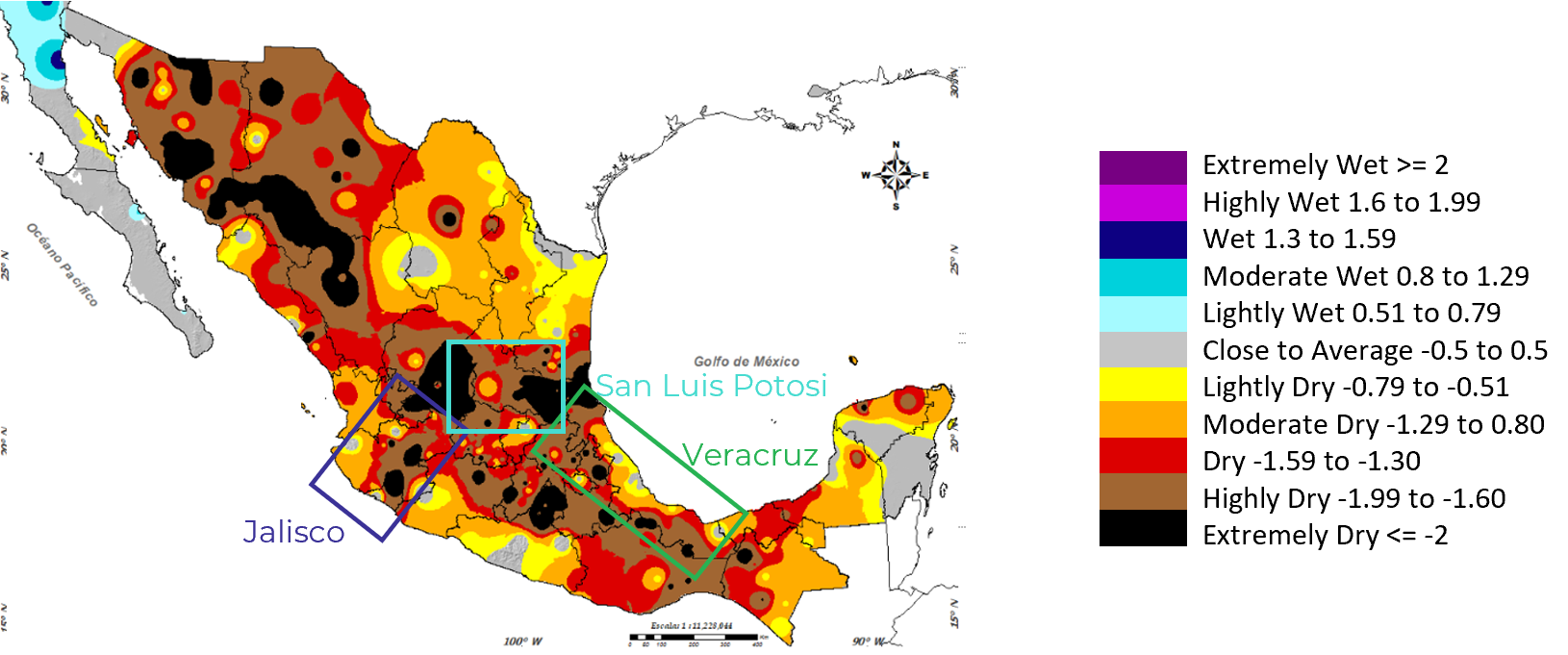

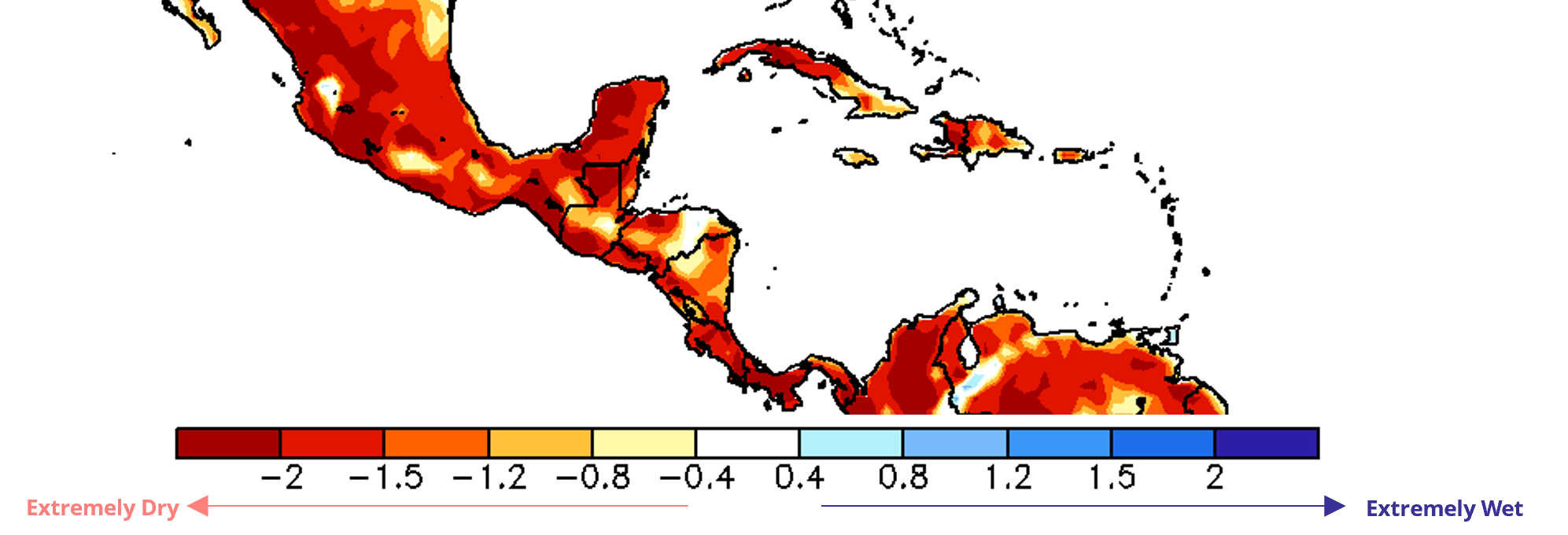

El Niño disrupted rainfall patterns in Mexico, causing drier-than-usual conditions during the crucial sugarcane growth period from April to September. The Standardized Precipitation Index (SPI) is an important and well-accepted index for drought monitoring and, it indicates that while the primary sugarcane-producing state, Veracruz, experienced relatively milder effects, Jalisco and San Luis Potosi were significantly impacted. Entering its second consecutive year of climate challenges, Mexico is bound to remain with limited availability, adding to the current price support in the international market. We estimate that the country will produce close to 5.2Mt once more, limiting its participation in the global trade flow.

El Niño disrupted rainfall patterns in Mexico, causing drier-than-usual conditions during the crucial sugarcane growth period from April to September. The Standardized Precipitation Index (SPI) is an important and well-accepted index for drought monitoring and, it indicates that while the primary sugarcane-producing state, Veracruz, experienced relatively milder effects, Jalisco and San Luis Potosi were significantly impacted. Entering its second consecutive year of climate challenges, Mexico is bound to remain with limited availability, adding to the current price support in the international market. We estimate that the country will produce close to 5.2Mt once more, limiting its participation in the global trade flow.

Image 3: Mexico’s SPI for 6 months (April – September)

Source: Conagua, SMN

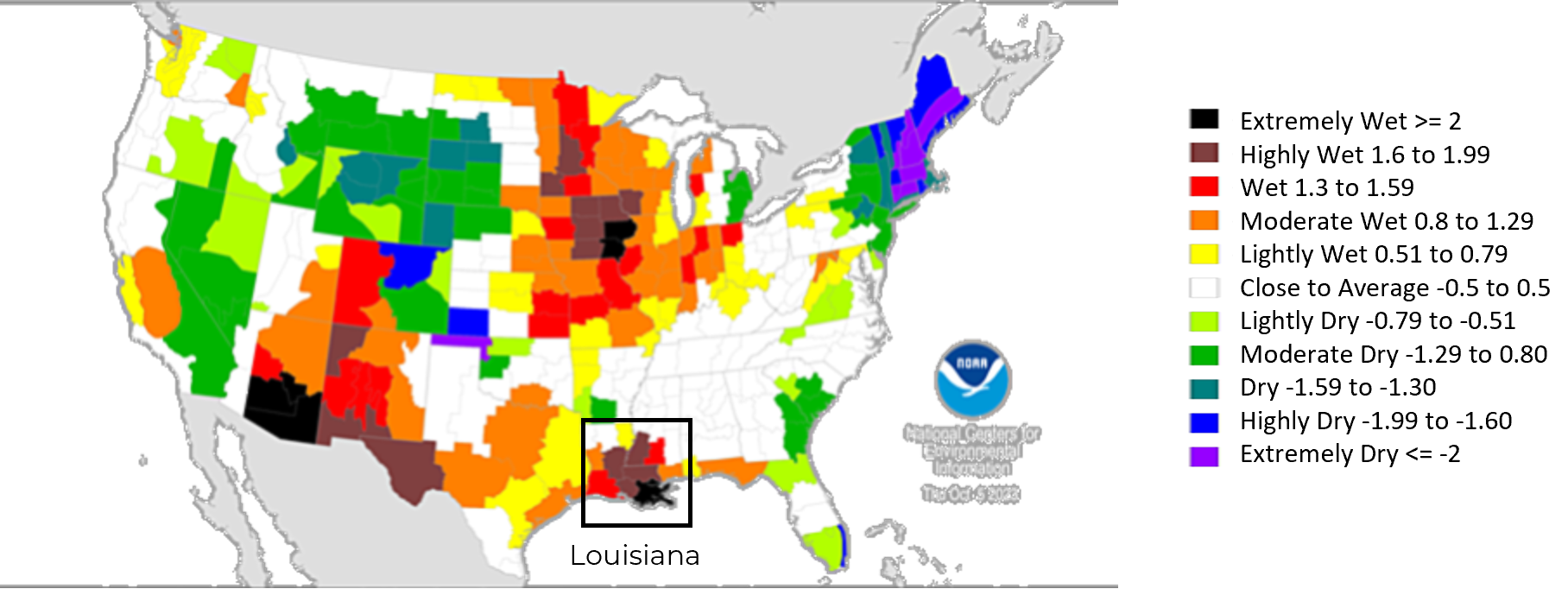

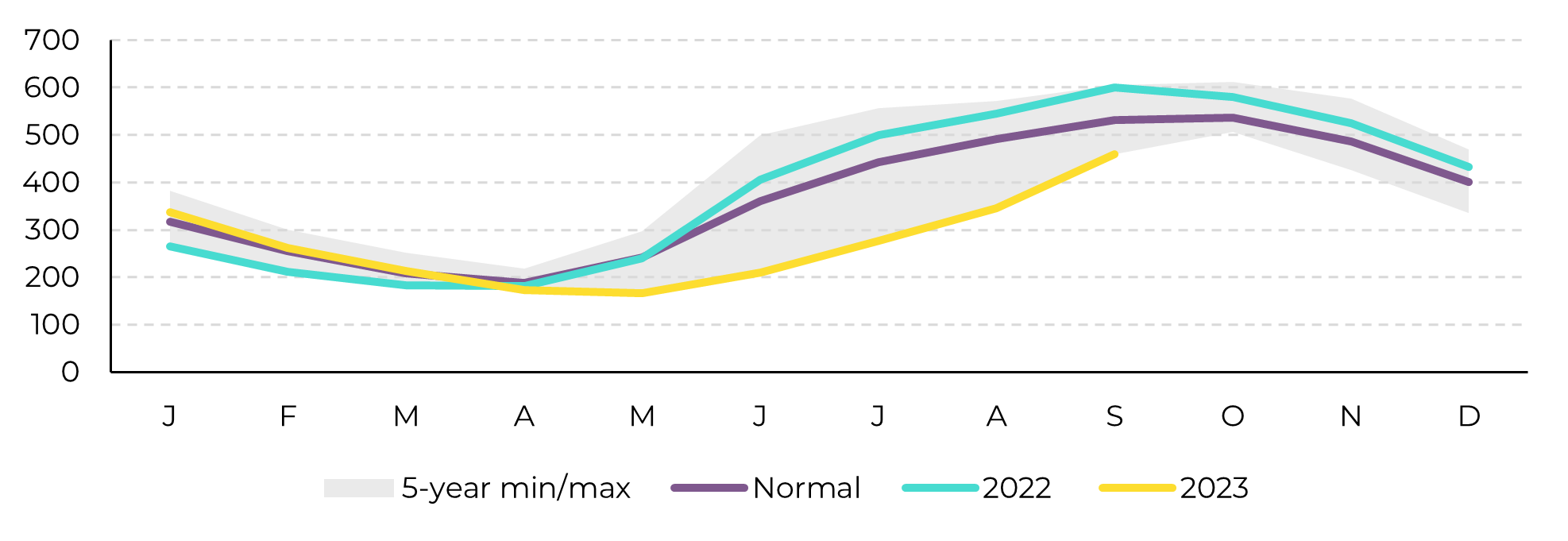

Dryness is also a hot topic in the US. Louisiana, responsible for nearly half of the US’s total sugar cane production was heavily penalized by the lack of rains. According to the USDA, the state’s cane availability is expected to face a drop of approximately 18% in 23/24. However, both Florida and key beet-producing states suffered little, allowing total sugar production estimates to remain above 8Mt. On the agency's lastest update, the country is likely to burn some stocks during 23/24, going from a 15.6% stock-to-use ratio estimated for 22/23 to 12.3%.

Image 4: US’s SPI for 6 months (April – September)

Source: NOAA

Dryness is also a hot topic in the US. Louisiana, responsible for nearly half of the US’s total sugar cane production was heavily penalized by the lack of rains. According to the USDA, the state’s cane availability is expected to face a drop of approximately 18% in 23/24. However, both Florida and key beet-producing states suffered little, allowing total sugar production estimates to remain above 8Mt. On the agency's lastest update, the country is likely to burn some stocks during 23/24, going from a 15.6% stock-to-use ratio estimated for 22/23 to 12.3%.

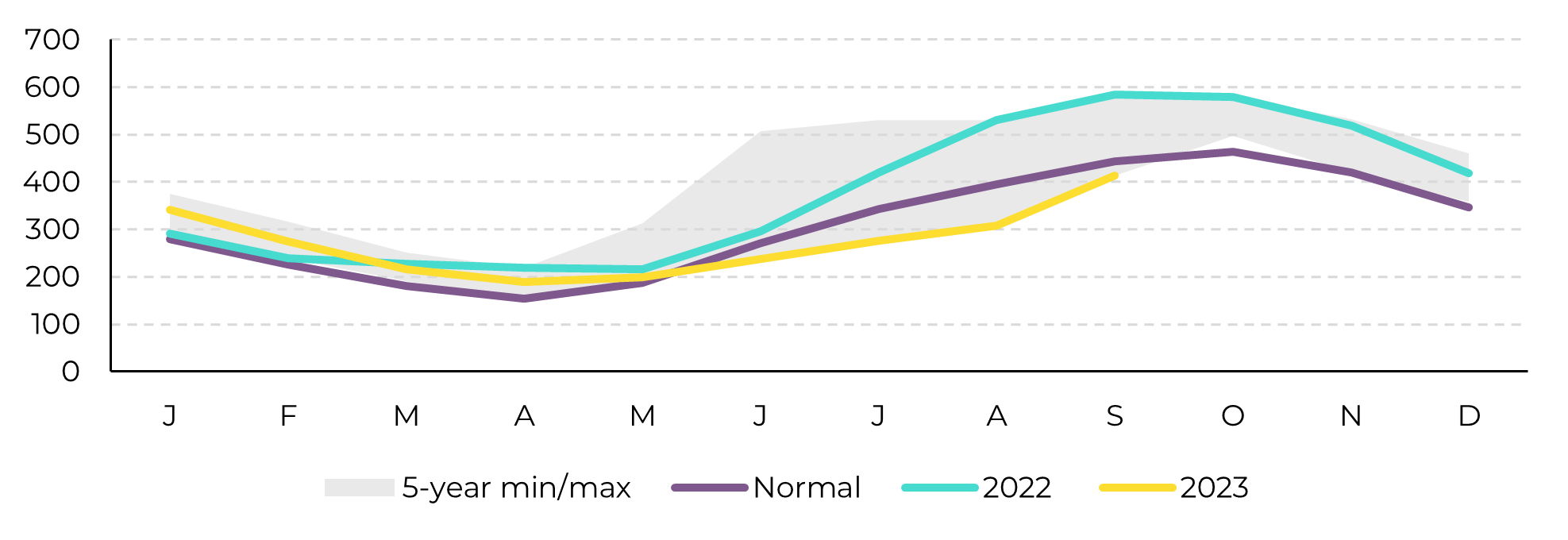

Examining the SPI for the entire Central American region, it becomes evident that the dry climate is a prevailing trend. Regarding Guatemala and El Salvador, it can be anticipated that their production levels will remain comparable to the previous harvest, at 2.5Mt and 0.8 kt respectively. In the most optimistic scenario, in terms of production, a marginal increase might be plausible, dependent on their irrigation capabilities. However, looking at current soil moisture levels, it becomes extremely hard believe in it.

Examining the SPI for the entire Central American region, it becomes evident that the dry climate is a prevailing trend. Regarding Guatemala and El Salvador, it can be anticipated that their production levels will remain comparable to the previous harvest, at 2.5Mt and 0.8 kt respectively. In the most optimistic scenario, in terms of production, a marginal increase might be plausible, dependent on their irrigation capabilities. However, looking at current soil moisture levels, it becomes extremely hard believe in it.

Image 5: Central America SPI for 6 months (April – September)

Source: NOAA

Key cane-producing states in Guatemala, such as Escuintla, Santa Rosa, and Scuhitepequez are facing low precipitation and reduced soil moisture, adding a cap to a possible sugar production recovery. The same trend can be observed in El Salvador. La Libertad, one of the biggest sugar-producing states, has soil moisture at its lowest.

Image 6: Soil moisture in Escuintla Guatemala (mm in top 0-1.6m soil)

Source: Refinitiv, hEDGEpoint

Image 7: Soil moisture in La Libertad El Salvador (mm in top 0-1.6m soil)

Source: Refinitiv, hEDGEpoint

Apart from West and East Europe, numerous countries in the Northern Hemisphere engaged in sugar production have encountered adverse climate conditions. Combined they are the main supportive factor balancing out Brazil’s excellent crop.

In Summary

The global sugar market experienced stable support last week due to various factors, including rains in Center-South and India's export ban extension, coupled with strong oil prices.

Mexico, facing its second year of climate adversity, is expected to produce around 5.2Mt, limiting its participation in the global trade flow. In the US, Louisiana's sugar cane production was severely affected by drought, leading to an 18% drop, while Florida and other beet-producing states are expected to maintain higher production levels. Central American countries like Guatemala and El Salvador are also grappling with reduced soil moisture, hindering sugar production recovery.

Weekly Report — Sugar

Written by Lívea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Reviewed by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.